Have you ever wondered why crypto prices soar one day and drop the next? Understanding what drives these price changes can help you make smarter decisions with your investments.

Your crypto portfolio isn’t just about luck—it’s shaped by key market forces that influence every rise and fall. You’ll discover the main factors behind crypto price movements, giving you the insight to navigate the market with confidence. Keep reading to unlock the secrets that can boost your crypto game.

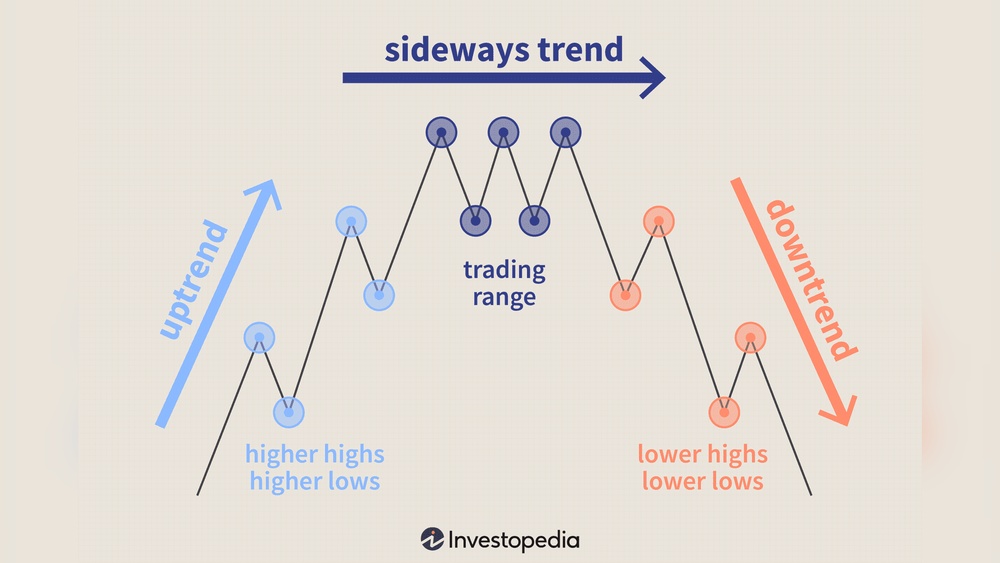

Market Demand And Supply

Market demand and supply shape crypto prices every day. Prices rise when demand is high but supply is low. Prices fall if supply exceeds demand. Understanding these forces helps explain why crypto values change quickly. Several factors affect demand and supply in crypto markets.

Role Of Investor Interest

Investor interest drives demand for cryptocurrencies. More investors buying a token pushes prices up. Less interest leads to lower demand and price drops. News, trends, and market sentiment affect how many people want to buy. Interest can change fast, causing price swings.

Impact Of Token Scarcity

Scarcity means fewer tokens are available to buy. Limited supply usually means higher prices. Some cryptocurrencies have fixed supplies, like Bitcoin’s 21 million limit. When tokens are rare, buyers compete, raising prices. New tokens or increased supply can lower scarcity and price.

Influence Of Trading Volume

Trading volume shows how many tokens change hands daily. High volume means strong demand and supply activity. This often leads to more stable prices and less chance of manipulation. Low volume can cause big price jumps from small trades. Volume reveals market interest and liquidity.

:max_bytes(150000):strip_icc()/theory-of-price.asp-Final-24772f8216aa42a6b02a1ca42f8b84da.jpg)

Credit: www.investopedia.com

Regulatory Environment

The regulatory environment plays a big role in shaping crypto prices. Rules and laws set by governments affect how people buy, sell, and use cryptocurrencies. Changes in these rules can create uncertainty or confidence in the market.

Understanding the regulatory environment helps explain why crypto prices rise or fall quickly. It also shows how legal frameworks impact investor behavior and market trends.

Effect Of Government Policies

Government policies on cryptocurrencies influence market demand and supply. Friendly policies encourage investment and innovation. Strict policies may limit access and reduce trading volumes.

Announcements about new rules often cause price fluctuations. Investors react fast to policy news. This reaction impacts crypto prices significantly.

Impact Of Legal Restrictions

Legal restrictions can limit the use of cryptocurrencies. Some countries ban trading or mining. These restrictions reduce market participation.

Legal barriers create fear among investors. Fear leads to selling pressure. This pressure pushes prices down quickly.

Role Of Global Regulations

Global regulations create a unified framework for crypto markets. They help reduce risks like fraud and money laundering. This builds trust among investors worldwide.

International cooperation on rules stabilizes prices. Without global standards, markets remain volatile. Clear regulations encourage steady growth in crypto value.

Technological Developments

Technological developments play a big role in driving crypto prices. New tech can change how a cryptocurrency works and how people use it. Updates and innovations often attract more users and investors. This can lead to price changes. Understanding these tech factors helps explain why crypto prices move.

Importance Of Blockchain Upgrades

Blockchain upgrades improve speed, security, and functionality. They fix bugs and add new features. A smoother blockchain can handle more transactions. This attracts users and boosts confidence. Prices often rise after successful upgrades. Delays or problems with upgrades can lower prices.

Role Of Innovation And Adoption

Innovation brings fresh ideas and tools to crypto projects. New apps or services increase crypto use. More adoption means more demand. Demand drives prices up. If a crypto finds real-world use, its value grows. Innovation keeps a project relevant and competitive.

Security Enhancements

Strong security protects users and their funds. Hacks and breaches scare investors. Upgrading security builds trust in a cryptocurrency. Secure platforms attract long-term holders. Better security can lead to price stability and growth. Weak security risks price drops and lost users.

Market Sentiment

Market sentiment plays a big role in shaping crypto prices. It shows how investors feel about the market. Positive feelings can push prices up. Negative feelings can cause prices to drop. Market sentiment reacts fast to news and events. Understanding this helps predict price moves.

Influence Of News And Media

News stories can change how people see cryptocurrencies. Good news, like new partnerships, often raises interest. Bad news, such as hacks or bans, scares investors. Media coverage spreads this information quickly. This can cause sudden price jumps or falls. Traders watch news closely to react fast.

Effect Of Social Media Trends

Social media has a strong impact on crypto prices. Platforms like Twitter and Reddit share opinions and tips. Viral posts can spark buying or selling waves. Influencers’ comments sway many followers. Social media creates a sense of community. This feeling can boost confidence or cause fear.

Role Of Investor Psychology

Investor emotions drive many market moves. Fear and greed often lead to quick decisions. Fear can cause panic selling, dropping prices sharply. Greed may push prices too high, creating bubbles. Understanding these emotions helps explain price swings. Markets often reflect collective investor mood.

Macroeconomic Factors

Macroeconomic factors play a big role in shaping crypto prices. These factors come from the overall economy and impact many markets, including cryptocurrencies. Understanding these forces helps explain why crypto values rise and fall over time.

Impact Of Inflation And Interest Rates

Inflation reduces the buying power of money. When inflation is high, people often look for assets that keep value. Crypto can attract investors as a possible hedge against inflation. Interest rates set by central banks influence borrowing costs. Higher rates make loans expensive and can reduce investment in crypto. Lower rates encourage borrowing and spending, sometimes boosting crypto demand.

Correlation With Traditional Markets

Cryptos often move with stocks and bonds but not always. Sometimes, crypto acts like a risk asset, rising with stock markets. Other times, it behaves like a safe haven, moving opposite to stocks. This mixed correlation makes crypto unique. Investors watch traditional markets to predict crypto trends.

Effect Of Global Economic Events

Big events like recessions, wars, or trade disputes impact crypto prices. Economic uncertainty can push investors toward crypto for safety. Positive events, such as economic growth, might reduce crypto demand as people prefer stable investments. Global policies on crypto regulation also shape market confidence and prices.

Credit: www.innosight.com

Whale Movements

Whale movements play a big role in changing crypto prices. Whales are people or groups holding large amounts of cryptocurrency. Their actions can shift market trends quickly. Understanding their moves helps explain sudden price changes.

Definition And Influence Of Whales

Whales are crypto holders with huge coin amounts. They can be individuals, companies, or funds. Because of their size, they can affect the market by buying or selling large amounts. Their trades often create strong price shifts.

Impact On Price Volatility

Whale trades can cause sharp price rises or drops. Large sales may trigger panic among smaller investors. Big purchases can spark buying interest. This creates high price swings in short times. Volatility often follows whale activity closely.

Tracking Large Transactions

Crypto tools track whale movements by watching big transactions. Public blockchains show transfer amounts and wallet addresses. Analysts study these to guess future price actions. Tracking whales helps traders prepare for market changes.

Market Manipulation Tactics

Market manipulation tactics often influence crypto prices sharply. These tactics create false signals about demand and value. Traders may be tricked into buying or selling at wrong times. Understanding these tactics helps investors protect their money. Awareness of common schemes can reduce risks in crypto trading.

Pump And Dump Schemes

Pump and dump schemes involve inflating a coin’s price quickly. Organizers buy a lot of a cheap crypto. Then, they spread hype to attract buyers. The price rises fast as more people buy in. Once the price peaks, organizers sell their coins. This causes the price to crash. Many small investors lose money in this process.

Wash Trading And Spoofing

Wash trading is when someone buys and sells the same asset. This creates false trading volume to trick others. Spoofing is placing fake orders to mislead traders. Spoofers cancel these orders before execution. Both tactics create a false market picture. Traders may think there is more interest than reality. This can cause misleading price moves.

Regulatory Measures Against Manipulation

Regulators work to stop market manipulation in crypto. They create rules to increase market transparency. Many countries require exchanges to report suspicious activities. Some impose heavy fines on manipulators. Regulations also protect small investors from fraud. These measures help build trust in the crypto market. Enforcement is key to reduce manipulation risks.

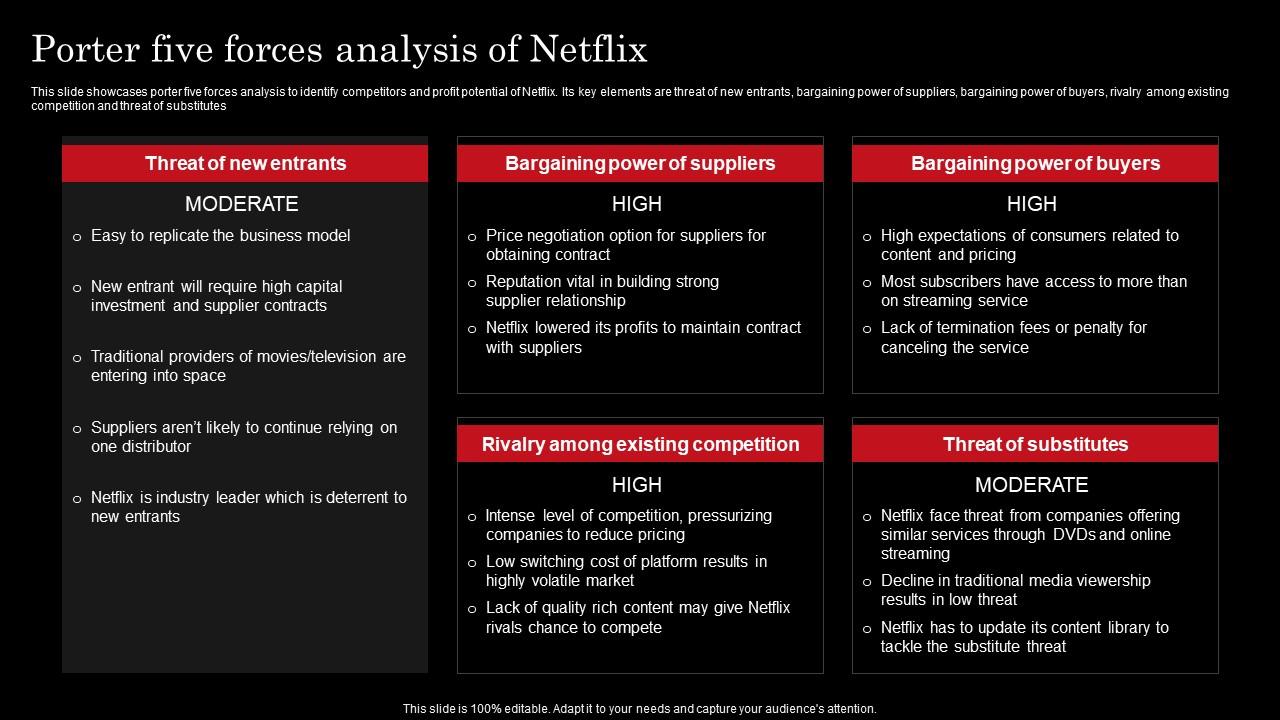

Credit: www.slideteam.net

Frequently Asked Questions

What Are The Main Factors Influencing Crypto Prices?

Crypto prices are influenced by supply and demand, market sentiment, regulation, technological developments, and macroeconomic trends. News and investor behavior also play significant roles.

How Does Market Sentiment Affect Cryptocurrency Value?

Market sentiment shapes investor confidence and buying behavior. Positive news boosts prices, while fear or uncertainty can trigger sell-offs and price drops.

Why Do Regulations Impact Crypto Market Prices?

Regulations create legal clarity and trust but can also restrict trading. Announcements of new laws or bans often cause price volatility in crypto markets.

How Does Supply And Demand Control Crypto Price?

Limited supply with high demand drives prices up. Conversely, increased supply or reduced demand causes prices to fall, reflecting basic economic principles.

Conclusion

Crypto prices move due to many factors. Market demand and supply play a big role. News and events can change prices fast. Investor emotions also affect the market. Understanding these forces helps make better choices. Prices can rise or fall without warning.

Stay informed and watch the market closely. This knowledge helps you follow crypto trends easily. Keep learning and stay patient in crypto investing.