Are you ready to take control of your crypto investments and protect yourself from sudden market swings? Building a diversified crypto portfolio is the key to reducing risk and boosting your chances of success.

But where do you start? How do you choose the right mix of coins without getting overwhelmed? You’ll discover simple, practical steps to create a balanced crypto portfolio that works for you. Keep reading to unlock strategies that can help you grow your investments safely and confidently.

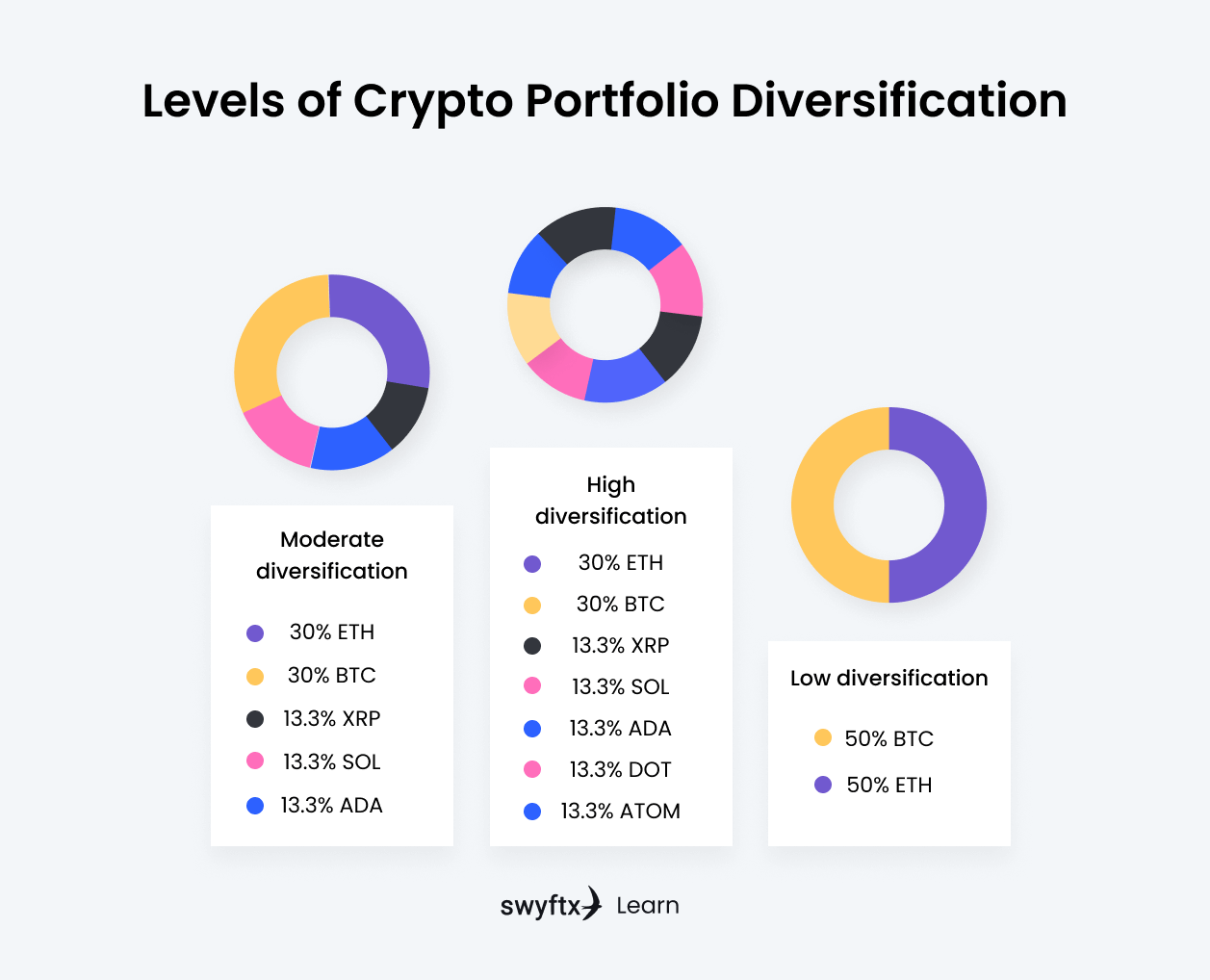

Credit: learn.swyftx.com

Benefits Of Crypto Diversification

Diversifying a crypto portfolio brings several key benefits. It spreads your investment across different coins and tokens. This approach helps protect your money and improve your chances of earning profits. Understanding these benefits can guide better decisions in the crypto market.

Risk Reduction

Diversification lowers the risk of losing all your money. Different cryptocurrencies behave in unique ways. Some may drop in value while others rise. By holding various assets, losses in one can be balanced by gains in another. This approach reduces the chance of severe financial damage.

Maximizing Returns

Spreading investments across multiple coins can increase profit potential. Some cryptocurrencies grow faster than others. A diverse portfolio captures gains from different sources. This increases the overall return compared to holding a single asset. It helps tap into multiple opportunities in the market.

Navigating Volatility

Crypto markets are known for price swings. Diversification helps manage this unpredictable behavior. Different assets react differently to market changes. Some may stay stable while others fluctuate. This mix smooths out the impact of volatility on your portfolio. It makes the investment journey less stressful and more steady.

Key Asset Types To Include

Building a strong crypto portfolio means including different types of assets. Each type has its role and risk level. Mixing these assets helps spread risk and improve potential returns.

Choosing the right assets is key to a balanced portfolio. Consider assets that offer growth, stability, and innovation. Here are the main types to include.

Blue-chip Cryptos

Blue-chip cryptos are the most established digital currencies. Bitcoin and Ethereum lead this group. They have large market value and strong community support. These assets often act as the foundation of a portfolio. They provide stability and steady growth over time.

Altcoins With Potential

Altcoins are smaller cryptocurrencies beyond the top leaders. Some altcoins show promise due to unique technology or use cases. Investing in altcoins can bring higher rewards but also higher risk. Research is important before choosing altcoins to add.

Stablecoins For Stability

Stablecoins are digital coins tied to real-world assets like the US dollar. They keep their value steady and reduce volatility. Including stablecoins helps protect your portfolio during market swings. They offer easy access to cash without leaving crypto.

Defi Tokens And Nfts

DeFi tokens power decentralized finance apps. They enable lending, borrowing, and trading without banks. NFTs represent ownership of digital art or collectibles. Both tokens add exposure to new blockchain trends. These assets can diversify and add growth potential.

Portfolio Allocation Strategies

Portfolio allocation strategies help you spread your money across different crypto assets. This reduces risk and can improve returns over time. Choosing the right strategy depends on your goals, risk tolerance, and market view.

These strategies guide how much to invest in each coin or token. They also help you decide when to adjust your holdings. Understanding these methods helps you build a strong and steady portfolio.

Balanced Vs Aggressive Approaches

A balanced approach splits investments between stable and risky assets. It aims for steady growth with less chance of big losses. Aggressive strategies focus more on high-risk, high-reward coins. They can bring bigger gains but also bigger drops.

Balanced portfolios usually hold more established coins like Bitcoin and Ethereum. Aggressive ones add smaller or newer tokens. Your choice depends on how much risk you want to take.

Weighting By Market Cap

Weighting by market cap means investing more in bigger cryptocurrencies. Large coins have higher market value and often more stability. This method favors coins like Bitcoin and Ethereum due to their size.

This strategy reduces risk by focusing on well-known projects. Smaller coins get less weight but can still add growth potential. It helps keep your portfolio aligned with the market’s size and trends.

Periodic Rebalancing

Periodic rebalancing means adjusting your portfolio at set times. It keeps your investment mix close to your chosen strategy. For example, if a coin grows too big, you sell some to buy others.

This prevents your portfolio from becoming too risky or too safe. Rebalancing helps lock in profits and reduce losses. Regular reviews ensure your portfolio matches your goals and risk level.

Research And Due Diligence

Research and due diligence form the foundation of a strong crypto portfolio. They help you avoid risks and spot good opportunities. Careful study of each asset reduces chances of loss.

Knowing what you invest in builds confidence. You learn the project’s goals, team strength, and market position. This knowledge guides smart choices and balance in your portfolio.

Evaluating Projects And Teams

Check the project’s whitepaper. It explains the purpose and technology behind the coin or token. Look for clear goals and realistic plans.

Examine the development team. Find out their experience and previous work. A strong, transparent team boosts project trust.

Review community feedback and social media activity. Active communities often mean better support and project health.

Analyzing Market Trends

Study price movements and trading volumes. These show how the market values the asset over time.

Observe broader crypto market trends. They impact individual coin performance too.

Use tools to track sentiment and news. Positive or negative news can cause price changes quickly.

Using On-chain Data

On-chain data reveals real activity on the blockchain. It shows transaction numbers, wallet addresses, and token distribution.

Analyze wallet activity to spot big holders or “whales.” Their actions can influence prices.

Check network health by looking at transaction speed and fees. Healthy networks attract more users and investors.

Risk Management Techniques

Managing risk is key to building a strong crypto portfolio. It helps protect your investments from big losses. Using simple risk management methods can keep your funds safer. These techniques help you control how much you can lose.

Setting Stop-losses

Stop-loss orders sell your crypto automatically at a set price. This limits your losses if the price drops suddenly. Choose a stop-loss point based on your risk comfort. It helps you avoid emotional decisions during market swings. Setting stop-losses keeps your portfolio from dropping too fast.

Avoiding Overexposure

Do not put too much money into one crypto asset. Overexposure increases your risk if that asset fails. Spread your investments to reduce the impact of any single loss. Balance your portfolio by investing in coins with different risks. Avoiding overexposure protects your overall portfolio value.

Diversifying Across Exchanges

Keep your crypto assets on different exchanges to reduce risk. Each exchange has its own security and technical risks. Using multiple platforms lowers the chance of losing all your assets. It also helps you take advantage of different trading options. Diversifying across exchanges adds an extra layer of safety.

Tools To Track And Manage Portfolio

Managing a crypto portfolio can be complex without the right tools. These tools help track investments, monitor changes, and simplify decision-making. Using the right software saves time and reduces mistakes. They keep you informed about your portfolio’s performance and market trends.

Portfolio Trackers

Portfolio trackers show the value of your crypto holdings in real time. They update prices and calculate profits or losses automatically. Many trackers support multiple exchanges and wallets. This helps you see all your assets in one place. Popular options include CoinTracker, Blockfolio, and Delta.

Automated Alerts

Automated alerts notify you about important market moves. Set alerts for price changes, volume spikes, or news. These alerts help you react fast to market shifts. You can customize alerts to match your strategy and risk level. Alerts come via email, SMS, or app notifications.

Tax And Reporting Software

Tax and reporting software simplifies crypto tax filing. It tracks transactions and calculates gains or losses accurately. These tools generate reports needed for tax authorities. They support multiple countries and tax rules. Examples include Koinly, CryptoTrader.Tax, and CoinTracking.

Common Mistakes To Avoid

Building a diversified crypto portfolio is not easy. Many new investors make common mistakes. These errors can cause big losses or missed chances. Avoiding these mistakes helps you protect your money and grow it safely.

Chasing Hype

Many people buy coins because of hype or rumors. This is risky. The price may drop fast after the hype ends. Buying without thinking can lead to losses. Focus on coins with strong use and good teams.

Neglecting Research

Some investors skip research and trust others blindly. This is dangerous. Always check facts about the coin and project. Learn about its goals, technology, and team. Good research lowers risks and improves decisions.

Ignoring Market Cycles

The crypto market goes up and down in cycles. Ignoring this can cause bad timing. Buy during dips and be careful in peaks. Understanding cycles helps you avoid panic selling or buying too late.

Credit: www.youhodler.com

Credit: materialbitcoin.com

Frequently Asked Questions

What Is A Diversified Crypto Portfolio?

A diversified crypto portfolio spreads investments across various cryptocurrencies. It reduces risk and increases potential returns by avoiding reliance on a single asset.

How To Choose Cryptocurrencies For Diversification?

Select coins with different use cases, market caps, and risk levels. Research projects, technology, and team credibility to ensure balanced portfolio growth.

Why Is Diversification Important In Crypto Investing?

Diversification helps minimize losses from market volatility. It balances risk and reward, protecting your investments from sudden downturns in specific coins.

How Much Should I Invest In Each Cryptocurrency?

Allocate funds based on risk tolerance and coin potential. Avoid over-investing in high-risk coins; balance stable and emerging assets for steady growth.

Conclusion

Building a diversified crypto portfolio helps reduce risks and improve chances of profit. Spread your investments across different coins and tokens. Keep learning about new projects and market trends. Stay patient and avoid rushing decisions. Review your portfolio regularly to balance your assets.

Remember, no investment is without risk. Smart choices and steady steps lead to better results. Start small, grow slowly, and stay informed. This way, you can build a crypto portfolio that suits your goals and comfort level.