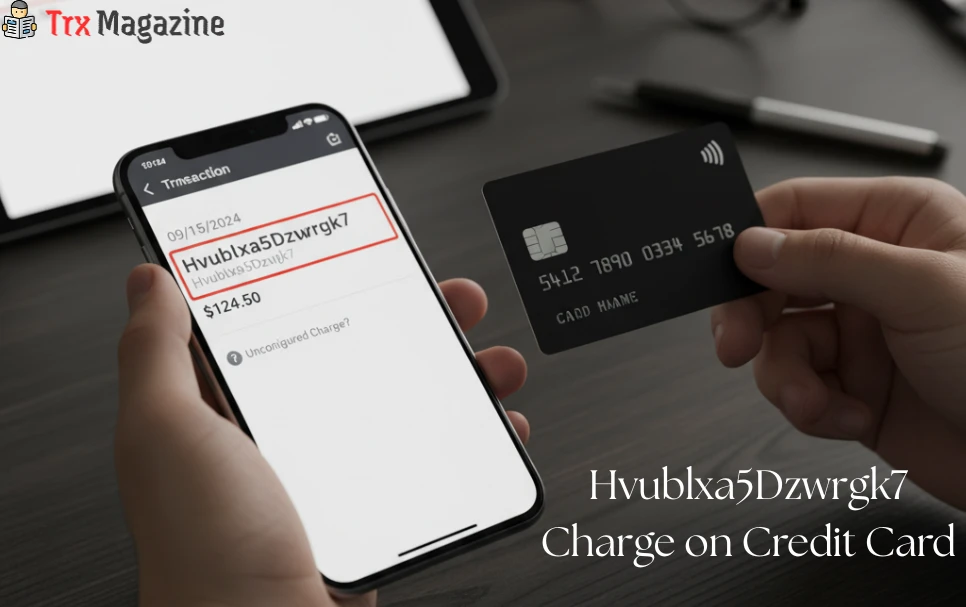

Have you ever spotted a mysterious charge labeled “Hvublxa5Dzwrgk7” on your credit card statement and wondered what it means? If so, you’re not alone and it can be frustrating trying to figure out where that charge came from and whether it’s legitimate.

Seeing a Hvublxa5Dzwrgk7 charge on credit card can be unsettling and make you worry about your finances. The good news is that understanding this type of confusing transaction is easier than it seems. In this guide, you’ll learn how to decode the Hvublxa5Dzwrgk7 charge, verify whether it’s a legitimate purchase, and take the right steps to dispute it if it isn’t yours.

Keep reading to take control of your credit card statement and protect your money.

What is Hvublxa5Dzwrgk7 Charge on Credit Card

A Hvublxa5Dzwrgk7 charge on credit card is a transaction label that may appear on your statement when a merchant, payment processor, or subscription service uses a different billing name than the one you recognize. This charge could represent a legitimate purchase you made online, a recurring subscription payment, or even a pending authorization. However, if you don’t recognize the charge, it could also be an error or unauthorized transaction. Understanding this charge helps you determine whether it’s valid or if you need to contact your bank to investigate further.

Identifying Credit Card Charges

Identifying charge on credit card can feel tricky. Each entry on your statement shows a merchant name, date, and amount. These details help you recognize purchases and spot errors.

Some charges might seem unknown at first. They could be from services you forgot about or from merchants using different names. Careful checking can clear up most confusion quickly.

Check Statement Details

Review your credit card statement carefully. Look for the merchant’s name, transaction date, and the charge amount. This information often points to where you made the purchase.

Sometimes merchants use different names than the store you visited. Try searching the merchant name online to find the real business behind the charge.

Compare the transaction date with your receipts or online orders. This can confirm if the charge matches a recent purchase.

Recognize Recurring Payments

Recurring payments often appear as similar charges each month. These are usually subscriptions or memberships.

Check for regular charges from streaming services, gyms, or apps you use. These can explain some unexpected entries.

If you find a recurring charge you no longer want, contact the service to cancel it. This stops future payments from appearing on your card.

Researching Unknown Merchants

Seeing an unknown charge on credit card can cause worry. Researching unfamiliar merchants helps clear up confusion and protect your money. Understanding who made the charge gives you control over your finances. It also helps spot possible fraud quickly.

Search Merchant Names Online

Start by typing the merchant name exactly as it appears on your statement. Use simple search engines like Google or Bing. This often reveals the business website or reviews from other customers. Sometimes the name is a payment processor, not the store itself. That can explain why the name seems strange.

Check the location and phone number shown in the search results. See if they match any recent purchases you made. Reading customer comments can also help identify if the merchant is real or suspicious.

Use Payment Processor Tools

Many payment processors offer tools to help identify charges. Stripe, PayPal, and Square provide online lookup services. Enter the charge amount, date, and merchant name to get more details. These tools show the actual store behind the payment processor name.

Using these resources can save time and reduce stress. They often reveal contact info and order details. This makes it easier to confirm if the charge is valid or needs dispute.

Cross-checking Purchases

Cross-checking purchases helps you understand and verify unfamiliar charges. This step protects you from fraud and billing errors. It also ensures your credit card statement matches your actual spending. Carefully reviewing transactions keeps your finances accurate and secure.

Review Receipts And Invoices

Start by gathering all recent receipts and invoices. Compare the date and amount with the charge on your statement. Receipts often show the merchant’s exact name. This helps link the charge to a real purchase. If the charge matches a receipt, you can confirm it is valid. Missing receipts might mean you forgot the purchase or someone else used your card.

Check Online Order History

Log in to accounts of stores where you shop online. Check your order history for transactions near the charge date. Look for items or services that match the charged amount. Online order history often provides order details and confirmation numbers. This helps you confirm whether the charge is yours or not. If no match appears, the charge might be wrong or fraudulent.

Getting More Info From Your Issuer

When you see a charge on your credit card that you do not recognize, getting more details from your card issuer is important. Your issuer holds the key to unlocking specific information about that charge. They can help you understand what the charge means and where it came from.

Knowing how to get this information quickly can save you time and stress. Two main ways to get details include using online tools and speaking directly to your bank.

Access Transaction Details Online

Many credit card issuers offer online accounts where you can view your transactions. Log in to your account to find the charge in question. You can often click on the charge to see extra details like the merchant’s full name and location. This can help you identify if the charge is from a store, service, or subscription you use.

Some issuers also provide tools that let you search for unclear merchant names. These tools help match the charge to a business or service. Check your issuer’s website or app for these features.

Contact Your Bank Directly

Calling your credit card company is another direct way to get information. A customer service agent can explain the charge in detail. They can confirm if the transaction is legitimate or if it might be fraud.

Tell them about any charges you do not recognize. They can help you start a dispute if needed. Your bank can also place alerts to protect your card from future unknown charges.

Handling Suspicious Charges

Handling suspicious charges on credit card needs quick action. These charges can drain your money without your knowledge. Spotting and acting on them fast helps protect your account and credit score.

Knowing how to handle such charges keeps your finances safe. It also helps you avoid future problems with unauthorized use.

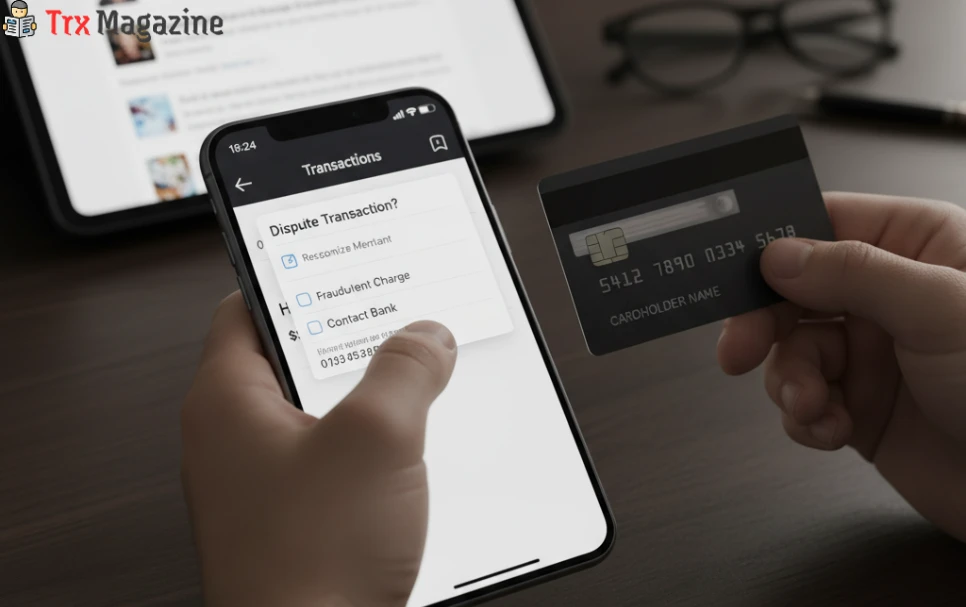

Report Unauthorized Transactions

Check your credit card statement regularly for unknown charges. If you find a suspicious charge, contact your card issuer immediately. Use the phone number on the back of your card for fast service.

Explain the transaction you did not authorize. Your issuer will block your card to stop more fraudulent activity. They may also issue a new card with a new number.

Start A Dispute Process

After reporting, start the dispute process with your bank or credit card company. Submit any proof you have, like receipts or emails. This helps prove the charge is incorrect.

The bank will investigate and may credit your account during this time. Keep records of all communication. Stay patient, as the process can take several weeks.

Frequently Asked Questions

How Do I Figure Out Where A Charge On My Card Came From?

Review your credit card statement for the merchant’s name, location, and date. Search the business name online or check receipts. Use payment processor tools like Stripe’s charge lookup. Contact your card issuer for details or to dispute unknown charges.

How To Identify Recurring Charges On A Credit Card?

Review your credit card statement for repeated merchant names and amounts. Check subscriptions or memberships you use regularly. Search unfamiliar merchant names online. Compare transaction dates with receipts or order history. Contact your card issuer for details or to dispute suspicious charges.

What Is A Ghost Charge On A Credit Card?

A ghost charge is a temporary credit card hold that appears but isn’t a completed transaction. It often drops off within days.

How To Look Up Charges On Card?

Check your credit card statement for merchant details and transaction date. Search the merchant name online or review receipts. Use payment processor tools like Stripe’s charge lookup. Contact your card issuer for more information or to dispute unfamiliar charges.

Conclusion

Understanding a charge on credit card helps protect your money. Always check your statement carefully. Look up unfamiliar merchant names online. Review your receipts and order history. Use tools from payment processors to identify charges. Contact your credit card company if you cannot find the charge details.

Acting quickly can prevent fraud or mistakes. Stay aware of your spending to avoid surprises. This simple habit keeps your finances safe and clear.