If you’re a founder, you’ve probably wondered how to turn your hard-earned shares into real cash. Knowing when and how to cash out your shares can change everything—helping you reward yourself, fund new ventures, or secure your financial future.

But the process isn’t always simple, and making the wrong move can cost you big. You’ll discover clear, practical steps to cash out your shares confidently and smartly. Ready to unlock the true value of your ownership? Keep reading to learn exactly how founders like you make it happen.

Credit: www.msn.com

Timing The Sale

Timing the sale of shares is a key decision for founders. Selling too early might mean missing future gains. Selling too late can risk losing value. Choosing the right moment helps maximize returns and reduce risks.

Market Conditions

The state of the market affects share prices. A strong market can increase share value. A weak market may lower prices and demand. Founders watch market trends closely before selling. They prefer times when investors are confident and active.

Company Milestones

Major company achievements can boost share value. Reaching revenue goals or product launches often attract investors. Founders may wait until after big milestones to sell. This timing can show growth and increase buyer interest.

Personal Financial Goals

Founders have personal money needs and plans. They may sell shares to buy a home or fund education. Sometimes, they sell to reduce financial risk. Personal goals guide when and how much to sell.

Credit: kdfoundation.org

Choosing The Right Method

Choosing the right method to cash out shares is a key step for founders. Each method has its own rules, benefits, and risks. The choice depends on factors like timing, company stage, and personal goals. Understanding the options helps founders make smart decisions that fit their needs.

Secondary Market Sales

Secondary market sales let founders sell shares to outside buyers. This method usually happens on private stock exchanges. It offers liquidity without needing the company to issue new shares. Founders can quickly convert shares to cash. Buyers gain ownership, which can boost the market value of shares.

Tender Offers

Tender offers happen when a company or investor buys shares from many shareholders. Founders can sell large amounts of stock at once. This method often involves set prices and clear timelines. It provides a structured way to cash out. Tender offers can attract serious buyers and create fair market conditions.

Private Transactions

Private transactions involve direct deals between founders and buyers. This method offers flexibility in pricing and terms. Founders can negotiate the best deal for their shares. Private sales can be faster and less public than other methods. They require trust and clear agreements to protect both parties.

Tax Optimization Strategies

Tax optimization strategies help founders keep more money when they sell shares. Smart planning reduces the amount paid in taxes. This means more cash stays in the founder’s hands. Founders should learn key methods to manage taxes wisely.

These strategies involve careful timing, using special accounts, and planning for the future. Each approach has rules to follow. Understanding these rules helps avoid costly mistakes.

Capital Gains Planning

Capital gains are profits from selling shares. These gains can be taxed at different rates. Long-term capital gains usually have lower tax rates than short-term gains. Holding shares for over one year reduces taxes.

Founders should plan when to sell shares. Spreading sales over years can lower yearly taxable income. This planning helps avoid moving into higher tax brackets. Timing sales around other income is also smart.

Utilizing Tax-advantaged Accounts

Tax-advantaged accounts reduce taxable income. Examples include IRAs and 401(k)s. Founders can move some gains into these accounts. This lowers taxes now or in the future.

Using these accounts requires understanding contribution limits. Early withdrawals may have penalties. Founders should plan contributions carefully to maximize benefits.

Gift And Estate Planning

Gifting shares can lower tax burdens. Founders can give shares to family or trusts. This reduces the size of their taxable estate. Gifts may also transfer tax obligations.

Estate planning helps pass wealth with fewer taxes. Setting up trusts or wills protects assets. Founders should consult experts to create effective plans.

Negotiating Terms

Negotiating terms is a key step when founders cash out shares. It shapes how and when they can sell their stock. Clear agreements help avoid future problems. Founders must understand different terms to protect their interests. The process requires focus on timing, value, and rules attached to shares.

Lock-up Periods

Lock-up periods limit when founders can sell shares. These time frames often last 90 to 180 days after an IPO. The goal is to prevent large sell-offs that hurt stock prices. Founders should negotiate shorter or more flexible lock-up terms. Flexibility allows quicker access to cash when needed.

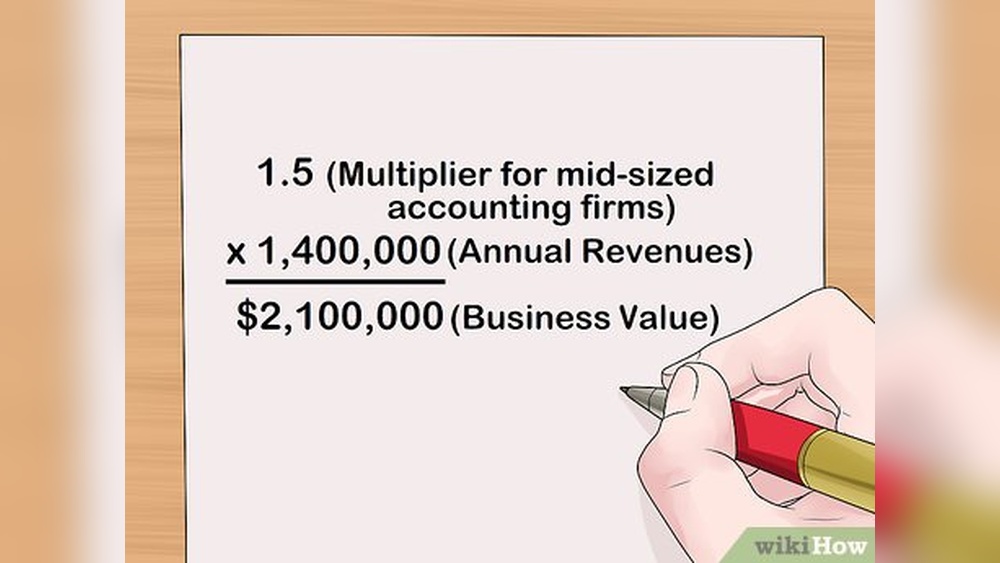

Pricing And Valuation

Pricing determines how much money founders get for shares. Valuation shows the company’s worth and affects share price. Founders aim for fair pricing based on market conditions and company growth. Negotiations may include price floors or ceilings. These protect founders from losing value during sales.

Rights And Restrictions

Rights and restrictions control what founders can do with shares. These include voting rights, transfer limits, and buyback options. Founders must review these carefully before selling. Negotiating favorable rights helps maintain some control over the company. Restrictions should not block founders from selling shares easily.

Working With Advisors

Founders often need help from experts to cash out shares safely. Advisors guide them through complex choices. They reduce risks and ensure smart decisions. Each type of advisor plays a unique role. Here is how they assist founders.

Legal Counsel

Legal counsel helps founders understand share sale laws. They draft and review contracts carefully. They check compliance with company rules and regulations. Legal experts protect founders from legal problems. They make sure all paperwork is clear and fair.

Financial Advisors

Financial advisors analyze the value of shares. They suggest the best timing to sell shares. They help plan how to use the money from sales. Advisors also look at market trends and risks. Their advice helps founders maximize their returns.

Tax Professionals

Tax professionals explain tax rules on share sales. They help minimize tax payments legally. They prepare tax documents and filings. Their guidance avoids costly tax mistakes. Tax experts make the cash-out process smoother and cheaper.

Credit: stocktwits.com

Managing Post-sale Wealth

Managing wealth after selling shares is a critical step for founders. The sale often brings a large sum of money. Handling it wisely can secure financial stability for years. Planning post-sale wealth helps avoid common pitfalls. It creates opportunities for growth and giving back. Founders must think beyond the sale and focus on long-term goals.

Diversification

Diversification lowers risk by spreading money across assets. Keeping all funds in one place is risky. Stocks, bonds, real estate, and cash balance a portfolio. Diversifying helps protect wealth from market ups and downs. It makes income more stable and less stressful. Consulting a financial advisor aids in smart diversification.

Reinvestment Opportunities

Reinvesting money can grow wealth further. Founders may invest in startups or other businesses. Real estate and stocks offer good chances for growth. Reinvestment keeps money working instead of sitting idle. Choosing the right opportunities depends on risk tolerance. Careful research and advice improve reinvestment success.

Philanthropy And Legacy

Philanthropy allows founders to give back to society. Donations support causes they care about deeply. Creating a legacy builds a lasting impact beyond business. Charitable giving can also offer tax benefits. Founders shape how they want to be remembered. Thoughtful planning ensures their wealth helps others well.

Frequently Asked Questions

How Do Founders Typically Cash Out Shares?

Founders cash out shares through secondary sales, company buybacks, or during acquisition events. They may also sell shares during public offerings to realize profits while maintaining control.

What Are The Tax Implications Of Cashing Out Shares?

Taxes depend on share type and holding period. Long-term capital gains tax usually applies if shares are held over a year, while short-term gains are taxed as regular income.

When Is The Best Time For Founders To Cash Out Shares?

Founders often cash out after company valuation rises significantly or during liquidity events like IPOs or acquisitions. Timing depends on market conditions and personal financial goals.

Can Founders Sell Shares Before The Company Goes Public?

Yes, founders can sell shares in private secondary markets or to investors during funding rounds, subject to company policies and shareholder agreements.

Conclusion

Founders cash out shares in different ways, each with risks and rewards. Choosing the right method depends on timing, company growth, and goals. Careful planning helps protect value and control. Selling shares can provide funds but may affect ownership. Always think about the future and seek expert advice.

Wise decisions today can lead to success tomorrow.