Are you frustrated because your net worth just isn’t moving up, no matter how hard you try? You’re not alone.

Many people work tirelessly, yet their financial growth feels stuck or even going backward. The good news? Understanding the real reasons behind this stall is the first step to fixing it. You’ll discover simple yet powerful habits and strategies that can turn your net worth around.

Get ready to take control of your financial future and watch your wealth grow steadily. Keep reading—you don’t want to miss these eye-opening insights!

Common Roadblocks

Many people struggle to grow their net worth due to common financial roadblocks. These obstacles stop money from building up over time. Recognizing these issues can help you make better money choices. This section covers four key roadblocks that limit your financial growth. Understanding them is the first step to solving your money problems.

High Debt Levels

Debt can drain your income through interest payments. High balances on credit cards or loans reduce the money you save. Paying only minimum amounts keeps debt high and slows wealth building. Focus on paying off debts quickly to free up cash. Lower debt means more money to invest or save.

Lifestyle Inflation

Spending more as you earn more is lifestyle inflation. It stops your net worth from growing even with higher income. Buying bigger houses or cars uses up extra money fast. Keep spending steady while increasing savings and investments. This habit helps your net worth grow steadily over time.

Lack Of Budgeting

Without a budget, you lose track of where money goes. Unplanned spending wastes funds that could boost your net worth. Setting a clear budget helps control expenses and save more. Knowing your income and costs guides better financial decisions. A simple budget can improve money growth.

Inadequate Emergency Fund

Unexpected expenses can force you to use savings or borrow money. Without an emergency fund, financial setbacks hurt your net worth. Build a fund with three to six months of living costs. This safety net protects your savings and prevents debt. A strong emergency fund keeps your money growing safely.

Impact Of Poor Financial Habits

Poor financial habits can stop your net worth from growing. These habits quietly drain your resources. They block your path to financial success. Recognizing these habits is the first step to change. Fixing them helps build stronger financial health.

Overspending

Spending more than you earn reduces your savings. It leaves little room for investment or emergencies. Small daily expenses add up fast. Avoid impulse buys and unnecessary purchases. Create a budget and stick to it. Control over spending frees money to grow your net worth.

Ignoring Investment Opportunities

Keeping money only in savings accounts limits growth. Investments offer higher returns over time. Not investing means missing out on compound growth. Research simple options like index funds or bonds. Start with small amounts and increase gradually. Investing regularly builds wealth steadily.

Failure To Track Net Worth

Without tracking, you can’t see your financial progress. It’s easy to overlook debts or missed savings goals. Track your assets and liabilities monthly. Use apps or spreadsheets to keep records updated. Monitoring net worth helps make better money decisions and adjust habits.

Smart Debt Management

Managing debt smartly plays a key role in growing your net worth. Debt can hold you back if not handled wisely. Understanding how to manage debt can save you money on interest and improve your financial health.

Smart debt management means making clear plans to reduce what you owe. It also means choosing the best methods to pay off debt quickly and affordably. This approach frees up money you can save or invest.

Prioritizing High-interest Debt

Focus on paying off debts with the highest interest rates first. High-interest debt costs more over time and slows down your net worth growth. Credit cards and payday loans often have the highest rates.

Paying these off quickly reduces the total interest you pay. It also frees money faster, which you can use to pay other debts or build savings. Prioritize these debts to lower your financial burden.

Debt Snowball Vs. Debt Avalanche

Two popular methods help you pay off debt: the debt snowball and the debt avalanche. The debt snowball targets the smallest debts first. This method builds confidence and motivation as you clear debts one by one.

The debt avalanche focuses on debts with the highest interest rates first. This saves the most money on interest over time. Choose the method that fits your style and keeps you motivated.

Consolidation Options

Debt consolidation combines multiple debts into one payment. This can lower your interest rate and simplify payments. Personal loans and balance transfer credit cards are common consolidation tools.

Consolidation can reduce stress and help you stay on track. Check terms carefully to avoid fees and higher rates. Use consolidation only if it lowers your total cost and helps pay off debt faster.

Boosting Income Streams

Growing your net worth often depends on increasing your income. Relying on just one paycheck limits your financial growth. Expanding income streams creates more money opportunities. It also helps you save and invest more. Here are some ways to boost your income and improve your net worth.

Side Hustles And Freelancing

Side hustles add extra money outside your regular job. They are flexible and fit your schedule. Freelancing lets you use your skills to earn more. Writing, graphic design, or tutoring are common freelancing jobs. These options help you earn without quitting your main job. Small efforts can lead to steady income growth.

Negotiating Raises

Asking for a raise can increase your primary income. Prepare by listing your accomplishments and value to the company. Show how you helped improve results or saved costs. Practice your pitch to feel confident during the talk. A well-timed raise boosts your earnings and net worth.

Passive Income Ideas

Passive income means earning money with little active work. Rental properties, dividend stocks, and online courses are good examples. These streams add to your income steadily over time. Start small and grow your investments gradually. Passive income supports your financial goals and net worth growth.

Effective Budgeting Techniques

Effective budgeting techniques play a key role in growing your net worth. Without a clear plan for your money, it is easy to overspend and lose track of your goals. Budgeting helps you control your finances and make smarter decisions. It allows you to allocate money for saving and investing. You can build wealth steadily by managing your income and expenses well.

Here are some practical budgeting methods that can help you fix your money habits and start increasing your net worth.

Zero-based Budgeting

Zero-based budgeting means assigning every dollar a job. You plan your income minus your expenses to equal zero. This method forces you to justify every expense. It helps prevent waste and unnecessary spending. You can decide how much to save or invest each month. This technique gives you full control over your cash flow and keeps your spending in check.

Tracking Expenses

Tracking expenses means writing down every purchase you make. It shows exactly where your money goes. You can spot patterns and find areas to cut back. Use apps or a simple notebook to record daily spending. Reviewing your expenses regularly makes it easier to stick to your budget. Tracking builds awareness and stops surprise bills from hurting your savings.

Adjusting Spending Habits

Adjusting spending habits is about changing how you use your money. It means prioritizing needs over wants. Avoid impulse buys and reduce non-essential expenses. Look for cheaper alternatives and negotiate bills when possible. Small changes add up and free up more money to save or invest. Changing habits takes time but helps your net worth grow steadily.

:max_bytes(150000):strip_icc()/net-worth-4192297-1-6e76a5b895f04fa5b6c10b75ed3d576f.jpg)

Credit: www.investopedia.com

Investment Strategies

Investment strategies play a key role in growing your net worth. Choosing the right methods helps your money work harder and smarter. A thoughtful approach reduces risks and builds wealth steadily. Simple changes in how you invest can lead to big improvements. Focus on strategies that match your goals and risk level.

Diversifying Portfolio

Diversification means spreading investments across different types of assets. This helps protect your money if one investment loses value. Stocks, bonds, real estate, and cash are common options to mix. A balanced portfolio reduces risk and improves chances for steady returns. Avoid putting all your money in one place.

Long-term Growth Focus

Investing with a long-term view allows your money to grow over time. Avoid quick buys and sales based on market ups and downs. Patience helps your investments recover from drops and rise with the market. Compounding returns add up and increase your net worth steadily. Stay focused on your goals, not short-term changes.

Regular Contribution Plans

Making regular contributions to your investments builds wealth over time. Even small amounts add up when given time to grow. Set up automatic deposits to stay consistent. This habit reduces stress and keeps your plan on track. Regular investing takes advantage of market changes and lowers the risk of bad timing.

Building And Protecting Assets

Building and protecting assets is essential for growing your net worth steadily. Assets increase your value and provide financial security over time. Without solid assets, your wealth may remain stagnant or even decline. Focus on growing what you own and shielding it from risks.

Home Equity Growth

Home equity is the part of your house you truly own. Each mortgage payment increases this equity. Property values can also rise, boosting your net worth. Regularly maintaining your home preserves or improves its value. Avoid withdrawing equity unless necessary, as it reduces your owned portion. Building home equity is a slow but reliable way to grow wealth.

Retirement Account Maximization

Contributing to retirement accounts adds to your long-term assets. Employer matches are free money that should never be missed. Increasing contributions yearly accelerates growth through compounding interest. Choose low-cost investment options to reduce fees that eat returns. Keeping funds invested for decades helps build a larger nest egg.

Insurance And Asset Protection

Insurance protects your assets from unexpected losses. Health, home, auto, and life insurance guard against financial setbacks. Proper coverage prevents forced sales of assets to cover costs. Review policies regularly to ensure adequate protection. Asset protection strategies reduce risk and help preserve your net worth.

Credit: creators.spotify.com

Monitoring Progress

Monitoring your net worth is key to making real progress. Tracking changes helps you see what works and what does not. It keeps you focused and motivated. Without regular checks, you might miss small issues that slow growth. Simple tools and clear steps can make this easy.

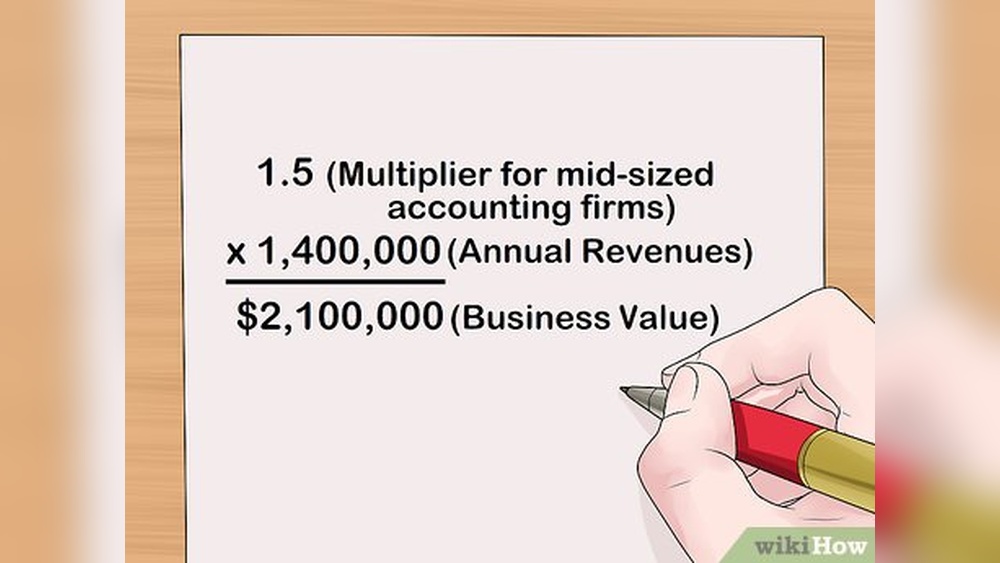

Using Net Worth Calculators

Net worth calculators help you measure your financial health. Enter your assets and debts to get a clear number. These tools update your progress with each entry. Many are free and easy to use online. Checking your net worth monthly shows if your wealth is rising or falling.

Setting Financial Milestones

Set specific goals for your net worth growth. Small milestones make large goals less overwhelming. For example, aim to increase net worth by a set amount every six months. Celebrate these wins to stay motivated. Milestones guide your actions and help keep you on track.

Reviewing And Adjusting Plans

Review your financial plan regularly to stay aligned with goals. Life changes can affect your income, expenses, or investments. Adjust your budget or saving habits based on progress. Flexibility lets you respond to challenges and new opportunities. Keep improving your plan to boost net worth steadily.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

How To Make Your Net Worth Grow?

Grow your net worth by saving consistently, investing wisely, and reducing debt. Track expenses and increase income. Build assets over time.

What Causes A Person’s Net Worth To Decrease?

A person’s net worth decreases due to rising debts like loans, unpaid bills, medical expenses, and poor investment returns. Overspending and asset depreciation also reduce net worth. Managing expenses and debt helps prevent declines.

How Much Is $1000 A Month Invested For 30 Years?

Investing $1,000 monthly for 30 years at an average 7% return grows to about $1. 4 million. Returns vary by market conditions.

How Much Should Your Net Worth Be By Age?

By age 30, aim for a net worth of about $24,000. By 40, target $75,000. By 50, strive for $190,000 or more. These benchmarks help track financial growth and guide savings and investment goals.

Conclusion

Growing your net worth takes time and smart choices. Avoid common money mistakes that hold you back. Focus on saving regularly and reducing debt. Invest wisely and track your progress often. Small changes lead to steady, lasting results. Stay patient and keep your financial goals clear.

Your net worth will improve with consistent effort.