Want to boost your net worth without leaving the comfort of your home? It’s easier than you think.

Whether you’re looking to save more, invest smarter, or create new income streams, small changes can lead to big results. Imagine watching your financial confidence grow day by day, just by taking simple, practical steps right where you are. Ready to discover how to make your money work harder for you?

Keep reading, and you’ll find straightforward ways to increase your net worth from home—no complicated jargon, just clear actions you can start now.

Boost Income From Home

Boosting your income from home offers a practical way to grow your net worth. It requires little to no upfront investment and uses resources you already have. Simple methods can bring steady extra cash without complicated setups. Explore options that fit your skills and time. You can start earning more right away.

Flip Items You Own

Look around your home for items you no longer need. Old electronics, clothes, or furniture can have value. Clean and repair them to increase appeal. Use online marketplaces to sell these items quickly. Flipping helps clear clutter and adds cash to your pocket.

Start Reselling On Amazon

Amazon offers a large platform for reselling products. Find deals on clearance or wholesale items. List them on Amazon with clear photos and descriptions. Track sales and customer feedback to improve your listings. Reselling requires effort but can grow into a steady income stream.

Create And Sell Online Courses

Share your knowledge by creating simple online courses. Choose topics you know well or skills others want to learn. Use platforms like Udemy or Teachable to host your courses. Promote your course on social media or blogs. This method creates passive income over time.

Freelance Or Remote Work Options

Freelancing offers flexible work you can do from home. Write, design, program, or provide virtual assistance. Websites like Upwork and Fiverr connect you with clients worldwide. Remote jobs in customer service or marketing also pay well. Build your profile and gain experience gradually.

Cut Expenses Smartly

Curtailing expenses is a direct way to increase your net worth from home. Spending less leaves more money to save and invest. Smart expense-cutting does not mean giving up everything. It means making thoughtful choices about where your money goes. Small changes add up over time and build financial strength.

Build And Stick To A Budget

Start by listing all your income and expenses. Use this list to create a clear budget. Track your spending each day and compare it to your budget. Adjust as needed to avoid overspending. A budget helps control impulses and keeps your money on track. It’s a simple tool that guides smart spending habits.

Reduce Recurring Costs

Look at monthly bills like subscriptions, utilities, and phone plans. Cancel services you rarely use. Negotiate lower rates or switch to cheaper providers. Cutting these costs frees up cash every month. Small monthly savings build up and improve your financial health. Regularly review your bills to find new savings.

Keep Vehicles Longer

Driving your car for more years saves money on new car purchases. New cars lose value quickly in the first few years. Maintaining your current vehicle well delays the need for a new one. This reduces monthly payments, insurance, and registration fees. Keeping cars longer is a smart way to cut big expenses.

Avoid Lifestyle Inflation

As income grows, resist the urge to spend more. Maintain your current lifestyle and save the extra money. Spending more with every raise slows net worth growth. Keep wants and needs clear to avoid unnecessary purchases. Saving the difference builds wealth steadily over time.

Manage And Eliminate Debt

Managing and eliminating debt is a key step to increase your net worth from home. Debt reduces your savings and limits your financial freedom. Paying off debt frees up money for investing and saving. It also improves your credit score, helping you get better loan terms in the future.

Start by understanding your debt types and balances. Create a clear plan to reduce what you owe. Stick to your payments and avoid new debts. This focus helps you build wealth steadily over time.

Prioritize High-interest Debt

Focus on paying off debts with the highest interest rates first. These debts cost you the most money over time. Credit cards often have high rates. Paying these down fast saves you interest fees. This approach reduces your total debt faster.

Use Debt Snowball Or Avalanche

Choose a method to pay off debts efficiently. The snowball method pays off the smallest debts first. This gives quick wins and motivation. The avalanche method targets debts with the highest interest first. It saves more money in the long run. Pick the one that fits your style and stick with it.

Avoid New Unnecessary Debt

Stop adding new debt while paying off old ones. Avoid unnecessary purchases that require borrowing. Use cash or debit cards to control spending. This habit keeps your debt from growing. It also helps you live within your means and save more.

Credit: www.amazon.com

Invest For Long-term Growth

Investing for long-term growth is a smart way to build your net worth from home. It focuses on steady gains over time rather than quick wins. This approach helps your money grow safely and reliably. Consistency and patience are key to success in long-term investing.

Maximize Retirement Contributions

Put as much as you can into retirement accounts like 401(k)s or IRAs. These accounts offer tax benefits that help your money grow faster. Try to contribute at least enough to get any employer match. This is free money that boosts your savings.

Use Low-cost Index Funds

Choose index funds with low fees to keep more of your returns. These funds follow the market and offer broad diversification. They lower risk by spreading your investment across many companies. This is a simple way to build wealth steadily.

Automate Investments

Set up automatic transfers to your investment accounts. This creates a habit of saving and investing regularly. It removes the need to remember or decide each time. Automated investing helps you stay consistent and grow wealth over time.

Reinvest Dividends

Put dividends back into your investment instead of spending them. Reinvesting increases the total value of your portfolio. It allows you to buy more shares without adding extra money. This method boosts growth through compounding returns.

Build Emergency Savings

Building emergency savings is essential to increase your net worth from home. It provides a safety net during unexpected events. This fund helps cover costs without borrowing or using credit cards. It brings peace of mind and financial stability.

Set Up A Separate Savings Account

Open a savings account solely for emergencies. Keep this money away from daily spending. Choose an account with easy access but separate from checking. This prevents accidental withdrawals and keeps funds secure.

Aim For 3-6 Months Of Expenses

Calculate your monthly essential expenses. Include rent, food, utilities, and transportation. Save enough to cover 3 to 6 months of these costs. This amount supports you if income stops suddenly.

Use Automatic Transfers

Set up automatic transfers from your checking to savings. Choose a fixed amount each week or month. This builds your emergency fund without extra effort. Consistency is key to growing savings steadily.

Credit: www.jefferson-bank.com

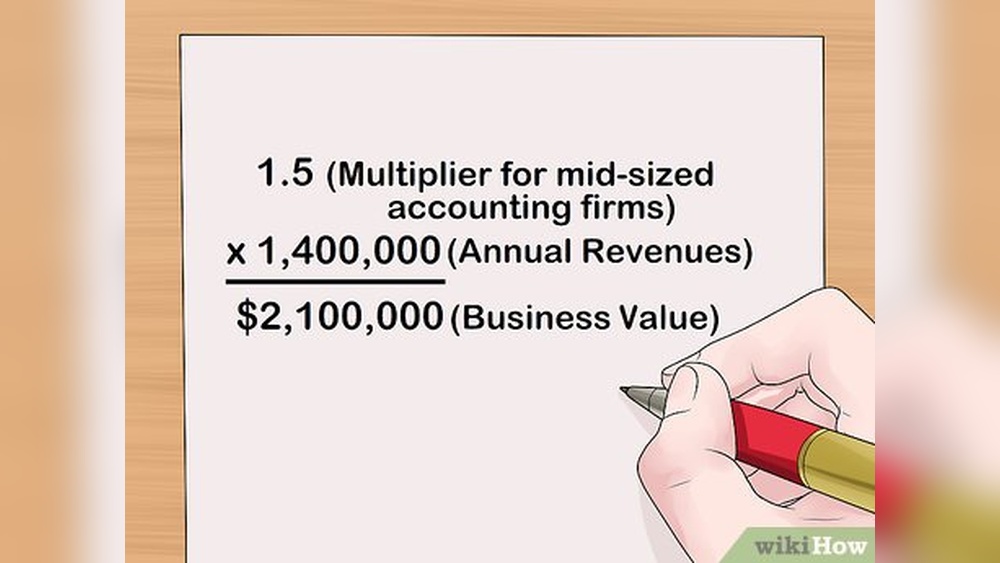

Leverage Homeownership

Owning a home is more than having a place to live. It is a powerful way to build wealth over time. By using your home wisely, you can increase your net worth without leaving your house. Homeownership offers several options to grow your financial value steadily and securely.

Build Equity Through Mortgage

Every mortgage payment helps you own more of your home. This ownership is called equity. Equity grows as you pay down your loan balance. It also rises if your home value increases. Building equity is a safe way to increase your net worth. It acts like a savings plan inside your house.

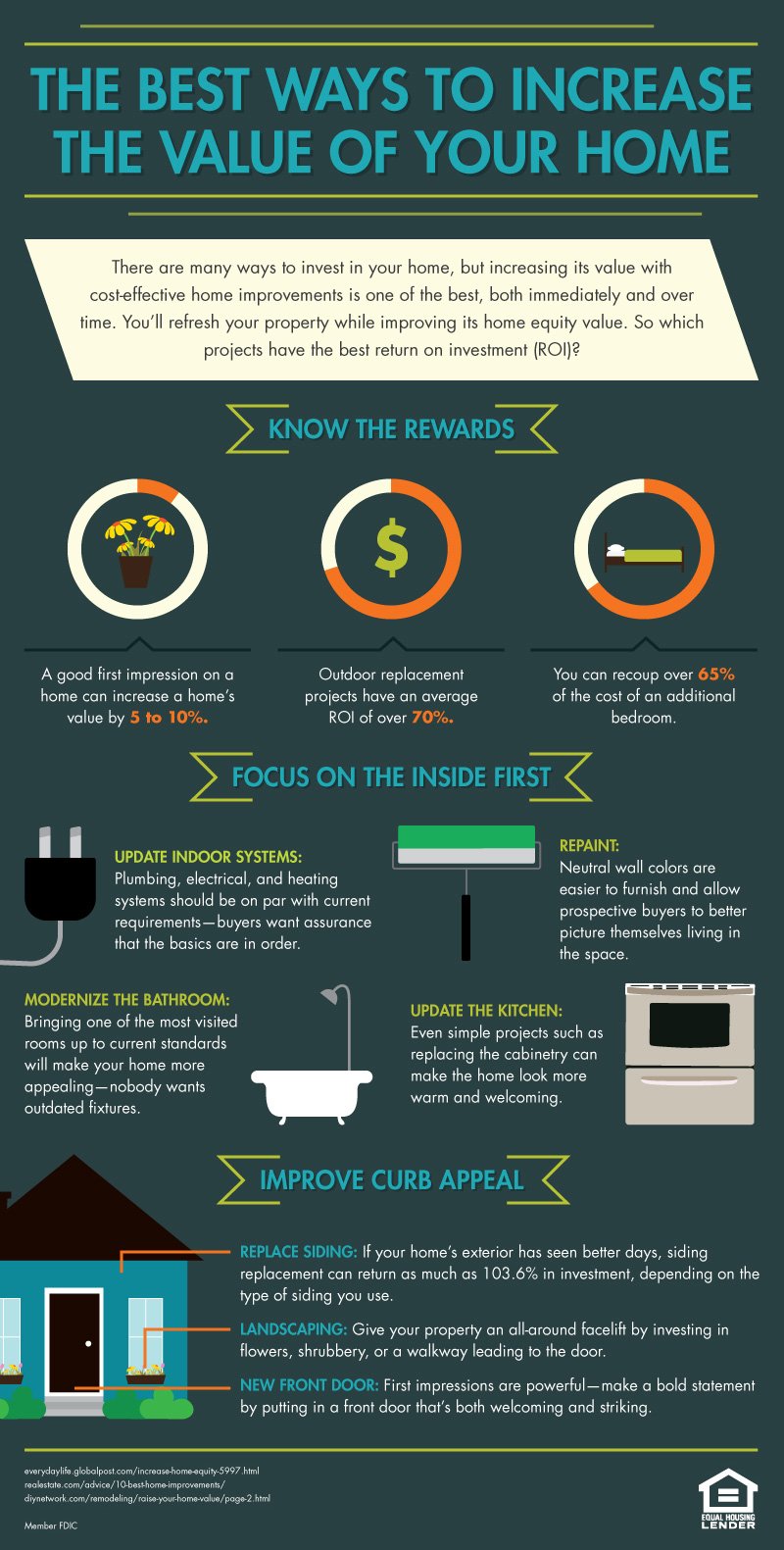

Consider Home Improvements

Making smart upgrades can boost your home’s value. Focus on projects that add lasting appeal and usefulness. Simple changes like fresh paint or better lighting attract buyers. Bigger projects like kitchen or bathroom updates add more value. These improvements increase your home’s market price and your net worth.

Explore Rental Income Opportunities

Renting part of your home brings extra money each month. You can rent a room, basement, or separate unit. This income helps cover mortgage costs and builds your savings. Rental income adds a steady cash flow, improving your financial strength. It turns your home into an income source without much effort.

Protect And Improve Credit

Protecting and improving your credit is essential for increasing your net worth from home. Good credit opens doors to better loan rates and financial opportunities. Poor credit can lead to higher costs and missed chances. Take control of your credit health with simple habits that make a big difference.

Monitor Credit Reports

Check your credit reports regularly from the three major bureaus. Spot errors or suspicious activities early. Dispute any mistakes to keep your report accurate. Use free tools or official websites to get your reports. Staying informed helps avoid surprises that hurt your credit score.

Pay Bills On Time

Pay every bill by its due date. Late payments lower your credit score quickly. Set reminders or use automatic payments to stay on track. Consistent on-time payments build trust with lenders. This habit strengthens your credit profile over time.

Keep Credit Utilization Low

Use only a small portion of your available credit. Aim to keep balances under 30% of your credit limits. High credit usage signals risk and lowers your score. Paying down balances regularly improves your credit standing. Low utilization shows responsible credit management.

Adopt Wealth-building Habits

Building wealth starts with forming strong habits at home. Small actions each day can grow your net worth over time. Adopting smart money habits helps keep your finances on track. These habits create a solid foundation for financial success.

Focus on habits that save money and avoid unnecessary spending. Discipline and patience matter more than quick fixes. Consistent effort leads to steady growth in your savings and investments.

Save Before Spending

Set aside money before paying bills or buying things. Treat saving as a fixed expense every month. This habit ensures you build savings automatically. Avoid spending all your income first, then saving what is left.

Saving first helps resist impulse purchases. It creates a cushion for emergencies and future investments. Over time, this habit increases your net worth steadily.

Avoid Keeping Up With Others

Ignore pressure to spend like friends or neighbors. Buying things to impress others wastes money. Focus on your financial goals instead of others’ lifestyles. Comparing yourself to others can lead to poor money choices.

Live within your means and prioritize saving. This mindset protects your money and builds wealth. Financial peace comes from making choices that fit your life, not from matching others.

Start Saving Early

Begin saving as soon as possible, no matter the amount. Early saving benefits from compound growth, increasing wealth faster. Even small amounts grow significantly over many years.

Delaying saving makes it harder to catch up later. Start now to enjoy financial freedom sooner. Consistency beats large but irregular contributions.

Credit: wealthtender.com

Frequently Asked Questions

How To Turn $1000 Into $10000 In A Month?

Turn $1000 into $10,000 in a month by flipping items, reselling on Amazon, or trading high-demand products. Use skills for quick services or invest in high-risk, high-reward opportunities. Stay disciplined, research markets, and act fast to maximize profits safely.

How To Grow Net Worth Quickly?

Increase net worth quickly by maximizing income, cutting expenses, paying off high-interest debt, investing wisely, and building emergency savings.

What Is The 70/30/10 Rule Money?

The 70/30/10 rule divides income into 70% for needs, 30% for wants, and 10% for savings or debt repayment.

What Will Increase The Net Worth Of A Household?

Increasing household net worth requires boosting income, reducing debt, saving consistently, investing wisely, and maximizing retirement contributions. Owning a home builds equity, while budgeting and cutting expenses improve savings. Prioritize paying off high-interest debts and create an emergency fund to secure financial stability.

Conclusion

Increasing your net worth from home takes small, steady steps. Focus on saving more and spending less each day. Pay off debts to reduce financial stress and free up money. Invest in simple, long-term options to grow your assets. Use online learning to improve skills and earn more.

Keep track of your progress and adjust as needed. These easy actions add up over time. You hold the power to improve your financial future right now. Start today and watch your net worth grow.