Want to grow your net worth and build lasting wealth? You don’t need a huge paycheck or a lucky break.

What really makes millionaires stand out are the simple daily habits they follow without fail. Imagine adopting just a few of these powerful habits—how much closer would you be to financial freedom? You’ll discover 10 key habits that millionaires rely on to steadily increase their wealth.

These are practical, easy-to-start actions that can transform your financial future. Ready to unlock the secrets and take control of your money? Keep reading to learn how you can start building your net worth today.

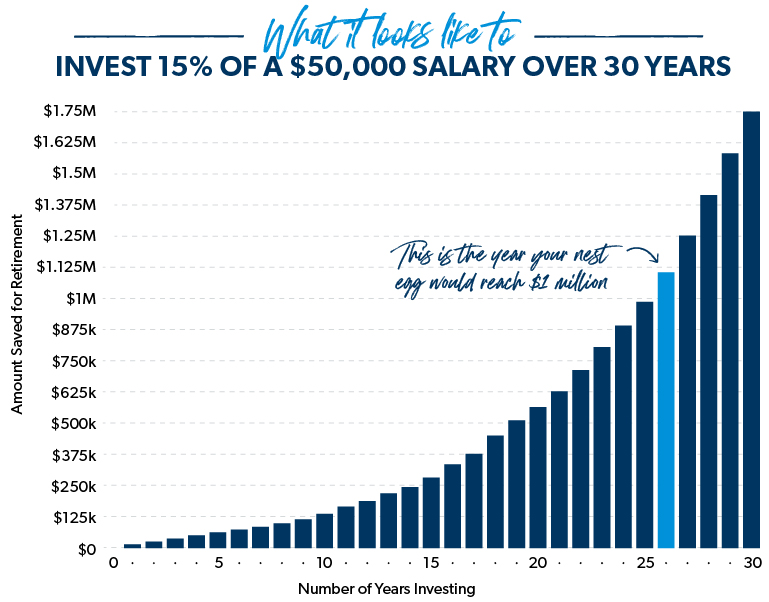

Credit: www.ramseysolutions.com

Wealth Mindset

Developing a wealth mindset is key to building lasting financial success. Millionaires think differently about money and opportunities. They see challenges as chances to grow, not obstacles to fear.

They believe their actions shape their future wealth. This mindset drives smart decisions and steady progress. It also helps them stay motivated through setbacks and delays.

Adopt Positive Thinking

Positive thinking fuels confidence and persistence. Millionaires focus on solutions, not problems. They avoid negative self-talk and doubts about money. This attitude helps them spot opportunities others miss.

Believing in success attracts more chances to grow wealth. It also builds resilience against financial setbacks. Staying optimistic keeps their goals clear and achievable.

Set Long-term Goals

Millionaires plan beyond immediate needs. They set clear, long-term financial targets. These goals guide their daily habits and choices. They break big goals into smaller steps to track progress.

Long-term goals keep them focused on building real net worth. This mindset avoids quick fixes or risky gambles. Planning ahead means steady wealth growth over time.

Income Strategies

Building and growing wealth requires smart income strategies. Millionaires do not depend on just one paycheck. They create multiple sources of income. These strategies help protect their wealth and increase net worth steadily.

Smart income strategies reduce financial risk. They allow money to flow even in tough times. This section explores two key habits millionaires follow to boost income and build lasting wealth.

Diversify Income Streams

Diversifying income means earning money from different sources. Millionaires avoid relying on a single job or business. They earn through side businesses, freelance work, or investments. This spreads risk and increases earning potential.

Having various income streams provides financial security. If one source slows down, others keep the money coming. Millionaires use this habit to stay financially strong and flexible.

Invest In Passive Income

Passive income comes from work done once but pays over time. Examples include rental properties, dividends, and royalties. Millionaires invest in assets that generate money without daily effort.

This income grows steadily and helps build net worth. Passive income adds freedom and stability to their financial life. It allows millionaires to focus on new opportunities and long-term goals.

Financial Discipline

Financial discipline is a key habit that millionaires use to grow their wealth steadily. It means making smart money choices every day. They control spending, save regularly, and avoid unnecessary risks. This steady approach builds a strong financial foundation over time.

Discipline in money matters helps avoid stress and prepares for future goals. Millionaires do not rely on luck but on good habits and planning. These habits keep them on track toward increasing their net worth.

Budget Strictly

Millionaires create detailed budgets and follow them closely. They know exactly how much money comes in and goes out. This clear view helps avoid overspending and shows where to save. Sticking to a budget prevents waste and keeps their financial goals in focus.

Live Below Means

They spend less than they earn, even after reaching wealth. This habit creates a surplus that can be saved or invested. Living below their means stops them from falling into financial traps. It builds lasting wealth without extra stress.

Avoid Debt

Millionaires avoid debt as much as possible. They understand debt can reduce future income and limit options. When they use credit, it is strategic and manageable. Staying debt-free or low on debt helps them keep control of their money and grow it safely.

Credit: www.plr.me

Continuous Learning

Millionaires understand the power of continuous learning. They never stop gaining new knowledge and skills. This habit helps them adapt to change and find new opportunities. Learning keeps their minds sharp and ready for challenges. It builds confidence and improves decision-making.

Continuous learning shapes their mindset and boosts their growth. It is a key factor in increasing their net worth over time. Let’s explore two important areas of this habit.

Self-development

Millionaires invest time in self-development daily. They read books, attend seminars, and listen to podcasts. These activities improve their mindset and productivity. They focus on building skills like leadership, communication, and problem-solving. Self-development helps them stay motivated and disciplined. It also builds resilience to overcome setbacks.

Financial Education

Financial education is a top priority for millionaires. They learn about budgeting, investing, and managing debt. This knowledge helps them make smart money choices. They study market trends and financial tools regularly. Understanding money allows them to grow wealth steadily. They avoid risks that can harm their finances. Financial education creates a strong foundation for lasting success.

Smart Investing

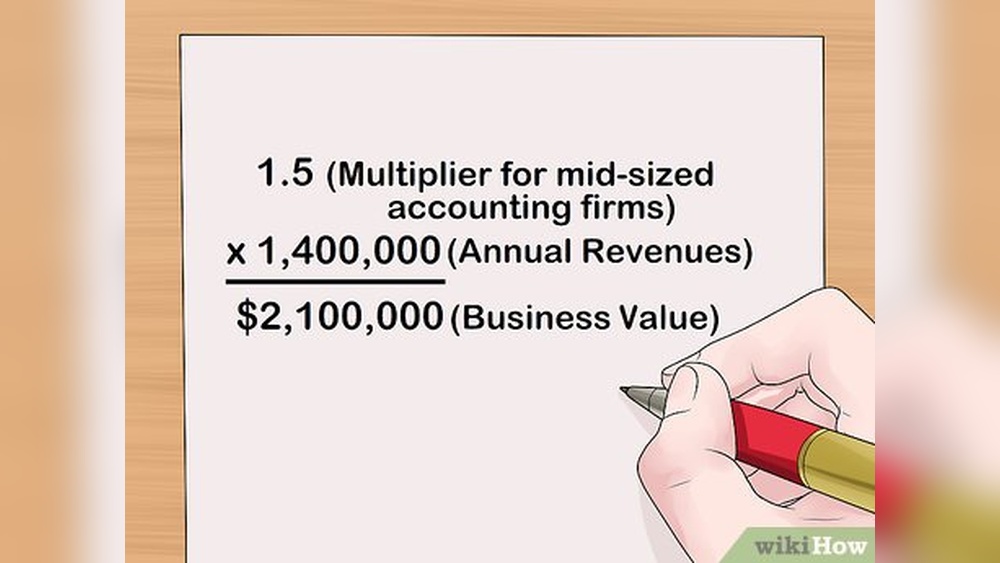

Smart investing is a key habit millionaires use to grow their net worth steadily. They make decisions that protect and increase their money over time. Wise choices in where and how to invest keep their wealth secure and ready for new opportunities.

Millionaires avoid risky moves and focus on assets that offer both safety and growth. They understand that smart investing means patience and constant attention to their financial goals. This approach helps them build lasting wealth.

Focus On Liquid Assets

Millionaires prefer liquid assets that can be quickly turned into cash. These include stocks, bonds, and mutual funds. Liquid assets provide flexibility to cover emergencies or new investments.

Keeping money in liquid form avoids locking funds in hard-to-sell properties or businesses. It allows millionaires to act fast when a good opportunity arises. This habit helps them maintain control over their finances.

Regular Portfolio Review

Successful investors regularly check their portfolios to ensure the right balance. They adjust their investments based on market changes and personal goals. This keeps their money working efficiently.

Reviewing the portfolio often helps spot underperforming assets early. Millionaires then decide whether to hold, sell, or buy more. This habit avoids losses and maximizes returns over time.

Time Management

Time management is a key habit millionaires use to grow their net worth. They control their day with clear focus and avoid distractions. Efficient use of time helps them reach goals faster and make better decisions. Every minute counts in building wealth.

Prioritize High-impact Tasks

Millionaires identify tasks that bring the most value first. They focus on actions that improve income or save money. Low-value tasks get less attention or are scheduled later. This habit ensures their energy goes to what matters most. It boosts productivity and accelerates financial growth.

Delegate When Possible

Successful people know they cannot do everything alone. They delegate tasks that others can handle well. This frees their time for important decisions and creative work. Delegation also builds trust and teamwork. It helps maintain balance and keeps their focus sharp.

Networking

Networking plays a crucial role in how millionaires grow their net worth. It opens doors to new opportunities and valuable resources. Successful people invest time and effort in building strong relationships. These connections often lead to partnerships, advice, and support that fuel financial growth.

Build Meaningful Connections

Millionaires do not just collect contacts. They focus on creating genuine relationships. This means showing interest in others and offering help without expecting immediate returns. Strong bonds create trust, which is the foundation of fruitful collaborations. Being authentic and respectful makes connections last longer.

Quality over quantity matters in networking. A few meaningful contacts can be more valuable than many shallow ones. Millionaires attend events, join groups, and engage in conversations that align with their goals. They listen actively and remember important details about people they meet.

Seek Mentorship

Mentors guide millionaires through challenges and decisions. These experienced individuals share knowledge and lessons learned from their own journeys. Having a mentor saves time and avoids costly mistakes. Millionaires seek mentors who inspire and push them to grow.

Finding a mentor requires openness and willingness to learn. Millionaires ask thoughtful questions and apply the advice given. They respect their mentors’ time and show appreciation. Mentorship builds confidence and expands one’s vision for success.

Automation

Automation is a key habit millionaires use to build wealth steadily and stress-free. It removes the need for constant attention to finances. This habit creates a system that works quietly in the background.

With automation, money moves without effort. This leads to consistency in saving and paying bills. Millionaires avoid late fees and missed opportunities by automating tasks.

Automate Savings

Millionaires set up automatic transfers to their savings or investment accounts. This happens right after payday. The money moves before they can spend it. This habit helps grow their net worth without thinking about it.

Automating savings means they never skip putting money aside. It turns saving into a simple, automatic step. Over time, these small transfers add up to large sums.

Automate Bill Payments

Paying bills on time is crucial to avoid penalties and maintain good credit. Millionaires automate bill payments to keep this process smooth. This habit prevents missed payments and late fees.

Automatic payments also save time and reduce stress. Bills get paid without reminders or last-minute rushes. This habit keeps their financial life organized and reliable.

Health And Self-care

Health and self-care play a crucial role in the journey to building wealth. Millionaires understand that a healthy body and mind fuel productivity and decision-making. They invest time and effort into caring for themselves to maintain energy and focus.

Good health supports long-term success. It helps avoid costly illnesses and downtime. Taking care of oneself is not just about exercise but also about managing stress and mental well-being.

Maintain Physical Health

Millionaires prioritize physical activity daily. Regular exercise boosts energy and sharpens the mind. Simple habits like walking, stretching, or gym workouts keep the body strong.

They eat balanced meals with nutrients that support brain and body function. Avoiding excessive junk food and sugary drinks prevents health issues. Staying hydrated helps maintain focus and stamina throughout the day.

Sleep is another key factor. Getting enough rest allows the body to repair and the mind to recharge. Many millionaires stick to a consistent sleep schedule to stay alert and productive.

Manage Stress Effectively

Stress can drain energy and cloud judgment. Millionaires use techniques to keep stress under control. Meditation and deep breathing exercises calm the mind and improve concentration.

They also set clear boundaries between work and personal life. Taking breaks and spending time with family or friends helps refresh their outlook. Some practice hobbies or spend time in nature to reduce stress.

Maintaining a positive mindset is common. Millionaires focus on solutions rather than problems. This approach lowers anxiety and keeps them moving forward.

Regular Financial Review

Millionaires increase their net worth by reviewing their finances regularly. This habit helps them stay aware of their financial position. They avoid surprises and can make smart money decisions. Regular financial review keeps their wealth growing steadily.

Track Net Worth

Tracking net worth means knowing what you own and owe. Millionaires write down all assets like savings, investments, and property. They also list debts such as loans and credit cards. This clear picture shows the real value of their wealth. They check this often, sometimes monthly or quarterly. This habit helps spot progress and areas to improve.

Adjust Strategies

After tracking, millionaires adjust their financial plans. They change saving, spending, or investing based on results. If an investment underperforms, they find better options. If expenses rise, they cut unnecessary costs. This flexibility keeps their net worth growing. They do not stick to one plan blindly. Reviewing and adjusting is key to long-term success.

Credit: www.newtraderu.com

Frequently Asked Questions

What Is The 10 10 10 Rule For Money?

The 10 10 10 rule divides income into 10% for giving, 10% for saving, and 10% for investing. It promotes balanced money management.

What Are The 7 Secrets Of Wealth?

The 7 secrets of wealth are: diversify income, adopt a wealth mindset, invest wisely, save consistently, set long-term goals, focus on results, and review finances regularly.

What Habit Makes You Rich?

Consistently saving, budgeting wisely, investing smartly, and continuously learning about finances build lasting wealth.

What Are The Habits Of Millionaires Dave Ramsey?

Millionaires, per Dave Ramsey, budget strictly, live below their means, avoid debt, save consistently, and invest wisely for long-term wealth.

Conclusion

Building wealth takes time and steady effort. Millionaires stick to simple daily habits. They save, invest, and control spending carefully. Learning and planning help them stay on track. Focus on small actions with big results. These habits create financial growth and stability.

Anyone can apply these steps to improve wealth. Success grows from patience and consistent choices. Start today, and watch your net worth grow.