Have you ever wondered how your net worth stacks up against others your age? Understanding where you stand financially can be eye-opening and even motivating.

Whether you’re just starting out, building your career, or planning for retirement, knowing the typical net worth by age helps you set realistic goals and make smarter money decisions. You’ll discover key insights that can guide your financial path and give you the confidence to grow your wealth steadily.

Ready to see how your finances measure up? Let’s dive in.

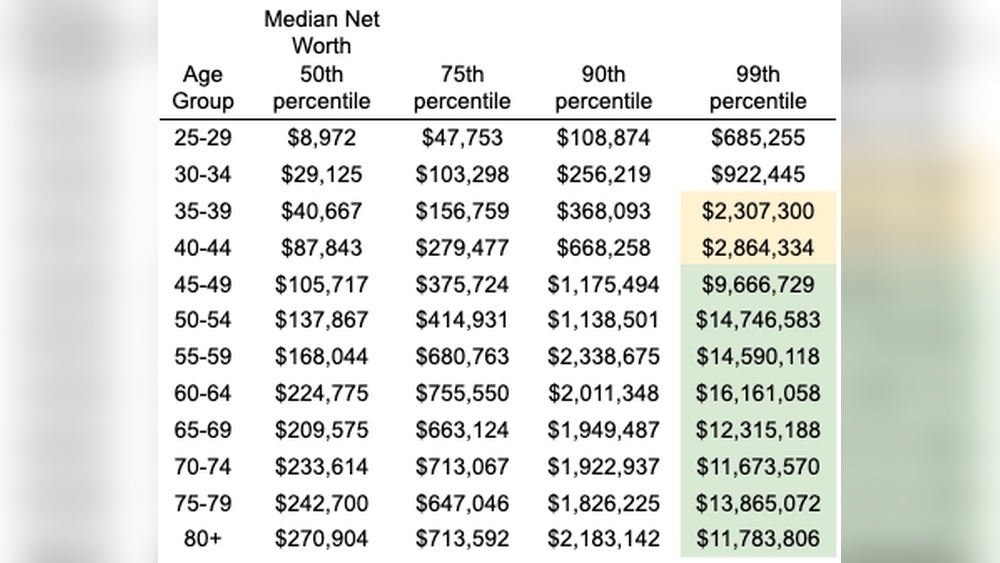

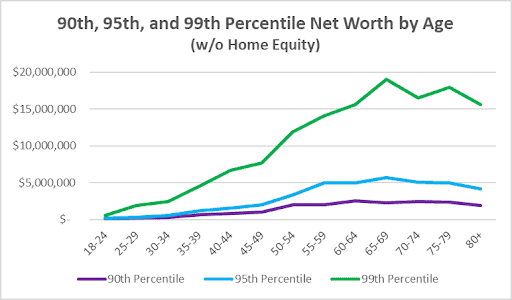

Credit: moneyguy.com

Net Worth Trends By Decade

Net worth changes a lot as people move through different stages of life. Each decade brings new financial goals and challenges. Understanding net worth trends by decade helps you see how money grows and shifts over time.

People start with small savings and debts. Later, earnings increase and investments grow. Near retirement, wealth preservation becomes key. Let’s explore these changes by decade.

Twenties: Building Foundations

In the twenties, net worth is usually low. Most people start careers and pay off student loans. Savings often go into emergency funds or small investments. This decade sets the base for future wealth. Learning good money habits is crucial now.

Thirties: Accelerating Growth

Income tends to rise in the thirties. People may buy homes or start families. Debts might still exist but savings grow faster. Investing in retirement accounts becomes important. This stage focuses on building assets and reducing liabilities.

Forties: Peak Earning Years

Net worth often peaks in the forties. Career advancement leads to higher salaries. Investments and property values usually increase. Paying off mortgages and debts accelerates. Many focus on maximizing retirement contributions during this time.

Fifties: Wealth Consolidation

In the fifties, people work to protect their wealth. Savings reach higher levels. Risky investments may be reduced. Paying off remaining debts is a priority. Planning for retirement and healthcare costs becomes clear.

Sixties And Beyond: Preserving Wealth

After retirement, income often slows down. Net worth depends on savings and pensions. Spending focuses on living expenses and health needs. Protecting assets against losses is vital. Many shift to safer investments for steady income.

Credit: wealthtender.com

Factors Influencing Net Worth

Net worth changes with age due to many factors. These factors shape how much money and assets a person has. Understanding these can help explain why net worth varies widely between people of the same age.

Some factors are in our control. Others depend on outside forces or life events. Together, they create a clear picture of financial health at any age.

Income And Career Choices

Income is a key factor in building net worth. Higher salaries allow more saving and investing. Career paths affect income growth over time. Jobs with steady income help accumulate wealth. Unstable jobs or low pay limit net worth growth.

Saving And Investment Habits

Saving money regularly builds a strong net worth. Good habits mean setting aside money even in small amounts. Investing helps money grow faster than saving alone. People who start investing early often have higher net worth. Poor saving habits can slow wealth accumulation.

Debt And Financial Obligations

Debt reduces net worth by adding financial burdens. Loans, credit cards, and mortgages all affect wealth. Managing debt well keeps net worth stable or growing. High debt levels can cause financial stress. Paying off debt quickly helps increase net worth.

Inheritance And Windfalls

Receiving an inheritance can boost net worth instantly. Unexpected gains, like lottery wins, also increase wealth. Not everyone gets these financial boosts. Those who do often see a sharp rise in net worth. Using windfalls wisely supports long-term financial health.

Surprising Wealth Milestones

Wealth grows differently for each person. Some hit big milestones early. Others find surprising gains later in life. These moments show how varied net worth can be by age. Understanding these milestones helps set realistic goals. It also highlights unexpected paths to wealth.

Early Millionaires Under 40

Some people become millionaires before 40. They often start businesses or invest smartly. Tech and creative fields produce many young millionaires. Saving early and living below means helps too. These early successes show that age is not a barrier.

Unexpected Wealth In Retirement

Many find wealth after they retire. Good savings, pensions, and investments grow over time. Some sell homes or businesses and gain large sums. Retirement can bring financial security that surprises many. Patience and steady planning play a big role.

Impact Of Homeownership

Owning a home builds wealth over time. Property value tends to rise each year. Paying off a mortgage increases net worth. Homeowners gain stability and a valuable asset. For many, a house is their biggest wealth source.

Role Of Side Hustles And Passive Income

Extra income streams add to net worth. Side jobs and freelance work boost earnings. Passive income like rentals or investments grow wealth silently. These income sources help build savings faster. They create financial cushions and increase freedom.

Wealth Gaps Across Demographics

Wealth gaps across different groups show clear differences in net worth by age. These gaps reveal how social and economic factors affect financial growth. Understanding these differences helps explain why some groups build wealth faster than others.

Gender Differences

Men and women often have very different net worth at the same age. Women usually earn less, saving less over time. Career breaks for family care reduce women’s wealth growth. Men often have higher investments, increasing their net worth faster.

Pay gaps and job opportunities play a big role. Women face barriers that slow wealth building. Closing these gaps requires fair pay and better support for working women.

Racial And Ethnic Variations

Racial and ethnic groups show large differences in wealth across ages. White households generally have higher net worth than Black and Hispanic households. Historical inequalities limit access to education and good jobs for some groups. This reduces their ability to save and invest.

Generational wealth also matters. Some groups start with more assets passed down. Others face challenges that make wealth building harder. These gaps create long-term financial disadvantages.

Geographic Influences

Where people live affects their net worth at every age. Urban areas often offer higher wages and better jobs. Rural areas may have fewer opportunities, limiting wealth growth.

Cost of living also impacts savings. High costs reduce money left for investments. Regions with strong economies help residents build wealth faster. Location shapes financial success in many ways.

Strategies To Boost Net Worth

Boosting your net worth requires clear and steady actions. Small steps add up over time. These strategies help build wealth smartly and steadily. Focus on what you can control and plan for the future.

Smart Investing Tips

Investing helps your money grow faster than saving alone. Choose a mix of stocks, bonds, and funds to spread risk. Start early to benefit from compound growth. Keep investing regularly, even small amounts. Learn about different investment options before deciding.

Debt Reduction Plans

Debt lowers your net worth and adds stress. Pay off high-interest debts first, like credit cards. Make more than the minimum payment when possible. Avoid taking new debts while paying off old ones. Use a plan to track your progress and stay motivated.

Budgeting And Expense Management

Track where your money goes each month. Cut unnecessary expenses to save more. Set a budget that fits your income and goals. Review your spending regularly and adjust as needed. Small savings in daily spending can grow your net worth.

Leveraging Tax Advantages

Use tax-advantaged accounts like IRAs and 401(k)s. These accounts reduce taxable income and help savings grow. Learn about deductions and credits you qualify for. Keep good records to make filing easier. Smart tax moves keep more money in your pocket.

Credit: wealthtender.com

Frequently Asked Questions

What Is The Average Net Worth By Age In The Us?

The average net worth varies widely by age group. For example, people aged 35-44 typically have around $436,000. Younger adults usually have less, while older adults accumulate more wealth over time. Net worth increases as income and investments grow with age.

How Does Net Worth Change From 20s To 60s?

Net worth generally starts low in the 20s due to student loans and low income. It increases steadily through the 30s, 40s, and 50s as people save and invest. By the 60s, many have significant assets from home equity and retirement savings.

Why Is Net Worth Important At Different Ages?

Net worth reflects financial health and stability at any age. It helps track progress towards financial goals. Younger individuals can focus on debt reduction, while older adults prioritize retirement savings. Understanding net worth by age aids better financial planning and decision-making.

How Can I Improve My Net Worth At Any Age?

To improve net worth, reduce debt and increase savings consistently. Invest wisely in stocks, bonds, or real estate. Budgeting and avoiding unnecessary expenses also help. Starting early maximizes compound growth, but it’s never too late to boost your wealth.

Conclusion

Net worth grows with time and careful planning. Age shows how wealth can change. Saving money early helps build a strong future. Everyone’s path is different, and that’s okay. Focus on steady progress, not quick gains. Small steps add up over the years.

Keep learning about money and stay patient. Your net worth reflects your choices and habits. Remember, wealth is about more than just numbers. It’s about security, freedom, and peace of mind.