Have you ever wondered how billionaires manage to pay far less tax than you might expect? It’s not because they’re breaking the law.

In fact, many use clever, legal strategies to keep more of their money. Understanding these tactics can change the way you see taxes—and maybe even help you keep more of your hard-earned cash. Keep reading, and you’ll discover the secrets behind how the ultra-rich reduce their tax bills while staying completely within the rules.

Wealthy Tax Strategies

Wealthy people use smart tax strategies to reduce their tax bills legally. These strategies help them keep more money. They use methods that most people do not know or cannot use easily. Understanding these tactics can show how the rich pay less tax.

Income Shifting Techniques

Income shifting means moving income to others in lower tax brackets. Wealthy families often spread income among relatives. They give money to children or spouses with lower taxes. This lowers the total tax paid on the family’s income. Trusts and family partnerships help shift income legally.

Capital Gains Advantages

Capital gains tax is usually lower than regular income tax. Wealthy people earn more from investments than salaries. They sell assets like stocks or property to pay this lower tax. Holding assets for longer than a year reduces taxes more. They also use losses to offset gains, cutting taxes further.

Tax-deferred Investments

Tax-deferred investments delay tax payments until later. Examples include retirement accounts and annuities. Wealthy individuals put money in these accounts to grow tax-free. Taxes are paid only when money is withdrawn. This helps their wealth grow faster and delays taxes.

Credit: www.amazon.com

Offshore Accounts And Trusts

Offshore accounts and trusts are common tools billionaires use to reduce their tax bills legally. These methods help protect wealth and manage assets in smart ways. They often involve moving money to countries with lower tax rates or special financial rules.

These strategies follow the law strictly. They take advantage of different tax systems around the world. This helps billionaires keep more of their income and investments without breaking rules.

Benefits Of Offshore Jurisdictions

Offshore jurisdictions offer lower taxes or no taxes on certain incomes. They provide privacy and protect financial information from public records. Many have simple rules for setting up accounts and trusts.

These places often have stable governments and strong legal systems. This gives confidence to wealthy individuals about the safety of their assets. Offshore jurisdictions also allow easy access to international markets and investments.

Types Of Trusts Used

Billionaires use different trusts to manage and protect their wealth. Discretionary trusts give trustees power to decide who benefits and when. This offers flexibility and privacy.

Asset protection trusts shield money from creditors and lawsuits. They keep wealth safe during legal troubles. Charitable trusts reduce taxable income by giving assets to good causes.

Legal Safeguards And Compliance

Strict laws govern offshore accounts and trusts to prevent abuse. Billionaires must follow reporting rules and disclose financial details to authorities. This ensures transparency and stops illegal tax evasion.

Many offshore services hire legal experts to maintain compliance with global tax laws. Regular audits and documentation keep the system honest. Proper use of these tools avoids penalties and legal problems.

Business Structures And Deductions

Billionaires use smart business structures and deductions to lower their taxes legally. These strategies help reduce taxable income and protect wealth. Understanding these methods reveals how they pay less tax without breaking rules.

Using Llcs And Corporations

LLCs and corporations offer tax benefits not available to individuals. They separate personal and business income, which helps reduce tax rates. Many billionaires choose these structures to keep profits within the business. This allows them to pay taxes at lower corporate rates. Some corporations also qualify for special deductions. These structures can protect personal assets from business liabilities too.

Maximizing Business Expenses

Business expenses lower the taxable income. Billionaires carefully track all expenses related to their business. This includes office costs, travel, and employee salaries. Even home office expenses can count if rules are met. Every legitimate expense reduces the amount of income subject to tax. This strategy helps keep more money within their business. Proper documentation is key to claim these expenses.

Depreciation And Asset Management

Depreciation allows businesses to spread the cost of assets over time. Billionaires use this to reduce taxable income yearly. Assets like buildings, vehicles, and equipment lose value each year. Instead of deducting the full cost at once, they deduct a portion every year. This lowers taxable income without selling the asset. Managing assets well helps control tax bills while maintaining wealth.

Philanthropy And Tax Breaks

Philanthropy offers billionaires a legal way to reduce their tax bills. Giving money to charity not only helps causes but also lowers taxable income. This section explains how philanthropy links to tax breaks.

Charitable Foundations

Billionaires often create their own charitable foundations. These foundations support causes they care about for many years. Donations to these foundations can be deducted from their taxable income. Foundations also allow them to control how the money is used. This method provides ongoing tax benefits while supporting their interests.

Donor-advised Funds

Donor-advised funds are another popular tool. These funds let billionaires donate money quickly and get immediate tax deductions. They can decide later which charities will receive the funds. This flexibility helps them plan their giving and tax strategy. Donor-advised funds simplify the process and increase tax savings.

Impact On Tax Liability

Charitable giving reduces the amount of income subject to taxes. Donations lower taxable income and can offset capital gains. This means billionaires pay less tax on their earnings. Tax laws allow deductions up to certain limits based on income. Proper use of philanthropy can significantly cut overall tax bills.

Estate Planning Tactics

Estate planning is a key way billionaires reduce their tax bills legally. It involves arranging assets to pass wealth efficiently. Smart estate planning lowers taxes on inheritance and gifts. These tactics protect family fortunes across generations.

Gifting Strategies

Billionaires use gifting to move money without tax penalties. They give assets below annual gift tax limits. This reduces the size of their taxable estate. Gifts can include cash, stocks, or property. Strategic gifting spreads wealth over time, avoiding large taxes later.

Generation-skipping Transfers

This method skips one generation to save taxes. Wealth is transferred directly to grandchildren or beyond. It avoids estate taxes on the skipped generation. Trusts often hold these assets until heirs are older. This tactic preserves more wealth in the family long-term.

Life Insurance Trusts

Life insurance trusts keep death benefits out of taxable estates. The trust owns the policy, not the individual. This reduces estate taxes on the payout. Heirs receive the insurance money tax-free. Trusts also protect assets from creditors and lawsuits.

Tax Law Loopholes

Billionaires use tax law loopholes to lower their tax bills legally. These gaps in tax rules let them pay less money without breaking the law. Understanding these loopholes shows how complex tax systems can be. It also reveals why some wealthy people pay less tax than many workers.

Exploiting Tax Credits

Tax credits reduce the amount of tax owed directly. Billionaires use credits meant for investments or energy-saving projects. They invest in businesses that qualify for these credits. This lowers their tax bill significantly. Many credits are designed to encourage specific behaviors. Rich people take advantage by directing funds where credits apply.

Timing Income And Expenses

Billionaires control when they earn income and pay expenses. They delay receiving income to a later year. This moves the tax payment far into the future. They also speed up expenses in the current year. This reduces taxable income now. This timing can cut taxes owed in high-income years. It allows shifting tax burdens across different periods.

Legal Gray Areas

Some tax rules are unclear or vague. Billionaires hire expert lawyers to find these gray areas. They use strategies that follow the letter of the law. Yet, these strategies may go against the law’s spirit. These include complex trusts and offshore accounts. Such methods create legal tax shelters. They lower taxes but stay within legal boundaries.

Role Of Tax Professionals

Tax professionals play a key role in how billionaires pay less tax legally. They use their knowledge to find ways that follow the law but reduce the tax burden. Without experts, it would be hard to navigate the complex tax system.

These professionals include accountants and lawyers who understand the rules deeply. They create strategies tailored to each billionaire’s financial situation. They also keep track of new tax laws and changes to keep their clients ahead.

Accountants And Lawyers

Accountants and lawyers are the main tax experts for billionaires. Accountants focus on numbers and records. They spot deductions and credits to lower taxes.

Lawyers look at legal ways to protect wealth. They use trusts, partnerships, and other tools. Both work together to build a strong tax plan.

Customized Tax Planning

Every billionaire has a unique tax plan. Tax professionals study their income, assets, and goals. They build a plan that fits each client’s needs exactly.

This plan may include investments, gifts, or business structures. The goal is to reduce taxes while following the law strictly.

Staying Ahead Of Changes

Tax laws change often. Professionals watch these changes closely. They adjust their strategies to keep saving money.

They also advise clients on new rules and deadlines. This helps billionaires avoid penalties and pay less tax legally.

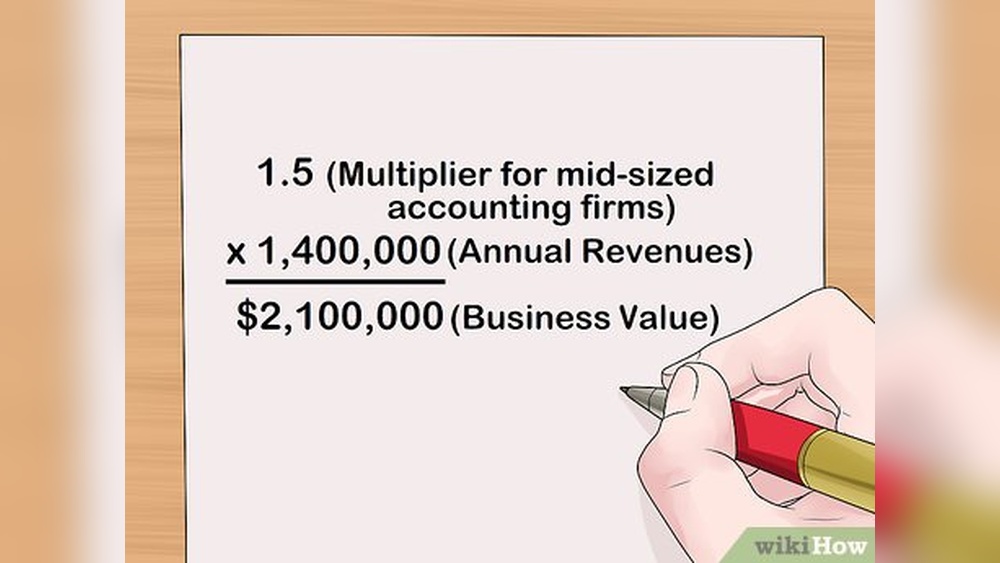

Credit: www.youtube.com

Credit: www.reddit.com

Frequently Asked Questions

How Do Billionaires Legally Reduce Their Tax Bills?

Billionaires use strategies like tax deductions, credits, and offshore accounts. They also invest in tax-advantaged assets and trusts. These methods lower taxable income without breaking laws. Expert tax planning helps them optimize these opportunities legally.

What Role Do Trusts Play In Billionaire Tax Savings?

Trusts protect assets and minimize estate taxes for billionaires. They transfer wealth while reducing tax liabilities. Trusts also allow control over asset distribution. This legal structure offers tax benefits and preserves family wealth efficiently.

Why Do Capital Gains Taxes Benefit Wealthy Individuals?

Capital gains taxes are usually lower than income taxes. Billionaires often earn through investments, paying less tax this way. They can defer taxes by holding assets longer. This strategy legally reduces their overall tax burden.

How Do Offshore Accounts Help Billionaires Pay Less Tax?

Offshore accounts offer tax advantages by shifting income to low-tax countries. They provide privacy and asset protection. Billionaires comply with laws by reporting these accounts properly. This method helps in legally minimizing tax payments.

Conclusion

Billionaires use legal ways to pay less tax. They take advantage of tax rules and smart planning. Investments, deductions, and trusts help reduce their tax bills. Not everyone knows these methods or can use them. Understanding these strategies shows how tax systems work.

It also raises questions about fairness in taxation. Taxes affect everyone, so learning about this matters. Awareness can lead to better discussions on tax laws. Simple changes might make the system fairer for all.