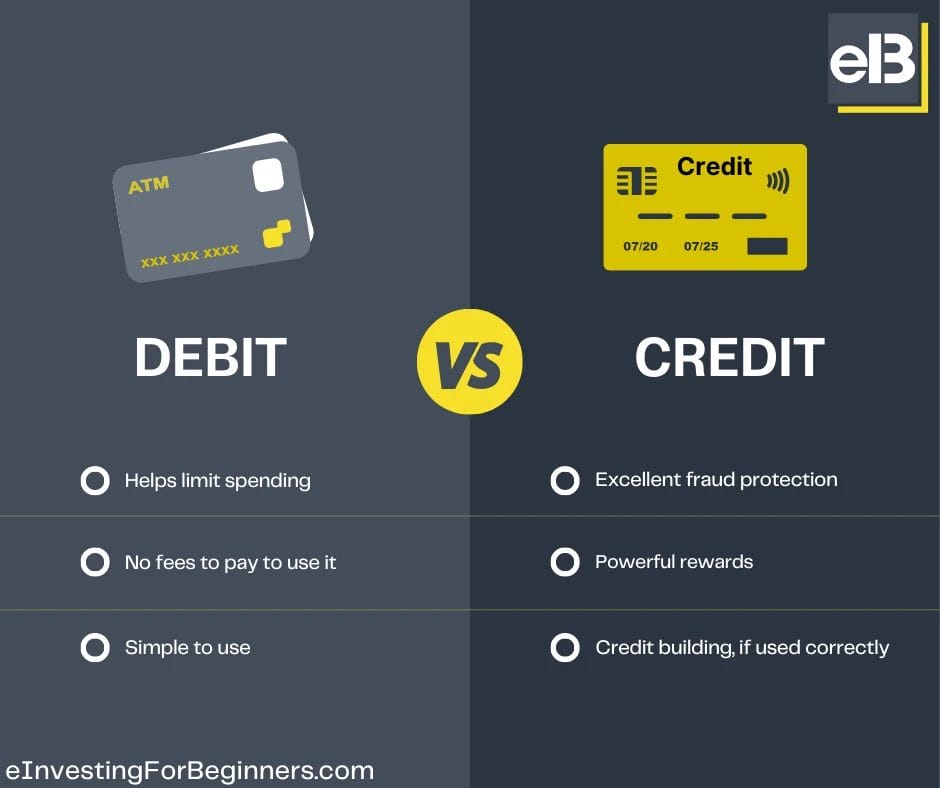

Choosing between a credit card and a debit card might seem simple, but the decision can have a big impact on your finances. You might wonder which one suits your spending habits better, offers more security, or helps you build a stronger financial future.

Whether you want to avoid debt, earn rewards, or protect yourself from fraud, understanding the key differences is crucial. You’ll discover the pros and cons of both cards, helping you pick the right option that fits your lifestyle and goals.

Keep reading to find out which card truly works best for you.

Credit Card Basics

Understanding the basics of credit cards helps you make smart financial choices. Credit cards let you borrow money to pay for purchases now and repay later. They come with features that can benefit your spending habits and credit score.

How Credit Cards Work

Credit cards give you a credit limit set by the bank. You use the card to buy goods or services up to this limit. Each month, you receive a bill showing what you owe. Paying the full amount on time avoids interest charges. Paying less than the full amount leads to interest on the remaining balance. Your credit card use affects your credit score, which lenders check when you apply for loans.

Common Credit Card Features

Most credit cards offer rewards like cash back or points for spending. Many cards have fraud protection to keep your money safe. Some cards include benefits like travel insurance or purchase protection. Credit cards also let you build credit history by showing responsible use. Annual fees may apply depending on the card type and benefits offered.

Debit Card Basics

Understanding the basics of debit card helps you decide which card suits your needs. Debit cards let you spend money directly from your bank account. They offer a simple and quick way to pay for goods and services without borrowing money.

How Debit Cards Work

Debit cards connect to your checking or savings account. When you use the card, money is taken out of your account right away. You can use debit cards at stores, online, or at ATMs to withdraw cash. The transaction requires a PIN or signature to confirm your identity. This process helps keep your money safe and secure.

Typical Debit Card Features

Most debit cards have a magnetic strip or chip for security. You can use them for daily purchases or cash withdrawals. Many cards offer fraud protection and alerts for suspicious activity. Some also let you check your balance or view transactions online. Debit cards usually have no interest charges because you spend your own money.

Key Differences

Choosing between a credit card and a debit card depends on how they work. Each card type has its own features that affect your spending and finances. Understanding these key differences helps you decide which card suits your needs best.

Payment Timing

Debit card use your own money immediately. The amount is taken from your bank account right away. Credit cards let you borrow money to pay later. You get a bill each month to settle your balance.

Spending Limits

Debit card spending is limited to your account balance. You cannot spend more than you have. Credit cards come with a set credit limit. This limit is usually higher than your bank balance.

Impact On Credit Score

Debit card use does not affect your credit score. It is a direct withdrawal from your account. Credit card use impacts your credit score. Paying on time helps build a good credit history.

Credit: www.easypeasyfinance.com

Benefits Of Credit Cards

Credit cards offer many advantages that debit cards do not. They help manage your spending and provide extra perks. Using a credit card wisely can improve your financial health and security. Below are some key benefits of credit cards that can help you decide if they suit your needs.

Rewards And Bonuses

Credit cards often come with rewards programs. You can earn points, cashback, or miles for every purchase. These rewards can save money or fund travel and shopping. Some cards offer sign-up bonuses for new users. Rewards add value to everyday spending without extra cost.

Fraud Protection

Credit cards provide strong protection against fraud. If someone steals your card information, you are not responsible for unauthorized charges. Credit card companies quickly investigate and refund fraud cases. This protection is usually better than what debit card offer. It keeps your money safer during online shopping and in stores.

Building Credit History

Using a credit card helps build your credit score. Paying your bill on time shows lenders you are responsible. A good credit history is important for loans, mortgages, and renting homes. Debit cards do not affect your credit score. Credit cards give you a chance to improve your financial reputation.

Benefits Of Debit Cards

Debit cards offer clear advantages for everyday spending. They help manage money by using funds directly from your bank. This keeps spending simple and avoids extra charges. Many people find debit cards easy and safe to use for daily purchases.

Direct Spending Control

Debit card let you spend only what you have. Each purchase is paid from your bank balance. This way, you see exactly how much money is left. It helps avoid surprises in your bills. You can track your spending easily and stay within your budget.

No Debt Risk

Using a debit card means no borrowing money. You do not owe any payments later. This avoids interest fees and debt problems. It keeps your finances healthy and stress-free. You only pay for what you buy.

Ease Of Use

Debit cards work almost anywhere. You can use them for shopping, bills, or online payments. They are simple to use with a PIN or signature. Many ATMs allow easy cash withdrawals. This convenience fits well with busy daily life.

Credit: einvestingforbeginners.com

Risks And Drawbacks

Both credit and debit cards come with risks and drawbacks that can affect your finances. Understanding these downsides helps you make better choices. Each card type has unique challenges related to spending, security, and debt.

Credit Card Debt And Interest

Credit cards allow borrowing money up to a limit. This can lead to debt if you spend more than you can repay. Interest charges on unpaid balances increase your debt quickly. High interest rates make it hard to clear balances fast. Late payments can cause extra fees and damage credit scores. Using credit cards without control may trap you in long-term debt.

Debit Card Fraud Vulnerability

Debit cards link directly to your bank account. Fraudulent transactions can drain your funds immediately. It may take time to spot unauthorized charges. Banks usually refund stolen money, but the process can be slow. Unlike credit cards, debit cards may offer less protection against fraud. Stolen debit card data can lead to loss of your actual money.

Overspending Concerns

Credit cards make spending easy with a borrowing limit. This can encourage buying things you do not need. Overspending can cause financial stress and debt buildup. Debit cards limit you to the money in your account. This helps control spending but may cause declined transactions. Both cards need careful budgeting to avoid money problems.

When To Choose Credit Card

Choosing a credit card over a debit card can benefit you in many ways. Credit cards provide advantages that debit cards cannot match. Knowing when to choose a credit card helps you make smarter financial decisions. Below are key moments when a credit card is the better option.

Travel And Online Purchases

Credit cards offer extra protection for travel and online buys. Many cards include travel insurance and fraud protection. If a problem arises, you can dispute charges more easily. This safety makes credit cards ideal for booking flights or hotels. Online shopping also becomes safer with credit cards. Your money stays protected if a merchant is untrustworthy.

Earning Rewards

Credit cards let you earn points, cash back, or miles. These rewards add value to your spending. Debit cards rarely offer such perks. Using a credit card for everyday purchases helps you accumulate rewards. These can save money on future trips or shopping. Choose cards with rewards that fit your lifestyle and goals.

Building Credit

Credit cards help build your credit score with responsible use. A good credit score opens doors for loans and better rates. Debit cards do not affect your credit history. Pay your credit card bill on time to avoid debt. Over time, a strong credit profile benefits your financial future.

Credit: madisoncu.com

When To Choose Debit Card

Choosing between a debit card and a credit card depends on your spending habits and financial goals. Debit cards draw money directly from your bank account. They help control spending by limiting purchases to available funds. Here are some key moments when a debit card is the better choice for you.

Budget Management

Debit cards help keep your budget on track. You spend only what you have in your account. No worries about overspending or large bills later. This makes it easier to manage monthly expenses. Using a debit card can prevent accidental debt. It is a simple way to stay within your means.

Avoiding Debt

Debit cards do not allow borrowing money. You cannot charge more than your balance. This stops debt from building up. No interest charges or late fees to worry about. Using a debit card is a safe choice for those who want to avoid credit risk. It offers peace of mind and financial control.

Everyday Purchases

Debit cards work well for daily spending. Paying for groceries, gas, or small bills is quick and easy. Many stores accept debit cards without extra fees. They also help track spending through bank statements. For simple, routine purchases, debit cards are a practical option. They keep your money flow steady and clear.

Tips For Responsible Use

Using credit and debit cards wisely keeps your money safe. Responsible habits help avoid debt and stress. Understanding simple tips can improve your financial health.

Managing Credit Card Payments

Always pay your credit card bill on time. Late payments lead to extra fees and higher interest. Try to pay the full balance each month. This practice helps avoid debt buildup. Set reminders or automatic payments to never miss a due date.

Monitoring Account Activity

Check your card statements regularly. Look for any unauthorized charges or errors. Reporting suspicious activity quickly prevents fraud losses. Use mobile apps or online banking for easy access. Keeping track helps you stay in control of your finances.

Setting Spending Limits

Decide how much you can spend each month. Stick to a budget to avoid overspending. Some banks allow you to set alerts for spending limits. This feature helps you keep expenses within your means. Controlling spending builds good financial habits over time.

Future Trends

The world of payment cards is changing fast. Both credit and debit cards are evolving to meet new needs. These future trends will shape how you use your cards.

Understanding these changes helps you choose the best card for your lifestyle.

Contactless Payments

Contactless payments are growing in popularity. They let you pay by tapping your card on a reader. This method is quick and easy.

Both credit and debit cards support contactless payments. It reduces the need to carry cash or enter a PIN for small purchases. This trend makes shopping faster and safer.

Integration With Mobile Wallets

Mobile wallets like Apple Pay and Google Pay are becoming common. You can add your credit or debit card to these apps. Then, pay using your smartphone or smartwatch.

This integration adds convenience. You no longer need to carry physical cards. It also helps track spending and manage budgets easily.

Security Enhancements

Security is a top priority for card providers. New features like biometric verification and real-time alerts are becoming standard. These tools help prevent fraud and unauthorized use.

Credit cards often have stronger protections, such as zero-liability policies. Debit cards are catching up with better encryption and monitoring systems. These improvements give you more peace of mind when paying.

Frequently Asked Questions

Which Is Better To Use, Debit Card Or Credit Card?

Credit cards offer better fraud protection, rewards, and credit building. Debit cards prevent overspending by using your own money. Choose based on your spending habits and financial discipline.

Which Type Of Card Is Best?

Credit cards are best for rewards, fraud protection, and building credit. Debit cards suit those avoiding debt and overspending. Choose based on your spending habits and financial goals.

How Many People Have $10,000 In Credit Card Debt?

About 44 million Americans carry $10,000 or more in credit card debt, reflecting widespread financial challenges.

Why Would Someone Use A Credit Card Over A Debit Card?

People use credit cards for building credit, earning rewards, better fraud protection, and flexible payment options.

Conclusion

Choosing between a credit card and a debit card depends on your spending habits. Credit cards help build credit and often provide fraud protection. Debit cards keep you within your budget since they use your own money. Think about your financial goals and how you manage money daily.

Use the card that fits your needs and keeps your finances safe. Remember, responsible use matters more than the card type you pick. Stay informed and spend wisely for a healthier financial future.