Do you ever wonder where your family stands financially? Knowing your family’s total net worth gives you a clear picture of your financial health.

It’s not just about numbers—it’s about understanding what you own versus what you owe. Imagine having the power to make smarter money decisions, set realistic goals, and plan confidently for the future. Calculating your family’s net worth is easier than you think, and this simple step can change the way you manage your finances forever.

Ready to take control? Let’s dive into how you can calculate your family’s total net worth today.

Assets To Include

Calculating your family’s total net worth starts with knowing which assets to include. Assets are valuable items or accounts your family owns. Adding up these assets gives a clear picture of your financial health. Focus on items that you can sell or convert to cash. Avoid counting items that have no market value. Here are key asset categories to consider.

Cash And Savings

Include all money you can access quickly. This means cash in hand, checking accounts, and savings accounts. Money market accounts and certificates of deposit also count. These funds provide liquidity and security. Keep track of the current balances to get an accurate total.

Real Estate And Property

List any homes, land, or buildings your family owns. Use the current market value, not the purchase price. Include rental properties or vacation homes. If you have a mortgage, record the full property value here, and subtract the mortgage under liabilities.

Personal Valuables

Count items like jewelry, art, collectibles, and vehicles. Estimate their resale value, not sentimental worth. These valuables add to your net worth but can be harder to price. Be realistic and use recent sales or appraisals as a guide.

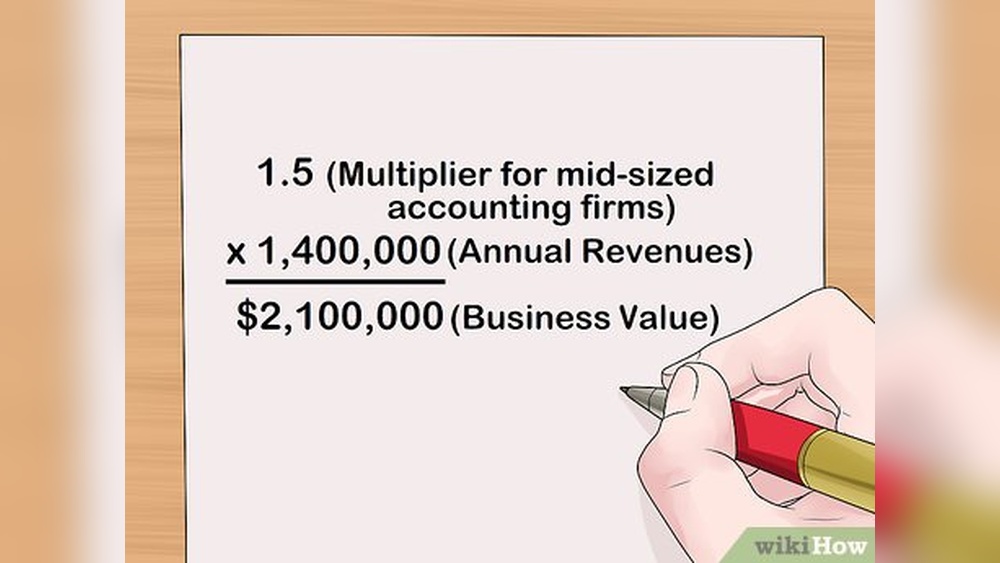

Other Financial Holdings

Include stocks, bonds, retirement accounts, and mutual funds. Also list any ownership in businesses or partnerships. Use the latest statements or market values. These assets grow over time and contribute significantly to net worth.

Credit: www.experian.com

Listing Your Debts

Listing your debts is an essential step in calculating your family’s total net worth. Debts reduce your overall value, so tracking them carefully gives you a clear picture of your financial health. Include every outstanding amount owed to understand your liabilities fully.

Start by gathering all statements and loan documents. Write down each debt and the current balance. Organize them by category to simplify the process.

Mortgages

Mortgages usually form the largest part of family debt. Note the remaining balance on each mortgage. Include primary homes, vacation properties, and any rental houses. Use the latest statement for accuracy.

Loans And Credit Cards

List all personal, auto, and student loans. Record the total amount owed on each. Also, include credit card balances. Add up the current debts, not the credit limits. This helps show the real amount you owe.

Other Financial Obligations

Include debts like unpaid taxes, medical bills, or legal obligations. Don’t forget any money owed to family or friends. These smaller debts still affect your net worth and should be counted.

Net Worth Calculation

Calculating your family’s total net worth gives a clear picture of your financial health. It shows the value of everything your family owns after paying off all debts. This simple calculation helps you understand where your family stands financially and plan for the future.

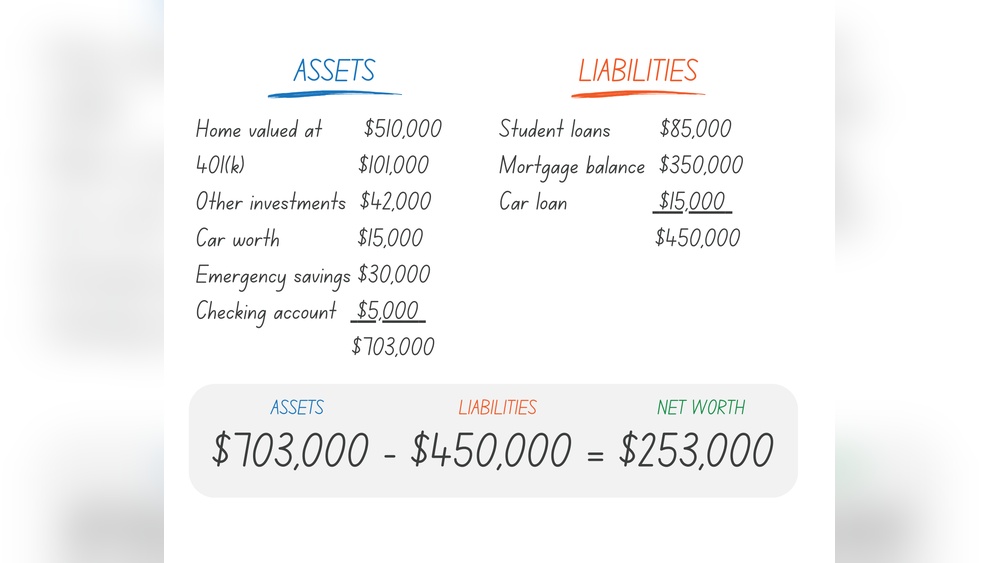

Subtracting Liabilities From Assets

Start by listing all your assets. Include cash, savings accounts, investments, and the market value of your home. Don’t forget cars, jewelry, and any small businesses you own. Next, list all liabilities. These are debts like mortgages, credit card balances, and loans.

Add up all assets to get a total value. Then add up all liabilities to get the total amount owed. Finally, subtract the total liabilities from total assets. The result is your family’s net worth. This number shows what your family owns after paying off debts.

Interpreting Positive And Negative Values

A positive net worth means your family owns more than it owes. This is a good sign of financial stability. It means you have assets to rely on in emergencies or for future goals.

A negative net worth means your debts are higher than your assets. This situation needs attention. It shows that your family owes more than it owns. Tracking this number regularly can help improve your financial health over time.

Credit: www.gauthmath.com

Tracking Financial Progress

Tracking your family’s financial progress is key to understanding your money situation. It helps you see if your wealth grows or shrinks over time. This makes it easier to plan for the future and reach your goals.

By watching your net worth regularly, you spot patterns. You find out what works and what does not. This keeps your family focused and motivated to improve finances step by step.

Monitoring Net Worth Over Time

Track your net worth monthly or quarterly. Use the same method each time for accuracy. Write down your assets like savings, investments, and property values. Also, list debts such as loans and credit card balances.

Compare these numbers to past records. Notice increases or decreases in your total net worth. Small changes add up to big improvements over the years. Tracking helps catch problems early and adjust spending or saving.

Using Tools And Calculators

Many online tools simplify net worth tracking. Enter your assets and liabilities into calculators. They provide clear totals and charts to show progress visually. Some apps sync with bank accounts for automatic updates.

Choose tools that are easy to use and secure. They save time and reduce errors in calculations. Using digital tools makes financial tracking less stressful and more consistent.

Tips To Increase Net Worth

Increasing your family’s net worth requires smart financial choices. Focus on steps that reduce what you owe and boost what you own. Small changes add up over time. A clear plan helps build wealth steadily.

Reducing Debts

Lowering debts frees up money for savings and investments. Start by paying off high-interest debts first, like credit cards. Make extra payments when possible to reduce principal faster. Avoid taking new loans unless necessary. Keep track of all debts and set realistic payoff goals. Reducing debt improves your credit score and financial stability.

Growing Assets

Assets increase your net worth and provide long-term security. Build savings by setting aside money regularly. Consider investing in stocks, bonds, or mutual funds for growth. Real estate can add value if chosen wisely. Keep valuable items such as vehicles and collectibles in good condition. Diversify your assets to spread risk and improve returns. Growing assets steadily strengthens your family’s financial foundation.

:max_bytes(150000):strip_icc()/net-worth-4192297-1-6e76a5b895f04fa5b6c10b75ed3d576f.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

How Is A Family’s Net Worth Calculated?

Calculate a family’s net worth by subtracting total liabilities from total assets. Assets include cash, investments, property, and valuables. Liabilities cover debts like loans, mortgages, and credit card balances. The result shows financial health, indicating if assets exceed debts or vice versa.

How To Find A Family Member’s Net Worth?

List all assets like cash, properties, and investments. Add up all debts and liabilities. Subtract liabilities from assets to find net worth.

What Is Your Family’s Net Worth?

Our family’s net worth equals total assets minus total liabilities, reflecting what we own after debts are paid.

How Do You Calculate A Person’s Net Worth?

Calculate net worth by subtracting total liabilities from total assets. Assets include cash, property, and investments. Liabilities cover all debts and loans. The formula is: Assets minus Liabilities equals Net Worth. This shows your financial value after paying all debts.

Conclusion

Calculating your family’s total net worth gives a clear financial picture. Add up all valuable assets you own. Then subtract all debts and liabilities. This simple formula helps track your financial progress. Knowing your net worth guides better money choices.

Update your numbers regularly to stay informed. Small steps today lead to stronger financial health tomorrow. Keep it simple, stay consistent, and watch your net worth grow.