Are you wondering how much you’ll owe when tax season comes around for your cryptocurrency? You’re not alone.

Navigating cryptocurrency taxes can feel confusing and overwhelming. But understanding the basics now can save you from costly mistakes later. You’ll discover exactly how your crypto earnings are taxed, what rules apply, and simple steps to stay on the right side of the law.

Keep reading to take control of your crypto taxes and avoid surprises that could hurt your wallet.

Credit: www.lexology.com

Crypto Tax Basics

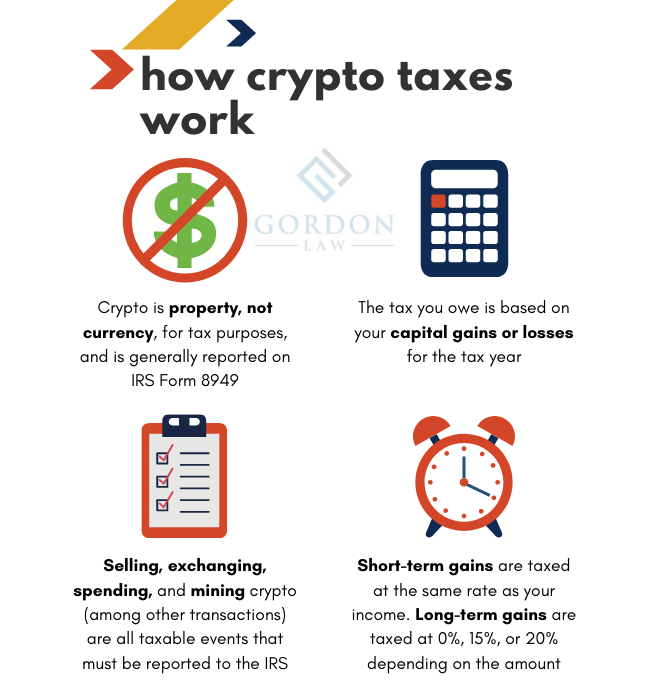

Understanding the basics of cryptocurrency taxes is important for all crypto users. Taxes on crypto depend on how you use or trade your coins. Many people do not realize that some crypto activities need to be reported to the tax authorities. Knowing these basics helps avoid mistakes and surprises later.

Taxable Crypto Transactions

Not all crypto actions are taxable. Selling crypto for cash counts as a taxable event. Trading one crypto for another also triggers taxes. Using crypto to buy goods or services is taxable too. Earning crypto from mining or staking is considered income. Each of these activities must be tracked carefully.

Tax Rates For Crypto Gains

Crypto gains can be taxed as income or capital gains. Short-term gains happen when you sell crypto within a year. These are taxed at regular income rates. Long-term gains apply if you hold crypto over one year. These rates are usually lower. The exact tax rate depends on your total income.

Reporting Requirements

All taxable crypto transactions must be reported to tax authorities. You need to keep records of dates, amounts, and values. Many countries require you to file specific forms for crypto. Failing to report can lead to penalties and fines. Organizing your crypto records makes reporting easier.

Credit: koinly.io

Calculating Your Crypto Taxes

Calculating your crypto taxes requires careful record keeping and clear understanding. Each transaction affects your tax bill differently. Tracking every detail helps avoid mistakes and penalties. This section explains key steps to calculate your crypto taxes accurately.

Tracking Cost Basis

Cost basis is the original value of your cryptocurrency. It includes the purchase price plus any fees. Track cost basis for each coin you buy. This number determines your gain or loss when you sell or trade. Keep detailed records of date, price, and fees for every purchase.

Determining Gains And Losses

Calculate gain or loss by subtracting cost basis from sale price. A gain means profit, and a loss means you lost money. Short-term gains apply if you held the crypto less than a year. Long-term gains apply if held longer. Reporting gains and losses correctly affects your tax rate.

Handling Crypto-to-crypto Trades

Trading one cryptocurrency for another counts as a taxable event. You must calculate gain or loss based on the cost basis of the crypto sold. The new crypto’s cost basis equals the fair market value at the trade time. Keep clear records of all trades to report correctly.

Tax Implications By Crypto Activity

Different crypto activities carry different tax rules. The IRS treats each type of crypto income uniquely. Understanding these rules helps you calculate your tax correctly. Below are key crypto activities and their tax implications.

Mining And Staking Income

Mining crypto creates new coins, which count as income. The fair market value of mined coins on the day you receive them is taxable. Staking rewards also count as income. Report these earnings as ordinary income. Later, if you sell these coins, capital gains tax may apply.

Earning Crypto As Payment

Getting paid in crypto for work or services is taxable income. The value of the crypto at payment time sets your income amount. This income is subject to normal income tax rates. Keep records of the payment date and value. Selling or exchanging this crypto later may trigger capital gains tax.

Using Crypto For Purchases

Spending crypto on goods or services triggers a taxable event. The IRS treats this like selling your crypto. Calculate capital gains or losses based on the crypto’s value when spent. Report gains as taxable income. Losses can offset other gains, reducing your tax bill.

Credit: gordonlaw.com

Tax Strategies To Minimize Liability

Understanding tax strategies helps reduce how much you owe on cryptocurrency gains. Smart planning can save money and avoid surprises during tax season. Here are some simple ways to lower your crypto tax bill.

Tax-loss Harvesting

Tax-loss harvesting means selling crypto assets that lost value. This allows you to offset gains from other sales. The losses reduce your overall taxable income. You can also carry over losses to future years.

Holding Period Benefits

Holding crypto for over one year often lowers tax rates. Long-term gains usually face smaller taxes than short-term gains. This strategy encourages patience and can cut your tax bill significantly.

Utilizing Retirement Accounts

Using retirement accounts like IRAs to buy crypto can delay taxes. Gains inside these accounts grow tax-free or tax-deferred. You pay taxes only when you withdraw funds, often at a lower rate.

Filing Crypto Taxes In 2025

Filing crypto taxes in 2025 requires careful attention. Tax rules for cryptocurrency keep changing. Staying updated helps avoid penalties. Preparing early makes the process easier. Understanding which forms to use is key. Mistakes on your tax return can cause delays or audits. Many people find tax software useful for managing crypto taxes. This section breaks down what you need to know for filing in 2025.

Choosing The Right Forms

Most crypto transactions go on Form 8949. This form reports your capital gains and losses. You also need to fill Schedule D to summarize gains. If you earned crypto from mining or staking, use Schedule 1 or Schedule C. Reporting income correctly prevents IRS issues. Check if your state requires extra forms for crypto. Always keep detailed records of all transactions.

Common Mistakes To Avoid

Many people forget to report all crypto sales. Each sale counts, even small ones. Not reporting income from crypto mining is a common error. Mixing personal and business crypto activities can cause confusion. Using wrong dates or amounts leads to miscalculation. Keep all transaction records and double-check your entries. Don’t ignore crypto received as gifts or airdrops. Honest and accurate reporting saves stress later.

Using Tax Software For Crypto

Tax software can simplify crypto tax filing. Many programs import transactions directly from exchanges. They calculate gains, losses, and income automatically. This reduces the chance of errors. Choose software that supports your crypto activities. Some offer guidance on new tax laws. Look for easy-to-use interfaces with clear instructions. Software helps organize records and speeds up filing. Always review the final report before submission.

Future Trends In Crypto Taxation

The future of cryptocurrency taxation is shaping up to be more complex and strict. Governments worldwide are paying close attention to digital assets. Tax rules are evolving fast. Understanding these trends helps you stay prepared and avoid surprises.

New laws will affect how much tax you owe. Global cooperation on crypto tax rules will increase. Authorities will use advanced tools to track crypto transactions. Being ready for these changes will save time and money.

Upcoming Regulatory Changes

Many countries plan to update their crypto tax laws. Rules will clarify how to report earnings and losses. Some governments want to tax smaller transactions too. Expect clearer definitions of taxable events. These changes aim to close tax gaps and ensure fairness.

Impact Of Global Tax Policies

Countries are working together on tax rules for crypto. International agreements will reduce tax evasion risks. Cross-border crypto trades may face new reporting standards. Global policies will push for transparency. This trend will affect both casual users and traders.

Preparing For Increased Irs Scrutiny

The IRS is boosting its crypto audit efforts. More people will receive tax notices about crypto income. Accurate record-keeping will become essential. Use software or tools to track your transactions. Reporting mistakes can lead to penalties and fines. Stay honest and organized to avoid issues.

Frequently Asked Questions

How Is Cryptocurrency Taxed By The Irs?

Cryptocurrency is taxed as property by the IRS. Gains from sales or trades are subject to capital gains tax. Income from mining or payments in crypto is taxed as ordinary income based on fair market value at receipt.

What Determines The Tax Rate On Crypto Gains?

The tax rate depends on your holding period and income. Short-term gains (under one year) are taxed as ordinary income. Long-term gains (over one year) receive lower capital gains rates, generally 0%, 15%, or 20%, based on your tax bracket.

Do I Owe Taxes If I Only Use Crypto For Purchases?

Yes, spending cryptocurrency triggers a taxable event. The difference between your purchase price and sale price is a capital gain or loss. You must report gains or losses on your tax return, even if you never converted to cash.

How Do I Report Cryptocurrency On My Tax Return?

Report cryptocurrency transactions on Form 8949 and Schedule D for capital gains. Income received in crypto is reported as ordinary income on Schedule 1 or Schedule C, depending on the activity. Keep detailed records of all transactions and values.

Conclusion

Cryptocurrency taxes can feel confusing at first. Knowing how much you owe helps avoid trouble later. Keep clear records of all your trades and sales. Tax rules may change, so stay updated every year. Use simple tools or ask experts if needed.

Paying taxes on crypto shows responsibility and keeps things legal. Understanding your tax duties makes handling cryptocurrency easier. Stay informed, stay prepared, and keep your finances in check.