Are you confident about where you stand financially? Knowing your net worth is one of the smartest moves you can make as a young professional.

It’s not just about numbers—it’s about understanding your financial health and making smart decisions that set you up for success. This Net Worth Checklist for Young Professionals will guide you step-by-step through everything you need to track, from your assets to your debts, so you can see the full picture.

Ready to take control of your money and start building real wealth? Keep reading to discover how simple actions today can lead to a stronger financial future tomorrow.

Net Worth Basics

Understanding the basics of net worth is essential for young professionals starting their financial journey. Net worth gives a clear picture of your financial health. It shows what you own and what you owe at a specific time. Tracking net worth helps in making smart money choices and setting realistic goals.

Assets Vs. Liabilities

Assets are things you own that have value. Examples include cash, savings, investments, and property. Liabilities are debts or money you owe. This can be loans, credit card balances, or mortgages. Net worth equals your total assets minus your total liabilities. Knowing the difference helps you see where your money stands.

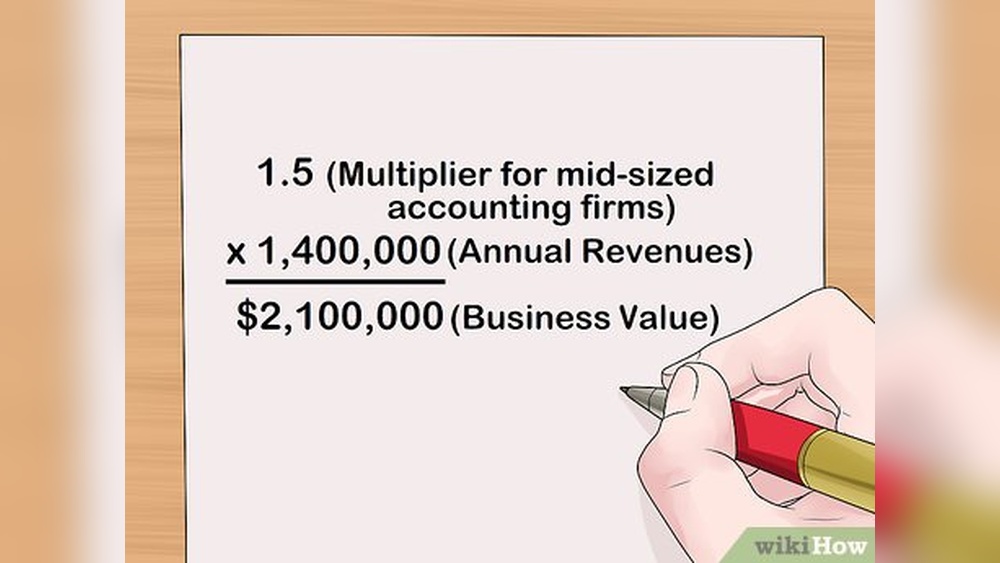

How To Calculate Net Worth

Start by listing all your assets. Include bank accounts, retirement funds, and valuables. Next, list all your liabilities. Add up credit card debt, student loans, and other obligations. Subtract total liabilities from total assets. The result is your net worth. Repeat this process regularly to track progress.

Why Net Worth Matters

Net worth shows your financial progress over time. It helps identify areas to improve or save more. A positive net worth means you own more than you owe. A negative net worth shows debts exceed assets. Knowing your net worth guides better financial decisions and builds confidence.

Credit: en.wikipedia.org

Setting Financial Goals

Setting clear financial goals is crucial for young professionals. It guides spending, saving, and investing habits. Goals help build a strong net worth over time. Without goals, money can slip away unnoticed. Defining what you want financially shapes your future decisions.

Start by distinguishing between short-term and long-term goals. Use a clear system to set goals that are achievable. Track your progress regularly to stay motivated and adjust plans as needed.

Short-term Vs. Long-term Goals

Short-term goals focus on what you want within months or a year. Examples include paying off a credit card or saving for a new laptop. They keep your daily finances balanced and stress low. Long-term goals take years to reach. Examples are buying a home or building retirement savings. Both types matter. Short-term goals support your immediate needs. Long-term goals secure financial freedom later. Knowing the difference helps you plan wisely.

Smart Goal Framework

Use the SMART framework to set strong financial goals. SMART means Specific, Measurable, Achievable, Relevant, and Time-bound. A specific goal clearly states what you want. A measurable goal lets you track progress with numbers. An achievable goal matches your current resources. A relevant goal fits your life priorities. A time-bound goal has a clear deadline. For example, “Save $1,000 in six months for emergency funds” is SMART. This method makes goals real and reachable.

Tracking Progress

Tracking progress helps keep your financial goals on course. Use apps, spreadsheets, or journals to record savings and debts. Review your numbers weekly or monthly. Celebrate small wins to boost motivation. If you miss a target, adjust your plan without giving up. Tracking also reveals spending patterns to improve. Consistent monitoring builds good financial habits. It turns goals into habits and success.

Budgeting Strategies

Budgeting strategies form the foundation of building solid net worth for young professionals. They help control money flow and avoid debt. Smart budgeting creates room for saving and investing. It also reduces financial stress and sets clear money goals.

Effective budgeting starts with planning and awareness. Knowing income and spending habits guides better money decisions. The following sections explain key budgeting steps that anyone can follow.

Creating A Realistic Budget

Start by listing all income sources. Include salary, bonuses, and side earnings. Then, write down fixed expenses like rent and utilities. Add variable costs such as groceries, transport, and entertainment.

Set spending limits for each category. Keep limits reasonable to avoid frustration. Leave a margin for unexpected costs. A realistic budget fits your lifestyle and goals.

Tracking Income And Expenses

Track every dollar earned and spent daily. Use apps, spreadsheets, or a simple notebook. Tracking reveals where money goes and spots wasteful habits.

Review records weekly or monthly. Check if spending stays within set limits. Adjust the budget if income or expenses change. Accurate tracking builds financial awareness.

Adjusting Spending Habits

Identify areas to cut back without hurting quality of life. Small changes add up over time. Try cooking more meals at home or using public transport.

Prioritize needs over wants. Delay purchases that don’t fit the budget. Redirect saved money toward savings or debt repayment. Smart spending boosts net worth steadily.

Building An Emergency Fund

Building an emergency fund is a key step for young professionals. It acts as a financial safety net during unexpected events. Having this fund reduces stress and avoids debt. Start small and grow your fund over time. This habit supports your long-term financial health.

How Much To Save

A good goal is to save three to six months of living expenses. This amount covers rent, food, bills, and other essentials. Start with a smaller target, like $500 or $1,000. Increase your goal as your income and expenses change. Saving steadily is better than waiting to save a large sum.

Where To Keep It

Keep your emergency fund in a place easy to access. A savings account with no withdrawal penalties works well. Avoid accounts that tie up your money or charge fees. Look for a bank offering good interest rates. Your fund should be safe but ready when needed.

When To Use It

Use your emergency fund only for true emergencies. Examples include medical bills, car repairs, or sudden job loss. Avoid using it for everyday spending or wants. Replenish the fund quickly after spending. This keeps you prepared for the next unexpected event.

Managing Debt Wisely

Managing debt wisely is a key step for young professionals building their net worth. Debt can either help or hurt your financial health. Handling it carefully keeps you on track toward financial goals. Smart management reduces stress and frees up money for savings and investment.

Understanding which debts need attention first is essential. Paying off high-interest debt quickly saves money. Using clear strategies speeds up repayment and avoids traps. Staying aware of common mistakes helps maintain control over your finances.

Types Of Debt To Prioritize

Start with debts that have the highest interest rates. Credit card balances usually carry the most costly rates. Next, focus on personal loans and payday loans. These debts grow fast if left unpaid. Student loans and mortgages often have lower interest and flexible terms. Prioritize paying off debts that drain your finances quickly. This approach reduces overall costs and stress.

Debt Repayment Strategies

The debt avalanche method targets the highest interest first. Pay minimums on all debts, then extra on the highest rate. This saves money on interest over time. Another way is the debt snowball method. Pay off the smallest debt first for quick wins. This boosts motivation and confidence. Choose the strategy that fits your personality and budget. Consistency and discipline make either method effective.

Avoiding Common Pitfalls

Avoid missing payments to keep your credit healthy. Late fees increase debt and lower credit scores. Do not borrow more to pay off old debts. This can create a cycle of debt. Watch out for payday loans with very high rates. Always have a budget to control spending. Track expenses and plan payments carefully. Seek help from credit counseling if overwhelmed. Staying aware protects your financial future.

Credit: www.ft.com

Investing Early

Starting to invest early gives young professionals a strong financial edge. It builds wealth steadily over time. Small, regular investments grow into substantial savings. The key is understanding options, risks, and benefits.

Basic Investment Options

Young professionals can choose from stocks, bonds, and mutual funds. Stocks offer ownership in companies and potential high returns. Bonds are loans to governments or companies with fixed interest. Mutual funds pool money to invest in various stocks and bonds. Each option fits different comfort levels and goals.

Understanding Risk And Returns

Every investment carries some risk. Higher returns usually mean higher risks. Stocks can be volatile but may grow your money faster. Bonds are safer but offer lower returns. Balancing risk and reward suits your personal situation. Learning about risk helps avoid losses and stress.

Compound Interest Benefits

Compound interest means earning interest on interest. It grows your investments faster than simple interest. The longer you invest, the greater the effect. Starting early maximizes this benefit. Even small amounts can turn into large sums over time.

Retirement Planning

Planning for retirement is essential for young professionals aiming for financial security. Starting early gives more time for savings to grow. It also reduces stress about money later in life.

Understanding different retirement options helps in making better choices. This section explains key retirement plans and smart ways to contribute.

Employer-sponsored Plans

Many employers offer retirement plans like 401(k) or 403(b). These plans allow automatic paycheck deductions for retirement savings. Some employers match contributions, which adds extra money to your account. Taking full advantage of employer matches increases your savings faster. These plans often have tax benefits, lowering your taxable income today.

Individual Retirement Accounts

Individual Retirement Accounts (IRAs) are personal savings accounts for retirement. You can open a Traditional IRA or a Roth IRA. Traditional IRAs offer tax deductions now but tax the money later. Roth IRAs require after-tax contributions but allow tax-free withdrawals in retirement. IRAs give more control over investment choices than employer plans. They are a good option if your employer does not offer a retirement plan.

Contribution Strategies

Start saving as soon as possible, even small amounts help. Aim to increase contributions yearly or with raises. Prioritize contributions to get full employer match first. Use automatic transfers to make saving consistent and easy. Balance retirement savings with other goals like paying debt or building an emergency fund. Review and adjust your plan regularly to stay on track.

Maximizing Income

Maximizing income is key for young professionals aiming to build wealth fast. Growing your earnings creates more money to save and invest. This increases your net worth over time.

Focus on smart ways to boost income beyond your main job. Small efforts can add up and improve your financial health. Use these strategies to increase your cash flow.

Negotiating Salary

Asking for a higher salary can raise your income significantly. Research typical pay for your role and experience. Prepare clear reasons why you deserve more pay. Practice your pitch confidently and professionally. Timing matters—choose moments after good performance reviews. Even a small raise grows your net worth over years.

Side Hustles And Freelancing

Extra work outside your job adds valuable income. Choose side jobs that fit your skills and schedule. Freelance writing, graphic design, or tutoring are popular options. Use online platforms to find short-term gigs. Side hustles can turn into steady money or full-time careers. Track your earnings and manage time carefully.

Passive Income Ideas

Passive income earns money with little daily effort. Examples include renting out property or investing in dividend stocks. Start small by saving for investments that pay regularly. Create digital products like ebooks or courses for ongoing sales. Passive income builds wealth slowly but steadily. It helps secure your future financial freedom.

Protecting Your Wealth

Protecting your wealth is a vital step for young professionals. It ensures that your hard-earned money stays safe. Building wealth is not enough without proper protection. Safeguarding your assets helps avoid financial setbacks. Think of it as creating a safety net for your future. This section covers simple ways to protect your wealth effectively.

Insurance Essentials

Insurance shields your income and assets from unexpected events. Health insurance covers medical bills. Disability insurance protects your earnings if you cannot work. Life insurance supports your loved ones financially after your death. Renters or homeowners insurance safeguards your property. Review your insurance policies yearly. Adjust coverage as your life changes.

Estate Planning Basics

Estate planning organizes your assets for the future. A will specifies who gets your property. A power of attorney lets someone handle your affairs if you cannot. Consider setting up a living trust to avoid probate. These tools reduce stress for your family. Start with simple documents and update them regularly.

Tax Strategies

Taxes affect how much wealth you keep. Use tax-advantaged accounts like 401(k)s and IRAs. These accounts lower your taxable income. Claim all eligible deductions and credits. Keep good records of your expenses and income. Consult a tax professional for personalized advice. Smart tax planning helps your money grow faster.

Tracking And Updating Net Worth

Tracking and updating your net worth is key for financial growth. It shows your progress and helps spot areas to improve. Keeping this information current builds good money habits. It makes your financial journey clear and manageable.

Using Spreadsheets And Apps

Spreadsheets offer a simple way to track your assets and debts. You can customize them to fit your needs. Many free templates exist online to get started fast. Apps automate tracking and sync with your bank accounts. They give real-time updates on your net worth. Choose tools that are easy to use and reliable.

Annual Reviews

Set a date each year to review your net worth. This habit helps you see changes over time. Check if your savings, investments, and debts have changed. Use this review to celebrate wins and spot setbacks. Annual reviews keep your finances on track and goal-focused.

Adjusting Plans As Needed

Your financial goals may change as life evolves. Adjust budgets and savings plans based on your net worth updates. Cut unnecessary expenses or increase investments if needed. Flexibility ensures steady progress despite challenges. Regular adjustments keep your plan realistic and effective.

Credit: crr.bc.edu

Frequently Asked Questions

What Is The 7 3 2 Rule?

The 7-3-2 rule guides content sharing: 7 parts value, 3 parts personal, 2 parts promotional posts.

What Is The 70/30/10 Rule Money?

The 70/30/10 money rule divides income into 70% for needs, 20% for wants, and 10% for savings or debt repayment.

What Should A 21 Year Old’s Net Worth Be?

A 21-year-old’s net worth typically ranges from $0 to $10,000. Focus on saving, reducing debt, and investing early.

How Much Will $100 A Month Be Worth In 30 Years?

Investing $100 monthly for 30 years at a 7% annual return grows to about $94,000. Consistent saving and compounding build significant wealth.

Conclusion

Building your net worth takes time and steady effort. Track your assets and debts regularly to see progress. Save consistently, spend wisely, and plan for the future. Small steps now lead to financial stability later. Stay focused on your goals and adjust as needed.

This checklist helps young professionals create a strong money foundation. Keep learning about finances to improve your net worth. Remember, your financial health grows with patience and good habits.