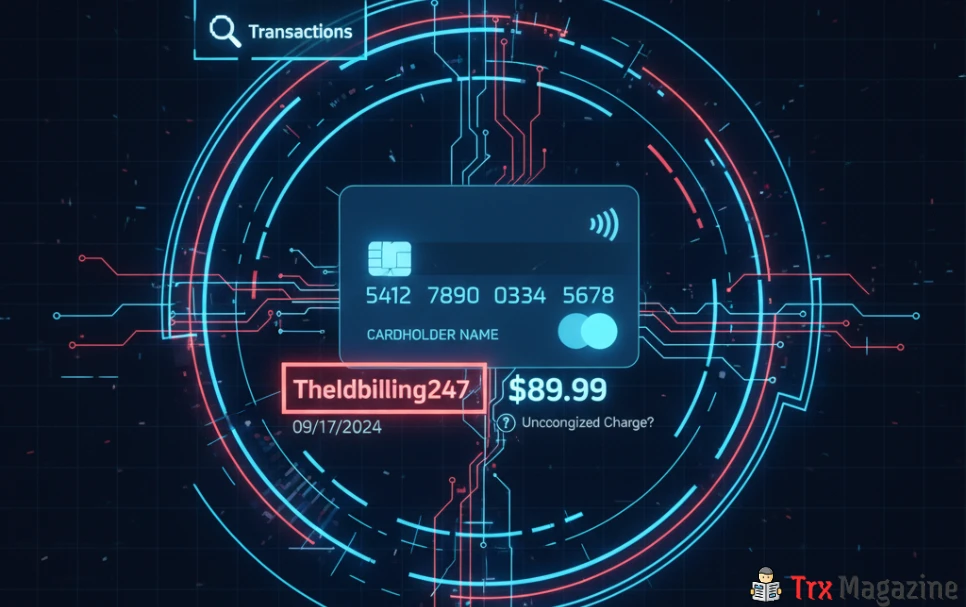

Have you ever spotted a mysterious charge labeled “Theldbilling247” on your credit card statement and wondered what it is? You’re not alone.

Unexpected charges can be confusing and even alarming, especially when you don’t recognize the merchant. Before you panic or ignore it, understanding what this charge means and how it got there is crucial for protecting your finances. You’ll discover exactly what “Theldbilling247” charges are, why they appear on your credit card, and the simple steps you can take to verify and handle them.

Keep reading to take control of your credit card statement and avoid unwanted surprises.

Identifying Theldbilling247 Charge on Credit Card

Theldbilling247 charges can be confusing for many cardholders. These charges often appear without clear details, making it hard to know what they are for. Recognizing these charges quickly helps you manage your credit card better. It also protects you from unwanted or fraudulent payments.

Understanding how these charges show up on your statement is key. This knowledge helps you decide if the charge is valid or if you need to take action. Below are common situations where you might see Theldbilling247 charges and how to spot them on your credit card statement.

Common Scenarios For Charges

Theldbilling247 charges often come from subscriptions or online services. Sometimes, they appear after free trials end without clear notice. Another reason is in-app purchases or digital content payments. Some users see these charges due to recurring billing agreements they forgot about. At times, mistaken or fraudulent charges also show up under this name.

How Charges Appear On Statements

On credit card statements, Theldbilling247 may appear as a single line item. The merchant name might be shortened or unclear. The charge date and amount will be listed, but no detailed description is usually given. This lack of detail can make it hard to identify the purchase. Check your recent online activity or subscriptions to match the charge.

Always compare the charge with your receipts or emails from merchants. If the charge looks suspicious, contact your card issuer immediately. They can help you confirm the charge and take steps to protect your account.

Reasons For Theldbilling247 Charges

Charges from Theldbilling247 can appear on your credit card for different reasons. Understanding these reasons helps you identify and manage unexpected fees. This section explains common causes of Theldbilling247 charges.

Many people find these charges confusing because they do not remember authorizing them. Knowing the source of these charges can help you take the right steps to address them.

Subscription Services And Trials

Theldbilling247 often charges for subscription services. These include monthly or yearly memberships you might have signed up for. Sometimes, free trials turn into paid subscriptions without clear reminders. If you forget to cancel before the trial ends, charges will appear on your card. These services may include apps, games, or digital content.

Always check your email for subscription confirmations. Many companies send automatic renewal notices. Keep track of trial periods to avoid unexpected bills.

Merchant Billing Practices

Some merchants use third-party billing companies like Theldbilling247. This practice can make charges look unfamiliar on your statement. Merchants may group charges under different names or billing entities. This causes confusion when identifying the source of the charge. Sometimes, multiple small charges appear instead of one large fee.

Review your purchase history carefully. Contact the merchant directly for clarification. Understanding merchant billing practices helps you spot unauthorized or duplicate charges.

Verifying The Charge Source

Verifying the source of a charge on your credit card is vital. This process helps confirm whether the transaction is legitimate. It also protects you from potential fraud or unauthorized use. Theldbilling247 charges can sometimes appear unclear. Taking steps to verify these charges ensures peace of mind and financial safety.

Checking Transaction Details

Start by reviewing your credit card statement carefully. Look at the date, amount, and merchant name listed for the charge. Sometimes the merchant name may differ from the business name you know. Check for any patterns in recent spending that might explain the charge. Note any unusual or unexpected transactions for further investigation. Keeping a record of these details will help when contacting your bank or merchant.

Using Issuer Tools For Merchant Info

Many credit card issuers offer tools to identify merchants linked to charges. Log in to your online banking account and find transaction details. Some issuers provide a merchant category code (MCC) or address. Use this information to verify the charge source. If unsure, call the customer service number on your card’s back. They can provide additional details about the transaction and merchant. This step helps confirm if the charge is valid or needs dispute.

Handling Unauthorized Charges

Unauthorized charges on your credit card can cause stress and confusion. It is important to act quickly to protect your finances. Handling these charges involves clear steps to secure your account and resolve the issue.

Taking immediate action helps prevent further loss and ensures your credit card details remain safe. Below are key steps to follow when dealing with unauthorized charges from Theldbilling247 or any other merchant.

Contacting Your Bank Or Card Issuer

Start by calling the number on the back of your credit card. Inform your bank about the suspicious charge from Theldbilling247. Your bank will check your recent transactions and freeze your card if needed. They can also guide you on how to protect your account. Acting fast can stop more unauthorized charges from happening.

Disputing Charges And Reporting Fraud

File a dispute for the unauthorized charge to get a refund. Provide your bank with details like the date and amount of the charge. Report any fraud or suspicious activity clearly and promptly. Your bank will investigate and work to remove the charge if it is fraudulent. Keep records of your communication for future reference.

Preventing Future Unexpected Charges

Unexpected charges on your credit card can cause stress and confusion. Preventing these surprises helps you control your spending and protect your finances. Taking simple steps now avoids future billing problems. Stay alert and act quickly to keep your credit safe.

Managing Subscriptions Effectively

Review all your subscriptions regularly. Cancel those you no longer use or need. Keep a list to track renewal dates and costs. Use reminders to check subscriptions before they renew. Avoid signing up for free trials without noting cancellation deadlines. This prevents automatic charges you might forget.

Blocking Or Canceling Merchant Billing

Contact your bank to block unwanted merchants. Ask them to stop future charges from specific companies. You can also cancel your card if charges continue. Request a new card with a different number. This stops merchants from charging your old card. Always report unknown charges to your bank immediately.

Understanding Ghost Charges

Many people find strange charges on their credit card statements. These are often called ghost charges. They can cause confusion and worry. Knowing what ghost charges are helps you recognize them. It also helps protect your money from unauthorized use.

Ghost charges are not always visible or easy to understand. They can appear without a clear merchant name or description. This makes it hard to identify where the charge came from. Understanding these charges can save you time and stress.

What Ghost Cards Are

Ghost cards are virtual credit cards linked to a main account. Businesses use them to control spending by creating multiple card numbers. Each ghost card can be used by different employees or departments. This keeps transactions organized while using one main account.

These cards do not have physical forms. They exist only digitally. This means they cannot be stolen like a regular card. But charges made with ghost cards still appear on the main credit card bill.

How Ghost Charges Relate To Billing

Ghost charges show up as expenses from the main credit card. They may not list the actual user or the exact purchase. This can make the charges look unfamiliar or suspicious. Businesses use ghost cards to track spending by project or team.

For individuals, ghost charges may appear if a company uses virtual cards for subscriptions or services. These charges can look like unknown billing. Checking with the merchant or your company’s billing department can help clarify them.

Resources For Charge Disputes

Disputing a charge from Theldbilling247 on your credit card can feel confusing. Knowing where to turn helps you act fast and protect your money. Several resources exist to guide you through the dispute process. Use these tools to get answers, report problems, and resolve issues efficiently.

Customer Service Contacts

Start by contacting your credit card company’s customer service. Call the number on the back of your card for direct help. Explain the charge and ask for details about the transaction. Request a temporary hold or dispute the charge if it looks suspicious. Many banks offer online chat or secure messaging for convenience. Keep notes of all conversations, including names and times.

Government And Consumer Protection Sites

Government websites provide trusted information on how to handle charge disputes. The Federal Trade Commission (FTC) offers clear steps for reporting unauthorized charges. Your state’s attorney general office can also assist with consumer complaints. The Consumer Financial Protection Bureau (CFPB) accepts disputes and investigates unfair billing practices. Use these sites to learn your rights and submit formal complaints. They serve as strong allies in resolving credit card issues.

Frequently Asked Questions

What’s That Charge On My Credit Card?

That charge may be a purchase, subscription, or fee. Review your statement or contact your card issuer for details.

How Do I Find Out Where A Charge Came From On My Credit Card?

Check your credit card statement for transaction details. Call the number on your card’s back to confirm the merchant. Use your issuer’s tools or apps to identify the charge source quickly.

Can I Block A Merchant From Charging My Card?

You can block a merchant from charging your card by contacting your bank. Request to revoke payment authorization or place a stop payment order.

What Is A Ghost Charge On A Credit Card?

A ghost charge on a credit card is a temporary, pending transaction that may disappear before final billing. Businesses use ghost cards linked to main accounts for centralized billing.

Conclusion

Theldbilling247 charges on credit card statements can cause concern. Always check your transaction history carefully. Contact your bank immediately if you find unknown charges. Protect your card details to avoid unauthorized payments. Stay alert and review statements regularly for safety.

Taking these steps helps keep your finances secure.