Do you ever wonder where you stand financially? Knowing your net worth is a simple way to get a clear picture of your money, assets, and debts.

But calculating it can feel confusing or overwhelming. What if there was an easy tool that puts this all at your fingertips? A net worth calculator helps you see exactly how much you own versus what you owe. Understanding your net worth can guide your financial decisions and give you confidence to plan for the future.

Keep reading to discover how this powerful tool works and why it matters for your financial health.

Credit: www.wallstreetprep.com

What Is Net Worth

Net worth shows how much money you really have. It is the total value of everything you own minus what you owe. This number helps you understand your financial health. It gives a clear picture of your wealth at a certain time.

Knowing your net worth helps with money decisions. It shows whether you are saving or spending more. It also helps plan for big goals like buying a house or retiring.

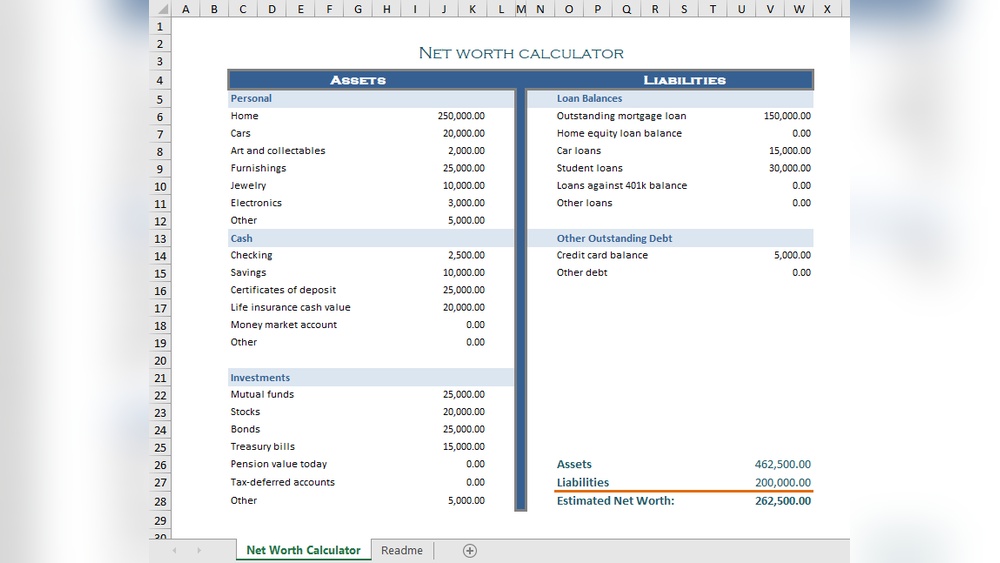

Assets

Assets are things you own that have value. This includes cash, savings, and investments. Your house, car, and valuable items count too. The total value of all assets adds up here.

Liabilities

Liabilities are debts or money you owe. Examples include loans, credit card debt, and mortgages. Subtracting liabilities from assets gives your net worth. Keeping liabilities low improves your net worth.

Why Net Worth Matters

Net worth is a simple way to track your money progress. It shows if your wealth grows over time. It helps spot money problems early. People use it to set clear financial goals.

Why Calculate Net Worth

Calculating your net worth shows a clear picture of your financial health. It helps you see the balance between what you own and what you owe. Knowing this number guides important money choices. It reveals progress toward your goals and spots areas needing attention.

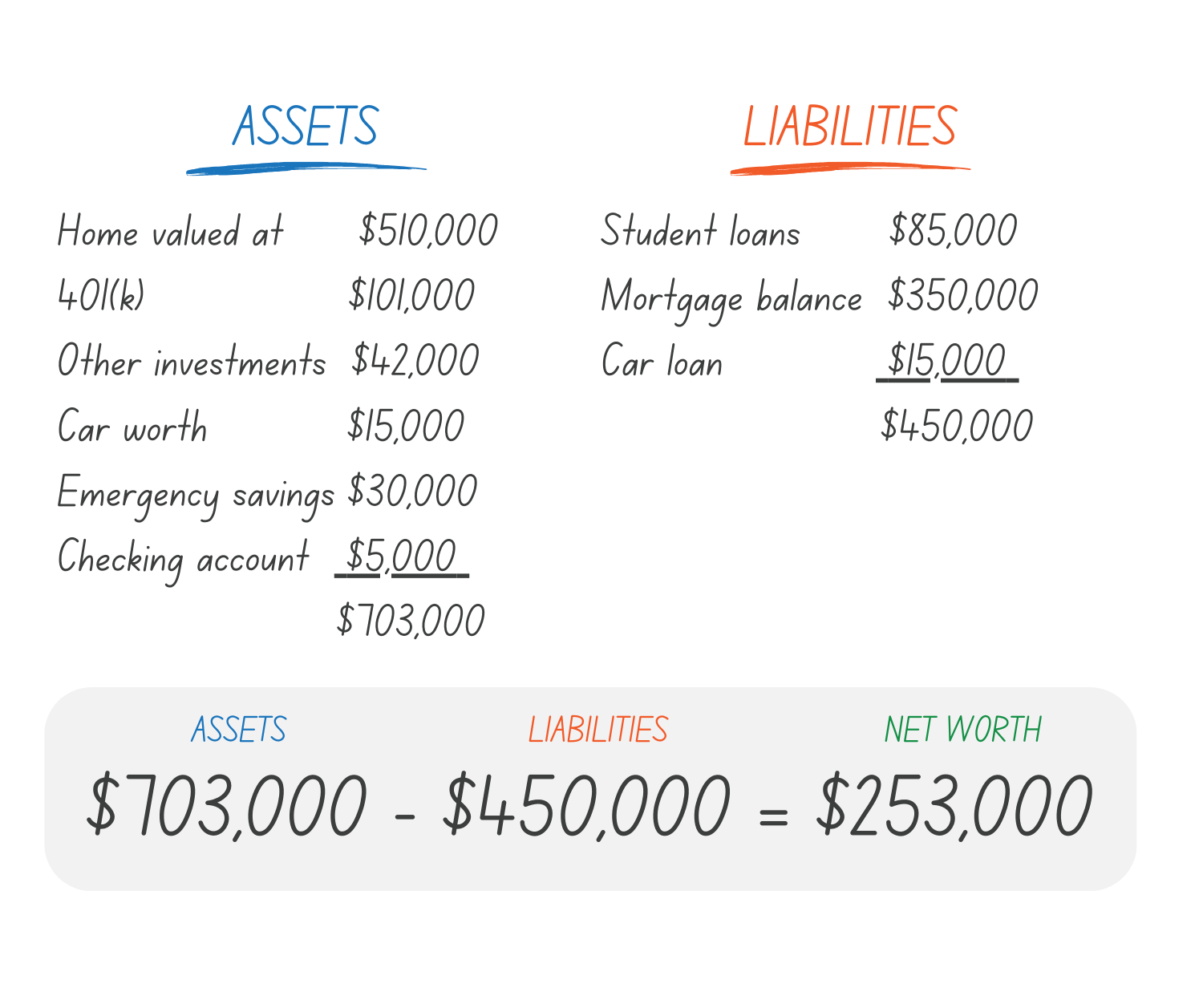

Understanding Your Financial Position

Net worth calculation gives a snapshot of your finances. It lists all assets like cash, property, and investments. Then, it subtracts debts like loans and credit cards. The result shows your true financial standing at a glance.

Tracking Financial Growth Over Time

Regular net worth checks show if your wealth grows or shrinks. Watching this trend helps adjust spending and saving habits. It highlights good decisions and warns about financial risks.

Planning For Future Goals

Knowing your net worth helps set realistic goals. Whether buying a house or saving for retirement, it shows what you can afford. This clarity makes planning simpler and more effective.

Improving Financial Habits

Calculating net worth encourages better money management. It pushes you to reduce debt and increase savings. This practice builds stronger financial habits over time.

Assets To Include

Calculating your net worth starts with listing all your assets. Assets show what you own that has value. These items add up to your total wealth. It helps to know which assets to include for an accurate net worth calculation.

Cash And Savings

Cash is the easiest asset to count. It includes money in your wallet and checking accounts. Savings accounts also hold cash you can access anytime. These funds are liquid and ready to use. Include all cash and savings to get a clear picture.

Investments

Investments grow your money over time. Stocks, bonds, and mutual funds are common types. Retirement accounts like IRAs and 401(k)s also count. Include the current market value of these investments. This shows your potential future wealth.

Real Estate

Real estate includes homes, land, and rental properties. Use the current market value, not the purchase price. Deduct any loans or mortgages tied to these properties. Real estate often forms a large part of net worth.

Personal Property

Personal property means valuable items you own. Cars, jewelry, electronics, and collectibles fit here. Estimate their current resale value, not what you paid. These assets add extra value to your net worth.

Credit: www.vertex42.com

Liabilities To Consider

Understanding your liabilities is key to calculating your net worth. Liabilities are debts or financial obligations you owe. They reduce the value of your total assets. Listing all liabilities helps create a clear financial picture. This section covers common liabilities to include in your net worth calculator.

Loans And Mortgages

Loans and mortgages are major liabilities for most people. They represent money borrowed that must be paid back. Include the total amount still owed on any personal loans. For mortgages, add the remaining balance on your home loan. These numbers lower your net worth.

Credit Card Debt

Credit card debt can add up quickly. It usually carries high interest rates. Include the full amount of unpaid credit card balances. Ignoring this debt gives a false sense of financial health. Keep track of all credit cards and their outstanding amounts.

Other Obligations

Other obligations include any debts not covered by loans or credit cards. Examples are unpaid taxes, medical bills, or legal fines. Include any regular payments owed, such as alimony or child support. These liabilities affect your overall financial status and should not be overlooked.

How To Use A Net Worth Calculator

A net worth calculator helps you see your total financial value. It adds up what you own and subtracts what you owe. Using this tool gives a clear picture of your money status. This guide shows how to use a net worth calculator easily and correctly.

Step-by-step Process

First, list all your assets. Include savings, investments, property, and valuable items.

Next, write down your debts. This covers loans, credit card balances, and mortgages.

Enter these numbers into the net worth calculator fields. Double-check each amount for accuracy.

Click the calculate button. The tool shows your net worth instantly.

Save the result for future comparison. Track your progress over time.

Common Mistakes To Avoid

Do not forget to include all assets. Missing items give an incorrect total.

Avoid underestimating debts. Write the full amount owed.

Do not mix personal and business finances. Keep them separate for clarity.

Ignore outdated values. Update asset prices regularly for accuracy.

Avoid skipping the review step. Always check your numbers twice before calculating.

Benefits Of Tracking Net Worth

Tracking your net worth offers clear insights into your financial health. It shows what you own versus what you owe. This simple step helps you make smarter money choices. It also builds confidence by showing your progress. Net worth tracking can guide you through many money decisions.

Financial Planning

Knowing your net worth helps create a solid financial plan. You see which areas need improvement. It allows you to plan for expenses like buying a house or retirement. You can decide how much to save or invest. This knowledge makes budgeting easier and more effective.

Goal Setting

Tracking net worth helps set clear financial goals. You know exactly what you want to achieve. Goals like paying off debt or building savings become real. It provides motivation by showing what is possible. Setting goals becomes focused and realistic.

Progress Monitoring

Regularly checking your net worth shows your financial progress. You can see if your efforts are working. It helps spot problems early before they grow. Tracking progress keeps you on track with your goals. It turns abstract ideas into concrete results.

Tools And Apps For Net Worth

Tracking your net worth helps you understand your financial health. Tools and apps simplify this process. They gather all your assets and debts in one place. This makes it easier to see your progress over time.

Many tools offer automatic updates by linking to your bank and investment accounts. They also provide easy-to-read charts and reports. This helps you make smarter money decisions without stress.

Online Net Worth Calculators

Online calculators are quick and easy to use. Enter your assets like cash, property, and investments. Then add your debts such as loans and credit cards. The tool instantly shows your net worth. No sign-up is usually needed. It’s a good start for beginners.

Mobile Apps For Net Worth Tracking

Mobile apps let you track net worth on the go. You can update your data anytime from your phone. Many apps sync with bank accounts automatically. They send alerts about your financial changes. Apps often include budgeting and saving features too.

Financial Software With Net Worth Features

Financial software offers detailed net worth reports. They handle complex finances like investments and retirement plans. These programs give in-depth analysis and forecasts. Ideal for users with multiple income sources. They require installation but provide strong security.

Credit: www.northstarfinancial.com

Tips To Grow Your Net Worth

Growing your net worth takes focus and steady effort. Small changes can make a big difference over time. You can improve your financial health by increasing assets, lowering debts, and investing wisely. These tips help build a stronger financial future.

Increase Assets

Assets add value to your net worth. Save money regularly and set it aside. Buy things that keep their value or grow, like property or stocks. Avoid spending on items that lose value quickly. Every asset helps build your wealth.

Reduce Liabilities

Liabilities lower your net worth. Cut down on debts like credit cards and loans. Pay off high-interest debts first. Avoid taking on new debts unless necessary. Lower debts mean more money stays with you.

Smart Investing

Investing grows your net worth over time. Choose investments that fit your goals and risk level. Diversify your investments to reduce risk. Keep learning about investment options. Good choices can increase your wealth steadily.

Frequently Asked Questions

What Is A Net Worth Calculator Used For?

A net worth calculator helps you measure your financial health. It subtracts your liabilities from your assets. This tool offers a clear snapshot of your wealth. It assists in planning budgets and financial goals effectively.

How Do I Calculate My Net Worth Manually?

List all your assets like cash, investments, and property. Then, list your liabilities including loans and debts. Subtract your total liabilities from your total assets. The result is your net worth, representing your financial position.

Why Is Knowing My Net Worth Important?

Knowing your net worth shows your financial progress over time. It helps track wealth accumulation and manage debts. This knowledge supports better financial decisions and goal setting. It’s essential for long-term financial planning and stability.

Can A Net Worth Calculator Track Financial Goals?

Yes, many calculators allow you to set and monitor goals. They show how your net worth changes with savings or investments. This helps you stay motivated and adjust your plans. Tracking progress ensures you meet your financial targets.

Conclusion

Knowing your net worth helps you plan your financial future. It shows what you own and owe clearly. Use a net worth calculator often to track changes. This simple step keeps your money goals in sight. Start today to better understand your financial health.

Small efforts lead to bigger financial confidence. Stay aware, stay prepared, and keep improving your money habits. Your net worth is a useful tool for smart choices.