Have you ever wondered how CEOs build wealth beyond their hefty paychecks? It’s not just about the salary you see on paper.

CEOs tap into smart strategies that multiply their income in ways most people don’t know about. If you want to discover how they do it—and maybe apply some of these secrets to your own financial journey—keep reading. This article will reveal the hidden paths CEOs use to grow their money, step by step.

Your financial mindset might just change by the end.

Credit: www.reddit.com

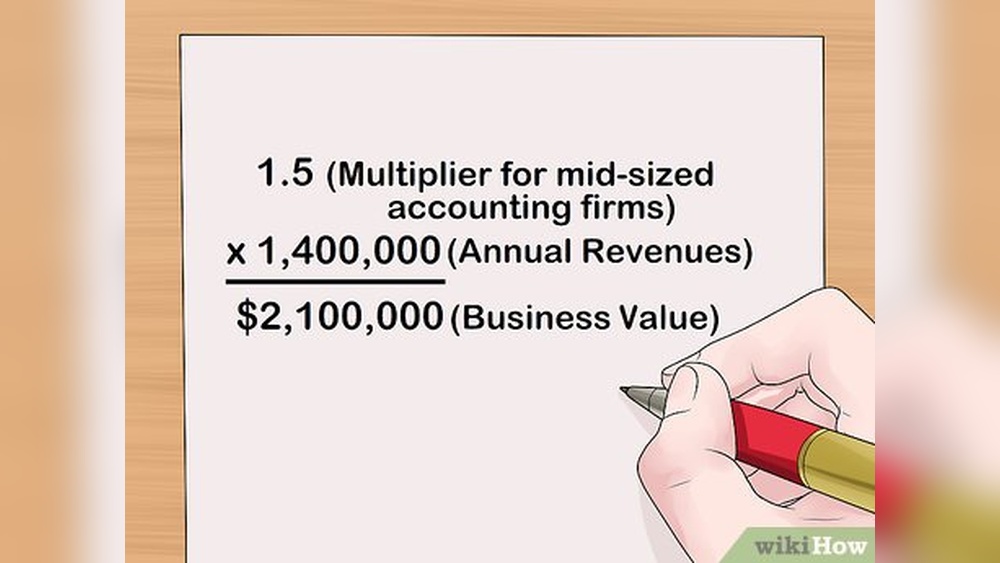

Equity Stakes And Stock Options

Many CEOs earn far beyond their salaries through equity stakes and stock options. These financial tools give them ownership in their companies. As the company grows, the value of these shares can increase significantly. This creates a powerful way to build wealth over time. Understanding how equity and stock options work helps explain how CEOs benefit financially.

Types Of Equity Compensation

CEOs receive different types of equity compensation. Common forms include stock options, restricted stock units (RSUs), and direct stock grants. Stock options allow buying shares at a fixed price later. RSUs are company shares given after certain conditions are met. Direct stock grants are shares given outright. Each type has unique benefits and tax rules.

Vesting Schedules And Their Impact

Equity compensation usually comes with a vesting schedule. This means CEOs earn their shares over time. Vesting encourages them to stay with the company longer. For example, shares may vest over four years with yearly or monthly steps. If a CEO leaves early, they may lose unvested shares. Vesting affects when and how much money a CEO can make.

Selling Shares Strategically

CEOs must plan when to sell their shares. Selling too early might mean missing out on more profits. Selling too late could risk the stock price dropping. CEOs also consider tax implications before selling. Many sell shares gradually to balance risk and reward. Strategic selling helps CEOs maximize earnings from their equity.

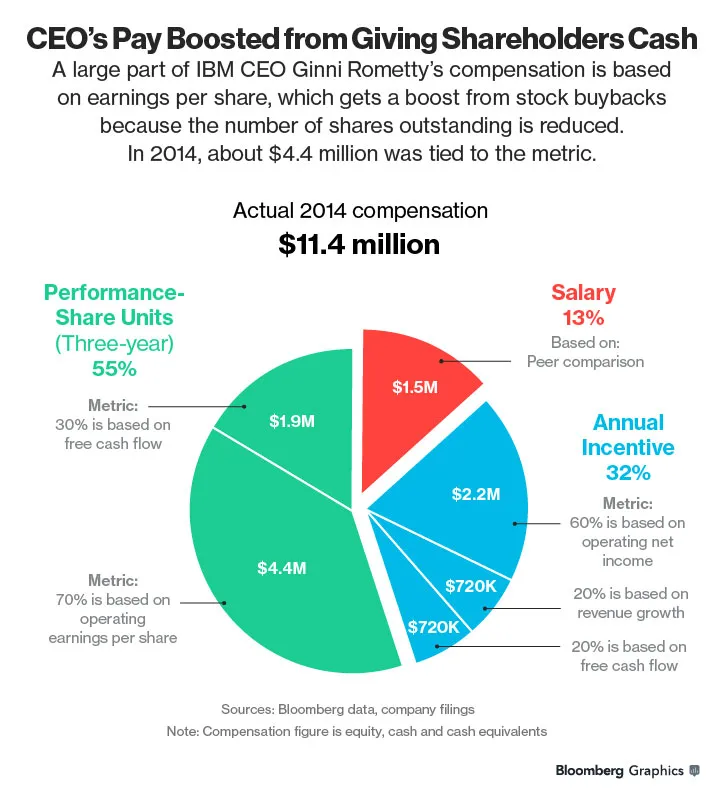

Bonuses And Performance Incentives

CEOs earn money beyond their base salary through bonuses and performance incentives. These rewards encourage leaders to meet company goals and boost overall success. Bonuses often depend on short-term results, while incentives may focus on long-term achievements.

Annual Bonuses Explained

Annual bonuses are extra payments based on the company’s yearly performance. CEOs receive these bonuses if the company meets or exceeds certain targets. These payments motivate CEOs to achieve strong financial results within a year.

Companies set clear goals for revenue, profit, or stock price. If the CEO reaches these goals, they earn a bonus. If targets are missed, bonuses might be smaller or absent.

Long-term Incentive Plans

Long-term incentive plans reward CEOs for success over several years. These plans often include stock options or restricted shares. CEOs benefit if the company grows in value over time.

This encourages leaders to focus on sustainable growth. They think beyond short-term profits and build lasting value for shareholders. These plans align CEO interests with long-term company health.

Metrics That Drive Bonuses

Bonuses depend on measurable business results. Common metrics include revenue growth, earnings per share, and return on investment. Meeting or exceeding these numbers can increase bonus size.

Other factors include customer satisfaction and operational efficiency. CEOs must balance many areas to earn top bonuses. These metrics keep leaders accountable and focused on key priorities.

Dividends And Profit Sharing

CEOs earn money beyond their base salary through dividends and profit sharing. These methods provide extra income and align their interests with the company’s success. Understanding these options helps explain how top executives build wealth.

Earning Through Dividends

Dividends are payments made to shareholders from a company’s profits. Many CEOs own shares in their companies. When the company makes a profit, it may pay dividends. CEOs receive these payments based on the number of shares they hold. This creates a steady income stream outside their salary. Dividends reward CEOs for helping the company grow and succeed.

Profit Sharing Plans

Profit sharing plans give CEOs a portion of the company’s profits. These plans motivate CEOs to increase company earnings. The more profit the company makes, the more the CEO can earn. Profit sharing can be a fixed percentage or vary yearly. It aligns the CEO’s goals with shareholder value. CEOs benefit directly from strong company performance.

Reinvestment Strategies

CEOs often reinvest dividends and profit shares back into the company. This helps increase their ownership and future earnings. Reinvestment can involve buying more company stock or funding new projects. It shows confidence in the company’s growth. Reinvestment supports long-term wealth building beyond salary payments.

Credit: www.bloomberg.com

Board Memberships And Consulting

CEOs often earn money beyond their regular salaries through board memberships and consulting roles. These activities offer extra income and valuable experience. They also expand a CEO’s influence in the business world.

Serving on boards and consulting helps CEOs share their expertise with other companies. It also builds strong networks for future opportunities. These roles are common ways for CEOs to boost their earnings.

Earning From Other Boards

CEOs join boards of other companies to earn additional income. Board members receive fees for attending meetings and offering advice. Some boards also pay bonuses based on company performance.

Being on multiple boards increases a CEO’s income streams. It also raises their profile in the industry. Board roles require strategic thinking and leadership skills.

Consulting Roles And Fees

Many CEOs work as consultants for other businesses. They provide advice on management, growth, and strategy. Consulting fees vary but can be very lucrative.

Consulting allows CEOs to use their knowledge beyond their own company. It often involves short-term projects or ongoing support. This work can fit around their main job.

Networking For Opportunities

Networking plays a key role in finding board and consulting work. CEOs meet other leaders at events and through mutual contacts. These connections lead to invitations for paid roles.

Strong networks help CEOs learn about new openings early. They also build trust and credibility in their field. Networking is essential for securing extra income outside salary.

Real Estate And Alternative Investments

CEOs often grow their wealth through real estate and alternative investments. These options provide income beyond their regular salary. They create financial stability and open new earning paths.

Real estate offers steady cash flow and property value growth. Alternative investments include private equity, venture capital, and digital assets. These choices help CEOs diversify their portfolios.

Investing In Commercial Properties

Many CEOs buy commercial properties like office buildings or retail spaces. These properties generate rental income every month. They also tend to increase in value over time.

Owning commercial real estate can protect against inflation. It often requires less management than residential properties. CEOs choose this for steady, long-term returns.

Private Equity And Venture Capital

CEOs invest in private companies through private equity or venture capital. These investments support startups or growing businesses. Returns can be high if the company succeeds.

This type of investing carries more risk but offers big rewards. It helps CEOs influence company growth directly. Many use their business experience to pick strong ventures.

Cryptocurrency And Other Assets

Some CEOs buy cryptocurrencies like Bitcoin or Ethereum. These digital assets can rise in value quickly. They add variety to an investment portfolio.

Other alternative assets include art, collectibles, or commodities. These often move differently than stocks or bonds. This helps CEOs reduce overall financial risk.

Authoring Books And Speaking Engagements

CEOs often earn extra income beyond their salaries through books and speaking. Sharing knowledge and experience helps them grow their influence. Writing books and speaking at events create new revenue paths. These activities also build their reputation and open doors to other opportunities.

Publishing Deals And Royalties

Many CEOs sign deals with publishers to write books. They receive an advance payment before the book sells. After publication, they earn royalties from each copy sold. Royalties provide a steady income stream over time. Books also boost credibility and attract new business.

Paid Speaking Opportunities

CEOs often get paid to speak at conferences and seminars. Event organizers pay them for sharing insights and expertise. Speaking fees can range from a few thousand to much more. These engagements help CEOs reach wider audiences. They also network with industry leaders and potential clients.

Building A Personal Brand

Books and speeches help CEOs build a strong personal brand. A powerful brand opens doors to consulting and media work. It increases their value in the business world. Personal branding attracts followers and loyal customers. This reputation can lead to long-term financial benefits.

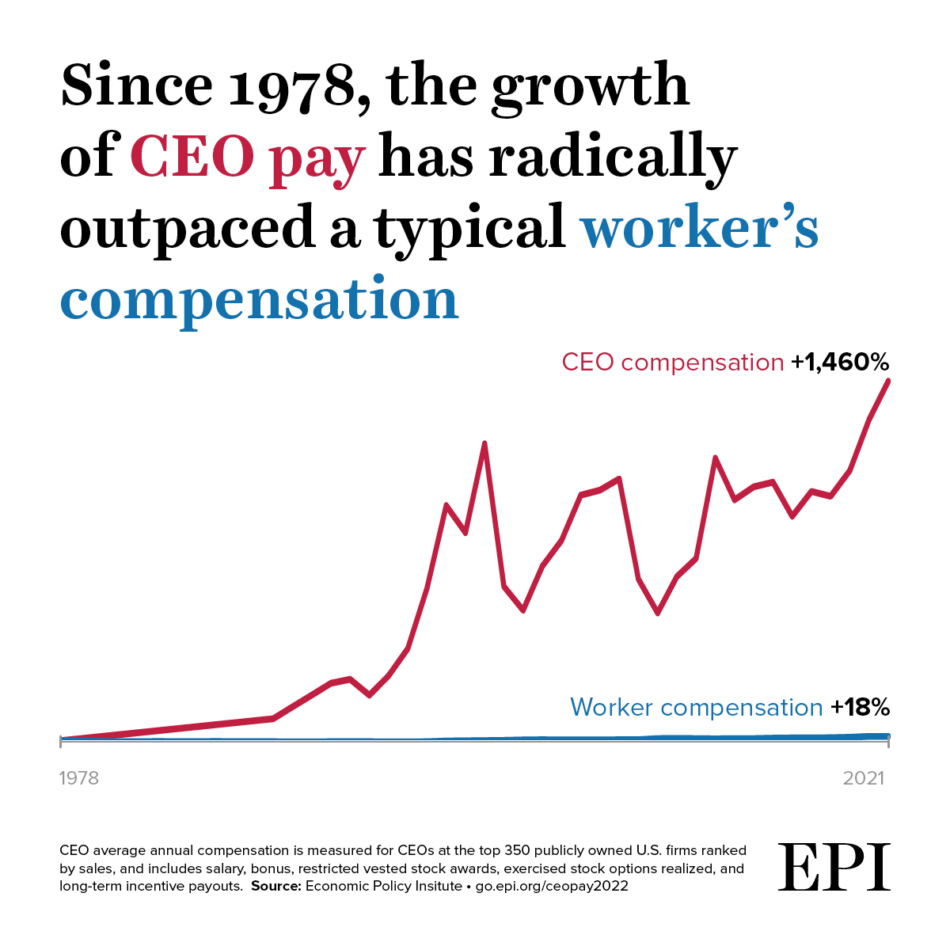

Credit: www.epi.org

Frequently Asked Questions

How Do Ceos Earn Beyond Their Base Salary?

CEOs earn extra through bonuses, stock options, and profit-sharing. They also gain from investments and board memberships. These sources significantly boost their total income beyond regular pay.

What Role Do Stock Options Play In Ceo Income?

Stock options let CEOs buy company shares at a set price. If stock prices rise, they profit by selling at higher rates. This incentive aligns CEO interests with company growth and shareholder value.

Can Ceos Make Money From Company Bonuses?

Yes, CEOs often receive performance-based bonuses. These bonuses reward meeting or exceeding company targets. They are a key part of CEO compensation packages.

Do Ceos Earn From Outside Investments?

Many CEOs invest in startups, real estate, or stocks. These investments generate additional income independent of their company salary. Diversification helps CEOs grow wealth beyond their primary job.

Conclusion

CEOs earn money in many ways beyond their salary. They invest in stocks, start new businesses, and own real estate. Some earn from speaking fees or writing books. These extra incomes help them grow wealth steadily. Understanding these methods can inspire smart money choices.

It shows that salary is just one part of income. Building multiple income streams is key to financial success. Think about how you can apply this idea too. Small steps can lead to big rewards over time.