Are you curious about how the value of a company is determined? Whether you’re a business owner, investor, or just someone interested in the world of finance, understanding how company valuation is calculated can give you a clear edge.

Knowing the real worth of a business helps you make smarter decisions, spot opportunities, and avoid costly mistakes. You’ll discover the simple steps and key factors that experts use to figure out a company’s value. By the end, you’ll feel confident in understanding and applying these methods to your own situation.

Keep reading to unlock the secrets behind company valuation and take control of your financial future.

Key Valuation Methods

Understanding how a company’s value is calculated starts with knowing the main methods used. Each method looks at different parts of the business. This helps give a clearer picture of what the company is worth. The right method depends on the business type and available data.

Asset-based Valuation

This method counts all the company’s assets. It adds up things like cash, equipment, and property. Then, it subtracts any debts or liabilities. This shows the company’s net worth. It works well for businesses with many physical assets. It may not capture future earning potential.

Income-based Valuation

This method looks at how much money the company makes. It focuses on profits or cash flow over time. The value is based on expected future income. It uses formulas like discounted cash flow (DCF). This method suits companies with steady earnings. It shows how valuable future profits are today.

Market-based Valuation

This method compares the company to similar businesses. It uses recent sales or stock prices of competitors. This helps estimate what buyers might pay. It is simple and reflects current market trends. It works best when there are many similar companies. It may not fit unique or new businesses well.

:max_bytes(150000):strip_icc()/business-valuation_final-081359e950444aaaa0326a3b512310c1.png)

Credit: www.investopedia.com

Factors Influencing Valuation

Company valuation depends on many key factors. These factors help buyers and sellers decide the company’s worth. Understanding these elements gives a clearer picture of value.

Each factor affects the valuation differently. Some factors show how well the company is doing now. Others suggest how it may grow in the future. Market and industry trends also play a big role.

Financial Performance

Financial performance is one of the main factors. It shows how much money the company earns. Profits, revenue, and cash flow all matter. Strong financials usually mean higher value. Investors want to see steady income and low debt.

Market Conditions

Market conditions affect company valuation greatly. A strong market means more buyers and higher prices. Economic growth, interest rates, and competition all influence value. If the market is weak, valuations tend to drop.

Growth Potential

Growth potential looks at future opportunities. A company that can grow fast is more valuable. New products, expanding markets, and innovation are key signs. Buyers pay more for companies with clear growth paths.

Industry Trends

Industry trends also shape valuation. Growing industries often have higher valuations. Trends show what products or services are in demand. Companies in declining industries may see lower values. Staying updated on trends helps predict company worth.

Common Valuation Metrics

Company valuation uses different methods to find out a business’s worth. Common valuation metrics help investors and managers compare companies. These metrics use financial data to give clear values.

Each metric shows a different side of the company’s financial health. Knowing these helps make smarter business decisions.

Price To Earnings Ratio

The Price to Earnings (P/E) ratio shows the price of a stock compared to its earnings. It tells how much investors pay for one dollar of profit. A high P/E means people expect growth. A low P/E can mean the stock is cheap or the company has problems.

Discounted Cash Flow

Discounted Cash Flow (DCF) looks at future money the company will make. It calculates how much those future earnings are worth today. This method uses a discount rate to adjust for risk and time. DCF is useful for companies with steady cash flow.

Enterprise Value Multiples

Enterprise Value (EV) multiples compare the company’s total value to earnings or sales. EV includes debt and cash, giving a full picture. Common EV multiples are EV/EBITDA and EV/Sales. These help compare companies with different debt levels.

Credit: www.forbesindia.com

Expert Tips For Accurate Valuation

Accurate company valuation requires careful analysis and clear strategies. Experts use several tips to ensure the value reflects the true worth. These tips help avoid common mistakes and give a realistic picture.

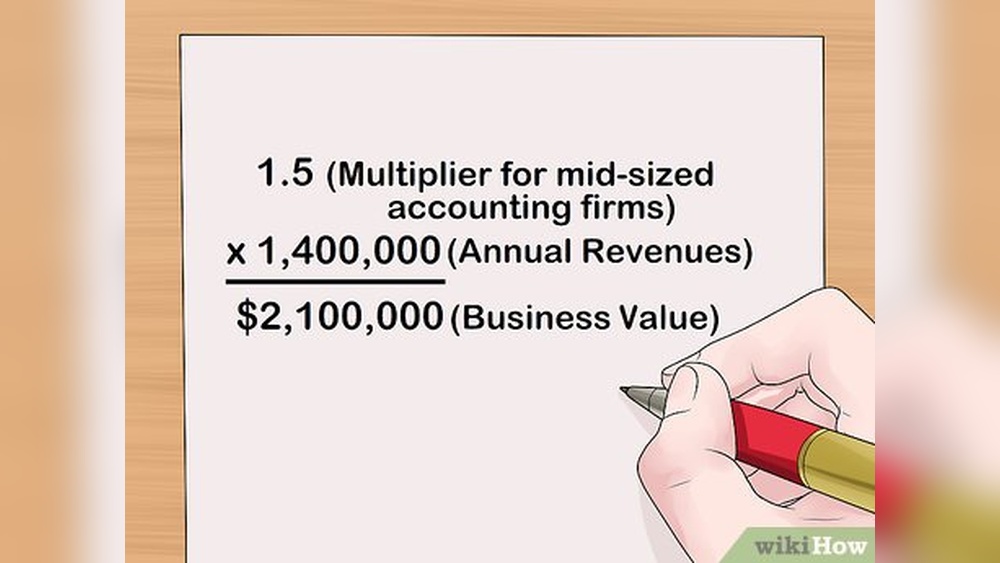

Use Multiple Methods

Relying on one method can lead to errors. Combining approaches like income, market, and asset-based methods shows a fuller picture. Different methods highlight various parts of the business. This balance improves accuracy and trust in the results.

Adjust For Risks

Risk factors affect the company’s value. Consider financial risks, market changes, and management quality. Adjusting for these risks lowers the value to a safer estimate. It protects buyers and sellers from surprises after the deal.

Consider Intangible Assets

Intangible assets like brand, patents, and customer loyalty add value. These elements do not appear on balance sheets but are crucial. Include them in the valuation to reflect the company’s true strength. Ignoring intangibles can undervalue the business.

Stay Updated With Market Data

Market conditions change fast. Use the latest data on industry trends and economic factors. Updated information keeps the valuation relevant and fair. Old data can mislead and cause wrong decisions.

Valuation Challenges To Watch

Calculating a company’s value is not always simple. Many factors can affect the final number. These factors create challenges that can change the valuation. Understanding these challenges helps you see why valuations can differ.

Some challenges come from the market, others from the data used. Some are about opinions and guesses. Each challenge needs careful attention to get a clearer valuation.

Market Volatility

Markets change quickly and often. Prices of stocks and assets can rise or fall fast. This makes it hard to pick a stable value. Sudden changes can make a valuation outdated in days. Market ups and downs add risk to the process.

Data Reliability

Good data is key to a good valuation. Sometimes data is incomplete or wrong. Financial reports may have errors or missing details. Bad data leads to wrong results. Trustworthy and complete information is necessary for accuracy.

Subjective Assumptions

Valuations often need guesses about the future. These guesses include growth rates and profit margins. Different people choose different numbers. These personal choices affect the value a lot. Subjective assumptions create wide ranges in valuation results.

Tools And Resources

Calculating a company’s value needs precise tools and reliable resources. These help gather data, analyze figures, and compare results. Using the right tools improves accuracy and saves time. It also helps business owners and investors make smart decisions.

Valuation Software

Valuation software simplifies complex calculations. It uses formulas to estimate company worth quickly. Many programs offer easy-to-use interfaces and step-by-step guides. Some even include customizable reports for different industries. This software helps reduce human error and speeds up the process.

Financial Reports

Financial reports provide key data for valuation. They include balance sheets, income statements, and cash flow reports. These documents show a company’s assets, debts, income, and expenses. Analyzing this information reveals the business’s financial health. Accurate reports are essential for a fair valuation.

Industry Benchmarks

Industry benchmarks compare your company with similar businesses. They show average values, profit margins, and growth rates. Benchmarks help identify strengths and weaknesses. They also guide realistic expectations for company worth. Using benchmarks ensures valuations align with market standards.

Credit: www.wikihow.com

Frequently Asked Questions

What Are The Common Methods For Company Valuation?

Common methods include discounted cash flow, comparable company analysis, and precedent transactions. Each method uses financial data to estimate value. Choice depends on industry, company size, and purpose of valuation.

How Does Discounted Cash Flow Value A Company?

Discounted cash flow estimates future cash flows and discounts them to present value. It reflects a company’s profitability and growth potential. This method is widely used for its accuracy and forward-looking approach.

Why Is Company Valuation Important For Startups?

Valuation helps startups attract investors and secure funding. It defines ownership percentage and influences negotiation power. Accurate valuation also guides strategic decisions and measures company progress over time.

What Financial Data Is Needed For Valuation?

Key data includes revenue, profit margins, cash flow, and assets. Historical financial statements and future projections are essential. Accurate data ensures reliable and realistic company valuation results.

Conclusion

Calculating a company’s value takes clear steps and key data. Earnings, assets, and market trends all play a role. Different methods suit different business types and goals. Understanding these basics helps you see what influences value. Use this knowledge to make smarter business choices.

Keep learning to stay confident in valuation matters. Simple tools and clear thinking guide the way. Company valuation is not a mystery anymore.