Have you ever wondered how digital wallets, those handy apps on your phone, actually make money? You probably use them to pay for coffee, shop online, or send money to friends without thinking twice.

But behind the scenes, these wallets aren’t just convenient—they’re also smart business machines. Understanding how they earn can help you see why they offer certain features and even how they might impact your spending habits. Keep reading, and you’ll discover the clever ways digital wallets turn your everyday transactions into profit, all while making your life easier.

Digital Wallet Revenue Streams

Digital wallets earn money through several key revenue streams. These streams enable wallet providers to offer free or low-cost services to users while generating profit. Each revenue source plays a unique role in the business model of digital wallets.

Understanding these revenue streams helps explain how digital wallets sustain their growth and innovation. They create value for users, merchants, and financial partners alike.

Transaction Fees And Commissions

Digital wallets often charge small fees for processing transactions. These fees apply mainly to merchants rather than consumers. Each time a payment happens, the wallet provider earns a percentage or fixed fee. This model ensures steady income as wallet usage grows worldwide.

Some wallets also earn commissions from financial institutions when users perform certain transactions. These fees are usually invisible to consumers but add up significantly over many transactions.

Merchant Partnerships And Incentives

Wallet providers collaborate with merchants to boost sales and customer loyalty. They offer special deals or cashback to users who shop with partner stores. In return, merchants pay incentives or fees to the wallet companies.

These partnerships create a win-win situation. Merchants attract more customers, while wallets increase user engagement and revenue.

Premium Features And Subscriptions

Many digital wallets offer optional premium services. Users can pay for advanced features like enhanced security, spending analytics, or higher transaction limits. Some wallets also provide subscription plans with extra benefits.

These paid options bring additional income beyond basic wallet functions. They appeal to users who want more control or convenience in managing their money.

Financial Services Integration

Digital wallets often integrate financial services such as loans, insurance, or investments. They earn revenue by charging fees or earning interest on these products. Some wallets partner with banks or fintech firms to provide these services.

This integration transforms wallets into all-in-one financial platforms. It broadens their revenue base while offering users more value in one app.

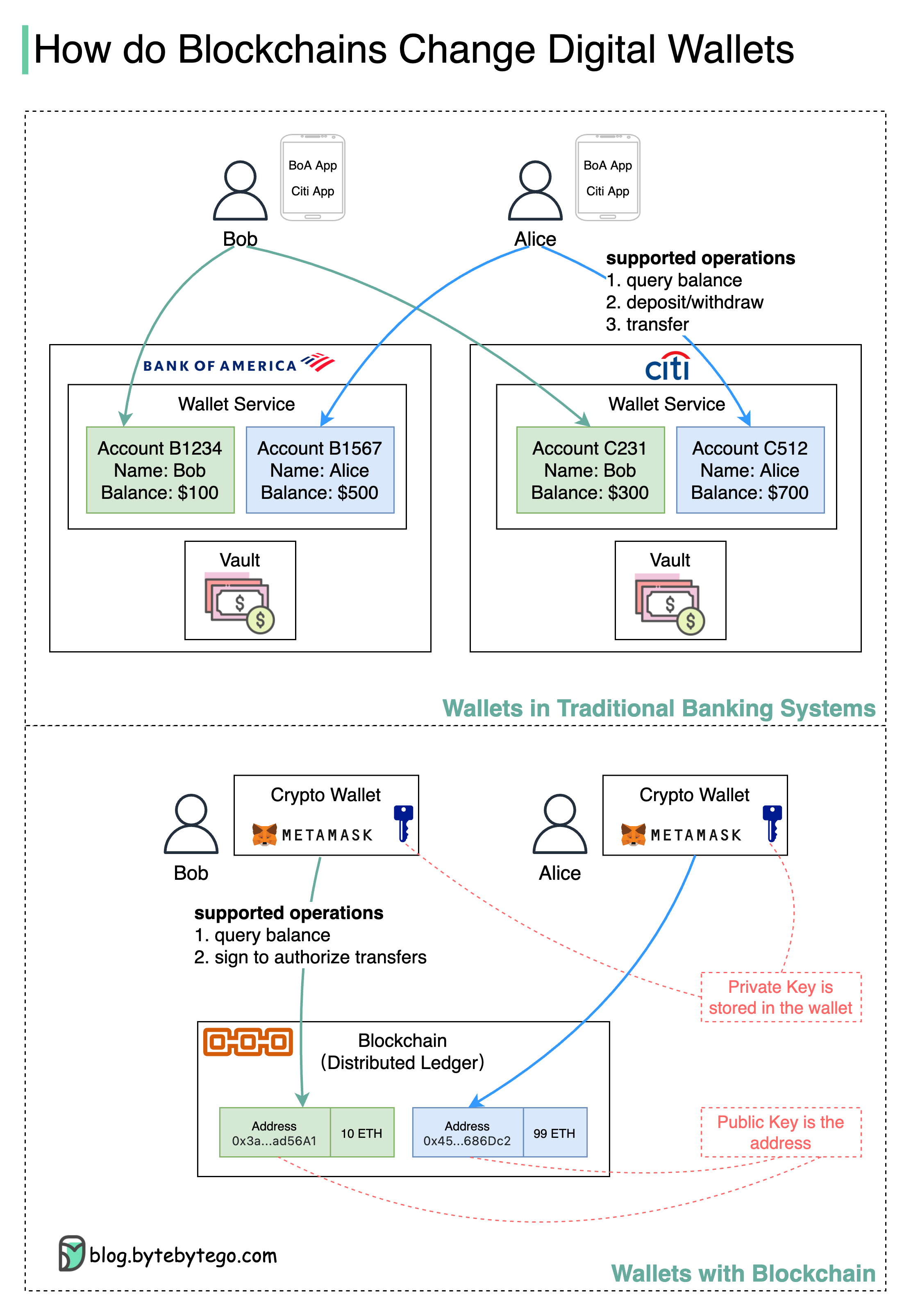

How Crypto Wallets Generate Income

Crypto wallets do more than store your digital coins. They also have smart ways to earn money. These wallets work with different partners and services. This allows them to make income while helping users manage cryptocurrencies.

By offering extra features and charging small fees, crypto wallets create steady revenue. They connect users to exchanges, convert money, and add third-party tools. Each method helps wallets stay profitable and grow.

Affiliate Links And Exchange Partnerships

Crypto wallets often team up with exchanges and platforms. They add affiliate links inside the app. When users sign up or trade via these links, the wallet earns a commission. This method creates a passive income stream.

Partnerships with popular exchanges also bring traffic and trust. Wallets get paid for every successful trade or signup. These deals boost wallet revenues without charging users directly.

Fiat-to-crypto Conversion Fees

Many crypto wallets let users swap regular money for crypto. This process is called fiat-to-crypto conversion. Wallets charge a small fee for each conversion. This fee is usually a percentage of the amount converted.

Even a tiny fee adds up with many users. It becomes a reliable income source. This fee covers the cost of providing currency exchange services.

Third-party Service Integrations

Crypto wallets integrate with external services like lending, staking, or insurance. They earn money by sharing revenue from these services. Users get more options while wallets get paid for referrals.

These third-party tools increase wallet utility. They also create multiple income channels. Wallets can keep offering new features without charging high fees.

Cost Structure For Users And Merchants

Digital wallets have a complex cost structure affecting both users and merchants. Understanding these costs helps explain how digital wallets generate revenue and maintain their services. This section breaks down the different fee policies and hidden charges involved.

Consumer Fee Policies

Most digital wallets do not charge consumers for basic transactions. Sending money, paying bills, or making purchases usually remain free. Some wallets may apply fees for instant transfers or currency exchanges. Users should check the wallet’s policy before using special features. Simple transactions often have no direct cost for consumers.

Merchant Fee Models

Merchants pay fees to accept digital wallet payments. These fees vary by wallet provider and transaction type. Some charge a percentage of the sale, while others add a fixed fee per transaction. Larger businesses might negotiate lower rates due to high volume. These merchant fees cover payment processing and platform maintenance.

Hidden Costs And Margins

Hidden costs can appear in exchange rates or delayed transaction settlements. Wallet providers may earn margins on currency conversion or interest from stored funds. Some platforms partner with banks or lenders, generating revenue from financial services. These subtle charges help keep digital wallets profitable behind the scenes.

Credit: www.bill.com

Technology Behind Digital Wallets

Digital wallets rely on advanced technology to offer fast and secure payments. Understanding this technology reveals how these wallets function and generate revenue. The technology ensures smooth transactions and protects user data. It also supports compatibility with various devices for wider use.

Contactless Payment Systems

Contactless payment systems use near-field communication (NFC) or Bluetooth technology. These systems allow users to tap or wave their device near a payment terminal. This quick exchange of data completes the transaction without physical contact. Contactless payments reduce wait times and enhance user convenience. They also enable merchants to accept payments quickly, increasing sales volume.

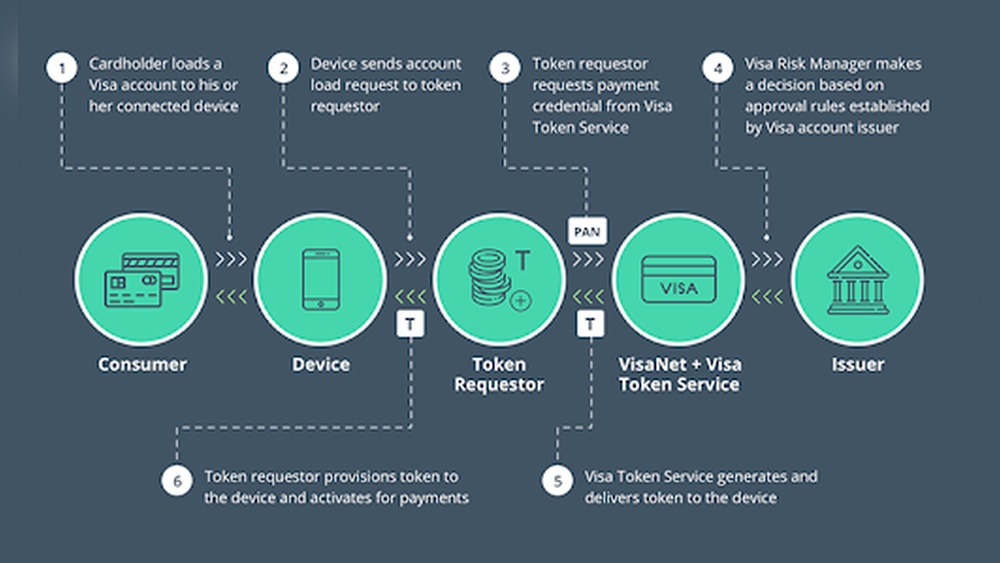

Security Protocols And Encryption

Security is crucial for digital wallets. They use strong encryption to protect sensitive data during transactions. Encryption converts data into a code that only the receiver can decode. Multi-factor authentication adds an extra layer of security by requiring multiple forms of verification. Secure protocols prevent unauthorized access and build user trust. This trust encourages more users to adopt digital wallets, boosting transaction numbers.

Mobile Device Compatibility

Digital wallets support various mobile devices, including smartphones and smartwatches. Compatibility with different operating systems like iOS and Android widens the user base. Apps are designed to work smoothly across devices, offering seamless user experiences. This flexibility allows users to pay anytime, anywhere. Increased usage on multiple devices helps digital wallet providers earn through transaction fees and partnerships.

Business Advantages Of Accepting Digital Wallets

Accepting digital wallets offers clear business advantages. These payment methods speed up transactions and improve customer experience. Adopting them helps companies stay competitive in today’s market.

Faster Checkout And Convenience

Digital wallets speed up the checkout process. Customers no longer need to enter card details manually. They just tap or scan, making payments quicker. This convenience reduces long lines and wait times. Faster checkout means more sales and less abandoned carts.

Customer Satisfaction And Loyalty

Many customers prefer using digital wallets for their ease and security. Offering this option shows that a business cares about customer needs. Satisfied customers tend to return more often. This builds loyalty and encourages repeat purchases. Happy customers also share positive feedback, attracting new buyers.

Market Expansion Opportunities

Digital wallets open doors to a broader market. They support multiple currencies and international transactions. Businesses can sell to customers beyond their local area. This expands reach without high costs. Accepting digital wallets makes global sales easier and faster.

Emerging Trends In Digital Wallet Monetization

Digital wallets continue to evolve with new ways to generate revenue. Companies explore fresh features and partnerships to boost income. These trends reflect a shift towards more integrated, user-friendly financial tools. Monetization now includes cryptocurrencies, budgeting aids, and global payment options. These advances help wallets attract and keep more users.

Stablecoins And Crypto Integration

Digital wallets now support stablecoins and cryptocurrencies. This allows users to hold and spend digital assets easily. Wallets earn fees from crypto transactions and exchanges. Partnerships with crypto platforms create revenue through commissions. This integration appeals to users interested in blockchain technology and digital investments.

Budgeting And Financial Management Tools

Many wallets offer built-in budgeting and money management features. These tools help users track spending and save money. Some wallets charge for premium financial advice or advanced analytics. Advertisements and partnerships with financial service providers generate income. These features increase user engagement and wallet usage frequency.

Cross-border Payment Solutions

Cross-border payments are a growing source of wallet revenue. Digital wallets reduce costs and speed up international money transfers. They charge fees or earn currency exchange spreads on these transactions. Collaborations with global banks and payment networks expand their reach. This trend supports users who send money across countries frequently.

Risks And Security Considerations

Digital wallets offer convenience but also carry certain risks. Security is vital to protect users’ money and personal data. Understanding these risks helps users stay safe while using digital wallets.

Potential Vulnerabilities

Digital wallets face threats like hacking and malware attacks. Weak networks can expose transactions to interception. Lost or stolen devices put wallet access at risk. Phishing scams trick users into sharing sensitive information. Software bugs may allow unauthorized access to funds.

User Authentication Methods

Strong authentication keeps wallets secure. Common methods include passwords, PIN codes, and biometric checks. Fingerprint and facial recognition add extra protection. Two-factor authentication (2FA) requires a second verification step. Authentication methods must balance security and ease of use.

Best Practices For Protection

Users should enable all security features offered. Regularly update apps to fix security flaws. Use strong, unique passwords and change them often. Avoid using public Wi-Fi for wallet transactions. Monitor accounts for suspicious activity and report issues quickly.

Credit: bytebytego.com

Credit: www.unitedfinancialcu.org

Frequently Asked Questions

Do Digital Wallets Charge A Fee?

Most digital wallets do not charge users fees for transactions. Some may charge merchants or for premium features.

What Is The Revenue Model Of A Digital Wallet?

Digital wallets earn revenue through transaction fees, merchant partnerships, premium features, currency conversion spreads, and financial service offerings.

How Do Crypto Wallets Make Money?

Crypto wallets earn money through transaction fees, affiliate partnerships, currency conversion spreads, and premium service charges. They also gain revenue by integrating third-party financial services and facilitating trades on linked exchange platforms.

Are Digital Wallets Risky?

Digital wallets use encryption to secure data, reducing risks. Still, device theft or hacking can expose your personal and financial information.

Conclusion

Digital wallets earn money in several simple ways. They charge fees on some transactions and get paid by merchants. Premium features also bring extra income. Partnerships with banks and financial services add to profits. Users enjoy quick, easy payments while wallets generate revenue quietly.

Understanding these methods helps users see how wallets stay in business. Digital wallets keep growing as more people choose fast, secure payment options. This balance benefits both users and companies behind these apps.