You’re about to invest your hard-earned money into a crypto project. But how do you know if it’s a genuine opportunity or just another scam waiting to drain your wallet?

The crypto world is full of promises that sound too good to be true—and often, they are. If you want to protect your investment and avoid costly mistakes, you need to spot the red flags before you commit. You’ll learn simple, effective ways to identify scam crypto projects early on.

By following these clear steps, you’ll gain the confidence to invest wisely and keep your assets safe. Keep reading—your financial future depends on it.

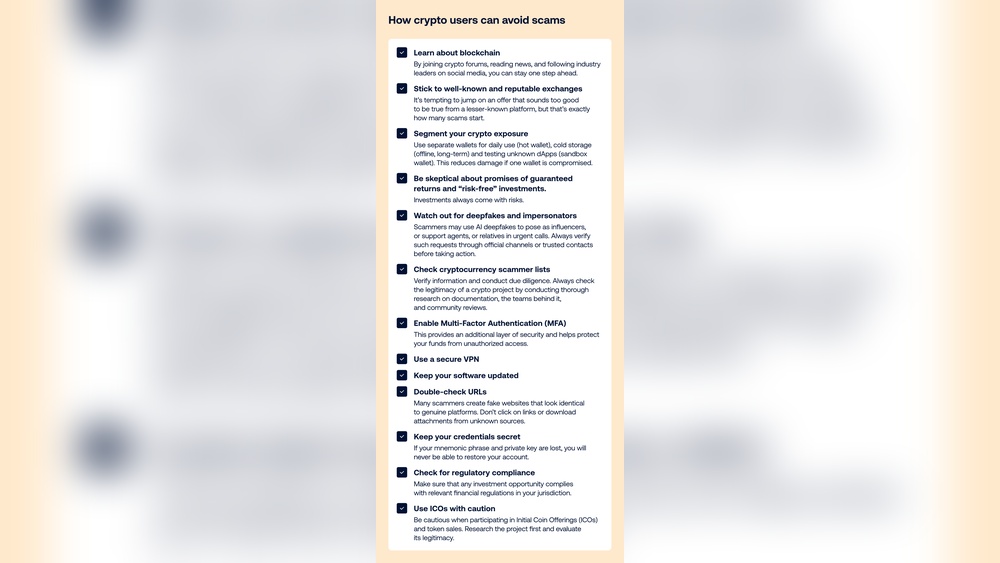

Common Scam Signs

Recognizing common scam signs helps protect your money. Scammers use similar tricks to lure investors. Spotting these signs early keeps you safe. Learn how to identify these red flags below.

Unsolicited Contact

Scammers often reach out without warning. They may message you on social media or email. Legitimate projects rarely contact strangers first. Be cautious of unexpected offers or invites.

Guaranteed Returns

No investment can promise fixed profits. Scams often claim high, guaranteed returns quickly. Real investments carry risks and no certainties. Avoid projects that guarantee big earnings fast.

Pressure Tactics

Scammers push you to decide fast. They say offers expire soon or spots are limited. This rush stops you from thinking clearly. Take your time to research before investing.

Requests For Private Keys

Never share your private keys or seed phrases. Legitimate projects do not ask for this info. Giving keys means losing control of your funds. Keep your keys secret and secure always.

Pay-to-withdraw Fees

Some scams ask fees to withdraw your money. Legit projects never charge you to access your funds. Watch out for withdrawal fees that seem unusual. This is a common trick to steal your money.

Fake Endorsements

Scammers use fake celebrity or company endorsements. They show fake logos or testimonials to gain trust. Always verify endorsements through official sources. False claims are a clear warning sign.

Credit: coinrule.com

Project Transparency Checks

Checking project transparency is vital before investing in any crypto project. Transparent projects share clear information about their team, code, and operations. This openness builds trust and reduces risks. Here are important ways to check project transparency.

Verify Team Credentials

Check the project team’s background. Look for real names and professional profiles on LinkedIn or other platforms. Confirm their experience in blockchain or related fields. Anonymous or fake profiles often signal scams. Genuine teams are proud to show their skills and history.

Audit Reports

Review audit reports from trusted security firms. Audits examine the project’s smart contracts for bugs or vulnerabilities. A verified audit helps ensure the code is safe and reliable. Lack of audits or poor audit results are red flags to avoid.

Domain Age And Website Authenticity

Check the website’s domain age using tools like Whois. Scam sites often use very new domains. Authentic projects usually have older, established domains. Also, inspect the website for professional design and clear contact details. Poor quality sites may hide scams.

Contract Address Validation

Validate the smart contract address on blockchain explorers like Etherscan or BscScan. Confirm that it matches the official project listings. Scammers often create fake contracts to steal funds. Always copy contract addresses from verified sources only.

Research Tools And Platforms

Research tools and platforms help spot scam crypto projects early. They provide data, trends, and community insights. Using these tools reduces risks and improves investment choices. They highlight project legitimacy and token activity. Understanding these platforms is key for smart crypto investing.

Launchpads For Early Access

Launchpads offer early access to new crypto projects. They vet projects before listing them. Examples include Binance Launchpad, Seedify, and Polkastarter. These platforms host initial token sales called IDOs or IEOs. Launchpads help verify project teams and goals. They reduce chances of scams by screening projects.

Dex Aggregators

DEX aggregators track tokens on decentralized exchanges. Tools like DEXTools show trending tokens and liquidity pools. They provide real-time data on token trades and volumes. This helps spot unusual activity or pump-and-dump schemes. Aggregators reveal project popularity and health. Monitoring them helps avoid fake tokens.

Data Aggregators And Listing Sites

Data aggregators list new and upcoming crypto projects. Sites like CoinMarketCap, CoinGecko, and CryptoRank provide token details and price history. ICO Drops and CoinList show presale and token sale schedules. These platforms verify project legitimacy through audits and team info. They also display user reviews and ratings. Checking these sites helps confirm project authenticity before investing.

Community And Social Signals

Community and social signals reveal much about a crypto project’s trustworthiness. Active, transparent, and engaged communities often indicate genuine projects. Scam projects tend to have quiet or overly aggressive social channels. Monitoring these signals helps spot red flags early and protect your investment.

Reddit, Discord, And Telegram Groups

Check Reddit forums related to the project. Genuine projects have detailed discussions and diverse opinions. Watch for repetitive praise without real questions or debate. Discord servers should be active with developers answering queries. Beware of groups with many bots or spam messages. Telegram groups must show real user interaction, not just promotional posts. Silence or aggressive moderators often hide issues.

Twitter Insights And Amas

Follow the project’s official Twitter account. Look for consistent updates and real engagement. Scam projects often use fake followers or automated likes. Analyze comments for honest feedback, not just hype. Participate in or watch Ask Me Anything (AMA) sessions. Genuine teams provide clear, direct answers. Avoid projects avoiding tough questions or giving vague responses.

Independent Reviews And Feedback

Search for unbiased reviews on trusted crypto websites and forums. Genuine projects usually have mixed but fair opinions. Scam projects get mostly negative or overly positive fake reviews. Look for feedback from known community members or experts. Check YouTube and blogs for detailed analysis. Avoid projects with no independent coverage or only paid promotions.

News Sources And Content Creators

News sources and content creators play a vital role in spotting scam crypto projects. They provide updates, expert opinions, and community feedback. Trustworthy voices help separate real projects from frauds. Stay alert to avoid falling for scams. Use multiple sources to get a clear picture.

Crypto News Websites

Reliable crypto news websites report on market trends and new projects. They verify information before publishing. Popular sites include CoinDesk, CoinTelegraph, and CryptoSlate. Watch for detailed articles about the team and technology behind projects. Avoid sites that hype coins without facts. Check if the news site has a good reputation and history.

Youtube Analysis

YouTube hosts many crypto content creators who review projects. Choose creators who explain risks and show proof. Beware of channels promoting coins with no research. Look for clear analysis of whitepapers and tokenomics. Watch multiple videos to compare opinions. Avoid channels that push quick gains or guaranteed profits.

Podcasts And Interviews

Podcasts offer deep dives into crypto projects and industry news. Experts share insights and interview project founders. Listen for honest discussions about challenges and goals. Podcasts can reveal red flags like vague answers or missing details. Follow podcasts with experienced hosts and verified guests. Use these talks to learn more before investing.

Credit: tech.co

Key Evaluation Criteria

Evaluating a crypto project before investing helps avoid scams and losses. Use clear criteria to judge if a project is real and trustworthy. These key points focus on the project’s utility, communication style, exchange presence, and token sale alerts. Follow these steps to protect your money.

Real Utility And Use Cases

Check if the project solves a real problem. It should have clear use cases for its token or platform. Ask what users gain by using the crypto product. Projects with strong utility attract genuine interest and long-term growth. Avoid tokens that only promise quick profits or vague benefits.

Red Flags In Communication

Watch for poor or aggressive communication from the team. Scam projects often pressure people to invest fast. Be cautious if messages promise guaranteed returns or use fake endorsements. Genuine projects share clear updates and answer questions openly. Silence or vague replies are warning signs.

Monitoring Exchange Listings

Check if the token is listed on reputable exchanges. Being on well-known platforms means the project passed some checks. New or unknown exchanges carry more risk. Also, study the trading volume and price trends. Low volume or sudden spikes may indicate manipulation or scams.

Setting Alerts For Token Sales

Set alerts for upcoming token sales or launches. Use trusted platforms and data sites like CoinMarketCap or CoinGecko. Early alerts help you research before investing. Avoid rushing into sales without understanding the project fully. Timely alerts give you a chance to act smartly.

Avoiding Hype And Fomo

In the fast-moving world of cryptocurrency, hype and fear of missing out (FOMO) can cloud good judgment. Many new investors rush into projects because of excitement or social pressure. Avoiding hype and FOMO is crucial to spot scam crypto projects early. Careful evaluation helps protect your money and builds smarter investment habits.

Focus On Substance Over Hype

Look beyond flashy marketing and big promises. Real projects show clear goals and detailed plans. Check the team’s background and the technology they use. Genuine projects share whitepapers, roadmaps, and code audits openly. Avoid projects that focus only on hype without solid proof.

Questioning Vague Claims

Be cautious about projects making unclear or exaggerated statements. Scammers often use buzzwords with little explanation. Ask simple questions: How does the project work? Who benefits? Where is the technology? If answers are missing or confusing, it is a warning sign. Clear, specific details build trust.

Patience In Investment Decisions

Don’t rush to invest based on excitement or pressure. Take time to research and think carefully. Look for independent reviews and community feedback. Wait for more information and updates before committing money. Patient investors avoid mistakes and spot scams early.

Credit: www.amazon.com

Frequently Asked Questions

How Do You Find Out If A Cryptocurrency Project Is Legitimate Or A Scam?

Verify the team’s credibility, check audits, review community feedback, confirm contract addresses on explorers, and watch for unrealistic promises. Avoid projects with vague info, pressure tactics, or requests for private keys. Use trusted platforms and independent reviews to ensure legitimacy.

How To Spot A Crypto Investment Scam?

Spot scams by avoiding promises of guaranteed returns, high pressure tactics, and requests for private keys. Verify team credibility, audit reports, and contract details on block explorers. Check independent reviews and domain age. If information is unclear or overly hype-driven, avoid investing.

How Do I Find New Crypto Projects Before Release?

Use launchpads like Binance Launchpad and Seedify for early sales. Track new projects on CoinMarketCap and CoinGecko. Join crypto communities on Twitter, Discord, and Telegram for updates and insights. Prioritize projects with strong development and real utility over hype.

How To Spot A Fake Crypto Transaction?

Spot fake crypto transactions by verifying transaction IDs on block explorers, checking sender addresses, and avoiding unsolicited requests for private keys or payments. Look for inconsistencies in transaction details and confirm with trusted sources before proceeding.

Conclusion

Stay alert and trust your research before investing in crypto projects. Check project teams, audits, and community feedback carefully. Avoid offers promising quick, guaranteed profits without clear details. Use trusted tools and platforms to verify information. Remember, taking time to learn helps protect your money.

Smart choices build safer crypto investments. Keep questioning, stay informed, and never rush into deals. Your careful approach can reduce risks and increase confidence in your decisions.