Are you looking to get the most out of every dollar you spend in 2026? Choosing the right credit card can make a huge difference in how much cashback you earn on your everyday purchases.

But with so many options available, how do you find the card that truly offers the highest cashback? You’ll discover which credit card stand out for top rewards, how their cashback programs work, and which one fits your spending habits best.

Ready to boost your savings effortlessly? Keep reading to find the perfect card that turns your spending into serious cashback rewards.

Top Cashback Cards In 2026

Cashback credit card remain popular in 2026 for saving money on everyday purchases. Choosing the right card depends on spending habits and reward preferences. Several cards stand out for their high cashback offers, bonus categories, and flexibility. These cards provide great value with straightforward rewards and few restrictions.

Below are some of the top cashback cards available in 2026. Each offers unique benefits suited to different types of spenders. Understanding these features helps pick the best card for maximum cashback.

Chase Freedom Flex Highlights

The Chase Freedom Flex card offers 5% cashback on rotating categories each quarter. These categories often include groceries, gas stations, and select streaming services. Cardholders also earn 3% cashback on dining and drugstore purchases. A flat 1% cashback applies to all other spending. This card has no annual fee and includes a sign-up bonus. It suits users who can track quarterly categories.

U.S. Bank Cash+ Features

The U.S. Bank Cash+ card lets users choose two categories to earn 5% cashback. Options include groceries, restaurants, gas stations, and home utilities. It also provides 2% cashback on one everyday category like gas or groceries. All other purchases earn 1% cashback. The card has no annual fee. It is ideal for people wanting to customize cashback rewards based on their spending.

Chase Freedom Unlimited Benefits

The Chase Freedom Unlimited card offers a simple cashback structure. It gives 1.5% cashback on all purchases with no category restrictions. Bonus rewards include 3% cashback on dining and drugstore purchases. A 5% cashback applies to travel booked through Chase Ultimate Rewards. This card has no annual fee and is great for those seeking consistent cashback without tracking categories.

Citi Custom Cash Advantages

The Citi Custom Cash card automatically earns 5% cashback on the top eligible spend category each billing cycle, up to $500 spent. Categories include groceries, gas stations, dining, and select streaming services. After reaching the limit, cashback drops to 1%. The card has no annual fee. It suits people who spend more in a specific category monthly and want flexible rewards.

Best Cards For Travel Rewards

Travel rewards credit card offer great value for frequent travelers. They provide points or miles that can save money on flights, hotels, and other travel expenses. Choosing the right card depends on your travel habits and budget. Here are some top cards for travel rewards in 2026.

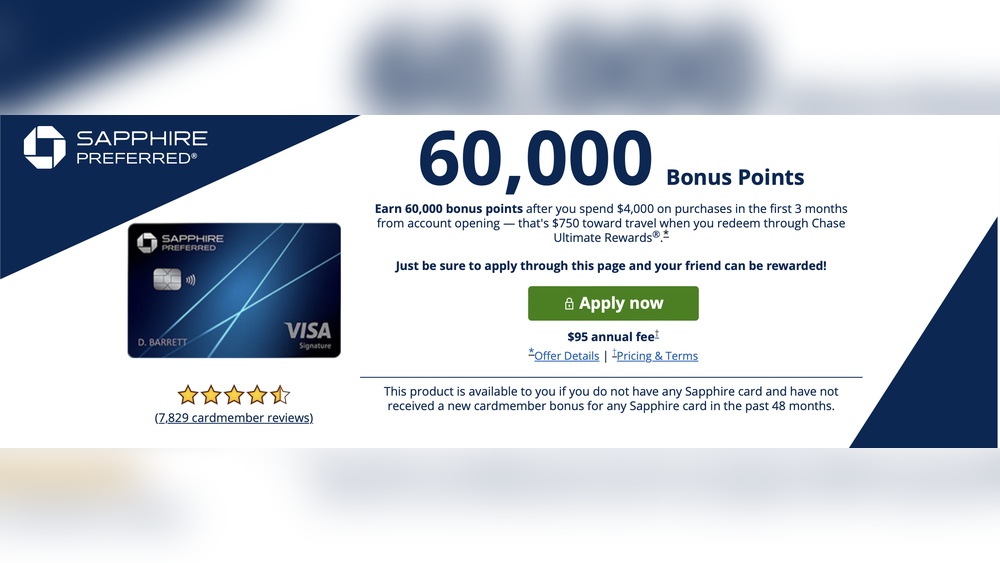

Chase Sapphire Preferred Perks

The Chase Sapphire Preferred card offers excellent rewards for travel and dining. It gives 2 points per dollar spent on travel and dining worldwide. Points can be redeemed for 25% more value through Chase Ultimate Rewards. The card has a reasonable annual fee and a strong sign-up bonus. Travel insurance and no foreign transaction fees add extra benefits.

Chase Sapphire Reserve Luxury

The Chase Sapphire Reserve is a premium travel card with luxury perks. It offers 3 points per dollar on travel and dining. Points are worth 50% more when used for travel via Chase’s portal. Cardholders get a $300 annual travel credit and Priority Pass lounge access. It also includes trip cancellation insurance and global entry fee credit.

American Express Gold And Platinum

The Amex Gold card is great for food and travel rewards. It offers 4 points per dollar at restaurants and U.S. supermarkets. The Platinum card focuses on luxury travel with 5 points per dollar on flights and hotels booked through Amex Travel. Both cards include travel credits and access to exclusive airport lounges. They have higher annual fees but offer valuable benefits for frequent travelers.

Flat Rate And Rotating Cashback Cards

Flat rate and rotating cashback cards offer two popular ways to earn rewards on everyday spending. Flat rate cards give you the same cashback percentage on all purchases. They are simple and predictable, making budgeting easy.

Rotating cashback cards change their bonus categories every few months. These cards reward you with higher cashback in specific spending areas. You must activate the categories to earn the extra rewards. They suit people who can track and adjust their spending.

Wells Fargo Active Cash Overview

The Wells Fargo Active Cash card offers a simple 2% cashback on all purchases. There are no category restrictions or caps. This flat rate makes it easy to earn rewards without tracking bonuses.

The card has no annual fee and includes a welcome bonus for new users. It is ideal for people who want steady cashback on everything they buy. Rewards can be redeemed as statement credits or deposits to your Wells Fargo account.

Chase Freedom Unlimited And Flex

The Chase Freedom Unlimited card offers a flat 1.5% cashback on all purchases. It adds bonus cashback on travel, dining, and drugstores. The card has no annual fee.

The Chase Freedom Flex card features rotating cashback categories each quarter. Categories include groceries, gas stations, and select streaming services. Cardholders earn 5% cashback on these categories after activation.

Both cards allow you to combine rewards with Chase Sapphire cards for higher point value. Freedom Flex suits shoppers who can track quarterly categories. Freedom Unlimited fits those who want consistent cashback with some bonuses.

Citi Double Cash Details

The Citi Double Cash card gives 2% cashback on all purchases. You earn 1% when you buy and 1% when you pay your bill. This flat rate rewards consistent spending and paying off balances quickly.

The card has no category restrictions or rotating bonuses. There is no annual fee. Cashback can be redeemed for statement credits, gift cards, or checks.

This card is best for people who want simple, high cashback without managing categories. It encourages paying off balances for maximum rewards.

Credit: www.gimbooks.com

Cashback For Groceries And Streaming

Cashback rewards for groceries and streaming services remain among the most valued by credit card users in 2026. Many people spend a significant portion of their budget on food and entertainment. Cards that offer high cashback in these categories can save users a lot of money. Choosing a card with strong rewards for groceries and streaming helps maximize everyday spending benefits.

Several credit cards focus on these categories, making it easier to earn cashback on essentials. Let’s examine two popular American Express cards known for their cashback offers on groceries and streaming.

Blue Cash Preferred From Amex

The Blue Cash Preferred card from American Express offers a leading cashback rate on groceries. Cardholders earn 6% cashback at U.S. supermarkets on up to $6,000 per year in purchases. After reaching this limit, the rate drops to 1%. This card also provides 6% cashback on select U.S. streaming services. It rewards users who spend heavily on food and streaming. The card charges an annual fee but can be worth it for big spenders. Cashback is received as a statement credit, making it simple to use.

Blue Cash Everyday Comparison

The Blue Cash Everyday card from Amex is a no-annual-fee alternative. It offers 3% cashback at U.S. supermarkets, which is half the rate of the Preferred version. Streaming services earn 3% cashback as well. This card suits users with moderate spending habits. It also gives 2% cashback at U.S. gas stations and select department stores. While the rewards rates are lower, there is no fee to worry about. This card is ideal for those who want cashback but prefer no yearly cost.

Top Cards For Food And Dining

Eating out and ordering food can add up quickly. Using a credit card that rewards your dining expenses helps you save money. Some cards offer higher cashback rates on food and dining purchases. These cards suit people who spend a lot on restaurants, cafes, and takeout. Below are two top credit cards known for their excellent dining rewards in 2026.

Capital One Savor Rewards

The Capital One Savor Rewards card offers 4% cashback on dining and entertainment. This high rate makes it one of the best cards for food lovers. You also earn 3% cashback on groceries and 1% on all other purchases. There is no limit to how much cashback you can earn. The card charges an annual fee, but the rewards often outweigh this cost for frequent diners. It also has a simple rewards structure, making it easy to use.

American Express Gold Card Benefits

The American Express Gold Card is popular for food and dining rewards. It gives 4 points per dollar at restaurants worldwide. You also get 4 points on U.S. supermarkets, up to a spending limit. This card suits those who shop for groceries and dine out regularly. The points can be converted into travel or cashback rewards. It has an annual fee, but many users find the rewards and perks valuable. The card also offers dining credits at select restaurants.

Cards For Beginners And Fair Credit

Choosing a credit card as a beginner or with fair credit can be challenging. Many cards offer rewards, but not all suit those with limited credit history. The right card helps build credit and offers decent cashback. This section highlights two great options for newcomers and those with fair credit. Both provide straightforward rewards and manageable terms.

Capital One Quicksilverone Insights

The Capital One QuicksilverOne card is made for fair credit holders. It offers a simple cashback rate of 1.5% on every purchase. No need to track categories or special deals. This card helps build credit with monthly credit line reviews. There is an annual fee, but the cashback can offset it for regular users. The card also provides access to credit tools and alerts. These features help users monitor and improve their credit score.

Wells Fargo Reflect Card Features

The Wells Fargo Reflect card focuses on low interest and balance transfers. While its cashback rewards are modest, it helps manage credit responsibly. New cardholders get a long introductory APR period on purchases and balance transfers. This feature reduces interest costs and helps pay down debt faster. The card also has no annual fee. It suits beginners who want to build credit without high fees or complex rewards.

Choosing The Right Card For Travel

Choosing the right credit card for travel can make your trips more rewarding and affordable. The right card offers cashback, travel benefits, and convenience. It helps you save money on flights, hotels, and other travel expenses. Picking a card that matches your travel style and budget is key. This guide breaks down options for premium perks and budget-friendly choices.

Premium Perks Comparison

Premium travel cards offer high cashback rates and extra travel perks. Cards like Chase Sapphire Reserve and American Express Platinum provide lounge access and travel insurance. They also offer bonus points on travel and dining. These cards often have higher annual fees. The rewards and benefits can outweigh the fees if you travel often. Look for cards that cover trip cancellations, lost luggage, and airport lounge access. These perks make travel smoother and more comfortable.

Budget-friendly Options

Travel credit cards with no or low annual fees suit budget travelers. Chase Freedom Unlimited and Wells Fargo Active Cash offer flat-rate cashback on all purchases. These cards provide simple rewards without extra costs. You still get good cashback on travel expenses. Some cards have rotating bonus categories for travel and dining. These options help save money without a high fee. They are ideal for occasional travelers or those who want easy rewards.

Credit: media.chase.com

Selecting Cards For Everyday Spending

Selecting the right credit card for everyday spending helps you save money every time you shop. Cards that offer cashback rewards on daily purchases like groceries, gas, and dining are ideal. The best cards balance simplicity with good rewards. Knowing your spending habits guides you toward the best choice. Some cards offer straightforward cashback with no fuss. Others provide flexible rewards that let you choose how to use points or cash back. Understanding these options helps you pick a card that fits your lifestyle and maximizes savings.

Simple Cashback Choices

Simple cashback cards give a fixed percentage on all purchases. No need to track categories or activate bonuses. These cards work well for those who want easy rewards. For example, the Wells Fargo Active Cash card offers a flat cashback rate on every dollar spent. The Citi Double Cash card rewards you twice on all purchases—once when you buy, once when you pay. These cards suit people with varied spending who prefer steady rewards. No complicated rules or limits, just straightforward cashback.

Flexible Rewards Cards

Flexible rewards cards let you earn more in certain categories. Categories may change each quarter or month, like groceries or gas stations. Cards like Chase Freedom Flex offer high cashback rates on rotating categories. You can also earn bonus points on travel, dining, or streaming services. These cards fit shoppers who track categories and adjust spending. Points earned can often be redeemed for cash, gift cards, or travel. Flexible rewards cards require a little effort but offer higher savings potential.

Maximizing Cashback Rewards

Maximizing cashback rewards requires a clear plan. Smart use of credit cards can boost your earnings significantly. Understanding how to earn the most from each card helps you get better returns. Focus on strategies that fit your spending habits and financial goals. This way, you can make the highest cashback work for you.

Rotating Category Strategies

Many credit cards offer rotating cashback categories. These categories change every few months. Common ones include groceries, gas, dining, and online shopping. Activate the bonus categories each quarter to earn higher cashback. Track these changes carefully to avoid missing rewards. Spend more in these categories during the bonus period. This simple tactic increases your overall cashback significantly.

Combining Cards For Best Returns

Using multiple credit cards can maximize rewards. Some cards offer flat-rate cashback on all purchases. Others provide high cashback in specific categories. Combine a flat-rate card with a rotating category card. Use each card for the category it rewards the most. This strategy helps you earn the highest cashback overall. Keep track of each card’s benefits and expiration dates. This approach ensures you never miss out on rewards.

Credit: www.navyfederal.org

Frequently Asked Questions

How Do You Get 5% Cash Back On Everything?

Earn 5% cash back by using credit cards with rotating bonus categories. Activate offers each quarter and shop within those categories. Chase Freedom Flex and U. S. Bank Cash+ are popular cards that provide this benefit. Track categories to maximize rewards throughout the year.

What’s The Best Credit Card To Get In 2025?

The best credit card in 2025 depends on needs. Chase Sapphire Preferred suits travelers; Wells Fargo Active Cash fits everyday use. For rotating rewards, try Chase Freedom Flex. Foodies may prefer Amex Gold. Choose based on spending habits and desired perks.

Is There A 6% Cash Back Credit Card?

Yes, some credit cards offer 6% cash back on specific categories. Examples include the U. S. Bank Cash+® Visa Signature® Card and rotating category cards like Chase Freedom Flex®. Always check terms as rates vary by spending category and time period.

Which Credit Card Gives 2% Cash Back On Everything?

The Citi Double Cash Card offers 2% cash back on all purchases: 1% when you buy and 1% when you pay.

Conclusion

Choosing the highest cashback credit card in 2026 depends on your spending habits. Cards like Chase Freedom Flex offer great rewards on rotating categories. For steady cashback, consider Citi Double Cash or Wells Fargo Active Cash. Those who spend more on groceries and dining may prefer American Express Gold Card.

Always compare annual fees and bonus offers before deciding. Use your card wisely to maximize cashback benefits. Keep track of category changes to earn the most. A smart choice can help save money all year long.