Are you worried about losing your money to a crypto scam? You’re not alone.

Scammers are getting smarter every day, making it harder to tell what’s real and what’s fake. But don’t let fear stop you from exploring the exciting world of cryptocurrency. Knowing the key red flags can protect your investments and give you confidence in your decisions.

You’ll learn exactly what signs to watch for and simple steps to keep your crypto safe. Keep reading—your future self will thank you.

Common Crypto Scam Types

Crypto scams take many forms. Scammers use tricks to steal money or personal information. Knowing common scam types helps you stay safe. Here are some typical crypto scams to watch out for.

Ponzi And Pyramid Schemes

Ponzi schemes promise high returns with little risk. They pay old investors with new investors’ money. Pyramid schemes rely on recruiting others to join. Both collapse when new members stop joining. These scams often sound too good to be true.

Fake Icos And Tokens

Scammers create fake Initial Coin Offerings (ICOs) or tokens. They claim new crypto projects need funding. Investors buy tokens that have no real value. After collecting money, scammers disappear. Always research ICOs and token legitimacy before investing.

Phishing And Malware Attacks

Phishing scams trick users into giving away private keys or passwords. Scammers send fake emails or messages that look real. Malware can infect devices to steal crypto wallets. Never click suspicious links or download unknown files. Protect your devices with security software.

Pump And Dump Schemes

Groups hype a cheap cryptocurrency to raise its price quickly. Many buy in, hoping for profits. Then, scammers sell their coins at high prices. The price crashes, and others lose money. Be cautious of sudden spikes in unknown coin prices.

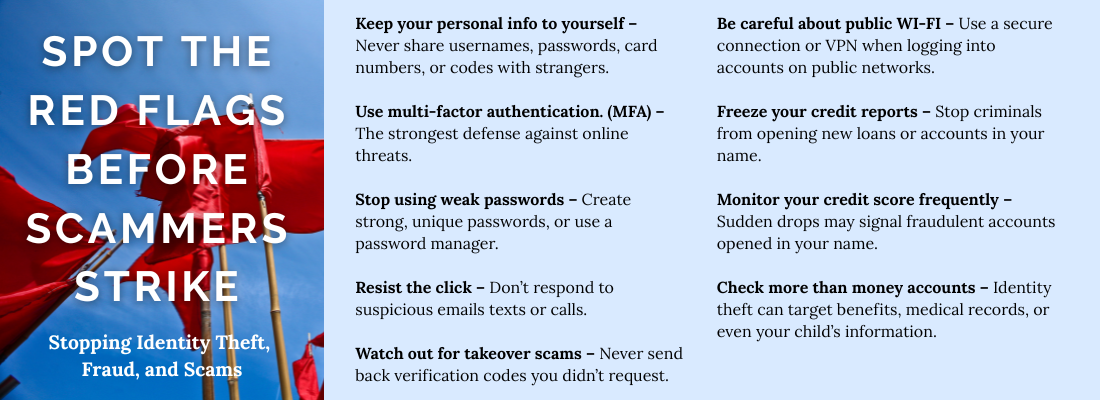

Credit: www.pvfcu.org

Key Red Flags To Watch For

Spotting a crypto scam early can save a lot of trouble. Scammers use tricks to make their offers look real and tempting. Knowing common warning signs helps protect your money and personal information. Watch closely for these red flags to stay safe in the crypto world.

Unrealistic Promises

Scams often promise huge profits with little effort. Claims of guaranteed returns or fast money are a big warning sign. No investment is risk-free or offers quick riches. Be very careful when a deal sounds too good to be true.

Lack Of Transparency

Scam projects hide important details about how they work. Legitimate companies share clear information about their goals and plans. If you cannot find clear facts or explanations, be suspicious. Transparency builds trust; its absence signals danger.

Pressure Tactics

Scammers push you to act fast without time to think. They use urgent messages or deadlines to create fear. Real investments give you time to research and decide. Never rush into buying or sending money under pressure.

Anonymous Or Unverified Teams

Trustworthy crypto projects show their team members publicly. Scams often hide identities or use fake profiles. Verify the team’s background and experience before investing. If you cannot find the team’s real information, stay away.

Suspicious Website And Social Media

Fake sites look unprofessional or have many errors. Scam projects may copy logos or content from real companies. Check social media for strange activity or fake followers. Reliable projects have active, honest, and consistent online presence.

Tools To Verify Legitimacy

Verifying the legitimacy of a cryptocurrency project requires the right tools. These tools help spot scams early. They provide clear information to check facts and protect your investments. Use these tools to confirm details and avoid risks.

Blockchain Explorers

Blockchain explorers show all transactions on a blockchain. They let you see wallet activity and token movements. Use explorers like Etherscan or BscScan to track funds and verify token creation. Genuine projects have transparent transaction records. Fake ones often hide or show suspicious patterns.

Official Project Websites

Official websites offer key project details. Check for clear contact info and team backgrounds. Look for a detailed whitepaper explaining the project’s goals. Scam sites often have poor design and unclear information. Verify if the domain is secure and updated regularly.

Community And Expert Reviews

Community feedback helps reveal a project’s trustworthiness. Visit forums like Reddit or BitcoinTalk for honest opinions. Expert reviews on trusted crypto sites add extra insight. Beware of overly positive reviews without criticism. Genuine projects face some questions and debates.

Regulatory And Legal Checks

Check if the project follows local laws and regulations. Look for registrations with financial authorities or licenses. Many scams ignore legal requirements. Confirm if the team is transparent about their location and legal status. Compliance reduces risks and builds trust.

Credit: meuser.house.gov

Prevention Strategies

Preventing crypto scams starts with smart habits. Protecting your assets requires care and attention. Simple steps can keep your investments safe. These prevention strategies help you avoid common traps.

Research And Due Diligence

Always check the project before investing. Look for verified information on websites and forums. Read reviews from multiple sources. Confirm the team behind the project is real. Avoid promises that sound too good to be true.

Secure Wallet Practices

Use wallets with strong security features. Keep your private keys private and offline. Backup your wallet information safely. Regularly update wallet software to patch vulnerabilities. Avoid sharing wallet details with anyone.

Avoiding Public Wi-fi And Scams

Public Wi-Fi networks can expose your data. Use a secure, private connection for transactions. Be cautious of phishing emails and fake websites. Never click unknown links or download suspicious files. Always verify the site’s URL before entering details.

Using Two-factor Authentication

Enable two-factor authentication on crypto accounts. This adds a second layer of security. Use authenticator apps instead of SMS if possible. It reduces the risk of unauthorized access. Always check your account activity regularly.

Responding To Suspected Scams

Knowing how to respond to suspected crypto scams is key to protecting your assets. Quick and calm action can limit damage. Recognizing the right steps helps you stay safe in the crypto space.

Reporting To Authorities

Report scams to local law enforcement quickly. Provide all details you have, including messages and transaction records. This helps authorities track scammers and warn others. Many countries have special cybercrime units for such cases. Reporting can also help you recover lost funds in some situations.

Protecting Personal Information

Stop sharing personal data immediately after suspecting a scam. Change passwords on your crypto wallets and related accounts. Enable two-factor authentication for extra security. Avoid clicking unknown links or downloading files from untrusted sources. Keep your private keys and recovery phrases secret at all times.

Seeking Support From Crypto Communities

Join trusted crypto forums and social media groups to share your experience. Other users can offer advice and warn about similar scams. Community support helps you stay updated on new threats. Be cautious about giving too much information, but use the group to learn and protect yourself better.

Credit: prestmit.io

Frequently Asked Questions

What Are Common Red Flags Of A Crypto Scam?

Common red flags include promises of guaranteed returns, lack of transparency, unverified team members, and pressure to invest quickly. Beware of unsolicited offers and fake endorsements. Always research the project’s legitimacy before investing.

How Can I Verify A Cryptocurrency Project’s Authenticity?

Check the project’s website, team credentials, and reviews. Look for whitepapers, regulatory compliance, and community feedback. Use trusted crypto forums and official sources to confirm details before investing.

What Steps Prevent Falling Victim To Crypto Scams?

Stay informed about common scams, avoid unrealistic promises, and never share private keys. Use secure wallets, enable two-factor authentication, and invest only what you can afford to lose.

Why Are Too-good-to-be-true Crypto Offers Risky?

Offers promising high returns with low risk often indicate scams. Scammers lure investors with unrealistic gains. Always question extraordinary claims and conduct thorough research before committing funds.

Conclusion

Spotting crypto scams takes careful attention and smart choices. Watch for promises that seem too good to be true. Always double-check information from trusted sources. Protect your money by avoiding risky offers and sharing personal info. Stay calm and think before acting fast.

Learning these red flags helps you stay safe online. Trust your gut feeling and take time to research. Staying alert keeps your crypto investments secure. Keep these tips in mind to avoid scams in the future.