Have you ever wondered how your net worth stacks up against others your age? Understanding where you stand can give you a clearer picture of your financial health and help you set smarter goals.

This article breaks down net worth percentiles by age, showing you what’s typical and what’s exceptional at every stage of life. By knowing these numbers, you’ll gain insight into your financial progress and discover ways to boost your wealth. Keep reading to find out how you compare—and how to climb higher on the ladder.

Credit: wealthtender.com

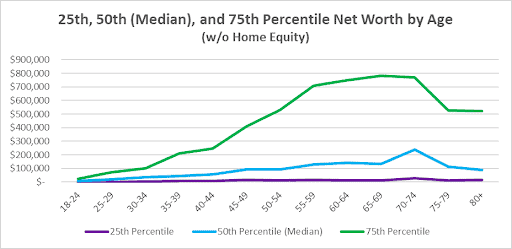

Net Worth Benchmarks By Age

Net worth benchmarks by age offer a clear view of financial progress through life stages. Understanding these benchmarks helps set realistic goals and track growth. Wealth builds differently at each age due to income, expenses, and savings habits. Tracking net worth percentiles provides insight into where you stand among peers.

Wealth Distribution In Your 20s

Most people in their 20s start with low net worth or even debt. Student loans and entry-level salaries impact savings. Building net worth often means focusing on paying off debt. Investing early, even in small amounts, can boost future wealth. This decade sets the foundation for financial habits.

Net Worth Trends In Your 30s

Net worth usually grows faster in the 30s due to higher income. Many buy homes and increase investments. Expenses like family and education may also rise. Saving consistently becomes key to wealth growth. Reaching the 50th percentile here shows solid financial progress.

Financial Milestones In Your 40s

The 40s often bring peak earning years and wealth accumulation. Investments and home equity tend to increase. Paying down mortgage debt is common at this stage. Preparing for retirement starts to take priority. A strong net worth in the 40s reflects disciplined money habits.

Wealth Patterns In Your 50s And Beyond

Net worth usually peaks in the 50s or early 60s. Retirement savings and paid-off homes boost financial security. Income may stabilize or begin to decline after peak years. Focus shifts to preserving wealth and planning withdrawals. Maintaining a healthy net worth helps ensure a comfortable retirement.

Credit: dqydj.com

Factors Influencing Net Worth

Net worth changes with age and depends on many factors. Understanding these factors helps explain why people have different amounts of wealth. Some influences come from how much money people make. Others come from how they manage their money and debts. Lifestyle choices also play a big role in shaping net worth over time.

Each factor affects net worth differently at various stages of life. Knowing these can guide better financial decisions for the future.

Income And Career Growth

Income is the main source of building net worth. Higher income means more money to save and invest. Career growth often leads to salary increases. People with steady career progress tend to grow their wealth faster. Job stability also helps maintain consistent income over time.

Savings And Investment Habits

Saving money regularly boosts net worth steadily. Investing can grow wealth faster than just saving. Smart investments include stocks, bonds, and real estate. People who start saving early gain more from compound growth. Discipline in saving and investing is key to building wealth.

Debt And Financial Obligations

Debt reduces net worth because it is money owed. High debts from loans or credit cards can slow wealth growth. Managing debt well means paying it off quickly. Some debts, like mortgages, can increase net worth if property value rises. Avoiding unnecessary debt helps improve financial health.

Impact Of Lifestyle Choices

Lifestyle decisions affect how much money is left to save. Spending on luxury or daily needs can limit savings. Simple living often leads to higher net worth over time. Prioritizing needs over wants helps control expenses. Good habits create a strong foundation for wealth building.

How To Use Percentiles For Wealth Insights

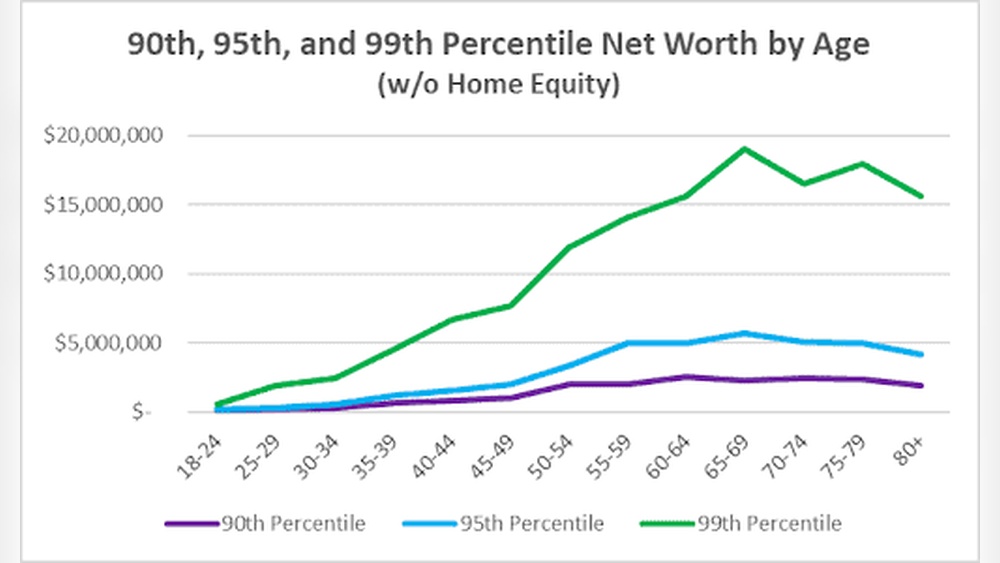

Understanding net worth percentiles helps reveal your wealth status clearly. It shows how your net worth compares to others your age. This insight guides smarter money choices. You see where you stand, not just a number but a position among peers.

Using percentiles can motivate better financial habits. It also helps avoid unrealistic expectations. Here are key ways to use net worth percentiles for wealth insights.

Calculating Your Net Worth Percentile

First, calculate your total assets minus debts. This gives your net worth. Next, find reliable data on net worth by age. Many financial sites provide percentile charts. Compare your net worth to those figures. This tells your percentile rank. For example, being in the 60th percentile means you have more wealth than 60% of your age group.

Comparing To Age Group Peers

Percentiles show your standing among people your age. This comparison is fairer than comparing to all ages. People at similar life stages face similar financial challenges. Understanding this helps you see realistic progress. It also highlights if you need to catch up or maintain your pace.

Setting Realistic Financial Goals

Use your percentile rank to set clear goals. Aim to move up one or two percentiles over time. This means steady, achievable growth. Setting small goals avoids frustration and burnout. Focus on saving, investing, and reducing debt. Adjust goals as you improve your net worth position.

Strategies To Boost Net Worth

Boosting your net worth requires clear and simple strategies. Small changes can make a big difference over time. Saving money wisely, investing smartly, managing debt, and increasing income all help grow your wealth. Focus on practical steps that fit your life and goals.

Smart Saving Techniques

Start by setting a budget to track your spending. Save a part of your income regularly. Use automatic transfers to a savings account. Cut small daily expenses that add up quickly. Build an emergency fund to avoid debt in tough times. Saving consistently creates a strong money base.

Investing For Long-term Growth

Put money into investments that grow over years. Choose stocks, bonds, or funds that match your risk level. Start early to benefit from compound growth. Diversify your investments to lower risks. Avoid quick gains and focus on steady growth. Long-term investing builds lasting wealth.

Managing And Reducing Debt

Pay off high-interest debts first. Avoid taking new debts unless necessary. Use extra money to reduce what you owe faster. Consolidate debts for easier payments and lower interest. Staying free of debt frees money for saving and investing. Debt control improves financial health.

Maximizing Income Streams

Look for ways to earn extra money. Consider part-time jobs or freelance work. Use skills to offer services or sell items online. Invest in education to increase job opportunities. Multiple income sources add security and speed up net worth growth. More income means more money to save and invest.

Common Pitfalls In Wealth Building

Building wealth takes time and careful planning. Many people face common mistakes that slow down their progress. Avoiding these pitfalls helps improve your net worth percentile by age. Simple habits can make a big difference over time.

Overlooking Emergency Funds

Many skip saving for emergencies. This can lead to debt when unexpected costs arise. An emergency fund acts as a safety net. It covers bills without harming investments or savings. Aim to save at least three to six months of expenses.

Ignoring Inflation Effects

Inflation reduces the value of money over time. Ignoring it means your savings lose buying power. Plan for inflation by investing in assets that grow faster than inflation. This helps keep your money’s value strong.

Excessive Lifestyle Inflation

Spending more as income grows is common. This habit is called lifestyle inflation. It limits your ability to save and invest. Keep your living costs steady while increasing savings. This builds wealth faster and improves your net worth.

Neglecting Financial Education

Understanding money basics is key to smart choices. Many avoid learning about finance. This leads to poor decisions and missed chances. Spend time reading or taking simple courses. Knowledge helps you grow wealth safely and steadily.

Tools To Track And Improve Net Worth

Tracking and improving net worth is easier with the right tools. These tools help you see where your money goes and how to grow it. They also show your progress clearly. Using them regularly builds good money habits. Here are some useful tools to help manage your net worth well.

Net Worth Calculators

Net worth calculators add up your assets and subtract debts. They give a clear snapshot of your financial health. Many calculators are free and simple to use online. Enter your savings, property, loans, and debts. The result helps you understand your current position fast. Track changes over time to see growth or needed changes.

Budgeting Apps

Budgeting apps help control spending and save money. They categorize expenses and track income automatically. Apps send reminders to keep budgets on track. Many apps connect to bank accounts for easy updates. They show where money leaks occur and suggest limits. Using a budgeting app reduces overspending and grows savings steadily.

Investment Platforms

Investment platforms let you grow your money by buying stocks or funds. Many offer low fees and easy account setup. Some platforms provide guidance for beginners. You can start with small amounts and increase gradually. Tracking investments helps you see returns and risks. Regular investing builds wealth and improves net worth over time.

Financial Advisor Resources

Financial advisors offer expert advice tailored to your goals. They help create plans for saving, investing, and debt. Advisors can teach strategies to protect and grow net worth. Many offer free initial consultations or online tools. Professional guidance helps avoid costly mistakes. Advisors keep you focused and motivated on your financial journey.

Credit: www.reddit.com

Frequently Asked Questions

What Is Net Worth Percentile By Age?

Net worth percentile by age ranks individuals based on their assets compared to peers. It shows financial standing at different life stages. This helps gauge wealth growth and set realistic financial goals over time.

How Is Net Worth Percentile Calculated?

It compares an individual’s net worth to others in the same age group. Percentiles indicate position, such as being wealthier than 70% of peers. Data comes from surveys, financial reports, and economic studies.

Why Is Net Worth Percentile Important?

It provides insight into personal financial health relative to age peers. Knowing your percentile helps identify saving gaps and investment opportunities. It motivates better money management to improve financial security.

What Age Groups Are Typically Analyzed?

Common age groups include 25-34, 35-44, 45-54, 55-64, and 65+. These brackets reflect life stages like career growth and retirement planning. Analyzing by age ensures relevant wealth comparisons.

Conclusion

Net worth changes with age and life experience. Younger people often have less wealth but more time. Older adults usually have higher net worth from years of saving. Understanding net worth percentiles helps set realistic financial goals. It also shows how your wealth compares to others your age.

Keep tracking your progress every year. Small steps build stronger financial futures. Wealth grows slowly but steadily. Stay patient and consistent with saving and investing. Your net worth reflects choices made over time.