Want to know where you really stand financially? Calculating your net worth gives you a clear snapshot of your financial health.

It’s easier than you think, and once you know how to do it, you’ll feel more confident about managing your money. This beginner’s guide will walk you through simple steps to add up what you own and subtract what you owe.

By the end, you’ll have a number that tells you exactly how much you’re worth—and that knowledge can help you make smarter decisions for your future. Let’s get started!

Credit: www.plr.me

Net Worth Formula

The net worth formula is a simple way to measure your financial health. It shows the difference between what you own and what you owe. Knowing this number helps you understand your money situation at a glance. Let’s break down the formula into easy parts.

Assets Explained

Assets are things you own that have value. This includes cash in bank accounts, investments, and property. Your car and home count too, as do valuable items like jewelry or art. Add up the current market value of all these items to find your total assets.

Liabilities Explained

Liabilities are debts or money you owe others. These include mortgages, student loans, and credit card balances. Car loans and other personal loans also count. Add up all these debts to find your total liabilities.

Simple Equation

The net worth formula is easy: subtract your total liabilities from your total assets. The equation looks like this:

If the result is positive, you own more than you owe. If it is negative, your debts are higher than your assets.

Listing Your Assets

Listing your assets is the first step in calculating your net worth. Assets are the things you own that have value. Knowing their worth helps you understand your financial position clearly.

Start by making a detailed list of all your assets. Include everything from cash in hand to valuable personal belongings. This list forms the base of your net worth calculation.

Cash And Bank Accounts

Cash and bank accounts are the easiest assets to list. Include all money in checking accounts, savings accounts, and cash you have at home. This money is liquid and ready to use anytime.

Check your bank statements to get the exact balances. Add these amounts together for your total cash assets.

Investments And Retirement Funds

Next, list all your investments. These include stocks, bonds, mutual funds, and other market assets. Also, include retirement accounts like 401(k)s and IRAs.

Use recent statements to find the current value of these accounts. This helps you see the true worth of your investments today.

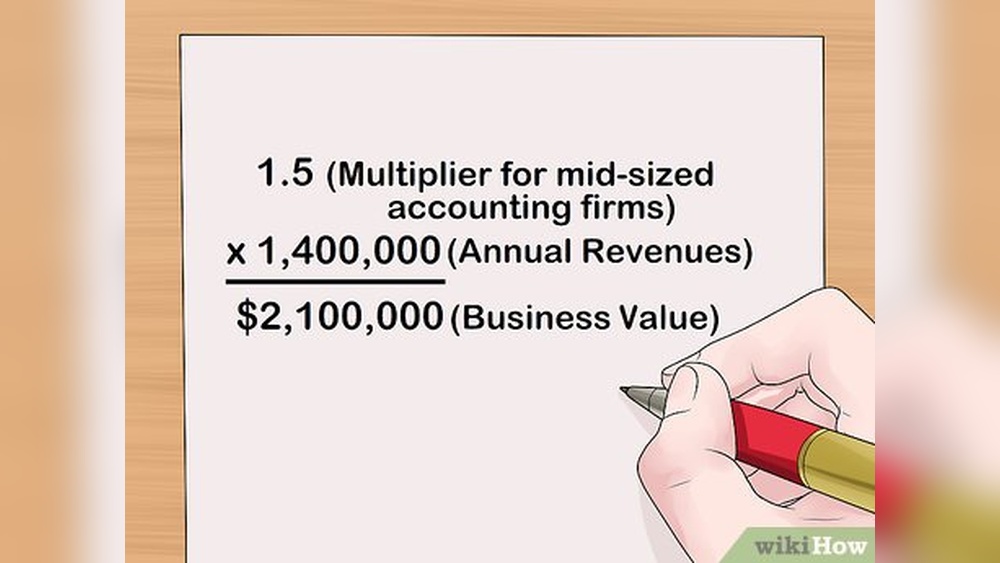

Property And Real Estate

Property includes your home, land, or any real estate you own. Estimate the market value of each property. This value is what you could sell it for now.

Use online tools or a professional appraisal to get a fair estimate. Include any vehicles you own as part of your property assets.

Valuable Personal Items

Valuable personal items add to your total assets. These can be jewelry, art, collectibles, or business stakes you own. Estimate their current market value.

Keep receipts or appraisals if possible to support your estimates. Listing these items gives a full picture of your wealth.

Listing Your Liabilities

Listing your liabilities is a crucial step in calculating your net worth. Liabilities are the debts or financial obligations you owe to others. Knowing your liabilities helps you understand how much money you need to pay off. This gives a clearer picture of your financial health.

Carefully list every debt, no matter how small. This ensures your net worth calculation is accurate. Organize your liabilities by type for easier tracking. Below are common categories of liabilities you should include.

Mortgages And Home Loans

Mortgages are loans taken to buy a home. Include the remaining balance you owe on your mortgage. If you have more than one home loan, list each separately. These debts often form the largest part of your liabilities.

Student And Auto Loans

Student loans cover education costs. Auto loans finance vehicle purchases. Write down the current amount you still owe on these loans. Keep loan statements handy to get exact figures. These debts reduce your net worth until fully paid.

Credit Card Balances

Credit card debt can grow quickly due to interest. Record the total outstanding balance on all your credit cards. Avoid including your credit limit, only the amount you owe. Paying off this debt lowers your liabilities and improves your net worth.

Other Debts

Other debts include personal loans, medical bills, and unpaid taxes. List these amounts separately for clarity. Don’t forget small balances on store cards or payday loans. Every debt counts and affects your total liabilities.

Calculating Net Worth

Calculating your net worth is a simple but important step to understand your financial health. It shows what you truly own after paying off all your debts. This calculation helps you see your progress and plan for the future. Here is how you can calculate your net worth in easy steps.

Subtracting Liabilities From Assets

Start by listing all your assets. These include cash, savings, investments, and the value of your home or car. Add the worth of any valuable items like jewelry or art. Then, list your liabilities. These are debts such as mortgages, loans, and credit card balances. Subtract the total liabilities from your total assets. The result is your net worth.

Interpreting Positive And Negative Results

A positive net worth means you own more than you owe. This is a sign of good financial health. A negative net worth means your debts exceed your assets. This shows you owe more than you own and may need to adjust your spending or saving habits. Tracking your net worth over time helps you improve your money situation.

Net Worth For Households Vs Individuals

Understanding net worth differs between households and individuals. Household net worth sums the assets and debts of everyone living together. Individual net worth considers just one person’s financial picture. Knowing the difference helps in tracking your money better. It also helps you compare your situation with others more fairly.

Combined Household Assets

Household net worth adds all assets owned by family members. This includes cash, properties, cars, and investments combined. It subtracts all debts owed by anyone in the household. This total shows the financial strength of a home, not just one person. It reflects shared expenses, like mortgages and loans. Household net worth gives a broader view of financial health.

Median Vs Average Net Worth

Median net worth is the middle value in a list of net worths. Half of households have more, and half have less than this number. It shows a typical financial position without being affected by very rich or poor extremes. Average net worth adds all net worth values and divides by the number of households. This number can be higher due to a few wealthy people. Median net worth often gives a better idea of common wealth.

Including Or Excluding Home Equity

Deciding whether to include home equity in your net worth calculation can change the result significantly. Home equity is the current market value of your home minus what you owe on your mortgage. It represents a large part of many people’s assets. Including it gives a fuller picture of your financial health. Excluding it focuses more on liquid assets that you can access quickly.

Understanding the role of home equity helps you choose the best method to calculate your net worth. This choice depends on your goals and financial situation.

What Is Home Equity?

Home equity is the difference between your home’s market value and your mortgage balance. If your home is worth $300,000 and you owe $200,000, your equity is $100,000. This equity is a valuable asset but not easily accessible unless you sell or refinance.

Reasons To Include Home Equity

Including home equity shows your total wealth more accurately. It reflects the biggest asset many people have. This helps track long-term financial growth. It can also help with planning for retirement or major expenses. Including home equity is useful if you plan to sell or borrow against your home.

Reasons To Exclude Home Equity

Excluding home equity focuses on cash and investments you can use quickly. It shows your liquid net worth. This is important for emergency funds or short-term goals. Excluding home equity gives a clearer view of your available money. It avoids overestimating wealth if your home value drops.

How To Decide What Works Best

Think about your financial goals and needs. Include home equity for a complete view of your wealth. Exclude it to see your ready-to-use assets. Review your net worth both ways for better insight. This helps you plan smarter and manage your money well.

Tracking Net Worth Growth

Tracking your net worth growth is a key step to understanding your financial progress. It shows how your wealth changes over time. This helps you see if you are moving closer to your financial goals. Regular tracking also highlights areas needing improvement or adjustment.

Tracking net worth growth is simple and effective. It keeps you motivated and focused on managing money well. Use clear and consistent methods to measure your net worth regularly. This section explains how to track your net worth growth step by step.

Set A Regular Schedule For Tracking

Choose a specific day each month or quarter to update your net worth. Consistency is important to spot real trends. Mark this date on your calendar. Use reminders to make it a habit. Regular updates give a clear picture of your financial health.

Use A Spreadsheet Or App

Create a simple spreadsheet to list your assets and liabilities. Update the values each tracking day. You can also use free apps designed for net worth tracking. These tools help you save time and reduce errors. They also show your net worth visually with charts.

Compare Changes Over Time

After each update, compare your net worth to previous periods. Look for increases or decreases. Understand why these changes happened. Did you pay off a loan, save more, or did investments change? This helps you learn what actions affect your net worth the most.

Set Goals Based On Your Growth

Use your net worth growth data to set clear financial goals. For example, aim to increase your net worth by a certain amount each year. Break big goals into smaller, achievable steps. Tracking progress toward these goals keeps you motivated and on track.

Credit: content.moneyinstructor.com

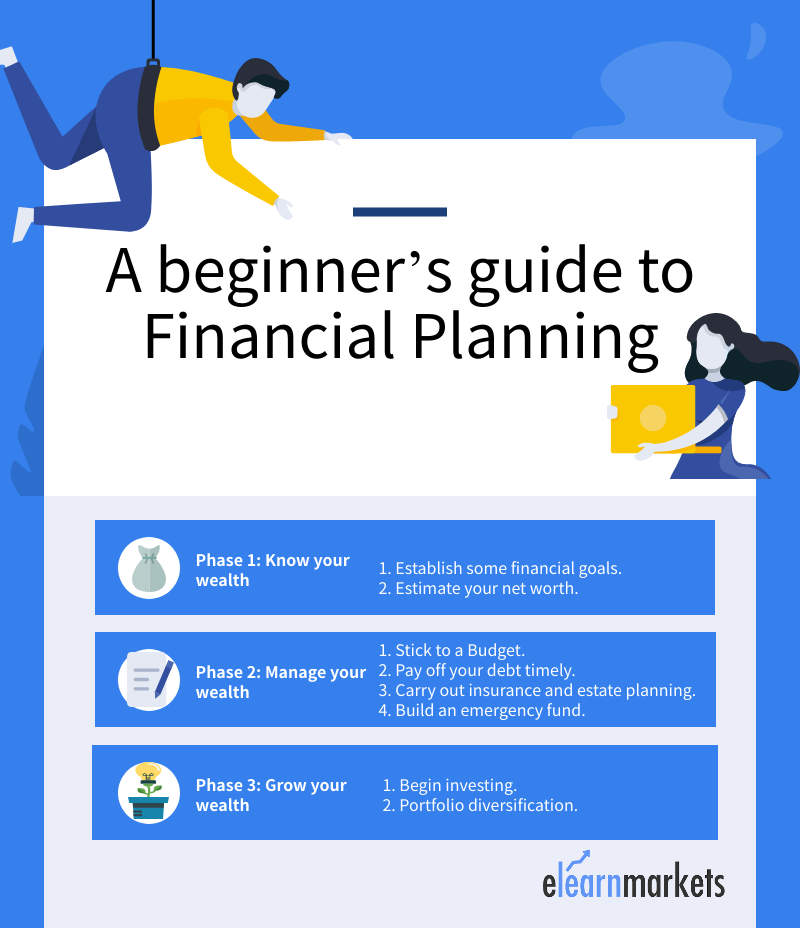

Tools And Resources

Calculating your net worth becomes easier with the right tools and resources. They help organize your assets and liabilities clearly. Using these aids saves time and reduces errors. Choose tools that match your comfort with technology and finance. Here are some popular options to consider.

Net Worth Calculators

Net worth calculators simplify the math by doing it for you. Enter your assets and debts, and the calculator shows your net worth. Many websites offer free calculators that are easy to use. They also provide visual summaries to help understand your financial position. These tools update quickly as you change your inputs.

Financial Apps

Financial apps track your money and net worth automatically. Link your bank accounts, loans, and investments in one place. The app updates your net worth daily or weekly. Some apps send reminders to check your progress. They also show trends to help you see growth or loss over time.

Educational Videos

Educational videos explain net worth concepts in simple steps. Watching videos helps you grasp the basics faster. Many videos show real-life examples to make learning practical. Some channels offer step-by-step guides on calculating net worth. Videos are great for visual and auditory learners.

Credit: blog.elearnmarkets.com

Frequently Asked Questions

What Is The Easiest Way To Calculate Your Net Worth?

Calculate net worth by adding all your assets’ values, then subtracting total liabilities. Assets include cash, investments, and property. Liabilities cover debts like loans and credit cards. The formula is: Assets minus Liabilities equals Net Worth. A positive result shows financial health; negative means debt exceeds assets.

What Is The 70/30/10 Rule Money?

The 70/30/10 money rule divides income into 70% for needs, 30% for wants, and 10% for savings or debt repayment.

How Many Americans Have A Net Worth Of $1,000,000?

About 22 million Americans have a net worth of $1,000,000 or more. This figure includes assets minus liabilities. Millionaires represent roughly 8% of U. S. adults, reflecting growing wealth accumulation in the country.

What Is The Formula For Calculating Net Worth?

The formula for net worth is: Net Worth = Assets – Liabilities. Add all assets, subtract all debts to calculate it.

Conclusion

Calculating your net worth helps you understand your financial health clearly. Start by listing all your assets and liabilities carefully. Subtract what you owe from what you own to find your net worth. Check this number regularly to track your progress.

Small changes over time can make a big difference. Knowing your net worth guides better money decisions. Keep it simple and update it often. This habit builds a strong financial foundation for your future.