Saving money might feel impossible when your income is low. But here’s the truth: you can start building your savings right now, no matter how tight your budget is.

What if small changes could add up to real financial security? Imagine having a safety net for emergencies or a little extra for something you want. This guide will show you simple, practical steps you can take today to begin saving—even if every dollar counts.

Ready to take control of your money and create a brighter financial future? Let’s dive in.

Credit: www.nearpays.com

Set A Realistic Budget

Setting a realistic budget is the first step to start saving money on a low income. A clear budget helps control spending and shows where every dollar goes. It makes saving simple and achievable. Without a budget, money slips away unnoticed.

Creating a budget means knowing exactly how much money comes in and how much goes out. This knowledge gives power to change habits. The goal is to spend less than you earn, even if the amount is small.

Track Every Expense

Write down every expense, no matter how small. Tracking helps see where money disappears. Use a notebook, an app, or a simple spreadsheet. Check daily or weekly. Tracking makes you aware and stops careless spending.

Include all costs: food, transport, bills, and small treats. Even a $1 coffee adds up. Tracking every dollar reveals real spending habits. This step is key to setting a budget that works.

Identify Spending Leaks

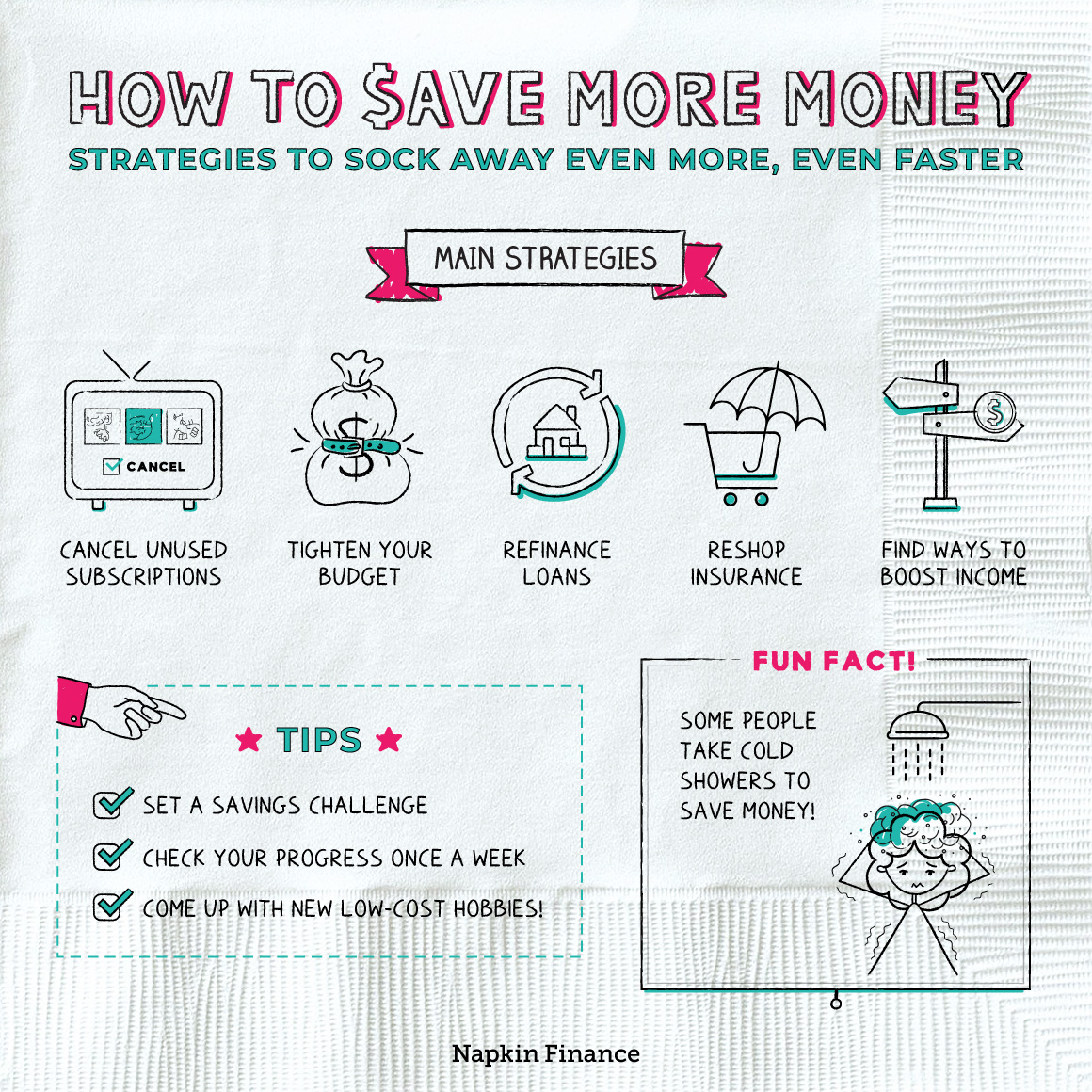

Look at your tracked expenses to find leaks. These are small costs that drain money over time. Examples include unused subscriptions, frequent takeout meals, or impulse buys.

Cut or reduce these leaks first. Cancel subscriptions not in use. Cook at home to save on eating out. Avoid shopping for things you don’t need. Fixing leaks frees up money for savings.

Finding and fixing spending leaks makes budgeting easier. It creates space in your budget for saving, even with a low income.

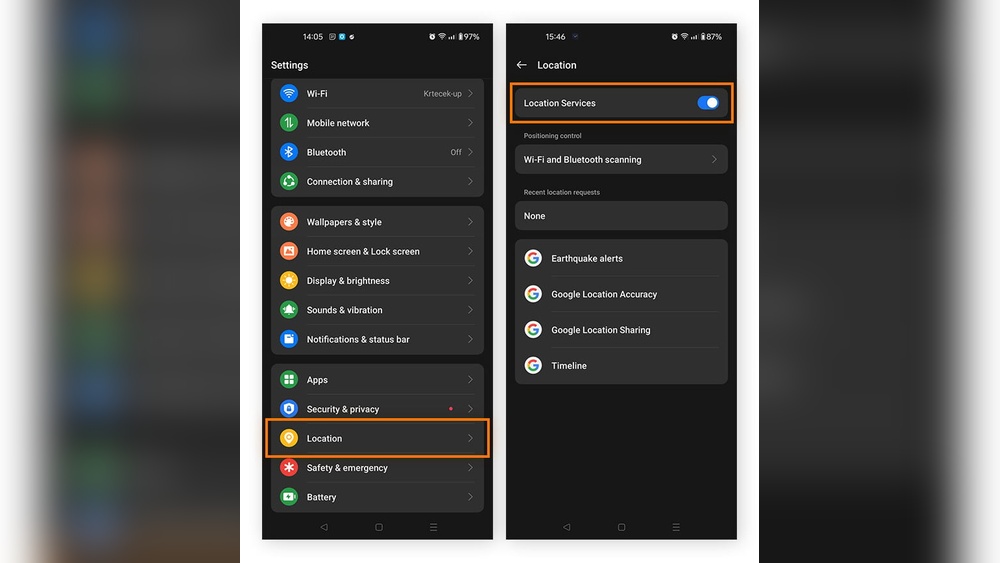

Credit: www.youtube.com

Cut Non-essential Costs

Cutting non-essential costs is a key step to start saving money with low income. Small expenses add up fast and reduce your ability to save. Focus on trimming spending that does not affect your daily needs. This frees up money to build your savings gradually and steadily.

Cancel Unused Subscriptions

Many people pay for subscriptions they rarely use. Streaming services, gym memberships, or magazines can drain your budget. Review all your subscriptions carefully. Cancel those you do not use every month. This simple step can save you a significant amount each year.

Limit Dining Out

Eating out often costs much more than cooking at home. Try to reduce the number of restaurant meals each week. Prepare simple meals using basic ingredients. Pack lunches for work or school instead of buying food outside. This lowers expenses and improves your saving ability.

Reduce Utility Bills

Utility bills can be a major part of monthly expenses. Save energy by turning off lights when not needed. Use energy-efficient bulbs and unplug devices after use. Lower the thermostat in winter and use fans instead of air conditioning in summer. These small changes help cut down utility costs.

Smart Food Savings

Saving money on food is one of the easiest ways to stretch a low income. Smart food savings help you spend less without giving up good meals. Simple habits can cut your grocery bills and keep your family well fed. Focus on planning, buying wisely, and preparing meals at home.

Meal Plan And Cook At Home

Plan your meals for the week before shopping. This avoids buying extra food you do not need. Cooking at home costs much less than eating out. You control the ingredients and portions. Use simple recipes with affordable ingredients. Batch cook meals and freeze leftovers to save time and money.

Buy Generic And Use Coupons

Choose store brands instead of name brands. Generic products often taste the same but cost less. Look for coupons in newspapers, apps, or online. Coupons reduce prices on items you already buy. Combine sales with coupons to save even more. Keep a small folder or app for easy coupon access.

Pack Lunches

Bringing lunch from home saves money every day. Prepare simple sandwiches, salads, or leftovers in reusable containers. Avoid buying lunch at work or school. Packing your lunch lets you control portion sizes and nutrition. It also reduces impulse purchases of snacks or drinks.

Automate Your Savings

Automating your savings helps you build money habits without thinking. It makes saving simple and consistent. Even with a low income, small amounts saved regularly add up fast.

Set a system that moves money to savings automatically. This reduces the chance of spending it by mistake. Automation keeps your savings growing steadily over time.

Set Up Automatic Transfers

Use your bank’s tools to move money from checking to savings. Choose a small amount that fits your budget. Schedule transfers on payday or any regular day.

This method saves money before you can spend it. You avoid the struggle of deciding each month. Over time, your savings grow without extra effort.

Treat Savings As A Bill

Think of savings like a monthly bill you must pay. Set it as a fixed cost, not an optional action. Pay yourself first before spending on anything else.

Prioritize savings like rent or utilities. This mindset helps keep your goals clear. It builds discipline and protects your future finances.

Find Extra Income

Finding extra income can help you save money even with a low income. It gives you more cash to put aside each month. Small amounts add up over time. This approach eases the pressure on your main income. You can use the extra money to build your savings faster. Here are two simple ways to find extra income.

Explore Side Hustles

Side hustles are small jobs you do outside your regular work. They can fit your skills and schedule. Examples include babysitting, dog walking, or freelance writing. Use your free time to earn extra cash. Online platforms make it easy to find side jobs. Choose tasks that you enjoy and can do well. This method boosts your income without quitting your job.

Sell Unwanted Items

Look around your home for things you no longer need. Clothes, electronics, or furniture can have value. Sell these items online or at local markets. This clears clutter and puts money in your pocket. Pricing items fairly helps them sell faster. Use the money earned to start or grow your savings. This is a quick way to find extra income without extra work.

Adopt A Frugal Mindset

Adopting a frugal mindset is key to saving money on a low income. It means changing how you think about spending and valuing what you have. Small changes in daily habits lead to big savings over time. Being frugal is not about being cheap. It is about making smart choices that protect your money.

Say No To Impulse Purchases

Impulse purchases drain your budget fast. Avoid buying things on a whim. Pause before spending. Ask yourself if you really need the item. Make a shopping list and stick to it. This simple habit stops extra costs and saves money.

Embrace Diy Solutions

Doing things yourself saves money. Fix small problems at home instead of hiring help. Cook meals instead of eating out. Make gifts or decorations instead of buying them. DIY also gives a sense of pride and control over your expenses.

Use Cash Envelopes

Cash envelopes help control spending. Allocate money for categories like food, transport, and entertainment. Put cash in separate envelopes for each category. When the money is gone, stop spending in that area. This method keeps your budget clear and prevents overspending.

Manage Debt Wisely

Managing debt wisely is crucial when trying to save money on a low income. Debt can quickly drain your finances if left unchecked. Taking control of your debt helps free up money for saving. A clear plan to handle debt reduces stress and builds financial confidence.

Focus On High-interest Debt

Start by identifying debts with the highest interest rates. These costs grow fast and trap you in more payments. Pay extra on these debts to reduce the total interest paid. Even small extra payments lower the balance quicker. This strategy saves money and shortens debt life.

Negotiate Lower Rates

Call your lenders to ask for lower interest rates. Explain your situation honestly and request better terms. Many companies prefer lower rates to missed payments. Lower rates reduce monthly payments and total debt cost. Keep track of all negotiations and confirm any changes in writing.

Use Community Resources

Using community resources can help stretch your budget and boost savings. Local stores and deals offer lower prices and special discounts. These options make everyday spending easier to manage. Being aware of these resources helps you avoid overspending. Saving money starts with smart choices close to home.

Shop At No-frills Stores

No-frills stores sell essentials without fancy packaging or extra services. These stores often have lower prices than big supermarkets. You can find food, cleaning supplies, and personal care items at good prices. Buying only what you need saves money and reduces waste. These stores focus on value, helping you spend less each trip.

Leverage Local Deals

Local deals include coupons, discounts, and sales in your area. Check community boards, flyers, and websites for current offers. Farmers markets and thrift shops often have bargains. Use apps to find daily discounts on groceries and essentials. Taking advantage of these deals lowers your monthly expenses significantly.

Credit: napkinfinance.com

Frequently Asked Questions

How To Start Saving Money With Little Income?

Start by tracking all expenses to identify savings opportunities. Cut non-essential spending like subscriptions and dining out. Plan meals and buy store brands. Automate small transfers to savings. Seek extra income through side jobs or selling items. Prioritize paying off high-interest debt.

What Is The $27.40 Rule?

The $27. 40 rule suggests saving $27. 40 regularly to build a consistent savings habit. It helps automate small, manageable savings. This approach promotes financial discipline and gradual wealth growth without overwhelming budgets.

How To Save Money When You Are Poor?

Create a strict budget and track all expenses. Cut non-essential spending like subscriptions and dining out. Plan meals, buy generic brands, and reduce energy use. Seek side jobs or sell unused items. Automate small savings and prioritize paying off high-interest debt.

Say no to impulse purchases.

What Is The 3 6 9 Rule Of Money?

The 3 6 9 rule of money suggests saving $3 daily, $6 weekly, and $9 monthly. It builds consistent saving habits effectively.

Conclusion

Saving money on a low income takes small, steady steps. Track your spending and cut extra costs first. Choose cheaper options and avoid impulse buys. Set clear goals to keep your motivation strong. Remember, even small savings add up over time.

Stay patient and consistent with your plan. Everyone can build financial security, no matter their income. Start today and watch your savings grow little by little.