Sending money across borders can feel slow, expensive, and complicated. But what if you could make these payments faster, cheaper, and more secure?

Using crypto for remittances and cross-border payments is changing the game—and it could change how you send money too. You’ll discover simple steps to use cryptocurrency to save time and fees, while keeping your transfers safe. Ready to unlock the power of crypto for your international payments?

Keep reading to find out how.

Credit: rif.technology

Benefits Of Crypto In Remittances

Cryptocurrency offers several benefits for sending money across borders. Using crypto for remittances can save money and time. It also provides safer and easier access to financial services for many people worldwide.

Lower Fees Compared To Traditional Methods

Crypto transactions usually cost less than banks or money transfer services. Traditional methods often charge high fees and hidden costs. Crypto removes middlemen, lowering the total expenses. This means more money reaches the recipient.

Faster Transaction Times

Sending money with crypto can take minutes or hours. Traditional bank transfers may take days to clear. Faster transfers help families get funds quickly in emergencies. Speedy payments improve convenience and reduce stress.

Enhanced Security Features

Cryptocurrencies use strong encryption to protect transactions. This reduces risks of fraud and theft. Blockchain technology keeps a clear record of every transfer. Users control their funds, avoiding errors or misuse by third parties.

Greater Accessibility For Unbanked Populations

Many people worldwide lack access to banks or financial institutions. Crypto only needs internet access and a digital wallet. This opens new options for those excluded from traditional finance. It helps send and receive money safely without a bank account.

Credit: blog.bake.io

Choosing The Right Cryptocurrency

Choosing the right cryptocurrency matters for remittances and cross-border payments. The right choice saves money and time. It also reduces risks from price changes. Not all cryptocurrencies work the same for sending money abroad. Consider factors like stability, speed, and availability. These help ensure smooth and affordable transfers.

Stablecoins Vs. Volatile Coins

Stablecoins keep their value steady. They are often linked to a currency like the US dollar. This makes them less risky for sending money. Volatile coins, like Bitcoin, can change price quickly. This can cause the amount received to be less or more than expected. Stablecoins reduce this uncertainty. This is important for sending fixed amounts.

Network Speed And Fees

Fast networks send money quickly. This helps the recipient get funds without delay. Fees are the cost to send money on the network. Some networks have high fees, making transfers costly. Others have low fees and are better for small amounts. Choose a cryptocurrency with fast transactions and low fees to save time and money.

Liquidity And Exchange Availability

Liquidity means how easy it is to buy or sell a cryptocurrency. High liquidity means you can exchange it quickly at a fair price. Exchange availability means the coin is listed on many platforms. This helps senders and receivers convert crypto to local money. Choose cryptocurrencies that are easy to trade worldwide for smooth payments.

Setting Up A Crypto Wallet

Setting up a crypto wallet is the first step to using cryptocurrency for remittances and cross-border payments. A wallet stores your digital coins safely and helps you send or receive money. Choosing the right wallet and securing it properly is key to protecting your funds.

Types Of Wallets: Hot Vs. Cold

Hot wallets connect to the internet and are easy to access. They work well for daily transactions and quick payments. Cold wallets stay offline, offering higher security. These are best for storing large amounts of crypto for a long time.

Hot wallets include mobile apps, desktop programs, and web wallets. Cold wallets often come as hardware devices or paper wallets. Each type has pros and cons. Hot wallets are convenient but less secure. Cold wallets are safer but less handy for frequent use.

Creating And Securing Your Wallet

Start by picking a wallet that fits your needs. Download the app or buy a hardware wallet from a trusted source. Follow the setup instructions carefully. Create a strong password and use two-factor authentication if available.

Keep your private keys private. These keys unlock your crypto. Never share them with anyone. Write down your recovery phrase and store it in a safe place. Avoid saving sensitive information on your phone or computer.

Backup And Recovery Tips

Back up your wallet regularly. Use multiple copies stored in different places. This protects you from losing access due to device failure or theft.

Test your backup to ensure it works. Know how to restore your wallet using the recovery phrase. This step is crucial to avoid permanent loss of your crypto funds.

Sending Crypto For Remittances

Sending crypto for remittances offers a fast and cost-effective way to transfer money across borders. It bypasses traditional banks and reduces fees. Users can send funds directly to a recipient’s wallet anywhere in the world. This process is simple but requires careful attention to details.

Step-by-step Transaction Process

Start by choosing a reliable crypto wallet or exchange. Next, buy the cryptocurrency you want to send. Enter the amount and the recipient’s wallet address carefully. Double-check the details before confirming the transaction. Finally, send the crypto and wait for the network to confirm it. The recipient will receive the funds shortly after confirmation.

Verifying Recipient Wallet Details

Always verify the recipient’s wallet address before sending. Copy and paste the address to avoid typing errors. Check that the address matches the intended cryptocurrency type. Sending crypto to the wrong address or network can cause permanent loss. Confirm with the recipient if unsure about the wallet details.

Avoiding Common Mistakes

Do not rush the transaction process. Small errors can lead to lost funds. Avoid sending crypto to inactive or unsupported wallets. Always check transaction fees before confirming. Keep your private keys secure and never share them. Use a small test transaction for first-time transfers to confirm the process works smoothly.

Receiving And Converting Crypto

Receiving and converting crypto is a key step in using it for remittances and cross-border payments. Once someone sends you crypto, you need a simple way to access it. Then, convert that crypto into your local money to use it for daily expenses.

This process is faster and often cheaper than traditional bank transfers. It gives you control over your funds. Understanding how to handle received crypto helps you get the most value out of it.

Accessing Received Funds

You need a digital wallet to receive crypto safely. Wallets store your private keys and allow you to manage your coins. Mobile wallets are popular for easy access on smartphones.

After the sender transfers crypto, check your wallet balance. Transactions usually confirm within minutes. Always keep your wallet secure with strong passwords.

Converting Crypto To Local Currency

To use crypto in daily life, convert it to your local currency. This step makes it easier to pay bills and shop. You can convert small or large amounts based on your needs.

Conversion rates change often. Check current rates before exchanging. Some wallets offer built-in conversion tools for quick swaps.

Using Crypto Exchanges And Services

Crypto exchanges help turn your coins into local money. Choose exchanges with good reputation and low fees. You can sell crypto for cash or bank transfers.

Some services allow direct withdrawal to your bank account. Others provide cash pickup locations or prepaid cards. Compare options to find the best fit for you.

Regulations And Compliance

Using crypto for remittances and cross-border payments requires careful attention to regulations and compliance. Laws vary by country and region. Following these rules helps avoid legal trouble and ensures smooth transactions. Understanding compliance also protects users and businesses from fraud and misuse.

Legal Considerations By Region

Different countries have different rules for crypto payments. Some allow free use, while others have strict controls or bans. Know the laws in both the sending and receiving countries. Check if licenses are needed to operate or transfer crypto. This keeps transactions legal and safe.

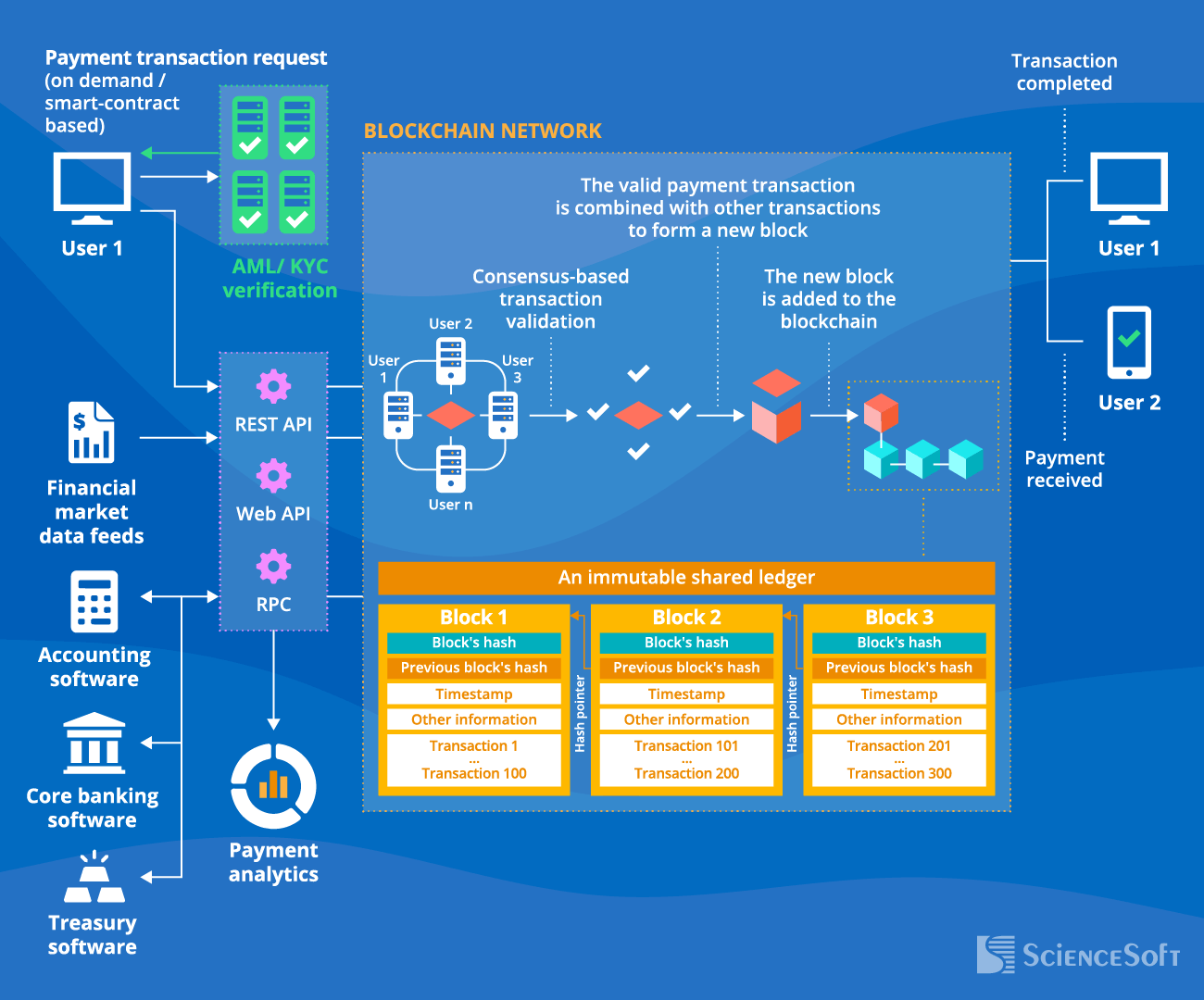

Kyc And Aml Requirements

Know Your Customer (KYC) and Anti-Money Laundering (AML) rules are key. Businesses must verify user identities before transfers. This stops illegal activities like money laundering and fraud. Many platforms require documents such as ID or proof of address. Following these steps helps build trust and comply with laws.

Staying Updated On Policy Changes

Crypto regulations change quickly. Governments often update rules to address new risks. Stay informed through official sources and trusted news. Regularly review compliance policies. This ensures ongoing legal use and avoids penalties. Being proactive helps keep your crypto payments safe and lawful.

Security Best Practices

Using crypto for remittances and cross-border payments offers speed and low fees. Security is key to protect your money and data. Following simple best practices reduces risks and keeps your funds safe.

Protecting Private Keys

Your private key controls access to your crypto wallet. Never share it with anyone. Store it offline in a safe place. Avoid saving keys on devices connected to the internet. Use hardware wallets for extra security. Losing your private key means losing your funds.

Recognizing And Avoiding Scams

Scams target crypto users with fake offers and phishing links. Check sender addresses carefully. Do not click unknown links or download attachments. Be wary of promises of quick profits. Verify information from official sources only. Scammers often create urgent messages to trick you.

Using Two-factor Authentication

Two-factor authentication adds a second security step to your account. It requires a code from your phone or app. Enable 2FA on wallets and exchanges. This stops hackers from accessing your account with just a password. Choose apps like Google Authenticator or Authy for 2FA.

Credit: www.scnsoft.com

Future Trends In Crypto Remittances

The future of crypto remittances looks promising and full of change. New developments will shape how people send money across borders. These changes aim to make transfers faster, cheaper, and easier to use for everyone.

Integration With Traditional Finance

Crypto is slowly joining traditional banks and payment systems. This will help users move money between crypto and regular money smoothly. Banks may offer crypto services to their customers soon. This link will increase trust and adoption of crypto remittances.

Emerging Technologies

New tools like blockchain upgrades and faster networks will improve crypto payments. Technologies such as Layer 2 solutions will cut costs and speed up transactions. Artificial intelligence could help detect fraud and make transfers safer. These advances will boost confidence in using crypto for remittances.

Expanding Use Cases Worldwide

More countries and businesses will accept crypto for cross-border payments. Migrant workers will find it easier to send money home. Small businesses will use crypto to pay suppliers globally. This growth will open new doors and create more opportunities for users everywhere.

Frequently Asked Questions

What Are The Benefits Of Using Crypto For Remittances?

Crypto offers faster, cheaper, and more secure remittances. It reduces transaction fees and eliminates intermediaries. This makes cross-border payments efficient, transparent, and accessible worldwide.

How Does Crypto Improve Cross-border Payment Speed?

Crypto transactions use blockchain technology, which processes payments instantly. Unlike traditional banks, it bypasses delays caused by intermediaries. This ensures near real-time cross-border transfers.

Is Using Crypto For Remittances Safe And Secure?

Yes, crypto uses strong encryption and decentralized networks. These features protect transactions from fraud and hacking. Always use reputable wallets and exchanges for added security.

What Cryptocurrencies Are Best For Remittances?

Stablecoins like USDT and USDC are popular due to low volatility. Bitcoin and Ethereum are also widely accepted but may have higher fees. Choose based on speed, cost, and recipient convenience.

Conclusion

Using crypto for remittances and cross-border payments saves time and lowers fees. Transactions happen faster than traditional banking methods. People can send money directly, without middlemen. Crypto also offers more privacy and security. Still, users should stay aware of risks and regulations.

Learning how to use wallets and exchanges helps avoid mistakes. Crypto makes sending money easier and more affordable worldwide. It is worth exploring for those who want better payment options.