Imagine waking up each year with your net worth 20% higher than the year before. What would that kind of steady growth mean for your future?

You might think it’s complicated or out of reach, but it’s not. With a simple, clear plan, you can make this goal a reality. You’ll discover easy steps to build your wealth consistently, avoid common money traps, and create lasting financial security.

Ready to see your net worth grow faster than you ever thought possible? Keep reading—your future self will thank you.

Set Clear Growth Goals

Setting clear growth goals is essential for increasing your net worth each year. Goals guide your actions and keep you focused. Without clear targets, tracking progress becomes difficult. You need specific, measurable objectives to stay on track. Clear goals help you plan steps wisely and adjust when needed. This clarity makes reaching your financial goals easier and more realistic.

Target 20% Annual Increase

Choose a growth rate that challenges yet motivates you. A 20% annual increase is ambitious but achievable. It pushes you to improve income, save more, and invest smartly. Set this target as a yearly benchmark for your net worth. Break it down into smaller goals for each quarter or month. This keeps you motivated and focused on steady progress.

Track Progress Regularly

Review your net worth often to see if you meet your goals. Monthly or quarterly tracking helps spot issues early. Use simple tools like spreadsheets or apps to record your assets and debts. Compare your current net worth to your target regularly. Adjust your plan if growth slows down. Regular tracking builds good financial habits and keeps you accountable.

Boost Your Income

Boosting your income is a key step to increase your net worth by 20% every year. Earning more money gives you extra funds to save, invest, and grow your wealth. Small changes in how you earn can add up over time.

Focus on ways to increase your earning power. Use your current skills, learn new ones, and find additional income sources. Even modest boosts in income can make a big difference.

Leverage Skills And Education

Use what you already know to earn more. Improving your skills can lead to better job positions or pay raises. Take courses or get certifications that help you stand out. Employers often pay more for specialized knowledge.

Keep learning to stay competitive. Online classes and workshops are affordable and flexible. The more you know, the more you can offer.

Explore Side Hustles

Find ways to earn money outside your main job. Side hustles can bring extra cash and open new opportunities. Choose something you enjoy or are good at. This makes it easier to keep going.

Popular side jobs include freelancing, tutoring, or selling handmade items. Use online platforms to reach customers. Even a few extra hours a week help build your income.

Turn Assets Into Income

Make your belongings work for you. Rent out unused space, like a room or parking spot. Sell items you don’t need or flip things for profit. Investments like stocks or real estate can also generate income.

Regular income from assets adds stability. It supports your goal to grow net worth steadily. Look for ways to use what you own to create cash flow.

Control Spending

Controlling spending is essential for growing your net worth. Keeping your expenses in check frees up money for saving and investing. This simple step can help you increase your net worth by 20% each year. Focus on smart spending habits and avoid unnecessary costs. Small changes add up over time and boost your financial health.

Avoid Lifestyle Inflation

As income rises, resist spending more on luxuries. Lifestyle inflation slows net worth growth. Instead, keep your living costs steady. Use extra money to invest or save. This approach builds wealth faster and secures your future.

Create A Budget Plan

Write down all income and expenses each month. A budget shows where your money goes. It helps you plan spending and savings. Update the budget regularly to stay on track. A clear budget supports better financial decisions and growth.

Cut Unnecessary Expenses

Review your spending for items you don’t need. Cancel unused subscriptions and avoid impulse purchases. Small daily savings can add up significantly. Redirect these funds into investments or savings accounts. This habit boosts your net worth steadily over time.

Credit: www.barnesandnoble.com

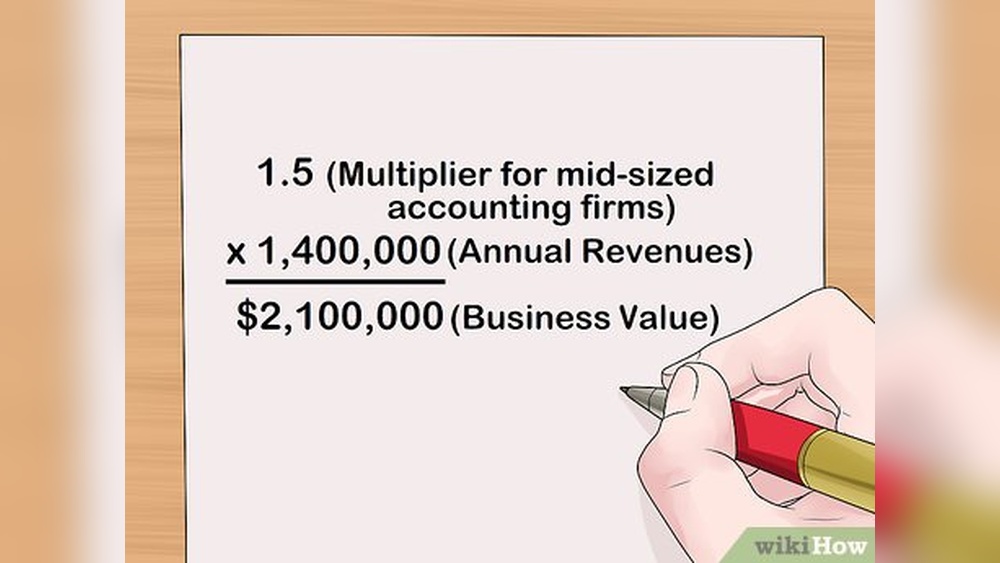

Invest Wisely

Investing wisely plays a key role in growing your net worth consistently. Smart investment decisions help your money grow steadily and safely. Building wealth requires patience and a clear strategy. Focus on spreading your money across different assets. Think about how your investments perform over many years. Also, take advantage of retirement plans to boost your savings. These steps create a solid foundation for your financial future.

Diversify Your Portfolio

Do not put all your money in one place. Spread your investments across stocks, bonds, and other assets. Diversification reduces risk and protects your money from big losses. It balances your portfolio when some investments fall. Choose different industries and regions for better stability. A well-diversified portfolio grows steadily over time.

Focus On Long-term Growth

Invest with patience and avoid quick profits. Long-term investments have a better chance to increase in value. Stay calm during market ups and downs. Reinvest dividends and earnings to boost growth. Avoid frequent buying and selling to save on fees. Time in the market matters more than timing the market.

Maximize Retirement Contributions

Put as much as you can into retirement accounts each year. These accounts offer tax benefits that help your savings grow faster. Employer matches add free money to your contributions. Start early to take advantage of compound growth. Consistent contributions build a larger nest egg for the future. Make retirement savings a priority in your plan.

Manage Debt Strategically

Managing debt strategically is key to growing your net worth by 20% yearly. Debt can either hold you back or help you move forward. The goal is to control debt in ways that benefit your financial health. A clear plan helps reduce costs and increase your investment power.

Not all debt is equal. Some types of debt drain your money faster. Others can be tools to build wealth. Understanding how to handle both types is essential for steady net worth growth.

Prioritize High-interest Debt

Focus on paying off high-interest debt first. Credit cards and payday loans often carry the highest rates. These debts grow quickly and reduce your ability to save or invest.

Eliminating high-interest debt lowers your monthly expenses. It frees up cash for investments that increase your net worth. Even small extra payments can speed up debt payoff and save money on interest.

Use Debt To Leverage Opportunities

Debt can be a tool to create wealth if used wisely. Consider borrowing for investments that generate income or appreciate over time. Real estate or business loans can be examples.

Make sure the expected return on borrowed money is higher than the cost of debt. This way, debt works for you, not against you. Always assess risks and have a repayment plan before borrowing.

Build Emergency Savings

Building emergency savings is a key step in growing your net worth steadily. It creates a safety net that protects you from unexpected expenses. This prevents you from using credit or selling investments at a loss. A solid emergency fund keeps your financial plan on track.

Set Aside 3-6 Months Expenses

Start by calculating your monthly living costs. Include rent, food, utilities, and transportation. Multiply this amount by three to six months. Aim to save this total before focusing on other goals. This amount covers essentials if income stops temporarily. It gives peace of mind and financial stability.

Keep Funds Accessible

Store your emergency savings in a place you can access quickly. A savings account with no withdrawal penalties works well. Avoid investing this money in stocks or long-term accounts. You need to reach it instantly during emergencies. Easy access means less stress in tough times.

Monitor And Adjust

Tracking progress is key to growing your net worth by 20% each year. Monitoring your finances lets you spot problems early. Adjusting your plans keeps your goals on track. This simple habit makes growth steady and reliable. It also builds confidence in your money decisions.

Review Financial Statements

Check your financial statements regularly. Look at bank accounts, investments, and debts. Compare your current net worth to past months. Notice any unexpected drops or gains. These details help you understand where you stand. Keep records organized and easy to access. Regular reviews reveal spending habits and income changes. Use this data to measure progress toward your goal.

Adapt Strategies As Needed

Change your plan based on what your numbers show. If growth slows, find out why. Maybe expenses are too high or income is steady. Adjust your budget or find new income sources. Shift investments if some do not perform well. Stay flexible and open to new ideas. Small changes can lead to big improvements. Keep your plan realistic and suited to your life. This keeps your net worth moving upward each year.

Credit: store.nolo.com

:max_bytes(150000):strip_icc()/GettyImages-2070440667-a0ec7450759a4413b2e10b96308ebe32.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

How To Turn $1000 Into $10000 In A Month?

Turn $1000 into $10,000 by reselling products, investing in high-growth stocks, or offering in-demand freelance services. Act quickly and stay disciplined.

What Is The Best Way To Increase My Net Worth?

Increase net worth by boosting income, reducing expenses, investing in appreciating assets, and maximizing retirement contributions consistently.

What If I Invest $$200 A Month For 20 Years?

Investing $200 monthly for 20 years can grow to approximately $96,000-$150,000, depending on average annual returns.

How Much Will $100 A Month Be Worth In 30 Years?

Investing $100 monthly at a 7% annual return grows to about $94,000 in 30 years. Compound interest boosts savings significantly.

Conclusion

Growing your net worth by 20% each year takes patience and smart choices. Track your progress regularly and adjust your plan as needed. Focus on saving, investing, and reducing debts to build wealth steadily. Small, consistent steps lead to big results over time.

Remember, growing wealth is a journey, not a quick fix. Stay disciplined and keep your goals clear. Your financial future improves with each positive decision you make today.