Have you ever wondered how much a CEO really makes each year? It’s a question that sparks curiosity because CEO salaries can seem both surprising and confusing.

You might think it’s just a big paycheck, but there’s much more behind those numbers. Understanding a CEO’s annual income can give you a clearer picture of business success and leadership rewards. You’ll discover what factors shape a CEO’s earnings and why those figures matter to you.

Keep reading to unlock the truth about CEO pay and what it means beyond the headlines.

Credit: www.hindustantimes.com

Ceo Salary Basics

A CEO’s annual income is more than just a paycheck. It includes different parts that together make up the total pay. Understanding these parts helps explain why CEO salaries can be very high. This section breaks down the basics of CEO salary to make it clear and simple.

Components Of Ceo Pay

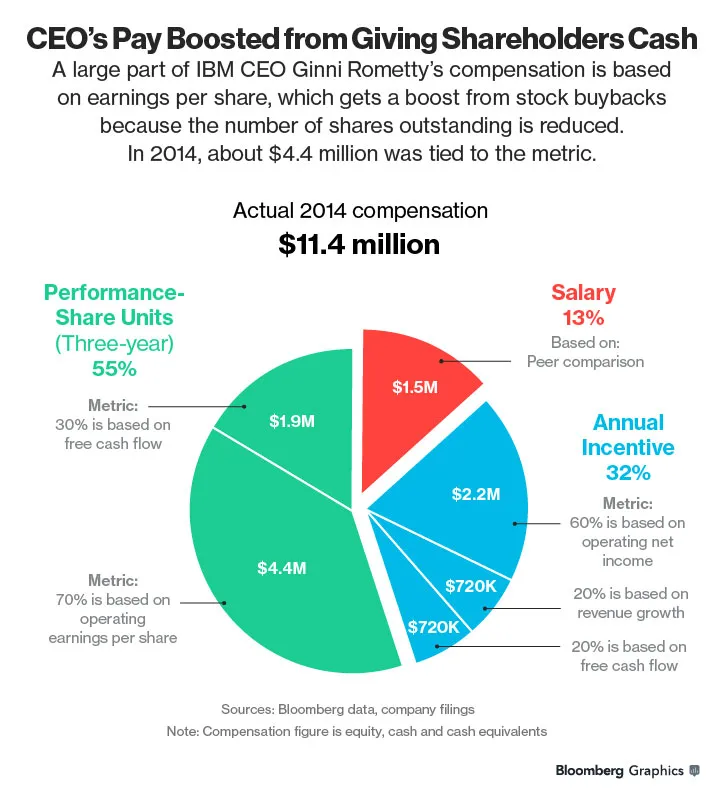

CEO pay includes several components. The most common parts are base salary, bonuses, stock options, and benefits. Base salary is the fixed amount paid regularly. Bonuses depend on company performance or goals met. Stock options give the CEO the right to buy shares later at a set price. Benefits include health insurance, retirement plans, and other perks. These parts combine to form the CEO’s total income.

Base Salary Vs Total Compensation

Base salary is the fixed yearly pay. It is often much smaller than total compensation. Total compensation includes base salary plus bonuses, stock options, and benefits. Many CEOs earn most of their money through bonuses and stocks. This depends on how well the company performs. Total compensation shows the full value of a CEO’s income.

Average Ceo Income

The average income of a CEO varies widely across different sectors and company sizes. CEOs earn salaries, bonuses, stock options, and other benefits. These combined earnings create a total annual income that can be quite large. Understanding the average CEO income helps reveal how leadership roles are compensated in business.

Income Variations By Industry

CEO pay differs a lot depending on the industry. Tech companies often offer higher salaries and stock options. Finance and healthcare sectors also provide substantial CEO incomes. Industries like retail or manufacturing tend to pay less. These differences reflect the sector’s profit margins and market demands.

Differences By Company Size

Company size greatly affects CEO earnings. Large corporations pay their CEOs much more than small firms. Bigger companies have more resources and complex operations. This leads to higher compensation to attract top talent. Small and medium businesses usually offer lower CEO salaries.

Top Ceo Earnings

Top CEO earnings show how much top executives can make yearly. These incomes include salary, bonuses, stocks, and other benefits. CEO pay varies widely across industries and companies. Some CEOs earn millions while others make much less. The highest paid CEOs often lead big companies with huge profits.

Understanding top CEO earnings helps to see the scale of executive compensation. It also reveals trends in business and the economy. Let’s explore some of the highest paid CEOs and record-breaking salaries.

Highest Paid Ceos In The World

The highest paid CEOs often lead tech and finance giants. Their total earnings can reach hundreds of millions of dollars per year. These leaders get large stock awards that can increase their wealth quickly. Examples include CEOs of companies like Tesla, Amazon, and Apple. Their salaries reflect company size, success, and market value.

Many CEOs earn more from stock options than from base salary. This links their pay to company performance. Investors watch these figures closely to judge leadership quality. High CEO pay can attract strong talent to big corporations.

Record-breaking Ceo Salaries

Some CEOs have earned record-breaking salaries in recent years. These salaries often include bonuses tied to company milestones. For example, a CEO might get extra pay after hitting sales targets. In some cases, total compensation can exceed $200 million in a single year.

Record salaries sometimes cause public debate about income inequality. Critics argue such pay is too high compared to average workers. Supporters say it rewards risk and hard work. These discussions highlight the importance of CEO pay transparency.

Factors Influencing Ceo Pay

CEO pay varies widely across companies. Many factors shape their annual income. These factors reflect the company’s success, market trends, and executive roles. Understanding these helps explain why some CEOs earn more than others.

Company Performance

Company performance is a key factor in CEO pay. CEOs leading profitable firms often receive higher salaries. Revenue growth and profit margins influence their income. Strong performance may trigger bonuses or raises. Poor results might limit pay increases or cause cuts.

Stock Options And Bonuses

Stock options and bonuses make up a large part of CEO pay. These rewards align CEOs with shareholders’ interests. Stock options allow CEOs to buy shares at a set price. Bonuses often depend on meeting specific goals. This pay structure motivates CEOs to improve company value.

Ceo Pay Vs Employee Salary

The difference between a CEO’s pay and an employee’s salary is often very large. CEOs earn millions, while many workers earn much less. This gap raises questions about fairness and company values. Understanding the pay gap helps us see how companies reward leadership versus everyday work.

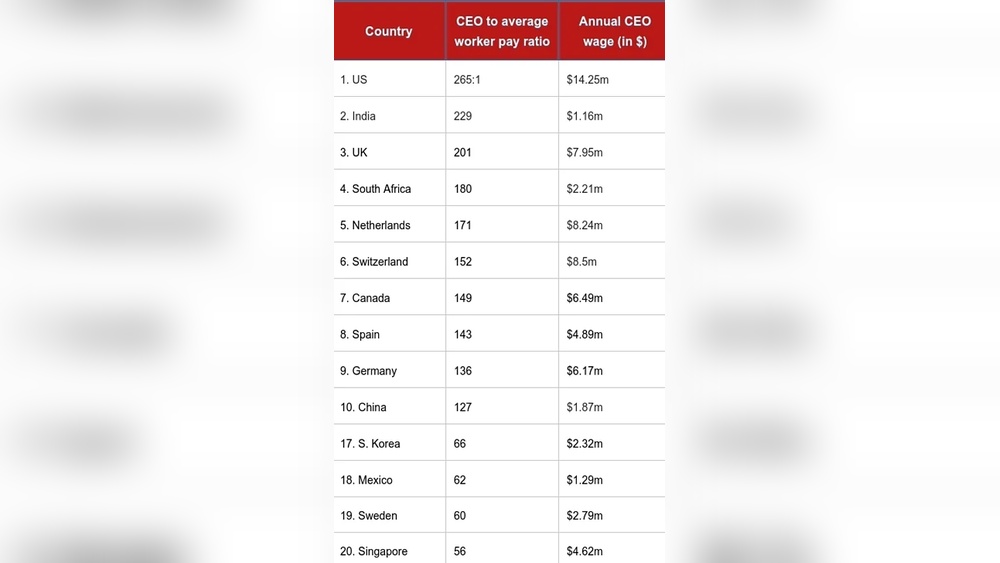

Pay Gap Statistics

On average, CEOs earn over 300 times more than their employees. This number changes by industry and company size. Some CEOs make tens of millions each year. Meanwhile, many employees earn less than $50,000 annually. The gap has grown larger over the past decades. This rise shows a growing divide in income within companies.

Impact On Workforce Morale

Large pay gaps can hurt worker motivation. Employees may feel undervalued or unfairly treated. This feeling can lower productivity and loyalty. Some workers might leave for better pay elsewhere. Companies with smaller gaps often have happier employees. Fair pay can build trust and teamwork. Closing the pay gap can improve workplace culture and success.

Controversies Around Ceo Income

CEO annual incomes spark strong debates worldwide. Many people find the high salaries unfair. They question if these earnings match the work done. The gap between CEO pay and average worker pay adds fuel to the fire. This topic brings up important social and economic concerns.

Public Perception And Criticism

Many view CEO incomes as too high. This view grows when workers earn far less. People feel CEOs get rewarded more than they deserve. Media often highlights the huge paychecks. This coverage shapes public opinion strongly. Some believe these salaries cause social inequality. Others see them as a sign of success. The debate continues in homes and workplaces alike.

Regulation And Reform Efforts

Governments try to address these concerns. Laws aim to limit excessive CEO pay. Some rules require companies to disclose salaries clearly. This transparency helps shareholders and the public. Efforts also include tying pay to company performance. Reform plans seek a fairer balance in earnings. Yet, critics say changes don’t go far enough. The push for reform remains an ongoing challenge.

Future Trends In Ceo Compensation

CEO pay is changing. Companies rethink how they reward their leaders. These shifts affect annual incomes and company culture. Trends show a move toward fairer and clearer pay systems. Understanding these trends helps explain future CEO earnings.

Shifts In Pay Structures

Many companies now link CEO pay to company results. Bonuses depend on profits, stock price, or meeting goals. This makes pay less fixed and more performance-based. Some firms use more stock options and fewer fixed salaries. This motivates CEOs to focus on long-term success.

Increasing Transparency

More companies share detailed information about CEO pay. This helps investors and workers see how earnings are decided. Laws in some countries require public reports on executive pay. Transparency builds trust and holds companies accountable. It can also reduce unfair pay gaps inside firms.

Credit: www.threads.com

Credit: www.bloomberg.com

Frequently Asked Questions

What Factors Influence A Ceo’s Annual Income?

A CEO’s income depends on company size, industry, and performance. Stock options, bonuses, and base salary also impact total earnings significantly.

How Much Do Ceos Earn On Average Yearly?

On average, CEOs earn between $150,000 to over $10 million annually. This varies widely by company scale and sector.

Do Ceo Bonuses Affect Their Total Annual Income?

Yes, bonuses can make up a large portion of a CEO’s income. They are often tied to company performance and goals.

Is Ceo Compensation Mostly Salary Or Stock Options?

CEO pay often combines salary, bonuses, and stock options. Stock options align CEO interests with company growth and shareholder value.

Conclusion

CEO annual income varies widely by company size and industry. Many factors affect their pay, including bonuses and stock options. Some CEOs earn millions, while others make much less. Understanding these differences helps you see the big picture. CEO pay often reflects company success and market demands.

This topic remains important for anyone curious about business leadership. Keep these points in mind when reading about CEO salaries. It’s a complex but interesting subject to explore.