Are you ready to make your travel dreams more rewarding? Choosing the right travel reward credit card can turn every purchase into points, miles, or perks that bring you closer to your next adventure.

But with so many options out there, how do you find the best one for your lifestyle and spending habits? Whether you’re a casual traveler or a jet-setter, this guide breaks down the top travel reward credit cards you should consider.

From cards that offer flexible points and big sign-up bonuses to those with luxury perks like airport lounge access, you’ll discover which options fit your needs and budget. Keep reading to unlock smart strategies and pick the perfect card that makes your money work harder for your travels.

Credit: www.rewardexpert.com

Top Travel Cards

Choosing the right travel rewards credit card can save you money and enhance your trips. Some cards offer great sign-up bonuses, while others focus on everyday spending rewards. Picking a card depends on your travel style and spending habits. Here are some top travel credit cards that offer great value for different needs.

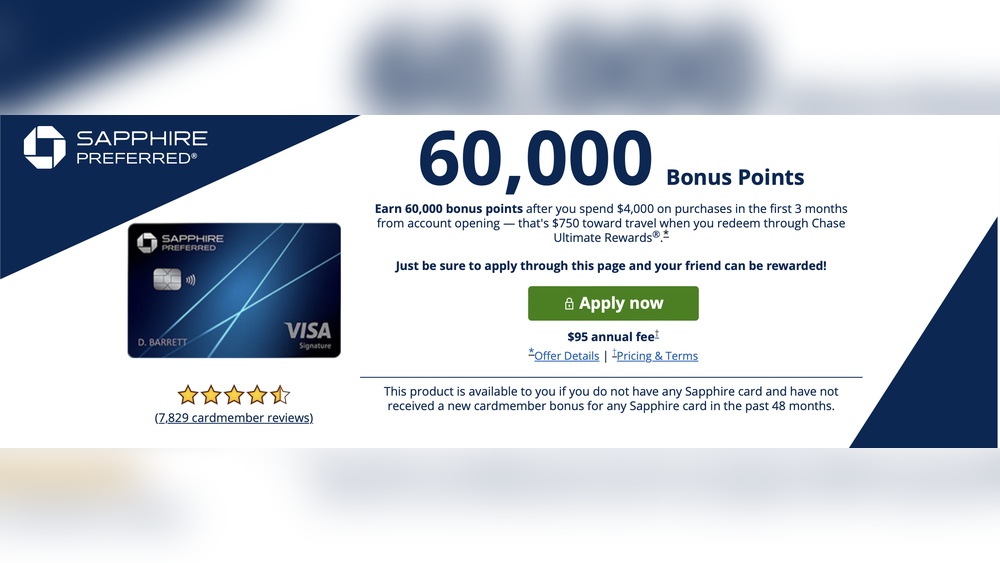

Chase Sapphire Preferred

This card is popular for its strong rewards on travel and dining. It offers a valuable sign-up bonus and flexible points. Points transfer to many airline and hotel partners. The annual fee is moderate, making it a good choice for many travelers.

Capital One Venture X

Designed for luxury travelers, this card provides premium lounge access and travel credits. It has a high rewards rate on all purchases. The card’s perks help cover the annual fee for frequent flyers. It’s ideal for those who want comfort and convenience.

American Express Gold

This card rewards dining and groceries very well. It offers valuable points on everyday spending. Amex Gold also provides dining credits and travel benefits. It suits travelers who spend a lot on food and dining out.

Amex Platinum Card

Best for high-spending travelers who want luxury perks. It offers extensive lounge access and travel credits. The card has a high annual fee but many benefits to offset it. Ideal for those who want premium travel experiences.

Capital One Venture Rewards

This card has a simple rewards structure with flat-rate points on all purchases. It is easy to use without worrying about bonus categories. The card fits travelers who prefer straightforward rewards and low hassle.

Wells Fargo Autograph

A no annual fee card with solid travel rewards. It earns points on dining, travel, and streaming services. The card suits travelers who want rewards without extra costs. Good for budget-conscious users.

Bank Of America Travel Rewards

This card offers rewards on all purchases with no annual fee. Points can be used to cover travel expenses. It is a simple and affordable option for casual travelers. A good choice for those new to travel cards.

Credit: www.cardrates.com

Best Cards By Category

Choosing the right travel reward credit card depends on your lifestyle and spending habits. Each card offers unique benefits that fit different travel needs and budgets. Categorizing cards helps match the best options to your priorities.

This section highlights top travel reward credit cards by category. Whether you want luxury perks, simple rewards, or no annual fees, find the best card to suit your style.

Best Overall And Entry-level

The Chase Sapphire Preferred® card stands out as the best overall. It offers strong rewards, a valuable sign-up bonus, and flexible points. This card suits beginners and frequent travelers alike. Its balance of perks and fees makes it a smart choice for many.

Best For Luxury And Lounge Access

The Capital One Venture X Rewards Credit Card delivers premium benefits. Enjoy airport lounge access, travel credits, and high rewards on travel spending. This card is ideal for travelers who want comfort and exclusive perks on their trips.

Best For Dining And Groceries

The American Express® Gold Card rewards dining and grocery purchases generously. It offers bonus points in these categories, helping you earn faster on everyday spending. This card fits food lovers and families who spend heavily on meals and groceries.

Best For Simple Rewards

The Capital One Venture Rewards Credit Card offers flat-rate rewards on all purchases. No need to track categories or limits. This card is perfect for users who want straightforward earning without complications.

Best No Annual Fee Options

The Wells Fargo Autograph® Card and Bank of America® Travel Rewards credit card offer solid rewards without annual fees. These cards help you earn points on daily spending without extra costs. Great for budget-conscious travelers.

Best For High-end Travel

The American Express Platinum Card® suits travelers who want top-tier benefits. It provides luxury travel credits, comprehensive lounge access, and elite status perks. This card works well for those who spend heavily on travel and want superior experiences.

Choosing The Right Card

Choosing the right travel reward credit card is important for getting the most value. The best card fits your spending habits and travel goals. Focus on cards that match your lifestyle. This approach helps maximize rewards and benefits. Keep your budget and preferences in mind. The right card can make your trips cheaper and more enjoyable.

Match Card To Spending Habits

Look at where you spend most of your money. Some cards reward dining and groceries more. Others give extra points on travel or gas. Choose a card that rewards your common purchases. This way, you earn more points faster. Check if the card offers bonus categories you use often.

Consider Annual Fees And Perks

Annual fees vary widely among travel cards. Some cards have no fee, while others charge high fees. Think about what you get for the fee. Perks like lounge access, travel credits, or insurance might justify higher fees. If you travel a lot, these benefits can save money. For light travelers, a no-fee card might be better.

Evaluate Point Flexibility

Points that transfer to many airlines and hotels offer more options. Flexible points let you choose the best deals and routes. Some programs have limited transfer partners. Also check if points expire or have blackout dates. Cards with good transfer partners increase your chances to use points easily.

Check Redemption Opportunities

Look at how you can redeem your points or miles. Some cards allow booking flights, hotels, or car rentals directly. Others offer cash back or gift cards. Compare the value you get per point across options. The best cards give multiple ways to use rewards without restrictions.

Maximizing Rewards

Maximizing rewards from your travel credit cards ensures you get the most value every time you spend. Smart use of bonuses, categories, and perks can boost your points and miles quickly. Focus on strategies that fit your travel style and spending habits. This way, you travel more and pay less.

Leveraging Sign-up Bonuses

Sign-up bonuses offer a large number of points after meeting spending requirements. These bonuses often equal free flights or hotel stays. Choose cards with high bonuses that match your travel goals. Plan your spending to reach the bonus threshold quickly. This jumpstarts your rewards balance with minimal effort.

Using Bonus Categories

Many cards offer extra points in specific categories like dining, travel, or groceries. Use your card where it earns the highest rewards. Track which purchases qualify for bonus points. Rotating categories or fixed bonus categories help you earn faster. Align your daily spending with these categories to maximize points.

Taking Advantage Of Lounge Access

Lounge access adds comfort and savings during travel. Many premium cards include airport lounge entry. Enjoy free snacks, drinks, and Wi-Fi while waiting for flights. Lounge access can offset annual fees by saving you money on food and relaxation. Use this perk to improve your travel experience.

Combining Points And Miles

Some programs allow you to transfer points to airline or hotel partners. Combining points from different cards can increase their value. Look for cards with flexible transfer options. This strategy helps you book better flights or upgrades. Use multiple cards to collect points that work together.

Travel Credit Card Tips

Travel credit cards offer great rewards but need smart handling. Following simple tips helps you get the most from your card. These tips reduce mistakes and increase your travel benefits. Use these travel credit card tips to enjoy smooth, rewarding journeys.

Avoiding Common Pitfalls

Pay your bill on time to avoid fees and interest charges. Watch out for high annual fees that may not suit your budget. Don’t overspend just to earn points; it can lead to debt. Understand reward restrictions and blackout dates before booking travel.

Timing Your Applications

Apply for new cards when you plan big travel or spending. Space out applications to keep your credit score healthy. Take advantage of sign-up bonuses by meeting spending requirements quickly. Avoid applying right before major credit checks like loans or mortgages.

Tracking Your Rewards

Use apps or spreadsheets to track points and expiration dates. Check your rewards balance regularly to avoid losing points. Know how to redeem points for the best value. Keep an eye on promotions that boost your rewards earning.

Staying Within Budget

Set a monthly spending limit on your travel card. Use the card only for planned expenses, not impulse buys. Monitor your statements to catch errors or unauthorized charges fast. Balance earning rewards with responsible spending habits.

Credit: www.peachstatefcu.org

Frequently Asked Questions

What Is The Best Credit Card To Get For Travel Rewards?

The best travel rewards card depends on your needs. Top picks include Chase Sapphire Preferred® for beginners, Capital One Venture X for luxury, and Amex Gold for dining. No-fee options like Wells Fargo Autograph® suit budget travelers. Choose based on spending habits and desired perks.

What Is The Best Credit Card To Have For Travelling?

The best travel credit card depends on your needs. Chase Sapphire Preferred suits most travelers. Capital One Venture X offers luxury perks. Amex Gold rewards dining, while Wells Fargo Autograph has no annual fee. Choose based on spending habits and desired benefits.

What Is The Best Travel Reward Credit Card?

The best travel reward credit card depends on your spending habits. Popular options include Chase Sapphire Preferred® for beginners, Capital One Venture X for luxury perks, and American Express Gold for dining rewards. Choose based on rewards, fees, and travel benefits.

How Do Travel Reward Credit Cards Work?

Travel reward credit cards earn points or miles on purchases. You can redeem them for flights, hotels, or travel expenses. Many cards offer bonus points on travel-related spending and perks like lounge access or travel insurance.

Conclusion

Choosing the right travel reward credit card can save you money and enhance trips. Focus on your spending habits to find the best fit. Cards like Chase Sapphire Preferred® suit beginners well. Luxury travelers may prefer Amex Platinum® for extra perks.

No-fee cards offer rewards without extra costs. Consider fees, rewards, and benefits before deciding. The right card can make travel more rewarding and enjoyable. Start planning your next journey with confidence and smart choices.