Your credit card is a powerful tool—but it can also be a target. Imagine waking up one day to find unauthorized charges draining your account or someone using your information to rack up debt in your name.

Scary, right? The good news is that you don’t have to be a victim. By taking simple but effective steps, you can protect your card and your finances from fraudsters. You’ll discover essential security tips that help you stay one step ahead of credit card fraud.

Keep reading to learn how to safeguard your money and enjoy peace of mind every time you use your card.

Common Credit Card Threats

Credit card fraud happens in many ways. Knowing common threats helps you stay safe. Scammers use tricks to steal your card details and money. Recognizing these threats can protect your finances and identity.

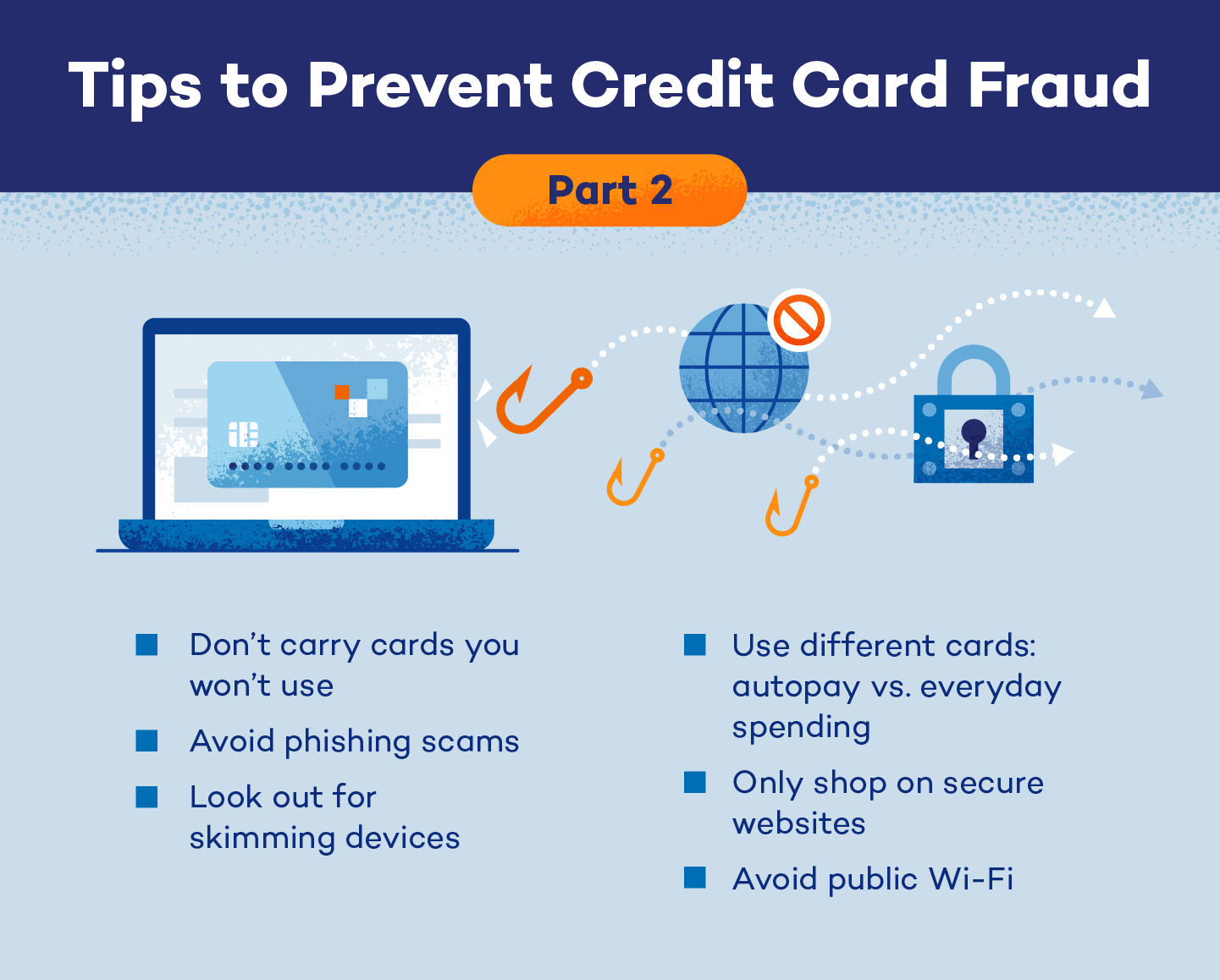

Phishing Scams

Phishing scams try to steal your personal info. You may get fake emails or messages that look real. They ask for credit card numbers or passwords. Never share your card details through email or unknown links. Always verify the source before responding.

Skimming Devices

Skimming devices copy your card data without you knowing. They are often placed on ATMs or gas pumps. When you swipe, the device captures your card info. Check machines for unusual parts before using them. Use trusted locations to reduce risks.

Data Breaches

Data breaches happen when hackers steal info from companies. Your credit card details can be exposed this way. Large stores and online sites can be targets. Use strong passwords and monitor your accounts for strange activity. Report any suspicious charges immediately.

Identity Theft

Identity theft occurs when someone uses your info to open accounts. They may use your credit card or personal details illegally. Protect your social security number and card info carefully. Shred documents with sensitive info and avoid sharing details online.

Safe Online Shopping

Shopping online offers great convenience but also carries risks of credit card fraud. Safe online shopping means taking simple steps to protect your personal and financial information. These actions reduce the chance of fraud and keep your details secure.

Following security tips helps you shop confidently on the internet. Use trusted methods and tools to guard your credit card data during every purchase.

Use Secure Websites

Always shop on websites that use HTTPS. This means the site encrypts your data. Check for a padlock icon in the address bar before entering card details. Avoid sites with HTTP only or no security signs. Secure sites protect your information from hackers.

Avoid Public Wi-fi

Public Wi-Fi networks are often unsafe. They allow criminals to intercept your data. Avoid entering credit card information on public Wi-Fi. Use your mobile data or a private network to shop online. This step prevents thieves from stealing your card details.

Enable Two-factor Authentication

Two-factor authentication adds a second layer of security. After entering your password, you confirm your identity with a code sent to your phone. Enable this feature on shopping sites and payment apps. It helps block unauthorized access even if someone steals your password.

Protecting Physical Cards

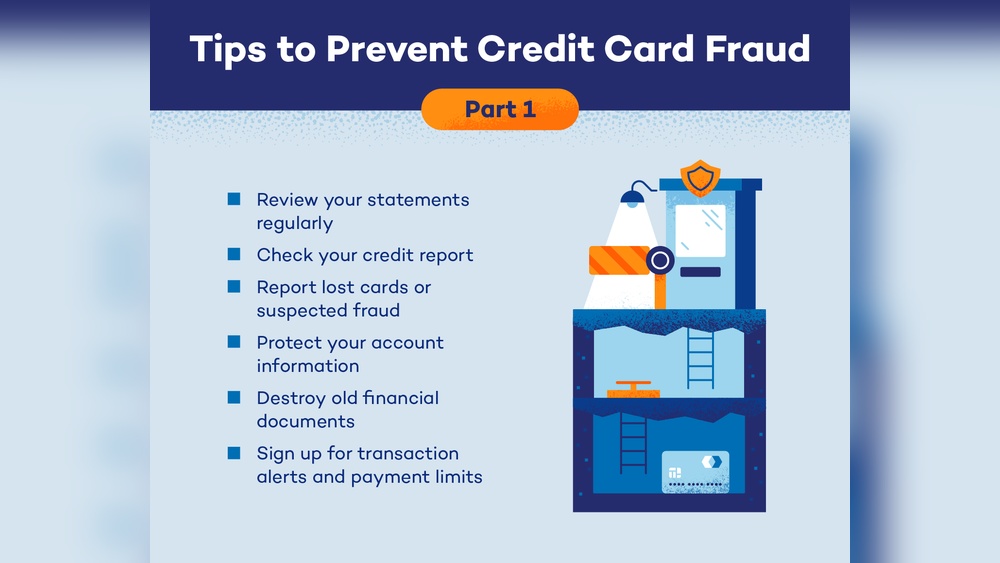

Protecting your physical credit cards is the first step to avoiding credit card fraud. Physical cards can be stolen, lost, or copied if you are not careful. Keeping your cards safe reduces the chance of someone else using them without permission. It is important to handle your cards with care and stay alert to any suspicious activity. Follow these simple tips to protect your cards and your money.

Keep Cards Secure

Always keep your cards in a safe place. Use a wallet or purse that closes tightly. Avoid leaving cards unattended in public areas. Do not share your card or PIN with anyone. Carry only the cards you need. Store extra cards separately at home. Be cautious when using your card in crowded places. Shield the keypad when entering your PIN to prevent others from seeing it.

Monitor Card Activity

Check your card statements regularly for any unusual charges. Use your bank’s app or website to review transactions often. Set up alerts to notify you of purchases or withdrawals. Report any transaction you do not recognize immediately. Early detection helps stop fraud before it causes damage. Keep a record of your recent purchases to compare with your statements. This practice helps you spot errors or fraud quickly.

Report Lost Or Stolen Cards Immediately

Report lost or stolen cards to your bank as soon as possible. The faster you report, the less chance thieves have to use your card. Most banks have 24/7 customer service for such emergencies. Follow the bank’s instructions to block or cancel the card. Request a replacement card right away. Keep the contact numbers for your bank saved in your phone or written down. Quick action protects your account from unauthorized use.

Credit: uk.clover.com

Credit Card Statement Review

Regular review of your credit card statements is a key step in stopping credit card fraud early. This habit helps spot any unusual or unauthorized charges quickly. It also ensures your spending records match your purchases. Staying alert can protect your money and credit score.

Careful statement checks give you control over your finances. They help you detect mistakes or fraud and act fast. Ignoring this step can lead to bigger problems and loss of funds.

Check For Unauthorized Charges

Look at every charge on your statement. Make sure you recognize each transaction. Unauthorized charges may be small or large amounts. Even tiny frauds can add up over time. Report suspicious charges to your bank immediately.

Set Up Alerts

Many banks offer alerts for credit card activity. Set them to notify you of large or unusual purchases. Alerts help you react quickly to suspicious use. Choose alerts that suit your spending habits. This extra layer of security keeps you informed.

Dispute Suspicious Transactions

If you find a suspicious charge, contact your card issuer right away. They will guide you on how to dispute the charge. Acting fast increases your chances of recovering lost money. Keep records of your communication for follow-up. Protect your rights by being proactive.

Using Credit Freezes

Using credit freezes is a strong way to protect yourself from credit card fraud. A credit freeze blocks access to your credit reports. This stops criminals from opening new accounts in your name. It acts like a lock on your credit, making it harder for thieves to use your information.

Freezing your credit is free and easy. It gives you control over who can see your credit report. Only you can lift the freeze when you want to apply for credit. This makes it a useful tool for preventing identity theft and fraud.

How Credit Freezes Work

A credit freeze stops lenders from checking your credit report. Without this check, they cannot approve new credit accounts. This keeps fraudsters from opening accounts with your name and details. You stay safe until you remove the freeze.

Credit bureaus hold your freeze. They require a PIN or password to lift it. You can freeze and unfreeze your credit anytime. This gives you full control over your credit information.

Limitations Of Freezes

Credit freezes do not block all fraud. They only stop new credit accounts from being opened. Fraudsters can still use your existing accounts or personal information in other ways. For example, they might file fake tax returns or use your ID for crimes.

Freezes do not affect your credit score or ability to use current cards. They also do not stop phone or bank fraud. You need other security steps to protect all parts of your identity.

Steps To Freeze Credit

Start by contacting the three major credit bureaus: Equifax, Experian, and TransUnion. You can do this online, by phone, or by mail. Each bureau will ask for your personal information to verify your identity.

After verification, you receive a PIN or password. Keep it safe for future use. Use this PIN to lift or remove the freeze anytime. Remember to freeze your credit with all three bureaus for full protection.

Protecting Your Social Security Number

Your Social Security Number (SSN) is a key piece of personal information. It links to your financial and identity records. Protecting your SSN helps prevent credit card fraud and identity theft. Understanding the risks and safeguards can keep your SSN safe.

Risks Even With Credit Freeze

A credit freeze stops new credit accounts from opening using your SSN. It does not stop all types of fraud. Criminals can still use your SSN for tax fraud, medical identity theft, or government benefits scams. Existing accounts can also be targeted despite the freeze. Stay alert to these threats and monitor your statements closely.

Irs Identity Protection Pin

The IRS offers an Identity Protection PIN (IP PIN) to taxpayers. This six-digit code adds a layer of security to your tax filings. Only you and the IRS know this PIN, preventing others from filing taxes under your SSN. Request your IP PIN annually to protect against tax-related identity theft.

Secure Storage And Sharing

Keep your SSN card in a safe, locked place at home. Avoid carrying it daily or sharing it unless absolutely necessary. Only provide your SSN to trusted entities and verify their identity first. Be cautious of phone calls, emails, or websites asking for your SSN. Protecting your SSN starts with careful handling and limited sharing.

Strong Passwords And Authentication

Strong passwords and authentication are key defenses against credit card fraud. They protect your accounts from unauthorized access. Using simple or repeated passwords makes it easier for thieves to break in. Strong authentication adds an extra layer of security beyond just a password. This section explains how to create strong passwords and use authentication methods effectively.

Create Unique Passwords

Each account needs its own unique password. Avoid using the same password across multiple sites. Unique passwords reduce the risk of multiple accounts being hacked at once. Use a mix of letters, numbers, and symbols. Avoid common words and simple sequences. Change passwords regularly to keep them secure.

Use Password Managers

Password managers store and generate strong passwords for you. They help manage many complex passwords without the need to remember them all. These tools encrypt your passwords safely. Use a trusted password manager to avoid weak or reused passwords. This reduces the chance of falling victim to hacking.

Enable Multi-factor Authentication

Multi-factor authentication (MFA) requires more than just a password to access your account. It often uses a code sent to your phone or an app. MFA makes it much harder for fraudsters to get in, even if they have your password. Always enable MFA on your credit card and banking accounts for better protection.

Credit: alleviatefinancial.com

Monitoring And Alerts

Keeping a close watch on your credit card activity helps catch fraud early. Monitoring and alerts let you spot unusual actions fast. This reduces the risk of losing money or having your identity stolen. Use various tools to stay informed about your account status daily.

Credit Monitoring Services

Credit monitoring services track your credit report for suspicious changes. They alert you if someone applies for credit in your name. These services often include identity theft protection features. Choose a service with real-time alerts and regular credit report updates. This helps you act quickly if fraud occurs.

Bank And Credit Card Alerts

Most banks offer alerts for credit card transactions. Set alerts for purchases over a certain amount or international charges. Receive notifications by text or email immediately after a transaction. This helps you spot unauthorized purchases right away. Customize alerts to match your spending habits for better protection.

Regular Account Reviews

Review your credit card statements every month. Check each charge carefully for anything you don’t recognize. Report suspicious transactions to your bank immediately. Keeping this habit helps catch fraud before it grows. Regular reviews also keep you aware of your spending and budget.

What To Do If Fraud Occurs

Discovering credit card fraud can be stressful. Quick action helps reduce damage and protect your finances. Knowing the right steps prevents further loss and aids recovery.

Contact Issuer Quickly

Call your card issuer immediately after spotting fraud. Report suspicious charges without delay. Most banks offer 24/7 fraud hotlines. Prompt contact helps freeze your card and stops new fraudulent purchases.

File A Fraud Report

Submit a detailed fraud report with your issuer. Provide information about unauthorized transactions. This report starts the investigation process. It also supports your claim to avoid liability for fake charges.

Check Credit Reports

Review your credit reports for unusual activity. Look for new accounts or inquiries you did not authorize. Request free reports from major credit bureaus. Monitoring helps catch identity theft early.

Credit: www.pandasecurity.com

Frequently Asked Questions

What Is The 2 3 4 Rule For Credit Cards?

The 2-3-4 rule limits credit card applications to 2 in 30 days, 3 in 90 days, and 4 in 12 months. It helps protect credit scores and approval chances.

Can Someone Use My Ssn If My Credit Is Frozen?

Yes, someone can misuse your SSN even if your credit is frozen. A freeze blocks new credit but not tax, medical, or government fraud. It also doesn’t stop misuse of existing accounts or identity theft unrelated to credit checks.

What Is The 15 3 Rule For Credit Cards?

The 15 3 rule limits credit card applications to 3 within 15 days. It reduces hard inquiries and improves approval chances.

Does Tapping Your Card Protect You From Skimmers?

Tapping your card reduces skimming risk by limiting physical contact. Still, criminals can use other methods to steal data. Always monitor statements and use secure ATMs for better protection.

Conclusion

Protecting your credit card information takes constant attention. Always monitor your statements for unusual activity. Use strong passwords and avoid sharing card details. Stay cautious when shopping online or in public places. Regularly update your security software and keep your devices safe.

These simple habits reduce the risk of fraud greatly. Staying informed helps you act quickly if problems arise. Your vigilance can keep your finances secure and stress-free.