Have you ever wondered why cryptocurrencies like Bitcoin can be so unpredictable? If you want to enjoy the benefits of digital money without the rollercoaster of price swings, stablecoins might be exactly what you need.

These special types of digital coins are designed to keep their value steady, making them easier and safer to use every day. You’ll discover how stablecoins work and why they are becoming essential in the world of finance. By the end, you’ll see how understanding stablecoins can help you make smarter choices with your money.

Keep reading to unlock the power of stability in the fast-paced crypto market.

Credit: www.gemini.com

What Are Stablecoins

Stablecoins are a special type of cryptocurrency designed to keep their value steady. Unlike other digital coins that change price quickly, stablecoins aim to stay stable. This makes them useful for daily transactions and saving money without losing value.

Stablecoins link their value to a stable asset like a dollar or gold. This connection helps keep their price fixed. Many people use stablecoins to avoid the ups and downs of other cryptocurrencies.

Types Of Stablecoins

Stablecoins come in different types based on what backs their value. They mainly fall into three categories: fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. Each type uses a unique method to maintain price stability.

Fiat-collateralized Models

Fiat-collateralized stablecoins have real money stored in banks. For every stablecoin issued, there is an equal amount of fiat currency held as backup. This method keeps the coin’s price close to the value of the fiat money, like the US dollar. People trust these stablecoins because they can exchange them for real cash anytime.

Crypto-collateralized Models

Crypto-collateralized stablecoins are backed by other cryptocurrencies. These coins use smart contracts to lock up crypto assets as collateral. Since cryptocurrencies can change value, these stablecoins often require extra collateral. This extra helps keep the stablecoin price steady even if the collateral value falls.

Algorithmic Stablecoins

Algorithmic stablecoins do not use any collateral. Instead, they rely on computer programs to control supply and demand. The algorithm increases or decreases the number of coins available to keep the price stable. This method tries to balance the market automatically without holding assets.

Credit: www.transfi.com

Mechanics Behind Stablecoins

Stablecoins are a special type of cryptocurrency designed to keep their value steady. Their mechanics work differently from other digital currencies that can change price quickly. Understanding how stablecoins maintain this stability helps explain their importance in the crypto world.

Backing And Reserves

Most stablecoins have assets stored as backing. These assets can be money, like US dollars, or other valuable items. The reserves act like a safety net, ensuring each stablecoin equals a real-world asset. This backing builds trust and keeps the coin’s value stable.

Price Stability Mechanisms

Stablecoins use different methods to keep their price steady. Some rely on direct backing, while others use algorithms to control supply. These mechanisms adjust the number of coins available to prevent price swings. They work quietly to keep value close to a target amount.

Role Of Smart Contracts

Smart contracts are automatic programs on the blockchain. They manage stablecoins without needing a middleman. Smart contracts handle transactions, maintain rules, and control supply changes. This automation makes stablecoins reliable and transparent for all users.

Benefits For The Financial Sector

Stablecoins offer many benefits to the financial sector. They help make financial systems more stable and efficient. Their design reduces risks and cuts costs. This makes transactions easier and faster for users and businesses.

Reducing Volatility Risks

Stablecoins keep their value steady by linking to real assets like the US dollar. This reduces the price swings common in other cryptocurrencies. Financial institutions can use stablecoins without fearing sudden losses. This stability helps protect investments and savings.

Enhancing Transaction Speed

Stablecoins allow near-instant payments across the globe. Traditional bank transfers take days. Stablecoins can complete transactions within minutes or seconds. Faster payments improve cash flow for companies and individuals. This speed supports better business operations and customer service.

Lowering Transaction Costs

Using stablecoins often costs less than traditional banking or payment systems. They reduce fees for cross-border transfers and currency conversions. Lower costs make financial services more accessible to many people. Businesses save money, and customers enjoy cheaper payments.

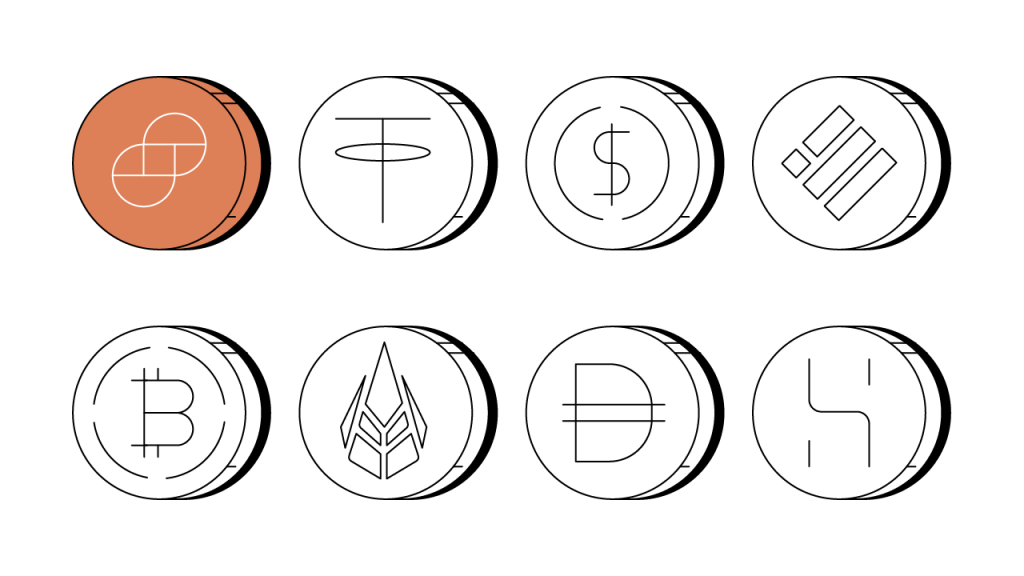

Credit: www.onesafe.io

Use Cases In Finance

Stablecoins have many uses in finance. They offer a reliable way to store and transfer value. These digital coins keep a steady price, often tied to a currency like the US dollar. This stability helps businesses and individuals avoid the ups and downs of regular cryptocurrencies. Below are some key ways stablecoins are used in the financial world.

Cross-border Payments

Sending money across countries can be slow and costly. Banks and services charge high fees for currency exchange and processing. Stablecoins make cross-border payments faster and cheaper. Transactions happen almost instantly. People and companies save money on fees. Stablecoins also avoid delays from bank holidays or time zones. This creates a smoother payment experience worldwide.

Decentralized Finance (defi)

DeFi uses blockchain technology to offer financial services without banks. Stablecoins play a big role in DeFi platforms. They provide a safe way to lend, borrow, and trade assets. Users avoid the risk of price swings common in other cryptocurrencies. Stablecoins help keep the system stable and accessible. This encourages more people to join the DeFi ecosystem.

Remittances And Micropayments

Millions of people send money to family in other countries. Traditional remittance services can take days and charge large fees. Stablecoins speed up these transfers with low costs. They also support very small payments, called micropayments. This makes it easier for people to pay for online content or services. Stablecoins help make money transfer simple and affordable for everyone.

Regulatory Challenges

Stablecoins face many regulatory challenges worldwide. Governments and agencies work to create rules that keep users safe. These challenges affect how stablecoins operate and grow. Understanding these issues helps explain the future of stablecoins in finance.

Compliance Requirements

Stablecoin providers must follow strict rules set by authorities. These rules include anti-money laundering (AML) and know your customer (KYC) laws. Providers need to verify users’ identities to stop illegal activities. Meeting these rules can be costly and complex. Some companies struggle to keep up with changing regulations.

Consumer Protection Concerns

Regulators worry about protecting people who use stablecoins. Users risk losing money if stablecoins fail or lose value. Clear rules are needed to ensure transparency about how stablecoins work. Consumers must understand the risks before buying or using stablecoins. Regulators want to prevent scams and fraud in this space.

Impact On Monetary Policy

Stablecoins can affect a country’s money system. They can change how money flows and how central banks control it. Regulators study these effects to keep financial stability. Some worry stablecoins might reduce the power of traditional banks. Governments want to manage stablecoins without harming the economy.

Future Trends

The future of stablecoins holds many new possibilities. These digital assets will likely change how money moves and works worldwide. Understanding upcoming trends can help us see their growing importance. Stablecoins are set to blend more with everyday finance and technology. This could make payments faster and safer for everyone.

Integration With Traditional Finance

Stablecoins are joining traditional banks and payment systems. Banks may use stablecoins to clear payments quickly. This helps reduce delays and costs in money transfers. More businesses might accept stablecoins alongside cash and cards. This makes spending digital money easier and more common.

Advancements In Algorithmic Models

New algorithms will improve stablecoin stability and trust. These models use smart contracts to control supply and demand. They adjust the coin’s value without needing real money backing. This can make stablecoins cheaper and faster to use. Algorithms also add security by reducing fraud and errors.

Potential For Central Bank Digital Currencies

Central banks are exploring digital versions of their money. These are called Central Bank Digital Currencies or CBDCs. CBDCs may use stablecoin technology for easy and safe payments. They can help governments track money flow and fight illegal activities. CBDCs might change how people save, pay, and borrow money.

Frequently Asked Questions

What Are Stablecoins And How Do They Work?

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar. They maintain a fixed value using reserves or algorithms. This stability reduces volatility, making stablecoins useful for transactions, trading, and storing value in the crypto space.

Why Are Stablecoins Important In Cryptocurrency?

Stablecoins provide stability in the volatile crypto market. They enable seamless trading, reduce risk, and facilitate faster cross-border payments. Additionally, they bridge traditional finance and digital assets, enhancing adoption and usability for everyday transactions.

How Do Stablecoins Maintain Their Price Stability?

Stablecoins use collateral, such as fiat reserves or crypto assets, to back their value. Some use algorithms to adjust supply based on demand. These mechanisms help keep the stablecoin’s price close to the pegged asset, ensuring trust and reliability.

What Are The Main Types Of Stablecoins?

The main types include fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. Fiat-collateralized stablecoins hold real-world currency reserves. Crypto-collateralized use crypto assets as backing. Algorithmic stablecoins rely on smart contracts to control supply and demand.

Conclusion

Stablecoins offer a simple way to keep digital money steady. They link to real assets, making them less risky. People use stablecoins to buy, sell, or save without big price swings. Banks and businesses find them useful for fast, low-cost transfers.

Understanding stablecoins helps you see the future of money. They bridge old and new financial systems smoothly. Staying informed about stablecoins can help you make smarter choices. The world of finance is changing, and stablecoins play a key part.