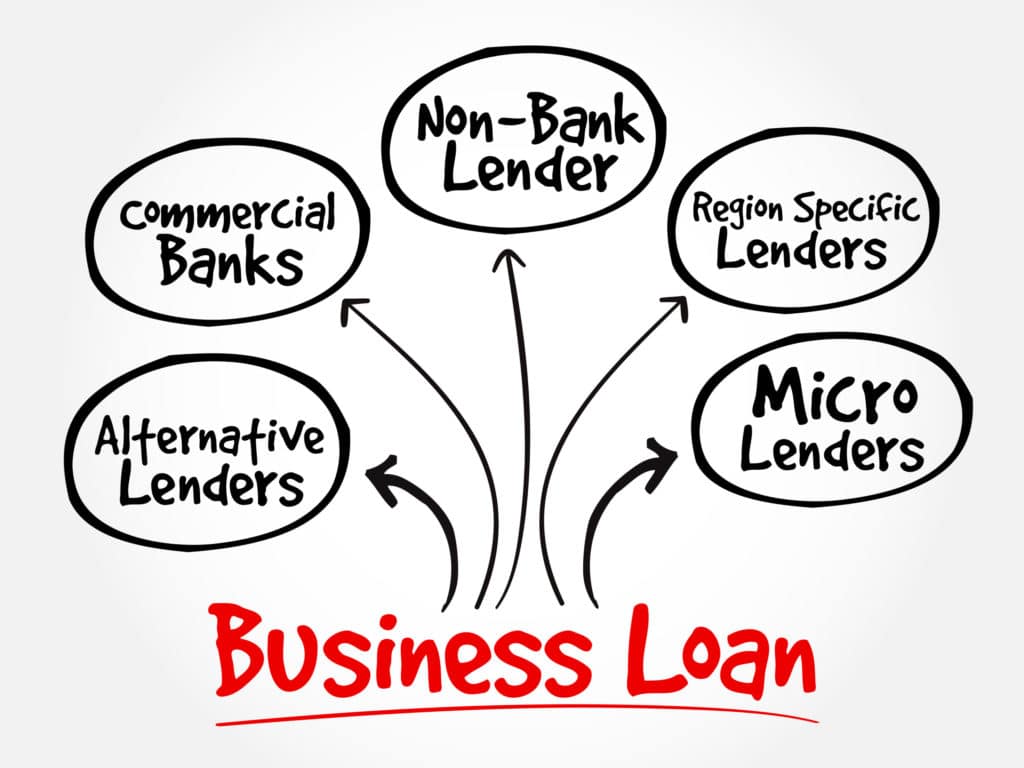

Looking to grow your business but unsure how to secure the funds you need? Understanding your business funding options, especially loans, can unlock the door to new opportunities.

Whether you’re starting fresh, expanding, or managing cash flow, the right loan can make a huge difference. You’ll discover simple, clear information about different loan types and how to choose the best one for your unique situation. Keep reading to find out how to turn your business goals into reality with the right funding strategy.

Credit: www.planprojections.com

Traditional Business Loans

Traditional business loans remain a popular choice for many small and medium-sized businesses. These loans offer a clear path to financing with set terms and interest rates. They come from established financial institutions and often provide larger loan amounts. Understanding the main types can help business owners choose the best fit for their needs.

Bank Loans

Bank loans are among the most common traditional financing options. Banks offer fixed or variable interest rates with set repayment schedules. Approval usually requires strong credit scores and solid business plans. These loans suit businesses with stable revenue and clear growth goals. The application process can be detailed and may take several weeks.

Credit Union Loans

Credit unions provide a more community-focused approach to lending. Their loan rates often come lower than banks. Membership is required, but many credit unions welcome small businesses. The process tends to be more personal and flexible. Credit union loans are ideal for businesses seeking a local lender.

Sba Loans

SBA loans are backed by the U.S. Small Business Administration. They offer lower down payments and longer repayment terms. These loans support startups and established businesses alike. Approval criteria are strict but the benefits are significant. SBA loans help businesses that might not qualify for conventional loans.

Online Loans And Lenders

Online loans and lenders offer fast and flexible funding for businesses. These digital platforms simplify the borrowing process. They reduce paperwork and speed up approval. Business owners can apply from anywhere, at any time. This method suits companies needing quick cash or less traditional financing.

Short-term Loans

Short-term loans provide funds for a few months up to a year. They cover urgent expenses or cash flow gaps. Approval is often faster than traditional loans. Repayment schedules are shorter but usually involve higher interest rates. These loans suit businesses needing quick money for immediate needs.

Merchant Cash Advances

Merchant cash advances offer money based on future sales. Lenders give a lump sum upfront. They collect repayments as a percentage of daily credit card sales. This option suits businesses with steady daily sales. It offers flexible repayment but can be more costly than other loans.

Peer-to-peer Lending

Peer-to-peer lending connects borrowers directly with individual investors. Online platforms manage the process. Interest rates may be lower than banks. Approval depends on creditworthiness and business potential. This option creates new opportunities for small business funding.

Alternative Financing Options

Alternative financing options provide flexible ways for businesses to get funds. These options suit different needs and situations. They often have easier approval and faster access to cash than traditional loans.

Small businesses and startups benefit from these choices. They help cover daily expenses or invest in growth. Understanding each type helps you pick the best fit for your business.

Invoice Financing

Invoice financing lets businesses borrow money against unpaid invoices. It helps improve cash flow quickly. Instead of waiting for customers to pay, you get funds upfront. This option suits companies with many clients and slow payments.

It helps cover bills and payroll without extra debt. Fees depend on the invoice amount and repayment time. It is a good way to keep business running smoothly.

Equipment Financing

Equipment financing provides funds to buy or lease business equipment. It spreads the cost over time. This option avoids a large upfront payment. It suits businesses needing machines, vehicles, or technology.

The equipment itself often serves as collateral. This lowers the risk for lenders. Payments are fixed and predictable, helping with budgeting. It allows businesses to stay up-to-date with tools.

Business Lines Of Credit

A business line of credit offers flexible borrowing up to a set limit. You use what you need and pay interest only on that amount. It works like a credit card for your business.

This option helps manage cash flow gaps or unexpected expenses. Funds are available anytime, providing quick access. Repay and borrow again as needed. It suits businesses with variable cash needs.

Credit: www.rapidfinance.com

Choosing The Right Loan

Choosing the right loan can shape your business’s future. It impacts cash flow, growth, and stability. Picking the best option needs careful thought. This guide breaks down key points to consider.

Assessing Your Business Needs

Start by identifying why you need funding. Is it for equipment, inventory, or daily expenses? Know the exact amount required. Consider how quickly you need the money. This clarity helps narrow down loan choices.

Comparing Interest Rates And Terms

Look at the cost of borrowing. Lower interest rates reduce your repayment burden. Study the repayment period and monthly payments. Longer terms mean smaller payments but more interest overall. Choose terms that fit your budget comfortably.

Evaluating Eligibility Criteria

Each loan has rules for approval. Check credit score requirements and business age limits. Some loans ask for collateral or a personal guarantee. Understand these conditions before applying. It saves time and avoids rejections.

Maximizing Loan Benefits

Loans offer many benefits for business growth and stability. Using a loan wisely can help your business expand, manage cash flow, and build credit. Proper planning and management maximize these benefits and reduce risks.

Understanding how to use loan funds effectively is key. Also, managing repayments and maintaining good credit keep your business healthy and trustworthy. These steps ensure loans support long-term success.

Using Funds For Growth

Use loan money to invest in important areas. Buy equipment, hire staff, or increase inventory. Spend on marketing to attract more customers. Focus on actions that increase revenue and profit. Avoid using funds for unnecessary expenses.

Managing Repayments

Make loan payments on time every month. Set reminders to avoid missing deadlines. Pay more than the minimum if possible. Early payments reduce interest and shorten loan life. Keep track of all payments and balances carefully.

Maintaining Good Credit

Good credit helps get better loan terms. Pay all bills and debts on time. Avoid taking too many loans at once. Regularly check your credit report for errors. Building good credit lowers borrowing costs and builds trust.

Credit: www.bill.com

Common Loan Application Mistakes

Applying for a business loan can be tricky. Many applicants make mistakes that slow down the process or cause rejection. Understanding common errors helps you prepare better. Avoid these pitfalls to increase your chances of approval.

Incomplete Documentation

Lenders require complete paperwork to review your loan request. Missing documents can delay approval or lead to denial. Double-check all forms, financial statements, and identification before submitting. A complete application shows professionalism and readiness.

Overlooking Credit Scores

Your credit score plays a big role in loan approval. Low scores can limit your options or increase interest rates. Check your credit report early and fix any errors. Knowing your score helps you choose the right lender and loan type.

Ignoring Loan Terms

Loan terms include interest rates, repayment schedules, and fees. Overlooking these details can cause future problems. Understand every term before signing. Clear knowledge prevents surprises and helps you manage payments effectively.

Frequently Asked Questions

What Types Of Loans Are Available For Business Funding?

Business loans include term loans, SBA loans, equipment financing, and lines of credit. Each serves different needs and repayment terms. Choose based on your business size, purpose, and credit profile for best results.

How Does A Business Loan Impact Credit Score?

Taking a business loan can improve credit if paid timely. Late payments or defaults harm credit scores. Responsible borrowing boosts financial reputation and eases future funding access.

What Are Common Requirements For Business Loan Approval?

Lenders typically require good credit, business plans, financial statements, and collateral. Demonstrating stable cash flow and a clear repayment plan increases approval chances.

Can Startups Qualify For Business Loans?

Yes, startups can get loans but may face stricter requirements. Alternative lenders and SBA programs often support new businesses with flexible terms.

Conclusion

Business loans offer many ways to fund your company. You can choose from banks, online lenders, or government programs. Each option has different terms and requirements. Think about your business needs and repayment ability. A good loan can help your business grow steadily.

Always read the fine print before signing. Take time to compare offers carefully. Smart funding decisions lead to better business success. Keep control of your finances and plan ahead. Your business deserves the right support to move forward.