Are you planning to take out a loan soon? Understanding how interest rates affect loans can save you a lot of money and stress.

Interest rates directly influence your monthly payments and the total amount you’ll repay over time. A small change in rates can mean the difference between an affordable loan and one that strains your budget. You’ll discover how interest rates work, why they change, and how these changes impact your loan options.

By the end, you’ll feel confident making smarter financial choices that protect your wallet. Keep reading to unlock the secrets behind interest rates and loans!

Credit: www.stlouisfed.org

Interest Rate Basics

Understanding interest rates is key to knowing how loans work. Interest rates show the cost of borrowing money. They affect monthly payments and the total amount paid over time.

Interest rates can change the size of your loan payments. Even a small difference can add up to a lot of money. It is important to learn the basics of interest rates before taking a loan.

What Interest Rates Mean For Loans

Interest rates tell you how much extra you pay for a loan. They are shown as a percentage of the loan amount. The higher the rate, the more you pay back.

For example, a 5% interest rate means you pay 5 dollars for every 100 dollars borrowed, each year. This cost is added to the loan balance, increasing what you owe.

Interest rates affect both the monthly payment and the total cost of the loan. They also influence how fast you can pay off the loan.

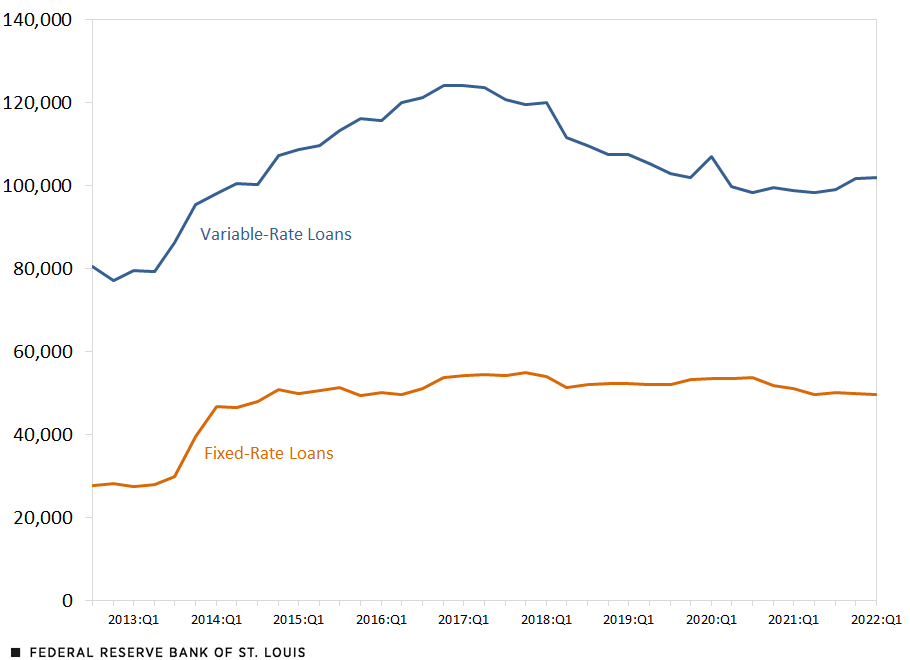

Fixed Vs. Variable Rates

Fixed rates stay the same for the loan term. Your monthly payment does not change. This makes it easier to plan your budget.

Variable rates can go up or down. They change with the market or lender policies. Your payment may increase or decrease over time.

Loans with fixed rates offer stability. Variable rates can be cheaper at first but carry risks. Choose the type that fits your comfort with change.

Factors Influencing Interest Rates

Interest rates on loans do not stay the same. They change based on many factors. These factors influence how much you pay in interest. Understanding these helps you make smart borrowing choices.

Several key elements shape interest rates. They include economic conditions, inflation, and policies by the Federal Reserve. Each plays a role in setting the cost of borrowing money.

Economic Indicators

Economic indicators show the health of the economy. Strong growth often leads to higher interest rates. This is because demand for money rises. Weak economic data can cause rates to drop. Lenders adjust rates to match economic strength or weakness.

Inflation Impact

Inflation means prices rise over time. High inflation reduces the value of money. Lenders charge higher interest to protect against this loss. When inflation is low, interest rates tend to be lower. This keeps borrowing affordable and stable.

Federal Reserve Role

The Federal Reserve controls short-term interest rates. It adjusts rates to manage economic growth and inflation. When the Fed raises rates, loans become more expensive. When it lowers rates, borrowing costs drop. These changes influence all types of loans.

Types Of Loans And Rate Effects

Interest rates play a key role in the cost of borrowing money. Different loans react differently to changes in these rates. Understanding how rates affect each loan type helps in making smart financial choices.

Some loans have fixed rates, while others have rates that can change over time. The impact on monthly payments and total loan costs varies by loan type and rate structure.

Mortgage Loans

Mortgage loans often come with fixed or adjustable interest rates. Fixed rates stay the same throughout the loan term, making payments predictable. Adjustable rates can rise or fall, affecting monthly payments. Higher interest rates increase the cost of buying a home. This can limit how much a borrower can afford.

Personal Loans

Personal loans usually have fixed rates. These rates depend on credit score and market conditions. When rates rise, monthly payments increase. Borrowers pay more in interest over time. Lower rates mean cheaper loans and smaller monthly bills.

Auto Loans

Auto loans often have fixed interest rates. The rate level affects the total cost of the vehicle. Higher rates raise monthly payments and total interest. Lower rates help buyers afford better cars or reduce loan length. The loan term also influences the total interest paid.

Student Loans

Student loans can have fixed or variable rates. Fixed rates stay stable during repayment. Variable rates change with market trends, causing payment shifts. Rising rates increase the cost of education loans. Lower rates reduce monthly payments and overall debt.

Credit: www.firstalliancecu.com

How Rate Changes Affect Borrowers

Changes in interest rates have a direct impact on borrowers. These shifts influence how much you pay monthly, how affordable loans are, and your chances of qualifying for credit. Understanding these effects helps borrowers plan better and manage loan costs effectively.

Monthly Payment Variations

Interest rate changes cause monthly payments to rise or fall. Higher rates increase the amount you pay each month. Lower rates reduce monthly payments, easing financial pressure. Borrowers with adjustable-rate loans see more frequent payment changes. Fixed-rate loan payments stay the same despite rate shifts.

Loan Affordability

Rising interest rates make loans more expensive overall. Higher costs can push loan payments beyond a borrower’s budget. Falling rates improve loan affordability by lowering total interest paid. This can encourage more people to borrow and invest. Affordability depends on the loan amount, term, and rate.

Credit Qualification

Interest rates affect your ability to qualify for loans. Higher rates mean higher debt costs, which can lower your creditworthiness. Lenders look at your debt-to-income ratio and payment ability. Lower rates improve your chances by reducing monthly obligations. Strong credit scores still matter regardless of rate changes.

Apr Vs. Interest Rate

Understanding the difference between APR and interest rate helps you choose loans wisely. Both show costs but measure different things. The interest rate shows the cost of borrowing money annually. APR includes the interest rate plus extra fees. This makes APR a better measure of the total loan cost.

Total Cost Of Borrowing

The interest rate tells you the yearly cost of the loan’s principal. It does not cover other expenses. APR combines the interest rate and all costs over one year. This means APR reflects the full cost of borrowing. Comparing APRs helps you see which loan is cheaper overall. A lower APR means less money paid over time.

Fees And Charges

Loans often have fees like application or service charges. These fees increase the total loan cost but do not show in the interest rate. APR includes these fees, giving a clearer picture of what you pay. Some loans with low interest rates may have high fees. Checking the APR prevents surprises by revealing these extra costs.

Strategies To Manage Interest Costs

Managing interest costs on loans helps save money and reduce financial stress. Small changes in strategy can lower the amount paid over time. Focus on improving your credit, choosing the right loan, and refinancing smartly. These actions work together to keep interest expenses manageable.

Improving Credit Scores

Higher credit scores often lead to lower interest rates. Pay bills on time and reduce debt to boost your score. Avoid opening many new accounts at once. Regularly check your credit report for errors and fix them quickly. A better score means lenders see less risk in lending to you.

Choosing Loan Types

Different loans have different interest rates and terms. Fixed-rate loans keep the same rate for the entire period. Adjustable-rate loans may start lower but can rise later. Consider how long you plan to keep the loan. Match the loan type to your financial situation and goals.

Refinancing Options

Refinancing replaces an old loan with a new one at a lower rate. This can reduce monthly payments and total interest paid. Watch for fees that might cancel out savings. Refinance when rates drop or your credit improves. Always compare offers from several lenders before deciding.

Impact Of Interest Rates On The Housing Market

Interest rates play a crucial role in shaping the housing market. Changes in these rates can influence how many people buy homes and how much they pay each month. When interest rates shift, the entire market feels the impact quickly.

Buyer Demand

Interest rates affect how many people want to buy homes. Lower rates make loans cheaper. This attracts more buyers to the market. More buyers mean higher demand for houses. Higher demand often leads to rising home prices. On the other hand, higher rates raise borrowing costs. This lowers buyer interest and reduces demand. Fewer buyers can slow down the housing market and stabilize prices.

Mortgage Payment Fluctuations

Interest rates directly affect monthly mortgage payments. When rates rise, payments increase even if the loan amount stays the same. This can strain buyers’ budgets and reduce affordability. Lower rates decrease monthly payments, making homes easier to afford. For adjustable-rate mortgages, payments can change over time. This adds uncertainty for homeowners, especially if rates increase suddenly. Understanding these fluctuations helps buyers plan their finances better.

Credit: www.bankrate.com

Future Trends In Interest Rates

The future of interest rates is a key factor for anyone planning to borrow money. Changes in rates affect loan costs and monthly payments. Keeping an eye on trends helps borrowers make smarter decisions. This section explores what experts expect for interest rates ahead.

Economic Forecasts

Experts watch many signs to predict interest rates. Inflation rates, job growth, and consumer spending all play roles. Central banks adjust rates to control inflation and support the economy. When inflation rises, rates often increase to slow spending. If the economy slows, rates may drop to encourage borrowing.

Potential Rate Movements

Interest rates may rise or fall based on economic data. Some forecasts suggest gradual increases to keep inflation in check. Others see possible rate cuts if growth weakens. Loan terms could become more expensive or cheaper depending on these moves. Borrowers should prepare for some rate changes in the near future.

Frequently Asked Questions

How Does An Interest Rate Affect A Loan?

Interest rates determine loan cost and monthly payments. Higher rates increase total repayment, while lower rates reduce borrowing expenses and payments.

What Is The 6% Interest Of $10,000?

6% interest on $10,000 equals $600. Multiply 10,000 by 0. 06 to find the interest amount.

What Does 4% Interest On A Loan Mean?

A 4% interest on a loan means you pay 4% of the loan amount annually as a cost for borrowing. It increases the total repayment.

What Does 99.9% Apr Mean On A Loan?

A 99. 9% APR means the loan costs 99. 9% of the borrowed amount annually, including interest and fees. It indicates a very high borrowing cost.

Conclusion

Interest rates directly impact loan costs and monthly payments. Lower rates reduce borrowing expenses, making loans more affordable. Higher rates increase loan costs and can limit borrowing options. Understanding these effects helps you plan finances better. Always compare rates before choosing a loan.

Remember, small changes in interest rates affect your total payment. Stay informed to make smart loan decisions.