Are you worried about how rising prices might affect your cryptocurrency investments? Inflation can change the game in surprising ways, and understanding its impact is key to protecting and growing your digital assets.

You’ll discover how inflation influences the value of cryptocurrencies, what risks to watch out for, and smart strategies you can use to stay ahead. Keep reading to make sure your investments don’t just survive but thrive when inflation hits.

:max_bytes(150000):strip_icc()/how-profit-inflation_V2-7a44069f363c407c8cbe36814b79e848.png)

Credit: www.investopedia.com

Inflation And Its Effects

Inflation affects many parts of the economy. It changes how much money is worth and impacts investments. Understanding inflation helps investors make smart decisions. It also shows why some investments lose value over time.

Cryptocurrency is a new type of investment. It reacts differently to inflation than traditional assets. Knowing inflation’s effects is key to understanding crypto’s role today.

Causes Of Inflation

Inflation happens when prices rise across many goods and services. It can start from many reasons. Sometimes, there is too much money in the system. Other times, costs to make products go up. Demand for goods can also increase faster than supply. These factors push prices higher.

Inflation Trends Worldwide

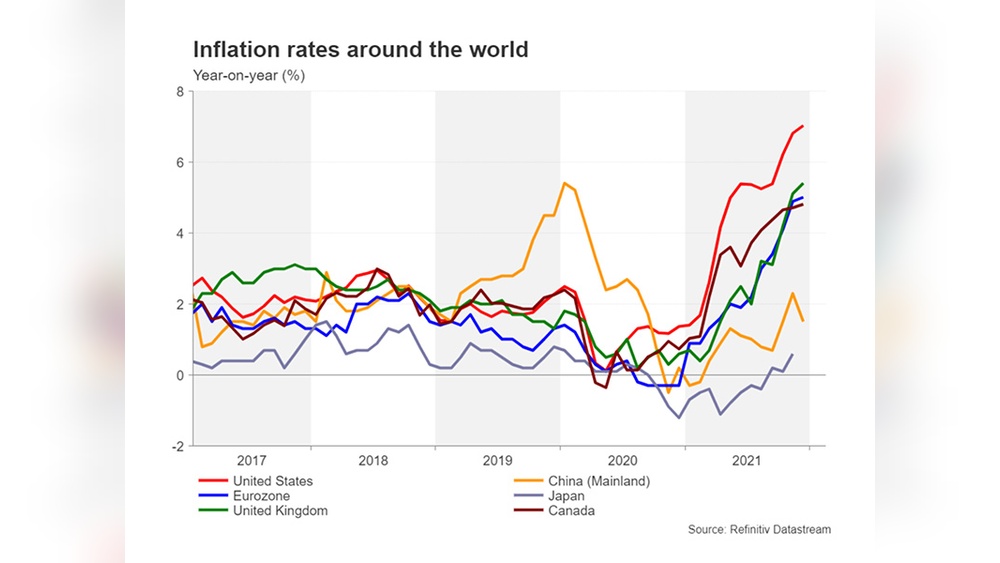

Many countries face inflation, but rates vary. Some nations have low, steady inflation. Others see sharp price increases. Global events like wars or pandemics can cause spikes. Central banks try to control inflation with policies. They raise interest rates to slow price rises.

Impact On Traditional Investments

Inflation lowers the value of cash and bonds. Fixed income investments lose real buying power. Stocks may rise with inflation but not always. Property values often increase with inflation. Investors worry about losing money in real terms. This uncertainty makes some look for alternatives like crypto.

:max_bytes(150000):strip_icc()/GettyImages-157311703-d5072cb293f44aa4a59c274e56fbd963.jpg)

Credit: www.investopedia.com

Cryptocurrency Basics

Cryptocurrency is a digital form of money. It works without banks or governments. People use it to buy goods or invest. Understanding how it works helps you see its value and risks.

Many people find cryptocurrencies interesting because they offer a new way to handle money. The technology behind them is different from regular money systems. This difference can affect investments, especially when inflation changes the economy.

How Cryptocurrencies Work

Cryptocurrencies run on blockchain technology. This is a public digital ledger. It records all transactions safely and transparently. Each transaction is verified by network participants called miners.

Miners solve complex math problems to confirm transactions. This process keeps the system secure. It also creates new coins as rewards. Users store cryptocurrencies in digital wallets. These wallets have private keys for security.

Popular Cryptocurrency Types

Bitcoin is the first and most famous cryptocurrency. It acts like digital gold. Ethereum is another popular type. It allows users to build apps on its platform. Other coins like Litecoin and Ripple serve different purposes.

Some cryptocurrencies focus on privacy, like Monero. Others aim for fast transactions, such as Stellar. Each type has unique features and uses. Knowing these helps choose the right investment.

Market Volatility In Crypto

Cryptocurrency prices can change quickly and often. This high volatility means prices can rise or fall sharply. It creates both risks and chances for investors. Factors like news, regulations, and technology updates impact prices.

Market volatility also relates to inflation. When inflation rises, people may buy cryptocurrencies as a safe place for money. This can increase demand and affect prices. Understanding volatility helps manage investment risks.

Inflation’s Influence On Crypto

Inflation affects many types of investments, including cryptocurrency. It changes the value of money over time. This makes crypto an interesting topic for investors. People wonder if crypto can protect their wealth from inflation. Understanding how inflation influences crypto helps in making smarter investment choices.

Crypto As An Inflation Hedge

Many investors see crypto as a way to fight inflation. Unlike regular money, some cryptocurrencies have a limited supply. This limit can stop the value from dropping too much. Crypto does not rely on banks or governments. This independence attracts those worried about inflation’s impact on cash.

Price Movements During Inflation

Crypto prices often change when inflation rises. Some coins gain value as more people buy them. Others can fall due to market fears or regulation news. Crypto markets can be very volatile. This means prices can go up and down quickly in inflation times.

Comparing Crypto To Gold And Stocks

Gold is a traditional safe choice during inflation. It holds value well but does not grow fast. Stocks can lose value if inflation hurts company profits. Crypto offers a mix of risks and rewards. It can rise faster than gold but with more ups and downs. Investors often use a mix of assets to balance risk.

Risks For Crypto Investors

Cryptocurrency investments come with unique risks. Inflation adds more uncertainty to these risks. Understanding these challenges helps investors make better choices.

Market Instability

Crypto markets change rapidly. Prices can rise or fall in minutes. Inflation can increase this instability. Investors may face sudden losses. This makes crypto investments very risky.

Regulatory Challenges

Governments may create new rules for cryptocurrencies. These rules can affect prices and usage. Inflation often leads to stricter regulations. Investors must watch for legal changes. These can limit access or increase costs.

Security Concerns

Crypto investments need strong security measures. Inflation can increase cybercrime risks. Hackers target digital wallets and exchanges. Losing access to funds is common. Investors must protect their assets carefully.

Strategies For Inflationary Periods

Inflation creates challenges for all investors. Cryptocurrency investors need clear strategies. Planning can reduce risks and protect value. Inflation affects different assets in unique ways. Crypto investors must adapt to changing markets. Smart strategies help maintain growth during inflation.

Diversifying Crypto Portfolios

Diversification spreads risk across many assets. Holding different cryptocurrencies lowers potential losses. Some coins perform better in inflation than others. Stablecoins can provide safety during market swings. Investing in various crypto sectors adds balance. This approach helps protect overall portfolio value.

Timing Market Entry And Exit

Choosing when to buy or sell matters. Entering the market at low prices is best. Exiting before major drops preserves gains. Watching inflation trends guides timing decisions. Avoid rushing into trades based on fear. Patience often leads to better investment results.

Long-term Vs Short-term Investments

Long-term holds can withstand inflation pressure. Many cryptocurrencies gain value over time. Short-term trades offer quick profit chances. They carry more risk during inflation spikes. Balancing both styles suits different goals. Understanding your risk helps decide the best method.

Future Outlook

The future of cryptocurrency investments amid inflation remains uncertain but promising. Many factors will shape how crypto assets perform as inflation pressures continue worldwide. Investors must watch key trends and changes closely to understand potential risks and opportunities.

Inflation affects currency values and purchasing power. Cryptocurrencies may offer some protection, but they also face unique challenges. The evolving landscape will depend on economic policies, technology, and market behavior.

Emerging Trends In Crypto

New types of cryptocurrencies and blockchain projects appear regularly. Stablecoins tied to real assets gain attention as a way to reduce volatility. Decentralized finance (DeFi) platforms expand access to lending and borrowing services. These trends attract more users and could change how people use crypto as a hedge against inflation.

Potential Impact Of Central Bank Policies

Central banks control interest rates and money supply to fight inflation. Their decisions influence crypto markets indirectly through traditional finance channels. Some countries explore digital currencies issued by central banks (CBDCs). Such moves may increase regulation and affect crypto adoption and prices.

Technological Innovations

Advancements in blockchain technology improve security and speed of transactions. Layer 2 solutions reduce costs and congestion on networks like Ethereum. Improved privacy features attract users concerned about data protection. These innovations help make cryptocurrencies more practical and trustworthy for investors amid inflation.

Credit: blog.bitpanda.com

Frequently Asked Questions

How Does Inflation Affect Cryptocurrency Prices?

Inflation often drives investors to cryptocurrencies as a hedge. Rising inflation can increase demand for digital assets, potentially boosting their prices. However, volatility remains high, and other factors also impact cryptocurrency values.

Can Cryptocurrencies Protect Against Inflation?

Yes, some cryptocurrencies, like Bitcoin, are seen as inflation hedges. Their limited supply can preserve value when fiat currencies lose purchasing power. However, market fluctuations can affect this protection.

Why Do Investors Prefer Crypto During High Inflation?

Investors seek assets that maintain value when inflation rises. Cryptocurrencies offer decentralization and scarcity, attracting those worried about fiat currency devaluation. This demand can increase crypto investment during inflationary periods.

Is Cryptocurrency A Safer Investment During Inflation?

Cryptocurrency can be a safer store of value against inflation, but it carries high volatility risks. Diversification is crucial to balance potential gains and losses during inflationary times.

Conclusion

Inflation affects cryptocurrency investments in many ways. Prices can rise, but risks also increase. Investors should watch the market closely. Understanding inflation helps make smarter choices. Cryptocurrencies may offer some protection against inflation. Still, they can be very volatile. Stay informed and review your investment plan often.

Balance is key to managing risks and rewards. Keep learning and adapt to changes in the economy. This approach can improve your chances of success.