Have you spotted a mysterious “Mehlomz” charge on your credit card and wondered, “Is this legit?” It’s unsettling when you see unfamiliar transactions on your statement. You want to know if it’s a harmless purchase you forgot about or a sign of something more serious.

In this guide, you’ll learn what a Mehlomz charge on credit card really means, how to confirm whether it’s legitimate, and the exact steps to take if you don’t recognize it. Taking action quickly can protect your finances and give you peace of mind. how to verify its authenticity, and what steps you should take if it doesn’t look right. Keep reading, your financial peace of mind could depend on it.

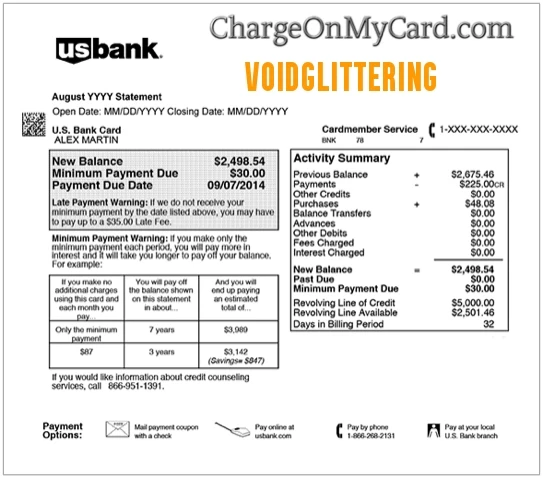

Visit here for more information of any Charges on credit card or debit card

Mehlomz Charge Explained

Seeing a charge labeled “Mehlomz” on your credit card can be confusing. Many people wonder what this charge means and whether it is safe or a scam. This section breaks down the Mehlomz charge to help you understand its origin and legitimacy.

Understanding these charges helps you manage your credit card statements better. It also protects you from unauthorized payments or fraud. Let’s explore what Mehlomz means and why it might appear on your bill.

What Does Mehlomz Mean On Your Statement

Mehlomz usually appears as the merchant name on your statement. It is often linked to a business or service that processed your payment. Sometimes, the name might not match the store or website where you bought something.

This happens because some companies use third-party payment processors. The name on your statement may show the payment processor’s business name, like Mehlomz, instead of the actual store.

Checking your receipts or recent purchases can help confirm if the charge is yours. If you do not recognize the charge, contact your credit card company immediately for more information.

Common Reasons For Mehlomz Charges

One common reason for Mehlomz charges is online purchases from smaller vendors. These vendors might use Mehlomz as their payment processor. Subscription services or recurring payments can also appear under this name.

Another reason is accidental or fraudulent charges. Scammers sometimes use fake merchant names to hide unauthorized transactions. Always review your statements carefully to spot unfamiliar charges.

Sometimes, family members or friends may have used your card with or without your knowledge. Ask them if they recognize the charge before raising a dispute.

Legitimacy Of Mehlomz Charges

Many people see Mehlomz charges on their credit cards and feel confused. Understanding if these charges are real is important. It helps protect your money and avoid fraud. This section breaks down the legitimacy of Mehlomz charges in simple terms.

Knowing whether Mehlomz is a trusted business or a scam can save you stress. Let’s explore key points that reveal the truth behind these charges.

Is Mehlomz A Recognized Merchant

Mehlomz does not appear on major merchant lists or well-known business directories. It is not a commonly recognized brand or retailer. Many users report seeing this name without having made related purchases. This lack of recognition raises questions about its legitimacy.

Some charges under Mehlomz might be linked to third-party payment processors. These processors use different names that may confuse cardholders. Checking your receipts and online orders can clarify if Mehlomz matches any known transactions.

Possible Fraud Or Scam Indicators

Unfamiliar Mehlomz charges often show signs of fraud. Sudden, unexplained deductions without receipts are a warning. Multiple small charges or recurring payments may indicate unauthorized use of your card.

Reports on forums and consumer sites mention Mehlomz charges linked to stolen card details. If you see these charges without any purchase history, act quickly. Contact your bank or credit card provider to dispute suspicious transactions.

Protect your account by monitoring statements regularly. Set alerts for unusual spending and update your passwords often. These steps reduce the risk of fraud connected to unclear charges like those from Mehlomz.

How To Verify Mehlomz Charges

Verifying a Mehlomz charge on your credit card is key to understanding its origin. This process helps you confirm if the charge is valid or possibly fraudulent. You can take simple steps to investigate the transaction without much hassle.

Start by examining the details shown on your credit card statement. These details often provide clues about the merchant and the nature of the charge. If the information is unclear, using online tools can help identify the business behind the charge. Also, checking your receipts and order history can confirm if you made a purchase that matches the charge.

Checking Your Transaction Details

Look closely at your credit card statement. Note the merchant’s name, transaction date, and amount charged. The name might be different from the store’s usual name, sometimes showing a payment processor. Check if the date matches any recent purchases you remember. This step often clears up confusion.

Using Online Tools For Merchant Lookup

Search the merchant name online to find more information. Some companies use third-party processors like Stripe or PayPal, so the name may differ. Use merchant lookup tools provided by payment processors to identify the charge. These tools help reveal the actual business behind the transaction.

Reviewing Receipts And Order History

Compare your credit card statement date with your receipts. Check your email or physical receipts for matching purchases. Log into accounts on shopping websites to review your order history. This can confirm if you authorized the charge and help spot unauthorized transactions early.

Steps To Take If Charge Is Unrecognized

Discovering a charge from Mehlomz on your credit card that you do not recognize can be alarming. Taking prompt action helps protect your finances and prevent further unauthorized transactions. Follow clear steps to address the issue effectively and regain control of your account.

Contacting Your Bank Or Card Issuer

Reach out to your bank or credit card company immediately. Use the customer service number on the back of your card. Explain that you found an unrecognized charge labeled Mehlomz. Ask for details about the transaction, including date and amount. Your bank can freeze your card to stop additional charges. They may also guide you on the next steps to secure your account.

Disputing Unauthorized Charges

File a formal dispute with your card issuer for the Mehlomz charge. Most banks offer online forms or phone support for this process. Provide all relevant details, such as transaction date and amount. Keep records of your communication and any confirmation numbers. The bank will investigate and may reverse the charge if it is fraudulent. This process can take a few weeks, so stay patient and follow up as needed.

Monitoring Your Account For Further Issues

Check your credit card statements regularly after reporting the charge. Look for any new unfamiliar transactions. Enable alerts for purchases on your card if your bank offers this service. Changing your online banking passwords adds extra security. Staying vigilant helps detect suspicious activity early and protects your money from future fraud.

Preventing Future Unauthorized Charges

Preventing future unauthorized charges is key to keeping your credit card safe. Taking simple steps can protect your money and avoid stress. Stay aware and proactive to stop fraud before it happens.

Best Practices For Card Security

Keep your credit card details private at all times. Avoid sharing your card number over phone or email. Use secure websites with “https” when shopping online. Regularly update your passwords and PINs for added safety. Never write down your PIN where others can see it. Report lost or stolen cards to your bank immediately. Always review your statements for any strange charges.

Using Virtual Credit Cards

Virtual credit cards offer a safer way to shop online. They create a temporary card number linked to your real card. This number can be used once or for a limited time. It stops thieves from accessing your real card data. Many banks and apps now provide virtual card options. Use them for subscriptions or new websites you don’t fully trust. Cancel the virtual card anytime without affecting your main account.

Setting Up Alerts And Notifications

Set up alerts to get notified of card activity. Banks often offer text or email alerts for purchases. These alerts help spot unauthorized charges quickly. You can set limits on transaction amounts for alerts. Some apps notify you instantly when your card is used. Check your alerts regularly and act fast if something looks wrong. Early detection is vital to prevent bigger problems.

Frequently Asked Questions

How Do I Figure Out Where A Charge On My Card Came From?

Check your card statement for the merchant name, date, and amount. Search the merchant online or review receipts. Contact your bank if unsure or to dispute the charge.

Why Did I Get A Random Charge On My Card?

A random charge may result from forgotten subscriptions, pending payments, or merchant name variations. Review your statement, check receipts, and search the merchant name online. Contact your card issuer if you suspect fraud or need more details about the transaction.

What Is A Ghost Charge On A Credit Card?

A ghost charge on a credit card is a pending transaction that appears but never fully processes. It temporarily reduces your available credit.

Can You Dispute A Credit Card Charge If You Got Scammed?

Yes, you can dispute a credit card charge if scammed. Contact your card issuer immediately to report and start the dispute process.

Conclusion

Mehlomz charges on your credit card can be confusing. Always check your statement carefully. Search the merchant’s name online for clarity. Compare charges with your receipts or orders. If unsure, contact your bank without delay. They can help verify or dispute charges.

Stay alert to protect your finances. Taking quick action keeps your account safe.