If you’re thinking about joining a startup or starting one yourself, understanding how startup equity works is crucial. Equity isn’t just a fancy word for ownership—it’s your chance to share in the company’s success.

But how does it really work? What does it mean for your future, your paycheck, and your control over the business? This article will break down startup equity in simple terms, so you can make smart decisions and see the full value of what you’re getting into.

Keep reading, because knowing this could change the way you think about your career and your money.

Equity Basics

Understanding the basics of startup equity is important for anyone involved with new businesses. Equity represents ownership in a company. It shows who owns part of the startup and how much they own. This ownership can grow in value as the company grows.

Equity helps attract talent and investors. It also motivates the team to work hard for the company’s success. Knowing the types of equity shares can clarify how ownership works.

What Is Startup Equity

Startup equity is a share of ownership in a new company. It gives the holder rights to a part of the company’s profits and assets. Equity holders can also influence business decisions.

Equity usually comes in the form of shares. The more shares someone has, the bigger their ownership slice. Startups use equity to reward founders, employees, and investors.

Types Of Equity Shares

Common shares are the most basic form of equity. They usually come with voting rights. Holders may receive dividends if the company pays them.

Preferred shares are special. They often have priority over common shares for dividends and assets. They may not always have voting rights.

Stock options are another type. They give employees the right to buy shares later. This helps keep employees motivated to grow the company.

Equity Allocation

Equity allocation shows how ownership in a startup is divided. It defines who owns what part of the company. This division impacts control, rewards, and future decisions. Understanding equity allocation helps everyone see their stake clearly.

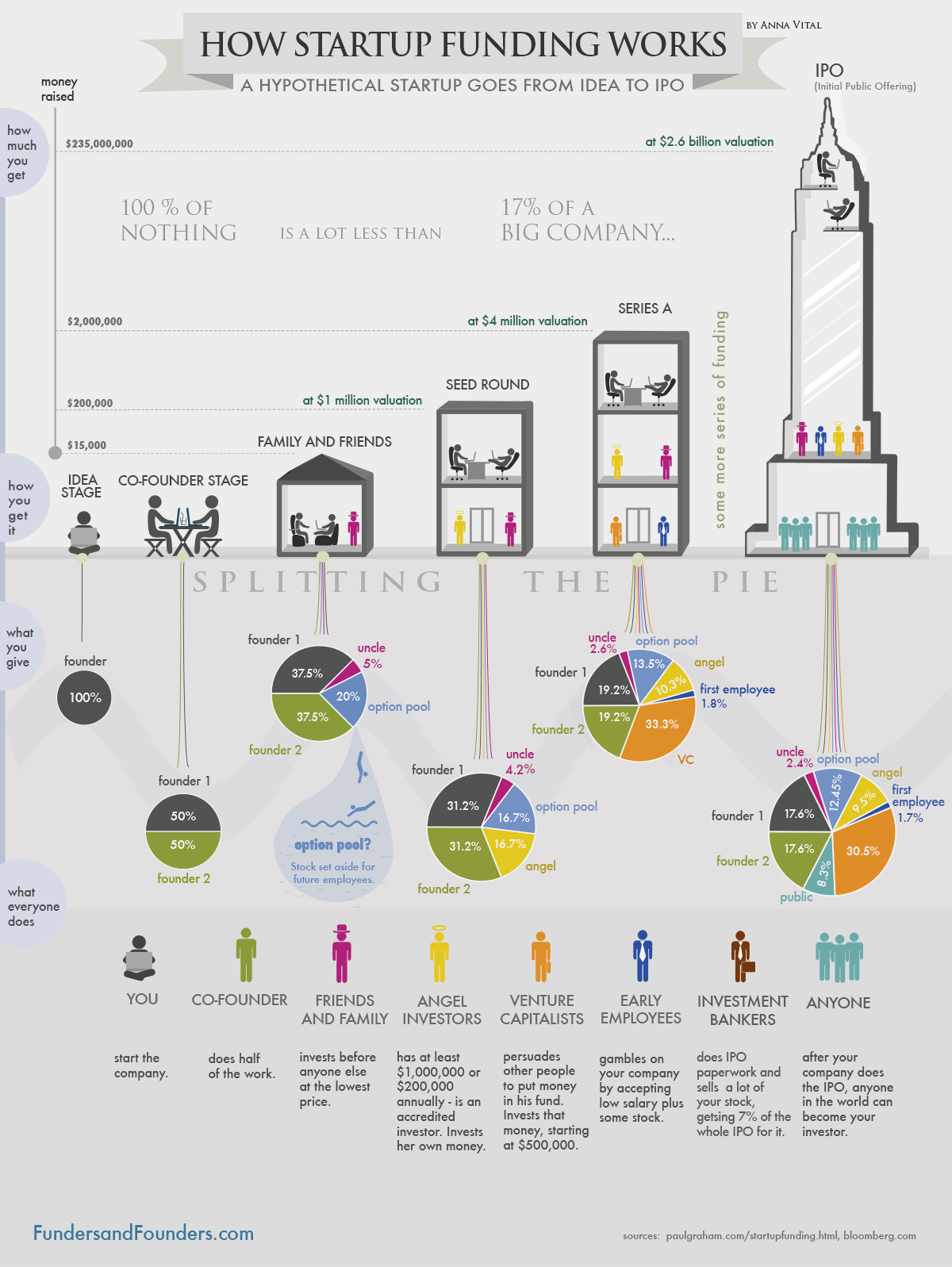

Founders’ Equity

Founders get the largest share of equity. This reward reflects their initial idea and effort. Founders’ equity usually splits based on role and contribution. It motivates founders to grow the business. They often face vesting schedules to earn full ownership over time.

Employee Stock Options

Employees receive stock options to join and stay motivated. These options give workers the right to buy shares later. Options align employees’ interests with company success. Vesting plans encourage long-term commitment. This method helps startups attract talent without high salaries.

Investor Shares

Investors get shares in exchange for funding. These shares give investors partial ownership. Their stake depends on the investment size and company valuation. Investors often want some control or decision power. Their support helps startups grow faster and reach milestones.

Vesting Schedules

Vesting schedules are a key part of startup equity. They define how and when employees earn their shares. This system helps protect both the company and the employees. It also encourages commitment over time.

Understanding vesting schedules is important for anyone joining a startup. It shows how equity builds up and when it becomes fully owned.

Purpose Of Vesting

Vesting ensures employees earn their shares gradually. It stops someone from leaving early with all the equity. This way, startups keep their team motivated for the long term. Vesting also helps align employees’ interests with the company’s success.

Common Vesting Timelines

Most startups use a four-year vesting schedule. This means employees earn 25% of their shares each year. Some companies use shorter or longer timelines. But four years remains the industry standard. Shares vest monthly or quarterly during this period.

Cliff Periods Explained

A cliff period is the time before any shares vest. Usually, it lasts one year. If the employee leaves before the cliff ends, they get no shares. After the cliff, a chunk of shares vest all at once. Cliffs protect startups from early departures and keep teams stable.

Credit: www.upsilonit.com

Equity Valuation

Equity valuation is a key step in understanding startup ownership. It determines how much the company is worth before and after investment. This value helps decide how much equity investors get in exchange for their money.

Knowing equity valuation helps founders and investors set fair terms. It impacts control, profit sharing, and future fundraising. Clear valuation prevents misunderstandings and legal issues.

Pre-money Vs Post-money

Pre-money valuation is the company’s value before new funding. It shows what the startup is worth on its own. Post-money valuation is the value after adding new investment.

For example, if a startup is worth $1 million pre-money and gets $250,000 investment, the post-money valuation becomes $1.25 million. This difference affects how much equity investors receive.

How Valuations Affect Equity

Valuations directly change the share percentage given to investors. A higher valuation means investors get fewer shares for their money.

A lower valuation means investors get more shares. This can dilute the founder’s ownership more. Choosing the right valuation balances investor interest and founder control.

Valuations also influence future fundraising rounds. Early valuations set the stage for later investments and company growth.

Dilution Effects

Dilution effects are a key part of how startup equity works. As a company grows, its ownership structure changes. This affects how much each shareholder owns. Understanding dilution helps founders and investors make smart decisions. It shows how ownership percentages shift when new shares are issued.

What Causes Dilution

Dilution happens when a company issues new shares. This can occur during funding rounds or employee stock option grants. The total number of shares increases. The percentage of ownership for existing shareholders drops. More investors or employees get a piece of the company. The ownership slice for each person becomes smaller.

Impact On Ownership Percentages

When dilution happens, ownership percentages fall. For example, a founder owning 50% might drop to 40%. This means less control and fewer voting rights. Dilution also affects financial gains from a sale or IPO. Shareholders get a smaller share of profits. Knowing dilution helps prepare for changes in ownership stakes.

Strategies To Manage Dilution

Startups use several strategies to reduce dilution effects. One way is to limit the number of new shares issued. Another is negotiating terms that protect early investors. Companies may also use stock buybacks to reduce outstanding shares. Planning funding rounds carefully keeps dilution in check. These steps help maintain fair ownership distribution over time.

Exit Scenarios

Exit scenarios are key moments for startup equity holders. These events let you turn shares into real money. Knowing the options helps you plan your next steps. Different exits affect your ownership and earnings in unique ways.

Selling Your Shares

Selling shares means you transfer ownership to someone else. This can happen in private deals or on stock markets. You get cash or other assets in return. Timing is important because share value changes over time. Selling early might mean less profit but quicker cash.

Ipo Implications

An IPO, or initial public offering, means the company goes public. Shares become available to many investors on stock exchanges. This often raises share value and liquidity. Equity holders can sell shares more easily after IPO. Some shares may have restrictions for a set period post-IPO.

Acquisition Outcomes

When a startup is acquired, another company buys it. Shareholders usually get cash, new shares, or both. The deal terms affect how much you earn. Acquisitions can be friendly or hostile, impacting share value. Your equity turns into ownership in the new company or cash payout.

Tax Considerations

Understanding tax rules is important when dealing with startup equity. Taxes can affect how much money you keep from your shares or options. Knowing the basics helps you plan better and avoid surprises. This section explains key tax points related to startup equity.

Tax On Stock Options

Stock options give the right to buy shares later. Taxes depend on the type of options you have. Incentive Stock Options (ISOs) often have tax benefits if held long enough. Non-Qualified Stock Options (NSOs) are taxed as income when exercised. It is important to track dates of grant, exercise, and sale.

Capital Gains Tax

Capital gains tax applies when you sell shares at a profit. The tax rate depends on how long you held the stock. Short-term gains are taxed like regular income. Long-term gains have lower tax rates. Holding shares for more than one year reduces taxes.

Tax Planning Tips

Plan your option exercises and share sales carefully. Consider exercising options early to start the holding period. Keep records of all transactions and dates. Consult a tax professional for advice on your situation. Proper planning saves money and reduces tax risk.

Credit: www.youtube.com

Building Wealth

Building wealth through startup equity means owning a part of a company. This ownership can grow in value as the company grows. Many founders and employees gain wealth this way. It takes time and smart decisions to make equity work for you.

Maximizing Equity Value

Focus on the company’s growth and success. Help improve products and services. Strong performance leads to higher company value. Watch for new funding rounds that may change equity worth. Keep track of company milestones and market trends.

Negotiating Equity Deals

Understand the terms before accepting any equity offer. Ask about the percentage, vesting period, and dilution risks. Negotiate for a fair share based on your role. Seek clarity on how and when you can sell shares. A clear deal protects your future wealth.

Long-term Wealth Strategies

Think beyond short-term gains. Hold equity as the company grows over years. Diversify your assets to reduce risk. Plan for taxes on stock options and shares. Stay informed about company updates and market conditions. Patient and steady actions build lasting wealth.

Credit: www.startup-book.com

Frequently Asked Questions

What Is Startup Equity And How Does It Work?

Startup equity represents ownership shares in a new company. Founders and investors receive equity based on their contributions. Equity gives holders voting rights and potential profits if the startup succeeds or sells.

How Is Startup Equity Typically Distributed?

Equity is divided among founders, investors, and employees. Founders usually get the largest shares initially. Investors receive equity in exchange for funding. Employees might earn equity through stock options as incentives.

What Is Vesting In Startup Equity?

Vesting means earning equity gradually over time. It ensures team members stay committed. Typically, equity vests over four years with a one-year cliff. If someone leaves early, they keep only vested shares.

How Does Dilution Affect Startup Equity Holders?

Dilution happens when new shares are issued, reducing ownership percentages. It lowers individual equity value but is common in funding rounds. Founders and early investors must accept dilution to grow the company.

Conclusion

Understanding startup equity helps you see how ownership works. It shows who owns what share of a company. Equity can grow in value as the startup succeeds. Knowing the basics helps you make better choices. It also prepares you for future changes and offers.

Keep learning about equity to stay confident and informed. This knowledge supports your journey in the startup world. It’s a key part of building your financial future. Simple steps now can lead to strong rewards later.