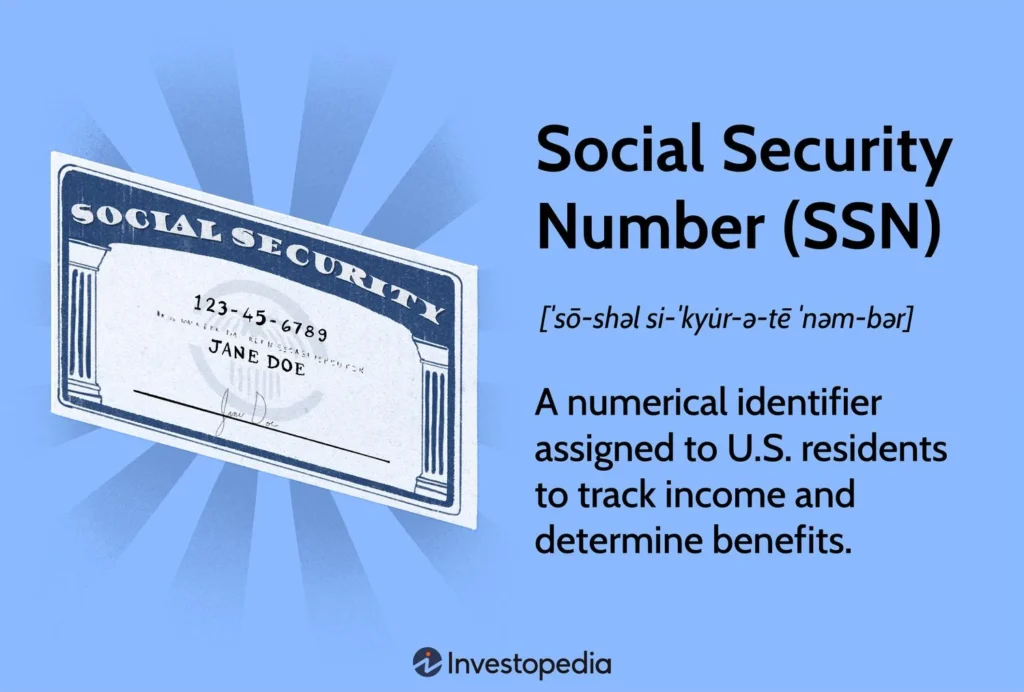

Your Social Security Number is more than just a string of digits. It’s a key that unlocks access to your financial identity, government benefits, and much more.

But do you really know how it works or why it’s so important to protect it? You’ll discover what your Social Security Number is, why it matters, and how to keep it safe from threats. Keep reading to take control of your personal information and avoid costly mistakes.

Purpose Of Social Security Number

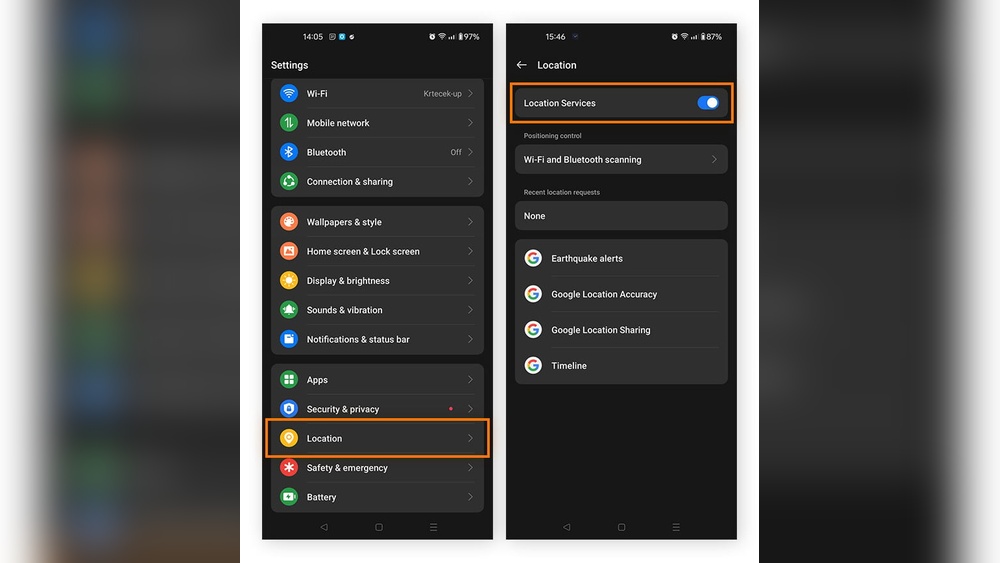

The Social Security Number (SSN) is a unique number assigned to every U.S. citizen and some residents. Its primary purpose is to serve as a personal identifier. The SSN helps government agencies and employers track an individual’s earnings and benefits. It also plays a key role in tax reporting and accessing various services.

Identification And Tracking

The Social Security Number acts as a unique identifier for individuals in many official systems. It helps track work history, earnings, and eligibility for government programs. Each SSN is unique, reducing confusion between people with similar names.

Here are some ways the SSN is used for identification and tracking:

- Maintaining accurate records of employment and wages.

- Tracking Social Security benefits eligibility and payments.

- Verifying identity during financial transactions.

- Preventing identity fraud by linking records to one number.

The SSN is essential for managing records across various government agencies. It helps to avoid errors in personal data and ensures proper tracking of each individual’s contributions and benefits.

| Use Case | Description |

|---|---|

| Employment Records | Tracks earnings and work history for Social Security credits. |

| Government Benefits | Links individuals to benefits like retirement and disability. |

| Identification Verification | Used by banks and other institutions to confirm identity. |

Benefits And Services

The Social Security Number is key to accessing many government benefits and services. It helps agencies quickly confirm eligibility and process claims. Without an SSN, applying for these benefits can be difficult or impossible.

Some important benefits and services linked to the SSN include:

- Social Security retirement benefits

- Disability insurance

- Medicare health coverage

- Unemployment benefits

- Supplemental Security Income (SSI)

Government agencies use the SSN to:

- Verify identity to prevent fraud.

- Track benefit payments and eligibility periods.

- Maintain accurate records of claims and payments.

Employers also require the SSN to report wages and taxes. This process ensures workers receive the benefits they earn through their work history.

Tax Reporting

The Social Security Number plays a vital role in tax reporting. The Internal Revenue Service (IRS) uses the SSN to identify taxpayers and link their income to their tax records. This tracking helps calculate taxes owed or refunds due.

Every worker must provide their SSN to employers. Employers then report wages and taxes withheld to the IRS using this number. Self-employed individuals also use their SSN when filing tax returns.

Key points about SSN and tax reporting:

- The SSN ensures accurate reporting of income and taxes.

- It helps prevent tax fraud by linking income to the correct person.

- The IRS uses the SSN to match tax returns with wage reports.

- SSNs are required on forms like W-2 and 1099.

Proper use of the SSN in tax reporting helps the government collect the right amount of tax. It also helps taxpayers receive tax credits and refunds accurately and on time.

History And Development

The Social Security Number (SSN) plays a vital role in the United States. It helps track earnings and benefits for workers. Its history reveals how the system was designed and changed to meet new needs. Understanding the SSN’s history and development shows why it remains important today.

Origins In The 1930s

The Social Security Number was created in the 1930s during the Great Depression. The U.S. government wanted a way to track workers’ earnings to support the new Social Security program. This program aimed to provide financial help to retired and disabled workers.

Key points about the SSN’s origin:

- 1935: Social Security Act passed by Congress.

- 1936: SSNs issued for the first time.

- Purpose: Track earnings and calculate benefits.

The initial SSN format was simple: three parts separated by dashes. These parts identified the state, group, and serial number. The card’s main use was for Social Security payroll taxes and benefit tracking.

| Part | Description |

|---|---|

| Area Number | State or region where SSN was issued. |

| Group Number | Used to break down numbers within the area. |

| Serial Number | Unique identifier within the group. |

Evolution Over Time

The SSN system changed as the country grew. It moved beyond tracking Social Security benefits. The number became a key form of identification for many purposes.

Changes over the years include:

- Expansion: Used by banks, employers, and government agencies.

- Privacy concerns: Led to rules on how SSNs can be used.

- Format updates: To avoid running out of numbers.

In 2011, the Social Security Administration changed how SSNs are assigned. The “randomization” method began. This method:

- Eliminated geographic significance.

- Helped protect privacy.

- Increased available numbers.

These changes made the SSN system more secure and flexible. The number became essential for tax reporting, credit checks, and more.

Modern Usage

Today, the Social Security Number is used in many areas of daily life. It serves as a primary ID in the U.S. for financial and legal activities.

Main uses include:

- Filing taxes with the IRS.

- Opening bank accounts and applying for loans.

- Getting health insurance and government benefits.

- Employment verification through E-Verify.

- Credit reporting and background checks.

Because the SSN is so important, protecting it is critical. Identity theft risks make it necessary to keep the number secure. Many institutions limit SSN use or ask for alternative IDs.

In summary, the Social Security Number started as a simple tracking tool. It evolved into a key identifier used in many parts of life. Its development reflects changing needs and growing concerns about privacy and security.

How To Obtain A Social Security Number

Obtaining a Social Security Number (SSN) is a key step for many residents in the United States. It is needed for work, taxes, and many official processes. The process to get an SSN is clear but requires following specific steps. Understanding how to apply, what documents are necessary, and the right timing can make the process smoother.

Application Process

The application process for a Social Security Number is straightforward. You must complete an application form called Form SS-5. This form asks for basic personal information such as your full name, date of birth, place of birth, and citizenship status.

Here is a simple list of steps to apply:

- Fill out the Form SS-5. You can find it on the Social Security Administration (SSA) website or at SSA offices.

- Gather the required documents proving your identity, age, and citizenship or immigration status.

- Submit your application and documents in person at your local SSA office or by mail if allowed.

- Wait for your SSN card to arrive by mail. This usually takes 10 to 14 business days.

Visit your local SSA office for help with the application if needed. Some offices may require an appointment, so check ahead.

| Step | Description |

|---|---|

| 1 | Fill out Form SS-5 |

| 2 | Prepare documents |

| 3 | Submit application |

| 4 | Receive SSN card |

Required Documents

Providing the correct documents is essential to get a Social Security Number. The SSA needs proof of your identity, age, and legal status in the U.S. These documents must be original or certified copies.

Here is a list of common documents accepted by the SSA:

- Proof of Identity: U.S. driver’s license, state ID card, or U.S. passport.

- Proof of Age: Birth certificate or passport showing your date of birth.

- Proof of Citizenship or Immigration Status: U.S. birth certificate, U.S. passport, or immigration documents such as Form I-551 (Green Card), I-94, or work permit.

For children, parents must provide their own identification and the child’s birth certificate. For non-citizens, immigration status documents are required.

| Document Type | Examples |

|---|---|

| Identity | Driver’s license, State ID, U.S. passport |

| Age | Birth certificate, Passport |

| Citizenship/Immigration | U.S. birth certificate, Green Card, I-94 |

Timing For Newborns And Immigrants

The timing to apply for an SSN differs for newborns and immigrants. For newborns, parents often apply shortly after birth. The hospital may offer to help with the application during the birth registration process.

Applying for a newborn’s SSN soon after birth helps with tax benefits and health insurance. The SSA typically processes these applications quickly.

Immigrants should apply for an SSN as soon as they are authorized to work or live in the U.S. Many receive the SSN as part of their immigration process. If not, they can apply at an SSA office once they have valid immigration documents.

Delaying the application can cause problems with employment, taxes, and benefits. It is best to apply early.

| Category | When to Apply |

|---|---|

| Newborns | Shortly after birth, often at hospital |

| Immigrants | After receiving work authorization or immigration status |

Security And Privacy Concerns

The Social Security Number (SSN) is a critical piece of personal information in the United States. It is used for tax reporting, credit, and government benefits. Because of its importance, the SSN is a prime target for misuse. Protecting this number is essential to avoid serious security and privacy problems. Understanding the risks and knowing how to protect your SSN helps reduce the chances of fraud and identity theft.

Identity Theft Risks

The SSN is one of the most valuable pieces of information for identity thieves. With just this number, criminals can:

- Open bank accounts in your name

- Apply for credit cards or loans

- File false tax returns to claim refunds

- Access medical services using your identity

Identity theft can cause financial loss, damage your credit score, and create long-term headaches. Many victims do not realize their SSN was stolen until serious damage occurs.

Here is a simple table showing common ways SSNs are stolen:

| Method | Description |

|---|---|

| Phishing | Fake emails or calls asking for your SSN |

| Data Breaches | Hackers stealing information from companies |

| Lost or Stolen Documents | Physical theft of wallets or mail containing SSNs |

| Skimming | Copying card data from ATMs or stores |

Safeguarding Your Number

Protecting your SSN means limiting its exposure. Only share your SSN when absolutely necessary. Many organizations ask for SSNs unnecessarily. Always ask why they need it and how they protect your data.

Follow these tips to keep your SSN safe:

- Do not carry your Social Security card with you

- Shred documents with your SSN before disposal

- Use strong passwords for online accounts

- Monitor your credit reports regularly

- Be cautious with emails or phone calls requesting your SSN

Store important documents in a secure place at home. Consider using a locked box or safe. Use identity theft protection services if you want extra security.

Legal Protections

Several laws protect your SSN and personal information. The Privacy Act of 1974 limits how federal agencies use your SSN. It requires agencies to explain why they need it and keep it secure.

The Identity Theft and Assumption Deterrence Act makes identity theft a federal crime. It allows law enforcement to prosecute offenders and helps victims recover.

State laws also provide protections. Many states require businesses to notify you if your SSN is exposed in a data breach.

Here are key protections summarized:

- Limited Use: Agencies and companies must have a valid reason to collect your SSN.

- Notification: You must be informed if your SSN is exposed.

- Penalties: Legal penalties exist for those who misuse or steal SSNs.

- Victim Rights: You can request fraud alerts on your credit reports.

Understanding your rights helps you take action if your SSN is compromised. Keep records of any identity theft reports and notify authorities immediately.

Social Security Number And Employment

The Social Security Number (SSN) plays a key role in employment in the United States. It is a unique identifier used by the government to track workers’ earnings and benefits. Employers use the SSN to report wages and taxes to the Internal Revenue Service (IRS) and the Social Security Administration (SSA). Understanding how SSNs relate to employment helps both workers and employers follow legal rules and avoid problems.

Verification Requirements

Employers must verify each employee’s identity and legal right to work in the U.S. This process involves checking the Social Security Number. Verification helps prevent fraud and illegal employment.

The main steps include:

- Collecting the SSN from the employee during hiring.

- Using Form I-9 to confirm identity and work authorization.

- Verifying the SSN through the Social Security Number Verification Service (SSNVS) or E-Verify.

Employers must ensure the SSN matches the employee’s legal documents. The verification can reveal:

| Verification Result | Meaning |

|---|---|

| Valid SSN | The number is correct and belongs to the employee. |

| Invalid SSN | The number does not match SSA records. May indicate error or fraud. |

| SSN not issued | The number was never assigned by SSA. |

Correct SSN verification protects employers from penalties and ensures workers receive proper credit for work.

Employer Responsibilities

Employers must handle SSNs carefully. They have several duties to follow the law and protect employee information.

Key responsibilities include:

- Collect SSNs properly: Only ask for SSNs when required by law.

- Maintain confidentiality: Keep SSNs safe and limit access.

- Report wages: Use SSNs on wage reports to IRS and SSA.

- Verify accuracy: Check SSNs before submitting payroll.

- Dispose securely: Shred or delete SSN records when no longer needed.

Employers must also provide Form W-2 to employees, showing wages and SSNs. This helps employees file taxes correctly.

Failure to follow rules can lead to fines, legal action, or identity theft risks. Protecting SSNs builds trust with workers and keeps business safe.

Impact On Hiring

The SSN affects the hiring process in many ways. It helps employers confirm identity and eligibility quickly. This reduces hiring errors and legal risks.

Important impacts include:

- Faster background checks: SSNs speed up criminal and credit checks.

- Accurate payroll: Correct SSNs ensure proper tax withholding.

- Compliance: Using SSNs meets government rules for employment.

- Verification delays: Incorrect or missing SSNs can slow hiring.

- Potential discrimination risks: Employers must avoid misuse of SSNs to unfairly judge candidates.

Employers who verify SSNs carefully improve the hiring process. They avoid costly mistakes and create a safer workplace.

Workers should provide accurate SSN information to avoid delays and ensure their benefits are recorded correctly.

Common Misuses And Scams

The Social Security Number (SSN) is a vital piece of personal information. It helps track your earnings and access government benefits. Sadly, many people misuse SSNs to commit fraud and theft. Scammers target SSNs to steal identities and money. Understanding common misuses and scams helps protect your identity and finances. Awareness reduces the risk of falling victim to fraud involving your SSN.

Phishing And Fraud

Phishing is a common way scammers steal SSNs. They send fake emails, texts, or calls pretending to be from trusted sources. These messages ask for your SSN or other personal details. Scammers use this information to open credit accounts or commit crimes in your name.

Types of phishing scams include:

- Email phishing: Fake emails ask you to click links or enter SSNs on fake websites.

- Phone scams: Callers claim to be from the Social Security Administration or banks.

- Text phishing: Messages urge you to provide your SSN quickly to avoid problems.

Fraud can also happen if someone steals your SSN to:

- Get loans or credit cards

- File false tax returns

- Receive medical care under your name

| Scam Type | How It Works | Goal of Scammer |

|---|---|---|

| Email Phishing | Fake email asks for SSN or login info | Steal identity or money |

| Phone Scam | Caller pretends to be official agency | Get SSN or payments |

| Text Phishing | Urgent text requests SSN | Use SSN for fraud |

How To Spot Scams

Knowing the signs helps you avoid SSN scams. Scammers often pressure you to act fast or keep secrets. They may claim your SSN is linked to a crime or problem. Real agencies do not demand SSN over email or phone without proof.

Warning signs include:

- Unexpected calls or messages asking for your SSN

- Threats about legal trouble or account closure

- Requests for payment via gift cards or wire transfer

- Emails or texts with spelling mistakes or odd language

- Links that lead to suspicious websites

Always pause before sharing your SSN. Verify the source by calling the official agency number. Never click links or download attachments from unknown senders.

| Red Flag | What It Means |

|---|---|

| Urgent Requests | Scammers want quick, unthinking action |

| Payment Demands | Official agencies do not ask for gift cards |

| Unverified Contact | Caller or sender identity not confirmed |

Reporting Suspicious Activity

Reporting scams helps protect others and stops criminals. If you suspect someone tries to steal your SSN, act quickly. Contact the Social Security Administration (SSA) or the Federal Trade Commission (FTC). You can also report to local police if you see fraud.

Steps to report suspicious activity:

- Keep records of calls, emails, or texts

- Do not give out your SSN or personal info

- Call the SSA at their official number or visit their website

- File a complaint with the FTC at

www.ftc.gov/complaint - Inform your bank or credit card company if needed

Reporting helps agencies track scam trends and warn others. It can lead to investigations and reduce fraud risks.

| Agency | Contact Method | Purpose |

|---|---|---|

| Social Security Administration (SSA) | Phone, website | Report misuse of SSN |

| Federal Trade Commission (FTC) | Online complaint form | Report identity theft and scams |

| Local Police | In person or phone | File a fraud report |

Alternatives And Future Changes

The Social Security Number (SSN) has long served as a key identifier in the United States. It helps track earnings, manage benefits, and verify identity. Still, the SSN faces challenges like identity theft and privacy concerns. This has sparked talk about alternatives and future changes to improve security and efficiency. Exploring new ideas and technologies can shape how personal identification works in the years ahead.

Proposals For New Identification Systems

Several proposals aim to replace or supplement the SSN with safer, more reliable systems. These new ideas focus on protecting personal data and reducing fraud risks.

- Unique Digital IDs: A digital identity tied to biometric data like fingerprints or facial recognition.

- Blockchain-Based IDs: Secure and decentralized, reducing risks of data breaches.

- Multi-Factor Identification: Combining numbers, biometrics, and device verification for stronger security.

Some lawmakers suggest issuing a new national ID number that changes periodically. This method limits the time criminals can misuse the number.

| Proposal | Key Feature | Benefit |

|---|---|---|

| Digital Biometric ID | Uses fingerprint or face scan | Hard to fake or steal |

| Blockchain ID | Decentralized record keeping | Data is secure and transparent |

| Multi-Factor ID | Combines several ID methods | Stronger identity proof |

These proposals focus on creating a safer and more flexible identity system. They aim to reduce identity theft and make verification easier across different services.

Technological Advances

Technology plays a major role in changing how identification systems work. New tools can provide faster and safer ways to confirm identity.

Biometric technology is becoming common. Devices can scan fingerprints, eyes, or faces to identify people quickly. This reduces the need to carry physical ID cards or remember numbers.

- Facial Recognition: Used at airports and banks for quick identity checks.

- Fingerprint Scanners: Embedded in smartphones and security systems.

- Mobile ID Apps: Store digital versions of IDs on phones.

Artificial intelligence (AI) helps detect fake IDs and suspicious activities. It analyzes data patterns to spot fraud faster than humans.

| Technology | Use Case | Advantage |

|---|---|---|

| Biometrics | Identity verification | Highly accurate and fast |

| AI Fraud Detection | Monitoring transactions | Quickly finds suspicious behavior |

| Mobile ID | Digital ID storage | Convenient and always available |

These advances could make future ID systems safer and more user-friendly. They reduce errors and help protect personal information better than traditional SSNs.

Global Comparisons

Other countries use different identification systems that offer lessons for the US. Comparing these systems shows many approaches to identity management.

For example, India uses the Aadhaar system. It assigns a 12-digit unique number linked to biometric data. This helps millions access government services efficiently.

In Europe, many countries use national ID cards with embedded chips. These chips store personal data securely and allow electronic authentication.

| Country | System | Key Feature | Benefit |

|---|---|---|---|

| India | Aadhaar | Biometric and demographic data | Streamlines access to services |

| Germany | National ID Card | Smart chip with personal info | Secure electronic authentication |

| Estonia | e-ID | Digital identity for online use | Supports e-government and banking |

These global examples highlight the importance of secure, flexible systems. They show how technology and policy combine to protect identity and improve access.

Frequently Asked Questions

What Is A Social Security Number Used For?

A Social Security Number (SSN) identifies U. S. citizens for tax and benefit purposes. It tracks earnings and eligibility for Social Security benefits.

How Do I Apply For A Social Security Number?

You apply for an SSN by completing Form SS-5 at your local Social Security office. Proof of identity and citizenship is required.

Can I Change My Social Security Number?

Changing your SSN is rare and allowed only in specific cases like identity theft or harassment. Approval is not guaranteed.

Is My Social Security Number Safe To Share?

Only share your SSN with trusted entities like employers or government agencies. Protect it to prevent identity theft.

Conclusion

A Social Security Number helps identify you in many official matters. Protect it carefully to avoid identity theft and fraud. Use your number only when necessary and share it with trusted sources. Keep track of your Social Security benefits and updates.

Understanding its purpose makes handling your personal information safer. Stay aware and keep your number secure at all times. This simple step protects your financial and personal life.