What should your net worth be at age 25? It’s a question that can feel both exciting and overwhelming.

You might wonder if you’re on track compared to others or if your savings and debt are where they should be. The truth is, there isn’t one magic number that fits everyone. Your net worth depends on many things—your income, student loans, career path, and even where you live.

But knowing average benchmarks and smart financial habits can give you a clear picture of where you stand and how to build a stronger future. Keep reading, and you’ll discover what to aim for at 25, how to measure your progress, and practical steps to boost your net worth—no matter where you’re starting from.

Net Worth Basics

Understanding your net worth at age 25 helps set a strong financial foundation. It shows what you own versus what you owe. Learning net worth basics guides smarter money choices early.

Net worth is more than a number. It reflects your current financial health and future potential. Let’s break down the core concepts.

Assets And Liabilities

Assets include everything you own with value. Examples are savings, investments, and property. Liabilities are debts you owe. These include loans, credit card balances, and mortgages. Knowing the difference helps you see your real financial position.

How Net Worth Is Calculated

Calculate net worth by subtracting liabilities from assets. For example, if your assets total $20,000 and your debts total $8,000, your net worth is $12,000. This simple math reveals your true financial standing.

Why Net Worth Matters At 25

At 25, your net worth sets a baseline for growth. It helps track progress toward financial goals like buying a home or retirement. Knowing your net worth encourages saving and smart spending habits early on.

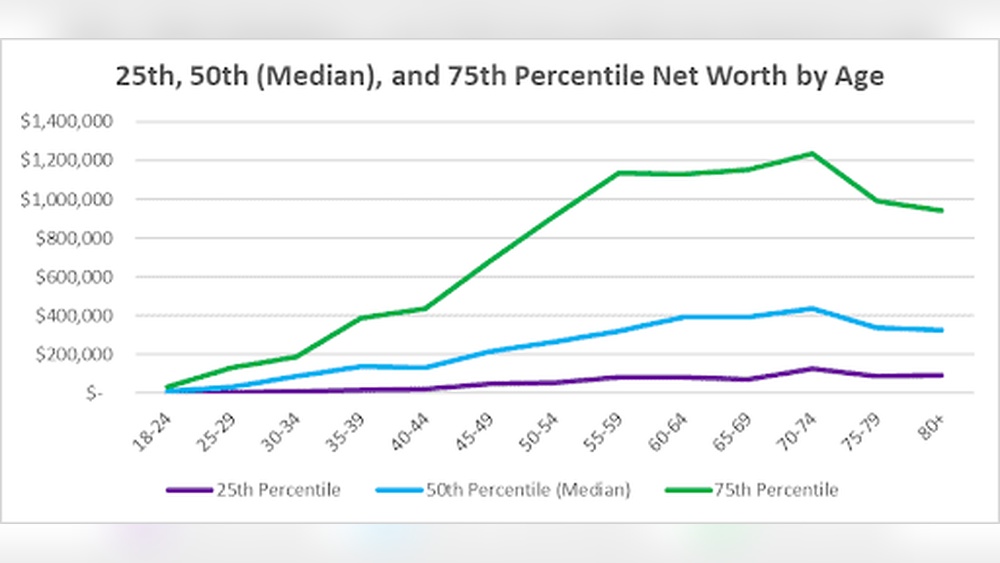

Average Vs. Median Net Worth

Understanding the difference between average and median net worth is key when assessing your financial health at age 25. These two measures give distinct pictures of wealth across a group. Knowing which one to use helps set realistic expectations and goals. This section breaks down national benchmarks, explains the difference between average and median, and shares age-based net worth statistics.

National Benchmarks

National benchmarks show typical net worth figures for people in their mid-twenties. According to recent data, the average net worth for 25-year-olds in the U.S. ranges around $40,000. The median net worth, however, is closer to $10,000. These numbers reflect the total assets minus debts for individuals at this age nationwide.

Benchmarks help you see where you stand compared to others. They provide a rough idea of what is common but do not tell the whole story. Use them as guides, not strict goals.

Differences Between Average And Median

Average net worth sums all individual net worth values and divides by the number of people. This number can be skewed by a few wealthy individuals with very high net worth. It may make the average look higher than what most people have.

Median net worth is the middle point in a list of net worth values. Half of the people have more, and half have less than this number. It gives a better sense of what a typical person owns at age 25. For most people, median net worth is a more accurate reflection of reality.

Age-based Net Worth Stats

At age 25, net worth varies widely. Many young adults carry student loan debt, which lowers net worth. Others may have started saving or investing early, increasing their net worth. Career path and income play major roles in these differences.

Statistics show that most 25-year-olds have a net worth under $15,000. A smaller group has net worth above $50,000, often due to early investments or inheritance. These stats highlight the broad range of financial situations at this age.

Factors Affecting Net Worth

Many factors shape your net worth at age 25. Understanding these helps set realistic goals. Your net worth depends on more than just income. It reflects your financial choices and situation.

Several key elements influence how much you have saved or owe by this age. These include debts, your career, and personal decisions. Each factor plays a role in building or reducing your net worth.

Student Loan Debt Impact

Student loans often reduce net worth for young adults. Many carry significant debt after college. Loan payments lower the money available to save or invest. This debt affects your financial freedom and net worth growth. Managing student loans well can improve your financial future.

Income And Career Path

Your job and income level strongly affect your net worth. Higher income allows more saving and investing. Career choices at 25 set the stage for future earnings. Some paths start slow but grow over time. Consistent income helps build assets steadily.

Life Circumstances And Choices

Personal life changes impact net worth in many ways. Some may buy a home early or start a family. Others may face unexpected expenses or delays in career growth. Spending habits and saving priorities vary widely. These choices create a wide range of net worth results.

Credit: wealthtender.com

Setting Realistic Benchmarks

Setting realistic benchmarks for your net worth at age 25 helps create clear financial goals. It gives direction and motivation to save and invest wisely. Understanding typical targets also eases stress about financial progress. Every person’s situation varies, so benchmarks guide rather than define success.

Common Savings Goals

Many financial experts suggest having saved at least half your annual salary by age 25. For example, if you earn $40,000 yearly, aim to have $20,000 saved. This can include cash savings, retirement accounts, or investments. Meeting this goal builds a strong foundation for future wealth.

Besides savings, having an emergency fund covering three to six months of expenses is key. It protects against unexpected events like job loss or medical bills. Starting small and growing this fund over time is a smart move.

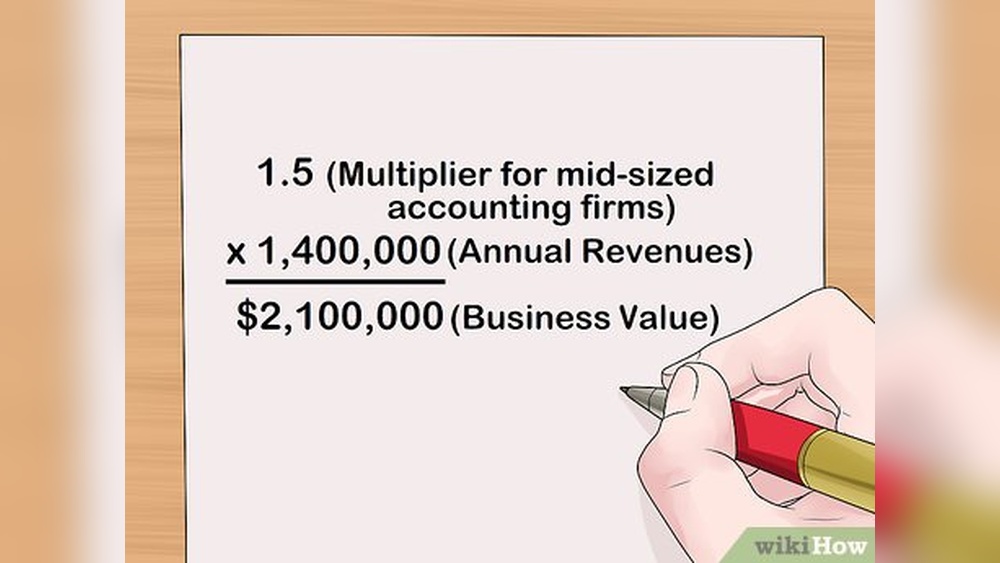

Salary Multipliers To Aim For

Salary multipliers offer a simple way to measure net worth progress. At age 25, a common target is to have a net worth equal to 0.5 to 1 times your annual salary. This means your assets minus debts should match half or all of what you earn yearly.

For example, if your salary is $50,000, aim for a net worth between $25,000 and $50,000. This range allows for differences in career paths and life choices. It also encourages consistent saving and debt management.

Personalized Financial Targets

Personalized targets depend on income, expenses, and life goals. Some may need to save more due to student loans or family support. Others might start investing early to build long-term wealth.

Tracking your income and spending helps set achievable milestones. Adjust your goals based on changes like raises or new expenses. Consulting a financial advisor can tailor a plan to your unique situation and future plans.

Strategies To Boost Net Worth

Growing your net worth by age 25 requires clear and focused strategies. Early financial habits shape your wealth for years ahead. Simple steps can make a big difference. Start with smart saving, careful debt management, and using employer benefits fully. These strategies build a strong financial base.

Building Emergency Funds

Save money for unexpected expenses. Aim for three to six months of living costs. Keep this fund in a separate, easy-access account. This fund protects you from debt if sudden costs arise. Building an emergency fund gives peace of mind and financial security.

Managing And Reducing Debt

Pay off high-interest debts first, like credit cards. Make regular payments to reduce debt steadily. Avoid adding new debt while paying off old balances. Reducing debt frees up money for saving and investing. Lower debt means higher net worth and less financial stress.

Maximizing Employer Matches

Contribute enough to your retirement plan to get the full employer match. This is free money that boosts your savings instantly. Set up automatic contributions to stay consistent. Employer matches increase your net worth faster without extra effort. Don’t miss out on this valuable benefit.

Credit: www.hustleescape.com

Smart Saving And Investing

Smart saving and investing set a strong foundation for your financial future. At age 25, the habits you build can grow your net worth steadily. Starting early helps your money work harder over time. Balancing saving and investing ensures you have funds for emergencies and growth. Planning for retirement might seem far, but early steps matter.

Starting Early For Compound Growth

Compound growth means your money earns returns, which then earn returns too. The earlier you start saving and investing, the more time your money has to grow. Even small amounts add up over years. Time is a key factor in building wealth. Starting at 25 gives you a big advantage.

Balancing Savings And Investments

Saving money means keeping cash safe for short-term needs. Investing means putting money into stocks, bonds, or funds to grow over time. Both are important. Keep enough savings for emergencies. Invest extra money to build wealth. A good balance protects you and helps your net worth increase.

Retirement Planning Basics

Retirement may seem far away, but planning now is wise. Contribute to retirement accounts like 401(k) or IRA if available. Aim to save a part of your income regularly. Employer matches in retirement plans are free money and should be used fully. Early planning reduces stress later and grows your savings faster.

Tracking Progress

Tracking your net worth progress by age 25 helps you stay on the right path. It shows how well you manage money and reach goals. Regularly checking your finances keeps you motivated and aware of changes.

Simple methods make tracking easy. Keeping a clear record of income, expenses, assets, and debts improves your financial habits. Tracking progress helps you spot areas to improve or adjust.

Budgeting Techniques

Create a budget to control spending and boost savings. Use the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings or debt. Track expenses weekly to avoid overspending. Apps or spreadsheets can help keep budgets clear and simple.

Regular Net Worth Check-ins

Set monthly or quarterly dates to review net worth. Add up your assets like savings and investments. Subtract debts such as loans or credit cards. Watching the changes guides smarter money decisions. Regular check-ins reveal progress or setbacks early.

Adjusting Goals Over Time

Your financial goals can change as life does. Adjust targets if income rises or expenses shift. Keep goals realistic and flexible to avoid frustration. Updating goals keeps you focused and ready for new challenges. Small changes can lead to big results over time.

Common Challenges At 25

Turning 25 brings a mix of excitement and challenges. Many young adults face financial hurdles that affect their net worth. Understanding these common challenges helps set realistic goals and build better money habits. Managing debt, career shifts, and lifestyle changes often shape financial health at this age.

Handling Student Loans

Student loans can weigh heavily on finances at 25. Many carry significant debt from college or trade schools. Monthly payments may consume a large part of income. Balancing loan repayment with saving feels tough. Making consistent payments reduces total interest over time. Refinancing or income-driven plans offer some relief. Prioritizing debt helps improve net worth gradually.

Navigating Career Changes

This age often brings job changes or career exploration. Switching roles can disrupt income flow temporarily. New jobs may offer different salaries and benefits. Building skills and experience takes time and patience. Freelance or part-time work might supplement income. Staying adaptable and focused on growth supports better financial stability. Career progress influences savings and investment potential.

Dealing With Lifestyle Inflation

As income grows, spending often increases too. Lifestyle inflation means buying more or pricier things. This can reduce the ability to save or invest. Avoiding unnecessary expenses protects financial goals. Creating a budget helps control spending habits. Choosing needs over wants builds stronger net worth. Mindful spending allows for steady wealth growth over time.

Top Performers’ Net Worth Habits

Top performers at age 25 share habits that grow their net worth. These habits shape their financial future. They save more, invest wisely, and handle debt carefully. Following these habits can help build a strong financial base early on.

Higher Savings Rates

Top performers save a larger part of their income. They set aside money regularly, even if the amount is small. This steady saving builds a safety net for emergencies. It also creates funds for future investments and opportunities. Saving early means more money grows over time.

Smart Investment Choices

Investing is key to increasing net worth beyond savings. High achievers pick investments with good growth potential. They diversify to reduce risks and avoid putting all money in one place. Starting investments early lets compound interest work in their favor. This habit turns small amounts into larger sums over years.

Debt Management Strategies

Managing debt wisely prevents financial stress and loss of wealth. Top performers avoid high-interest debt like credit cards. They pay off student loans and other debts quickly. This reduces interest costs and frees up money for saving and investing. Controlling debt helps keep net worth positive and growing.

Credit: en.wikipedia.org

Frequently Asked Questions

What’s The Average Net Worth Of A 25-year-old?

The average net worth of a 25-year-old in the U. S. is around $10,000 to $40,000. It varies by income, debt, and savings habits. Building assets and managing liabilities early helps grow net worth steadily over time.

How Much Should A 25 Year Old Have In A 401k?

A 25-year-old should aim to have saved about 1x their annual salary in a 401(k). Prioritize employer match to boost savings early.

What Is A Good Net Worth At 26?

A good net worth at 26 typically ranges from $10,000 to $40,000. Aim to save and invest an amount equal to your annual salary. Focus on building assets, managing debt, and growing your savings steadily. Personal income and expenses influence your ideal net worth.

Is $50,000 Saved By 30 Good?

Saving $50,000 by age 30 is a strong financial milestone. It exceeds many average net worths for this age. Prioritize saving consistently and investing early to build wealth. Personal income, expenses, and goals influence if this amount suits your situation.

Conclusion

Net worth at age 25 varies widely by individual. Focus on saving and reducing debt steadily. Aim to have savings equal to your yearly salary. Prioritize building assets and managing liabilities carefully. Personal goals and situations shape financial progress most.

Consistent effort today leads to stronger wealth tomorrow. Remember, small steps add up over time. Keep tracking your finances to stay on course. Your journey to financial health starts with simple habits.