Are you worried about keeping your crypto safe? You should be.

Losing access to your digital coins can be frustrating and costly. But don’t panic—knowing the right way to store your crypto can protect your investment. You’ll discover the different types of wallets available and learn which one fits your needs best.

By the end, you’ll feel confident about securing your crypto the smart way. Keep reading to find out how to protect what’s yours.

Credit: www.fool.com

Crypto Wallet Basics

Understanding the basics of crypto wallets is key to keeping your digital coins safe. Crypto wallets are tools that let you store, send, and receive cryptocurrencies like Bitcoin or Ethereum. They act like a digital bank account, but you control them fully. Knowing how wallets work helps you pick the right one for your needs.

What Is A Crypto Wallet?

A crypto wallet is software or hardware that holds your cryptocurrency. It does not store the coins themselves but keeps the information needed to access them. This information allows you to send and receive crypto on the blockchain. Wallets come in many forms, such as apps, devices, or even paper. Each type offers different levels of security and convenience.

How Wallets Store Private Keys

Private keys are secret codes that prove ownership of your crypto. Wallets store these keys safely so only you can use them. If someone else gets your private key, they can take your coins. Wallets keep keys in encrypted form, making theft difficult. Some wallets keep keys offline, which adds extra protection against hackers.

Credit: cryptocloud.plus

Hot Wallets

Hot wallets are digital tools that store cryptocurrency and stay connected to the internet. They allow quick access to your crypto for trading or spending. Hot wallets are popular because of their ease of use and fast transactions.

These wallets are suitable for small amounts of crypto. You can move funds quickly but must be careful about security. Understanding different types of hot wallets helps you choose the right one for your needs.

Software Wallets

Software wallets are apps or programs installed on your device. They manage your private keys and allow you to send or receive crypto. These wallets often support many cryptocurrencies in one place. They offer control and convenience in managing your digital coins.

Mobile And Desktop Options

Mobile wallets run on smartphones and are handy for daily use. They let you pay or trade crypto on the go. Desktop wallets work on computers and provide more features. Both types store your keys locally, giving you control over your funds.

Security Risks And Benefits

Hot wallets face risks because they connect to the internet. Hackers can try to steal your private keys if your device is unsafe. Using strong passwords and two-factor authentication improves security. The benefit is fast access and easy transactions for active users.

Cold Wallets

Cold wallets keep your cryptocurrency safe by storing it offline. They protect your digital coins from online hacks and malware. These wallets do not connect to the internet, making them very secure. Cold wallets are ideal for holding large amounts of crypto for a long time.

Hardware Wallets

Hardware wallets are small devices that store your private keys. They connect to your computer only to sign transactions. This keeps your keys safe from internet threats. Popular hardware wallets support many cryptocurrencies. They often have a screen to verify transactions before approval. Hardware wallets are easy to use and highly secure.

Paper Wallets

Paper wallets are physical printouts of your private and public keys. You can generate them offline and print the keys on paper. No digital copy means no risk of hacking. Store your paper wallet in a safe, dry place. This method is cheap but requires careful handling. Losing the paper means losing access to your funds.

Offline Storage Advantages

Keeping crypto offline stops hackers from stealing your keys. Cold wallets reduce risks from phishing and malware attacks. They are the safest option for long-term storage. Offline storage helps avoid accidental loss from device failure. Your crypto stays under your full control. No internet connection means fewer vulnerabilities.

Custodial Vs Non-custodial Wallets

Choosing the right crypto wallet is key to keeping your digital assets safe. Two main types exist: custodial and non-custodial wallets. Each offers different levels of control and security. Understanding these differences helps you pick the best option for your needs.

Control Over Your Funds

Custodial wallets store your crypto for you. A third party holds the private keys. This means you rely on them to access your funds. Non-custodial wallets give you full control. You hold your private keys directly. This allows you to manage your crypto without middlemen.

Trust And Security Considerations

Custodial wallets require trust in the service provider. They protect your funds but could be a target for hackers. Non-custodial wallets put security in your hands. You must keep your keys safe. Losing them means losing access to your crypto forever.

Multi-signature Wallets

Multi-signature wallets provide a smart way to protect your cryptocurrency. They require more than one key to approve a transaction. This adds an extra layer of safety. These wallets are great for people who want strong security without too much hassle.

How Multi-sig Works

A multi-signature wallet needs multiple private keys to send crypto. Instead of one key, it might need two or three keys. This means no single person can move the funds alone. It works like a joint bank account. Multiple users must agree before any money is spent.

This system lowers the risk of theft. If one key is lost or stolen, the funds stay safe. Only with the set number of signatures can transactions happen. This setup suits businesses or groups sharing digital assets.

Enhanced Security Features

Multi-sig wallets reduce the chance of hacking. Attackers must get several keys, not just one. This makes stealing funds much harder. The wallet can also stop unauthorized transactions quickly.

Users can spread keys across devices or locations. This spreads the risk and protects against loss or theft. Some wallets alert users when a transaction tries to start. This gives time to stop fraud.

Choosing The Right Wallet

Choosing the right wallet is key to keeping your cryptocurrency safe. Each type of wallet offers different benefits and risks. Understanding these helps protect your digital assets from theft or loss.

Think about how often you use your crypto and what level of security you need. The right wallet fits your lifestyle and comfort with technology. It should balance ease of use with strong protection.

Factors To Consider

Start by checking the wallet’s security features. Look for options like two-factor authentication and private key control. See if the wallet supports the cryptocurrencies you own.

Consider backup and recovery options. Losing access means losing your crypto forever. Choose wallets that offer easy ways to restore your funds.

Device compatibility matters too. Some wallets work only on mobile, others on desktop or hardware devices. Pick one that matches your everyday tools.

Balancing Convenience And Security

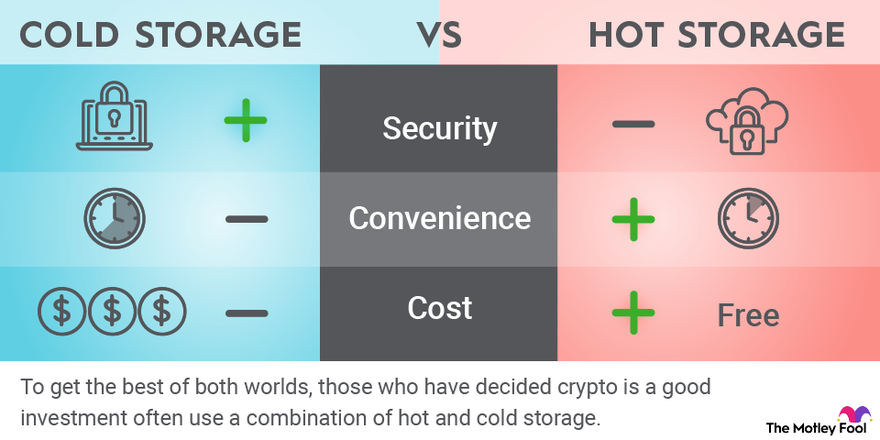

Hot wallets connect to the internet and are easy to use. They suit daily trading but face higher hacking risks. Cold wallets store keys offline and offer better security.

Cold wallets are less convenient but protect against online threats. Use them for long-term storage of large amounts. Hot wallets work well for small amounts and quick access.

Find a balance that fits your needs. A mix of hot and cold wallets often provides the best safety and access. Always keep your recovery information safe and private.

Best Practices For Wallet Security

Keeping your crypto wallet safe is very important. Hackers try to steal digital coins all the time. Following simple security steps can keep your wallet secure. These methods protect your assets from theft and loss.

Strong Passwords And 2fa

Use a strong password for your wallet. A good password has letters, numbers, and symbols. Avoid easy passwords like birthdays or common words. Change your password often. Enable two-factor authentication (2FA). This adds a second layer of security. 2FA requires a code from your phone or email. It stops hackers from entering your wallet even if they get your password.

Regular Backups

Make backups of your wallet regularly. Store backup files in several safe places. Use external drives or secure cloud storage. Backups help restore your wallet if your device breaks or is lost. Write down your seed phrase on paper. Never save it digitally. Keep this paper in a secret and dry place. Losing your seed phrase means losing access to your crypto forever.

Avoiding Phishing And Scams

Watch out for phishing emails and fake websites. They look real but try to steal your info. Do not click suspicious links or download unknown files. Always check the website address before logging in. Use official apps or websites only. Never share your private keys or seed phrase with anyone. Scammers often ask for this to steal your crypto. Stay alert and think twice before sharing any wallet details.

:max_bytes(150000):strip_icc()/cold-storage.asp-final-94413d1c10eb4f06b31b3b165977c70d.png)

Credit: www.investopedia.com

Frequently Asked Questions

What Are The Main Types Of Crypto Wallets?

Crypto wallets are broadly categorized into hot wallets and cold wallets. Hot wallets connect to the internet and are convenient but less secure. Cold wallets store keys offline, offering enhanced security against hacks and theft.

How Do Hardware Wallets Protect Cryptocurrencies?

Hardware wallets store private keys offline in a physical device. They require physical confirmation for transactions, making remote hacking nearly impossible. This method ensures your crypto remains secure even if your computer is compromised.

Why Choose A Software Wallet For Crypto Storage?

Software wallets are user-friendly and accessible on mobile or desktop devices. They allow quick transactions but are more vulnerable to malware and phishing attacks compared to hardware wallets.

Is A Paper Wallet Safe For Long-term Storage?

Paper wallets keep private keys offline, reducing hacking risks. However, they can be damaged, lost, or stolen easily. Proper storage in a safe place is crucial for long-term use.

Conclusion

Choosing the right crypto wallet protects your digital assets. Hot wallets offer easy access but less security. Cold wallets keep coins safe but can be less handy. Always backup your wallet and keep your keys private. Regularly update your wallet software to stay secure.

Understand each wallet type before making a choice. Staying cautious helps prevent theft and loss. Safe storage means peace of mind for your crypto journey.