Need quick cash but don’t want to go through a complicated loan process? Borrowing money from Cash App might be the simple solution you’re looking for.

If you’ve ever wondered how to borrow money from Cash App, you’re in the right place. This guide will walk you through every step—from checking if you’re eligible to getting the money in your account fast. Plus, you’ll learn insider tips to increase your chances of approval and avoid common pitfalls.

Keep reading to discover how you can use Cash App to solve your short-term financial needs easily and safely.

Cash App Borrow Basics

Cash App offers a simple way to borrow money directly within the app. This feature helps users access small loans quickly without visiting a bank. Understanding how Cash App Borrow works is important before using it. This guide explains the basics clearly and simply.

Knowing who can use the borrow feature and what it involves helps you decide if it fits your needs. The borrowing process is fast, but eligibility rules apply. Let’s explore the main points.

What Is Cash App Borrow

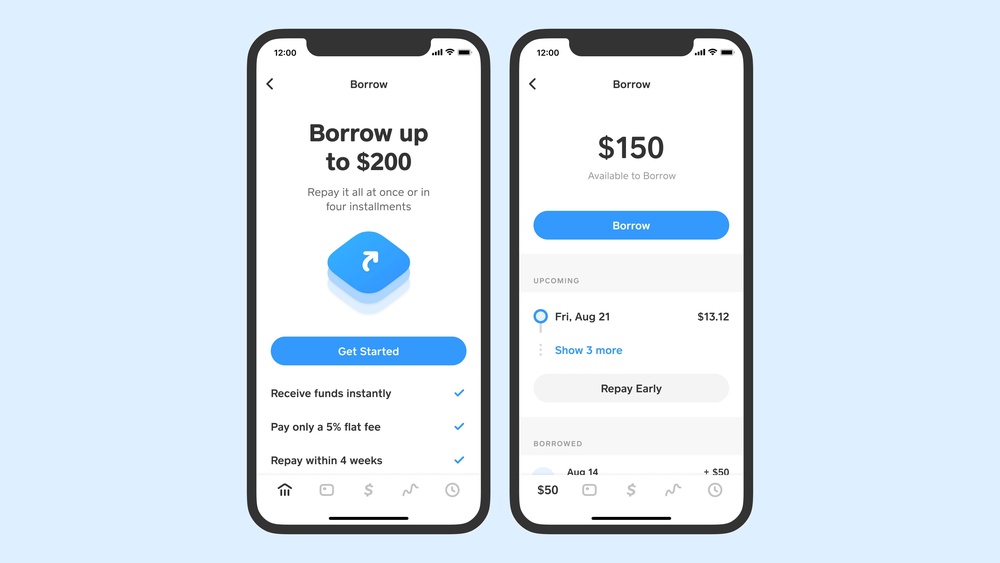

Cash App Borrow lets users take short-term loans from their Cash App balance. The loan amount varies based on your account history and activity. It works like a small personal loan, deposited instantly to your Cash App wallet.

Users repay the loan with a fixed fee, not traditional interest. The repayment schedule is clear, with options to pay weekly or in one sum. Borrowing money this way avoids credit checks and long waits.

Who Can Access Borrow Feature

Access to Cash App Borrow depends on your account activity and history. Not all users will see the borrow option immediately. Cash App evaluates your usage, payments, and direct deposits to decide eligibility.

Users with regular Cash App activity, such as sending or receiving money and using the Cash Card, have better chances. Setting up direct deposit also improves your eligibility. The more active and reliable your account, the more likely you can borrow.

Credit: www.youtube.com

Checking Eligibility

Checking your eligibility is the first step to borrow money from Cash App. The app does not allow everyone to borrow funds. It uses specific rules to decide who qualifies. Understanding these rules helps you prepare your account and increase your chances of approval.

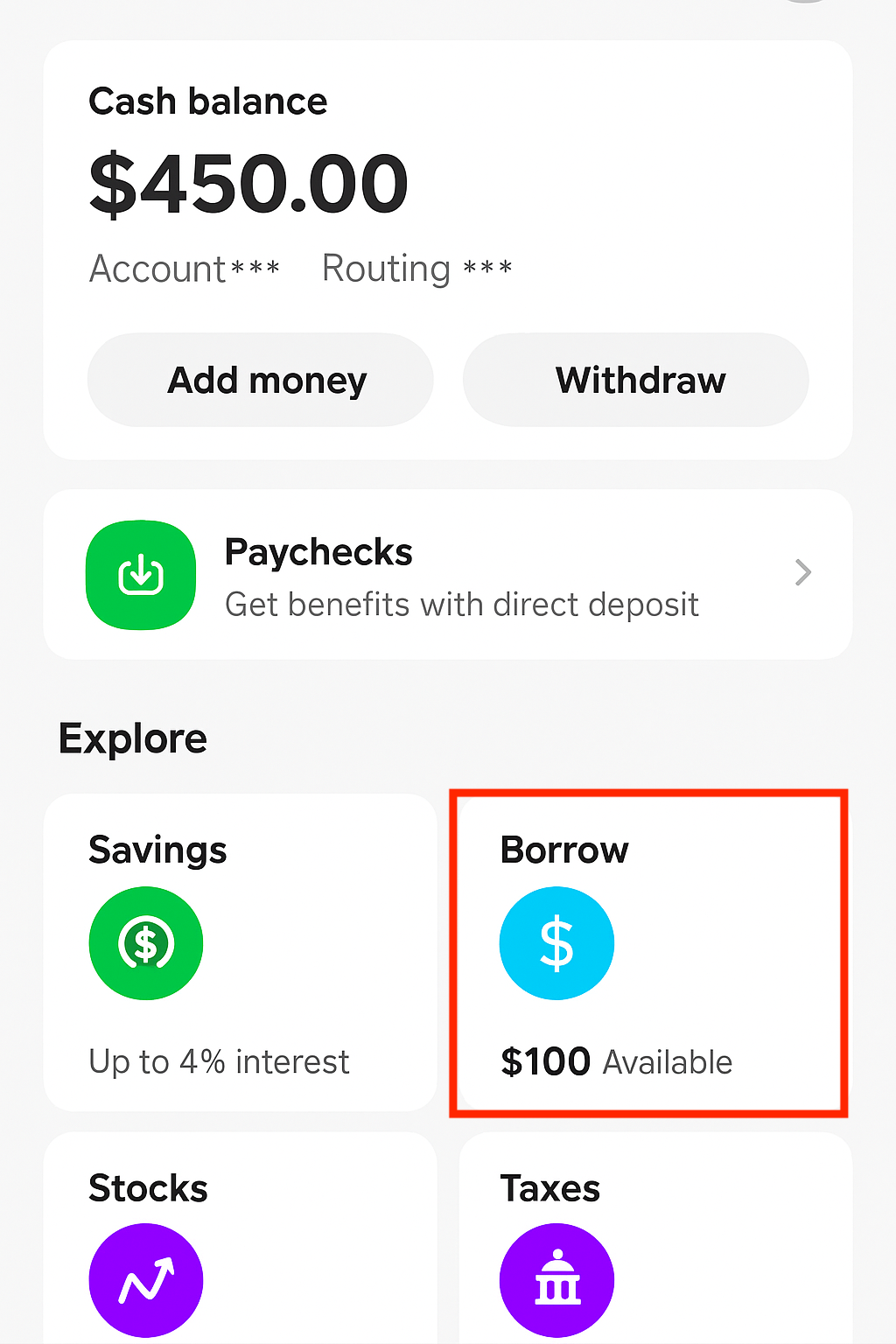

Cash App looks at several factors before showing the borrow option. You can check your status inside the app under the Banking tab. If you meet the requirements, the Borrow button appears. If not, you need to meet certain criteria first. These include direct deposit activity, Cash Card usage, account history, and state rules.

Direct Deposit Requirements

Cash App requires regular direct deposits to qualify for borrowing. Direct deposits show steady income and financial stability. You must have recurring deposits from your employer or government benefits. One-time or irregular deposits usually do not count. The more frequent and consistent your deposits, the better your chances.

Cash Card Usage

Using the Cash Card often helps build your borrowing eligibility. Cash App tracks your spending and usage patterns. Frequent transactions with the Cash Card prove active account use. This activity signals responsibility and increases your borrow limit. Simply owning the Cash Card is not enough; use it regularly for purchases.

Account Activity Factors

Cash App reviews your overall account activity before allowing loans. This includes your balance history, transaction volume, and repayment behavior. Keeping a stable balance and making timely payments improve your eligibility. Avoid frequent overdrafts or suspicious transactions. A clean account history shows you as a reliable borrower.

State Restrictions

Borrowing through Cash App is not available in all states. Some states have laws that restrict or regulate short-term loans. Cash App complies with these local rules and may block borrowing in those areas. Check if your state supports Cash App borrowing before applying. This information is usually found in the app’s terms or help section.

Activating Borrow On Cash App

Activating Borrow on Cash App is the first step to access short-term loans. This feature allows users to borrow money directly within the app. Activation depends on your account status and usage history. Follow simple steps to find and enable the Borrow option quickly.

Finding The Borrow Button

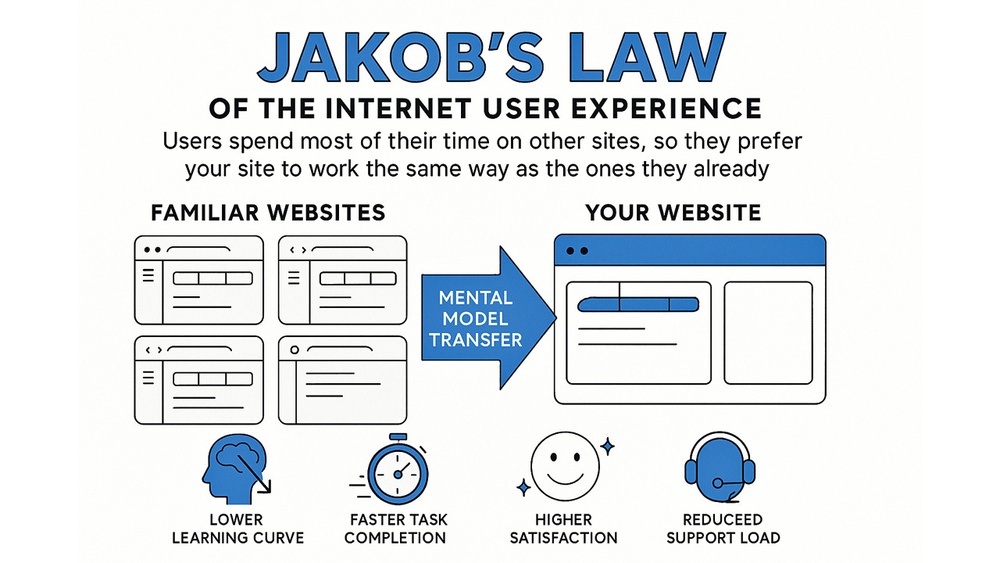

Open Cash App and tap the Banking icon on your main screen. Scroll through the options to see if the Borrow button is visible. This button appears only for eligible users. If you do not see it, keep using the app regularly. Eligibility improves with activity like direct deposits and Cash Card usage.

Completing Verification Details

Tap the Borrow button to start the process. You will need to provide some personal information. Enter your Social Security Number, full name, date of birth, and address if asked. This verification helps Cash App confirm your identity. After completing these details, review the loan terms carefully. Confirm to activate Borrow and receive funds instantly.

Steps To Borrow Money

Borrowing money from Cash App is a simple process that many users find helpful. The app offers a quick way to get funds directly to your account. Follow the steps below to borrow money easily and safely.

Selecting Loan Amount

First, open Cash App and tap the Banking tab. If you qualify, you will see a “Borrow” button. Tap on it to start the process. Next, choose the amount you want to borrow. The app will show you the available loan amounts based on your eligibility. Pick the amount that fits your needs. Keep in mind the limits set by Cash App.

Reviewing Loan Terms

After selecting the loan amount, carefully read the loan terms. This includes the total repayment amount, interest rate, and fees. Check the due date for repayment as well. Understanding these details helps avoid surprises later. Take your time to review everything before proceeding.

Confirming And Receiving Funds

Once you agree with the terms, confirm your loan request. You may need to enter personal details such as your Social Security Number and date of birth. After confirmation, Cash App will send the borrowed money directly to your balance. Usually, funds arrive instantly or within a few minutes. You can then use the money for your needs right away.

Repayment Options

Repaying a loan borrowed from Cash App is simple and flexible. Understanding your repayment options helps you manage your loan easily. You can choose methods and schedules that fit your needs. Timely payments have a strong impact on your account and borrowing ability.

Payment Methods

Cash App offers multiple payment methods for loan repayment. You can repay using your linked bank account or Cash App balance. Automatic payments can be set up for convenience. Manual payments are also allowed through the app. Using the Cash Card is another option to make payments quickly.

Repayment Schedules

Cash App provides flexible repayment schedules to suit your budget. You may repay weekly or in one lump sum. Some loans allow partial payments as you receive income. The due date is clearly stated when borrowing. Early repayment is possible without penalties.

Impact Of Timely Payments

Making payments on time benefits your Cash App borrowing history. It helps maintain or improve your eligibility for future loans. Late or missed payments can lead to extra fees or restrictions. Timely repayment builds trust with Cash App’s lending system. It keeps your account in good standing and avoids complications.

Improving Borrow Eligibility

Improving your eligibility to borrow money from Cash App requires consistent app usage and good financial habits. Cash App evaluates how you use the service to decide if you qualify for a loan. Small steps can increase your chances of approval and better loan terms.

Focus on actions that show steady income flow and responsible account management. These steps build trust with Cash App’s lending system.

Setting Up Direct Deposit

Direct deposit proves you have a steady income. It shows Cash App that you receive regular payments. Set up your paycheck to deposit directly into your Cash App balance. This improves your borrow eligibility faster than occasional deposits.

Regular income helps Cash App assess your ability to repay a loan. Without direct deposit, it is harder to qualify for borrowing.

Using Cash Card Frequently

Using your Cash Card often signals active account use. Spend with your Cash Card for groceries, bills, or small purchases. Frequent use shows Cash App you manage your funds responsibly.

Regular transactions help build a positive account history. This history plays a key role in borrowing decisions.

Maintaining Account Health

Keep a positive balance and avoid overdrafts. Pay back any borrowed money on time. Late payments reduce your chance to borrow in the future.

Keep your account free from suspicious activity. A healthy account means no frozen funds or disputes. This builds trust with Cash App’s system.

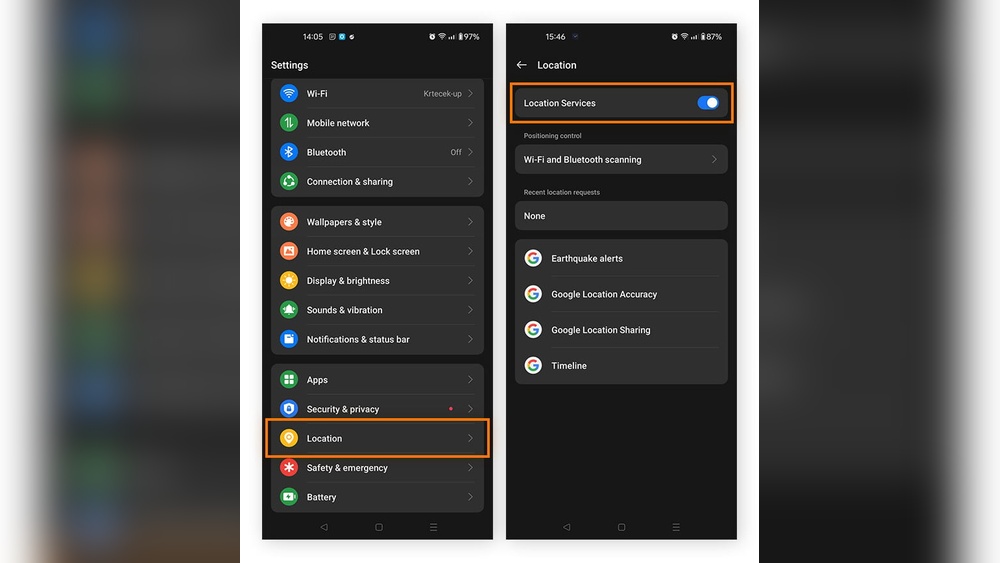

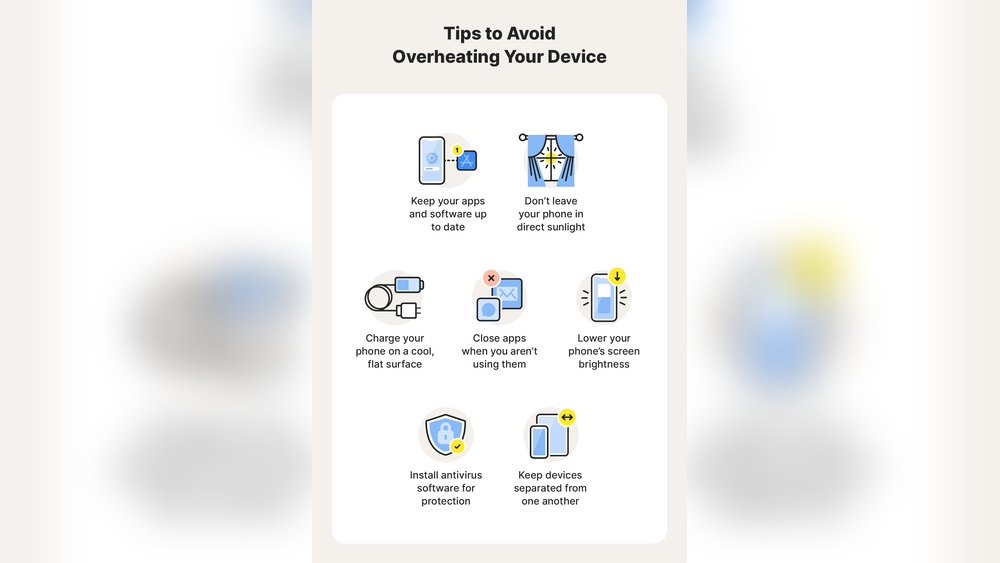

Keeping App Updated

Always update Cash App to the latest version. New updates fix bugs and improve app performance. A smooth-running app helps Cash App track your activity accurately.

Older versions might miss important features or security checks. Staying updated ensures you do not miss borrowing opportunities.

Common Borrow Issues

Borrowing money from Cash App is simple but may face some common issues. These problems can block access or complicate repayments. Understanding these issues helps users handle them quickly. Here are some frequent concerns and ways to manage them.

Why Borrow May Not Appear

Not all users see the borrow option in their Cash App. The feature shows only to eligible accounts. Eligibility depends on account activity, history, and verification status. New users or those with low activity may not qualify yet. Using the app regularly and linking a bank account can improve chances. Cash App updates eligibility periodically, so checking often helps.

Handling Unpaid Loans

Unpaid loans cause issues with borrowing again. Missing repayments can block future borrowing features. Cash App may charge late fees or restrict account functions. It is important to repay loans on time to avoid extra costs. If you struggle to repay, contact Cash App support for advice or payment plans. Keeping a good repayment record improves trust and eligibility.

Dealing With Ineligible Accounts

Some accounts cannot borrow due to restrictions or verification issues. Ineligible accounts include those not meeting age or residency rules. Also, accounts flagged for suspicious activity lose borrowing privileges. Updating personal information and verifying identity may help regain eligibility. Users should review Cash App policies and follow instructions to fix issues. Patience is key as eligibility may take time to restore.

Credit: www.youtube.com

Risks And Considerations

Borrowing money from Cash App offers quick access to funds. Yet, it carries risks and important points to consider. Understanding these can protect your finances and credit health.

Short-term Nature Of Borrow

Cash App loans are designed for short-term use only. You must repay the borrowed amount quickly, usually within a few weeks. This fast repayment schedule can strain your budget. Plan carefully to avoid trouble meeting deadlines.

Late Payment Consequences

Missing a payment on your Cash App loan can cause problems. Late payments may trigger extra fees and higher interest charges. They can also hurt your credit score. Repeated delays reduce your chances of future borrowing.

Fee Awareness

Cash App loans include fees and interest that increase the total repayment. These costs vary based on how much you borrow and how long you take to pay back. Review all fees before borrowing to avoid surprises. Knowing the full cost helps you borrow responsibly.

Credit: smart.dhgate.com

Frequently Asked Questions

How Do I Activate A Borrow On Cash App?

Open Cash App and tap the Banking icon. If eligible, tap the “Borrow” button. Select an amount, review terms, enter details, and confirm to activate borrowing.

Can You Borrow Money From Your Cash App?

You can borrow money from Cash App if eligible. The “Borrow” option appears in the Banking tab. Loans are small, short-term, and repayable via your Cash App balance or linked card. Eligibility depends on account activity, direct deposits, and Cash Card usage.

Why Is Borrow Not Showing Up On Cash App?

Borrow may not show on Cash App if you lack eligibility, haven’t set up direct deposit, or the app isn’t updated. Use Cash Card often and keep your account active to unlock this feature.

How Do You Get A Loan On Cash App?

Open Cash App and tap the Banking icon. Tap “Borrow” if available, select amount, review terms, enter details, and confirm to get funds instantly. Maintain direct deposits and use your Cash Card to improve eligibility. Repay loans on time to avoid fees.

Conclusion

Borrowing money from Cash App can be simple and fast. Check your app often to see if the borrow option appears. Always review the terms before accepting any loan. Use the borrowed money wisely and repay on time to avoid extra fees.

Building a good Cash App history helps increase your chances of eligibility. Remember, this service is for short-term needs, not large loans. Stay responsible and manage your funds carefully to keep your financial health strong.