Have you ever spotted a mysterious “Spstore Gold” charge on your debit card and wondered what it means? You’re not alone.

Many people see this unfamiliar fee and feel concerned or confused about where it came from and whether it’s legitimate. Understanding exactly what the Spstore Gold charge is, why it appears on your statement, and how you can easily check its details is essential to keeping control of your finances.

You’ll get clear answers and simple steps to verify and manage these charges-so you can protect your money and avoid any unwanted surprises. Keep reading to find out everything you need to know about the Spstore Gold charge on your debit card.

Visit here for more information of any Charges on credit card or debit card

Spstore Gold Charge Basics

The Spstore Gold Charge on debit card can confuse many cardholders. Understanding its basics helps you recognize why it appears and what it means. This section explains the key facts about Spstore Gold Charge in simple terms. Clear knowledge avoids worries about unknown charges on your statement.

What Is Spstore Gold Charge

Spstore Gold Charge is a fee linked to certain purchases or services. It often shows up on your debit card statement after a transaction. This charge relates to a merchant or service provider named Spstore. The “Gold” part may refer to a specific product line or membership.

It is not a banking fee but a charge from the seller or service. This fee covers special features, products, or premium services you might have used. Knowing this helps you check if you authorized the payment.

Why It Appears On Debit Cards

This charge appears because you bought something from Spstore using your debit card. It can also show up if you signed up for a subscription or a special offer. Merchants send their fees to your bank, which then posts it on your statement.

Sometimes, the charge looks unfamiliar due to how the merchant labels it. The bank statement uses “Spstore Gold Charge” to identify the transaction clearly. If you see it, review your recent purchases or memberships to confirm.

How Spstore Charges Work

Understanding how Spstore charges work helps you track your debit card expenses. These charges come from transactions processed by Spstore. They often appear as “Spstore Gold Charge” on your bank statement. Knowing the process behind these charges can prevent confusion and help you manage your finances better.

Transaction Process

When you make a purchase through Spstore, your debit card is used for payment. The system reads your card details securely. It then authorizes the transaction by checking available funds. After approval, the payment is processed and recorded as a charge. This entire process happens quickly and ensures your purchase is complete.

The charge will show up on your bank statement as “Spstore Gold Charge.” This label helps identify the transaction source. It also confirms that the payment went through Spstore’s system.

Common Purchase Types

Spstore charges usually relate to online shopping and digital services. Many users see these charges for subscription services or app purchases. Some charges come from buying digital goods like games or software.

These charges may also appear for memberships or special service fees. Identifying the common purchase types helps you recognize legitimate transactions. It also assists in spotting any unauthorized or mistaken charges quickly.

Identifying Spstore Charges

Identifying Spstore charges on your debit card helps avoid confusion and unauthorized use. These charges appear as part of your transaction history. Understanding how they look and differ from fraud keeps your finances safe.

Knowing what to expect makes it easier to spot any unusual activity. Below are key points to recognize these charges clearly.

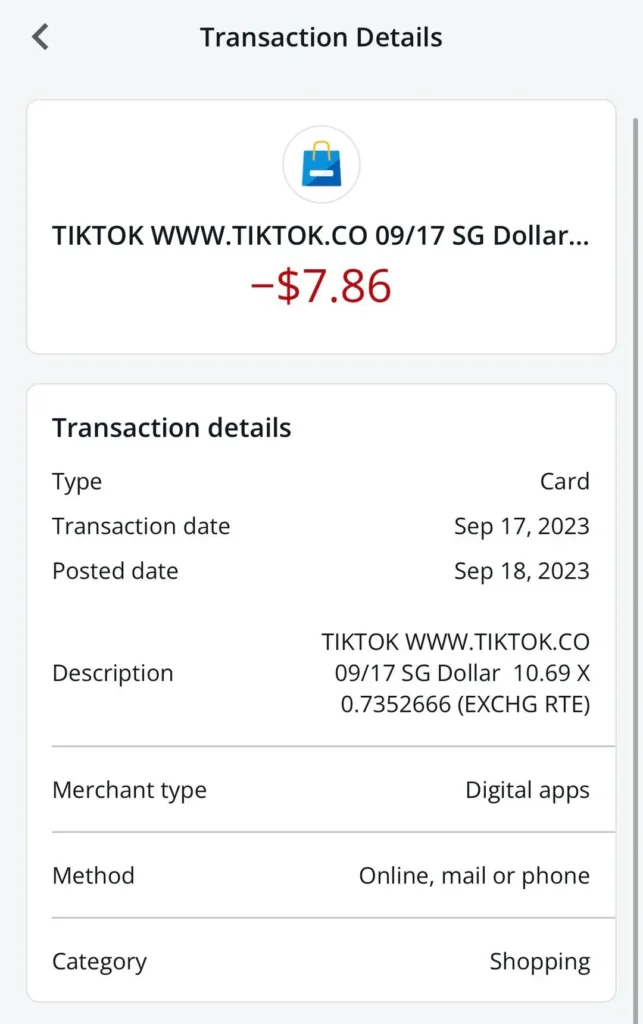

How It Shows On Statements

Spstore charges appear with the label “SPSTORE GOLD” or similar text. The amount deducted matches the service or purchase you made. The date on the statement matches your transaction date.

These charges usually list the merchant’s name or a short code related to Spstore. The amount is clear and consistent with your purchase. You might see a small fee added if it is a service charge.

Distinguishing From Fraudulent Charges

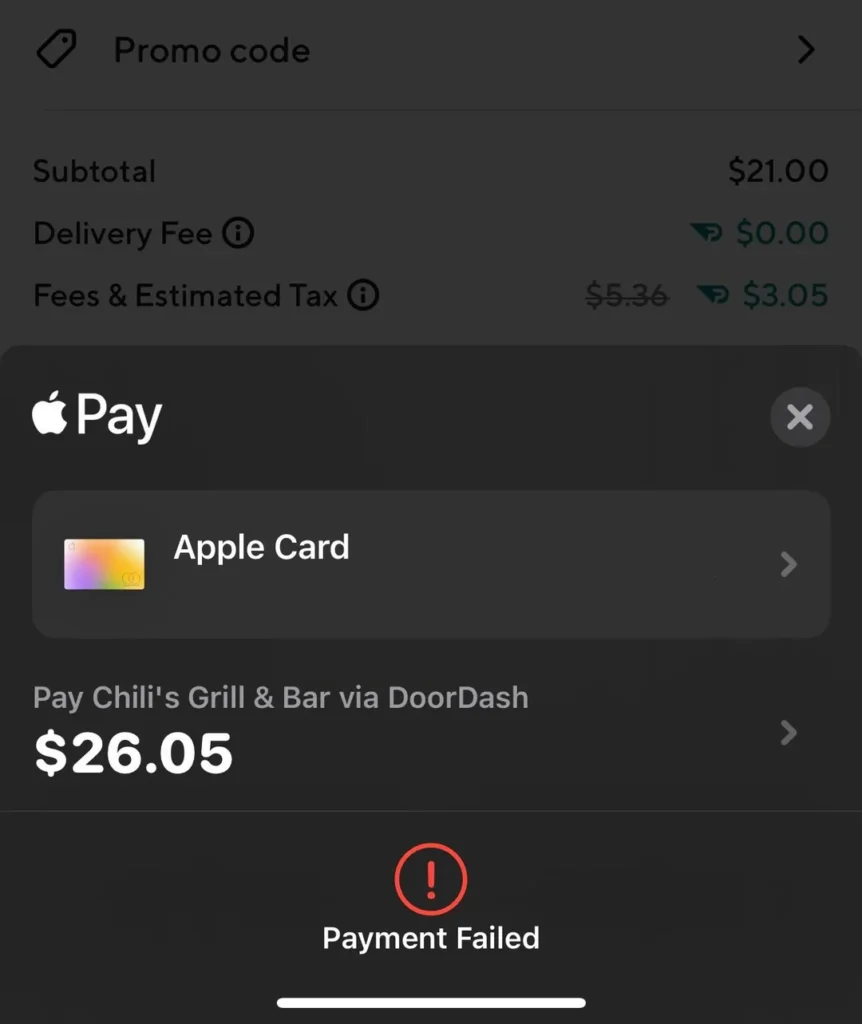

Fraud charges often look different from Spstore entries. They may have strange merchant names or unfamiliar amounts. Unexpected charges with no purchase history need quick attention.

Check your receipts and purchase records to confirm Spstore charges. If a charge looks suspicious, contact your bank immediately. Early action helps protect your account from fraud.

Steps To Check Spstore Charges

Checking Spstore Gold charges on your debit card helps you track your spending. You can confirm these charges easily using different methods. Each method provides clear details about your transactions. Follow these simple steps to verify the charges with ease.

Using Bank Statements

Review your monthly bank statements carefully. Look for entries labeled “Spstore Gold” or similar descriptions. These statements list all transactions and charges on your debit card. Check the date and amount to match the charge you want to verify. This method helps you keep a paper trail of your spending.

Contacting Your Bank

Call the customer service number on your debit card. Ask the representative about any Spstore Gold charges you see. They can explain the details and confirm if the charge is legitimate. Banks often provide additional information about the transaction origin. This step is useful for resolving any doubts quickly.

Using Online Banking Tools

Log in to your bank’s online portal or mobile app. Navigate to your recent transactions or activity section. Search for Spstore Gold charges in the list. Online tools may offer detailed descriptions and merchant information. You can also download or print your transaction history for future reference.

Managing And Disputing Charges

Managing and disputing charges on your debit card is vital. It helps protect your money and avoid unwanted fees. Understanding when and how to take action can save you from stress. This section guides you through the process of handling Spstore Gold charges.

Follow simple steps to report suspicious activity. Learn how to dispute incorrect transactions. Discover ways to prevent unauthorized charges on your debit card.

When To Report A Charge

Check your bank statement regularly. Report charges that look unfamiliar or wrong immediately. Delaying the report can make resolving issues harder. Contact your bank as soon as you spot a suspicious Spstore Gold charge. Early reporting increases the chance of recovering your money.

How To Dispute Transactions

Gather all related information about the charge. This includes the date, amount, and merchant details. Call your bank’s customer service or use their online portal to file a dispute. Explain clearly why you believe the charge is incorrect. Keep records of all communications until the issue is resolved.

Preventing Unauthorized Charges

Keep your debit card details safe and private. Avoid sharing your PIN or card number with others. Use secure websites when shopping online. Set up alerts to monitor transactions in real-time. Regularly update your bank contact information to receive important notifications.

Related Charges And Terms

Understanding related charges and terms linked to the Spstore Gold charge on debit cards helps users monitor their expenses better. These charges often appear as codes or abbreviations on bank statements. Knowing what each code means prevents confusion and aids in managing finances effectively.

Terms connected to Spstore Gold charges may include service fees, transaction codes, or processing charges. Banks and payment processors use these terms to categorize transactions. Clear knowledge of these helps identify the source and nature of each charge on your debit card.

Sp Aff And Other Similar Codes

SP AFF is a common code on bank statements tied to specific service providers. It usually stands for “Service Provider Affirm,” linked to buy now, pay later transactions. Other codes may represent different merchants or services, each with unique abbreviations.

Recognizing these codes can clarify which purchases or subscriptions caused the charges. It reduces worries about unauthorized fees. Regularly checking your statements for unknown codes is a smart habit to catch errors early.

Emv Chip Card Impact On Charges

EMV chip cards use a small gold chip for secure transactions. This technology creates unique codes for each purchase. It lowers the risk of fraud and unauthorized charges on debit cards.

Using an EMV chip card can sometimes lead to slight variations in transaction fees. Some merchants or banks may charge differently for chip-based transactions. Being aware of this helps users understand any extra costs linked to EMV chip usage.

Tips For Secure Debit Card Use

Using a debit card safely protects your money and personal information. Simple habits help avoid fraud and unauthorized charges. Learning smart ways to use your card adds security to your daily spending.

Following clear steps keeps your debit card secure. Watch your account closely, set helpful alerts, and shop online with care. These actions reduce risks and give you control over your finances.

Monitoring Transactions Regularly

Check your debit card transactions often. Look for charges you do not recognize. Early spotting of unusual activity prevents bigger problems. Use your bank’s app or website for fast access. Regular reviews keep your account safe and secure.

Setting Up Alerts

Turn on notifications for your debit card. Get alerts for every purchase or withdrawal. Alerts help you react quickly to unknown charges. Choose text messages or emails based on your preference. This simple step adds an extra layer of protection.

Safe Online Shopping Practices

Only shop on trusted websites with secure connections. Look for “https” in the website address. Avoid public Wi-Fi when making online payments. Use strong, unique passwords for your accounts. These habits protect your card data from hackers.

Frequently Asked Questions

What Is The Gold Chip On My Debit Card?

The gold chip on your debit card is an EMV chip. It securely processes transactions by generating unique, one-time codes, enhancing fraud protection.

What Is The Sp Charge On My Debit Card?

The SP charge on your debit card is a transaction fee from a service provider or store. It appears on statements for specific purchases or subscriptions. Check your bank statement or contact your bank for detailed information about the charge.

How To Report Charges On Debit Card?

Call the customer service number on your debit card or bank website. Report the charge and request card blocking or replacement immediately.

What Is Sp Aff Charge On Debit Card?

SP AFF * charge on a debit card indicates a transaction processed through Affirm, a buy now, pay later service provider.

Conclusion

Spstore Gold Charge on your debit card shows fees for certain purchases. Always review your bank statement to spot unfamiliar charges quickly. Checking these charges helps you manage your spending better. Contact your bank if a charge looks wrong or unexpected.

Staying aware keeps your account safe and avoids surprises. Understanding these fees makes your financial life easier. Keep tracking and stay informed to protect your money.